July greetings from Cedar Rapids, Kansas City and, by the time most of you read this, Nashville, the home of this year’s Fiber Connect conference. The schedule is full for both days; the evening reception on Monday will be the best time to catch up on the industry in general and/or the new role as CEO of CellSite Solutions.

Second-quarter earnings reports are beginning to trickle in, and, after a shorter than usual market commentary, we discuss several factors impacting performance below. Here are the remaining companies left to report:

| Company | Day | Date | am/pm |

| Microsoft | Tuesday | July 30 | pm |

| Meta | Wednesday | July 31 | pm |

| T-Mobile US | Wednesday | July 31 | am |

| Apple | Thursday | August 1 | pm |

| Amazon | Thursday | August 1 | pm |

The fortnight that was

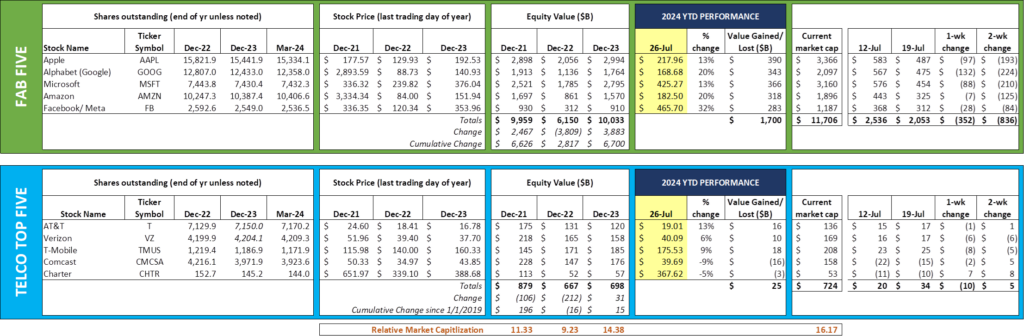

Pressure continued to mount on the Fab Five over the last two weeks, with the group losing an additional $836 billion in market capitalization. As stated in previous Briefs, this pattern of “sell on earnings speculation, buy on the earnings result” is not new and we would not be surprised to see the group back to AI-influenced valuations in 2024/ 2025.

Google was the only Fab Five company to post earnings so far (here), and their results were not enough to stop the “sell train” (-$132 billion in the last week, and $224 billion over the fortnight). The company is spending an impressive amount on data center infrastructure ($13 billion in Q2, with $12 billion per quarter expected for Q3 and Q4). The amazing part is that it paid (or will pay) for these builds from cash on hand – total long-term debt remained at a paltry $12 billion and the company continues to have negative net debt. Contrast that with the debt levels of Verizon, AT&T (both discussed below) and Lumen. Without a doubt, Google will shift to a “meet me at my data center” strategy after these investments have been completed, placing pressure on the traditional carrier hotel providers.

Selling pressure was not confined to the Fab Five – four of the Telco Top Five also lost market capitalization in the last week (Charter was the notable exception – we will have more on their strong earnings in the next Brief).

T-Mobile stole the headline of the week, however, with their announcement of a 50/50 joint venture with KKR to purchase the assets of fiber provider Metronet (announcement here). We will have additional comments on the transaction following their earnings call. US Cellular, Lumos, and now Metronet – T-Mobile has been busy in 2024 and we think they are just getting started. Our only question concerns integration resources. Integrating Lumos will be very different from acquiring Sprint. Can T-Mobile integrate 3-4-5 transactions simultaneously? We think they can but will have more conviction with a well-presented plan.

One thing we are concerned about with each of these transactions is the state and federal regulatory environments, particularly the Federal Trade Commission and the Department of Justice. This concern is more about “if” than “when” approval occurs, and bundling several acquisitions does not help the cause. More on this in the next Brief.

Overall, we love the Metronet transaction, believe it aligns well with T-Mobile’s “uncarrier” structure, and look forward to more details on the call. Congrats to the Metronet team, particularly John Cinelli, on pulling it off.

2Q earnings review – facts are stubborn things

“Facts are stubborn things; and whatever may be our wishes, our inclinations, or the dictates of our passions, they cannot alter the state of facts and evidence.” – John Adams (full context here courtesy of the National Archives)

The second quarter earnings picture thus far (four of the Telco Top Five have reported as of July 26th, and one of the Fab Five) has been a reality check. While there is a lot of spinning and positioning occurring during earnings presentations, we thought it would be best to analyze four facts:

- Verizon’s network, as measured by wholesale and retail subscribers, is larger than ever

- Comcast’s broadband subscriber base generates more revenue today than in 2019 (pre-COVID surge)

- Debt matters – a lot – and there needs to be more discussion about interest costs after financings

- AT&T should be performing better on fiber penetration given the market dynamics of their territory

1. Verizon is bigger than ever.

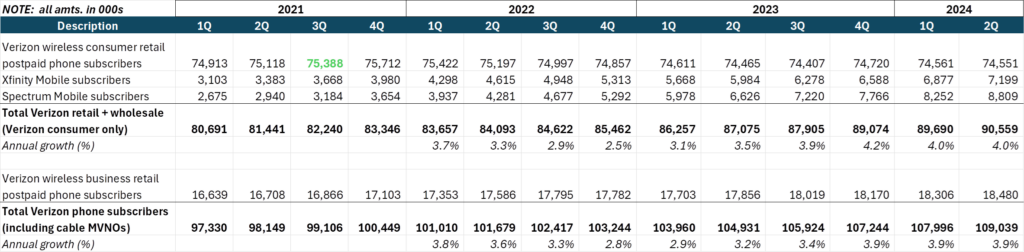

Verizon’s overall earnings (link here) were mixed, and, as we showed above, investors are beginning to have concerns about the company’s ability to meaningfully shift market share with their fixed wireless and myPlan programs. But, as the chart shows below, Verizon’s total phone subscriber base has grown, thanks to cable:

Note: We will post this schedule in the next interim Brief (online only) file.

Verizon consumer phone subscribers grew slightly from 2Q 2023 to 2Q 2024 (86K subscribers). But Verizon’s total consumer presence (excluding retail prepaid) grew nearly 3.5 million. And, for both consumer only and including business phone subscribers, growth has been accelerating, relative to the same periods in 2023 and 2022.

Three takeaways:

- #1 Verizon’s scale has increased. They may not have shown the full effect of this in their operating results (likely due to additional capacity being added to support fixed wireless), but for traditional phone customers, scale increased over the 14-quarter period shown above – and it’s increasing.

- #2 Cable has certainly stunted Verizon’s retail growth, but there’s no correlation between retail gains/ losses and cable MVNO gains/ losses. We assume that Verizon calculated the value of gaining high-margin customers when they calculated the retail customer lifetime value losses. So far, the bet seems to have been a good one for Big Red.

- #3 Cable’s gains came from a mix of AT&T and T-Mobile postpaid + retail prepaid. If cable’s MVNO base is lower end, and they are maintaining a low churn rate, that’s a good thing (which causes us to question why Verizon bought Tracfone). Clearly cable’s broadband + wireless bundle is a good combination, and cable’s wireless value proposition is resonating with their base.

2. Comcast’s broadband revenue base is bigger than ever (and still a lot bigger than pre-COVID).

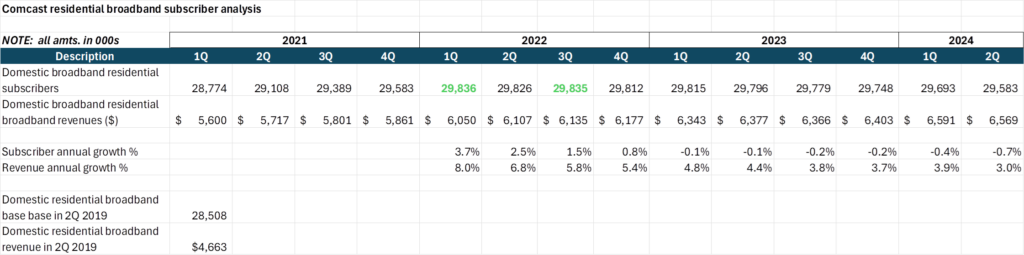

There has been a lot of cable bashing in 2024, and second quarter results from both Comcast and Charter clearly showed that they know how to manage churn as well as growth. Here is the domestic revenue growth line for Comcast:

Comcast’s domestic broadband base hit its highest point in Q1 and Q3 2022 – the peak of both ACP and work from home adoption (and at that peak the company had a broadband relationship with 53% of its homes passed). Even with the beginnings of ACP unwinding in the most recent quarter (note – management was quick to point out that there would be 3Q aftershocks as involuntary churn increases), the Comcast base is now the same size it was at the end of 2021.

What has changed is Comcast’s revenue growth. They really enjoyed the benefits of speed upgrades in 2022 and 2023 (8% annualized growth on a 4% base growth in Q1 2022 is remarkable), but broadband revenue growth has clearly slowed and could be in the low single digits for a quarter or two as ACP winds its way through.

The stubborn fact is that Comcast’s homes passed base was 58.24 million in 2Q 2019 and is currently 63.03 million (4.8 million growth or about 8.2% in five years). Subscribers have grown 3.8% (as much as 4.2%) and quarterly residential broadband revenues have grown 41%.

Comcast acknowledged that they have a lot of work to do, and utilization/ penetration could be better, but it appears that they are still operating at substantial scale and that recent subscriber losses have not impacted their ability to grow. Task #1 should be achieving higher penetrations in their new homes passed.

3. Debt matters a lot, especially to Verizon.

Two of the Telco Top Five are in the process of substantial deleveraging. As one of you recently quipped “Good thing we don’t have a spectrum auction on the horizon.” We discussed in last week’s interim Brief Verizon’s plans to sell 5,000-6,000 company-owned towers (stories from Bloomberg and Light Reading here and here). This could raise an additional $3-6 billion depending on the buyer and the quality of the cash flow.

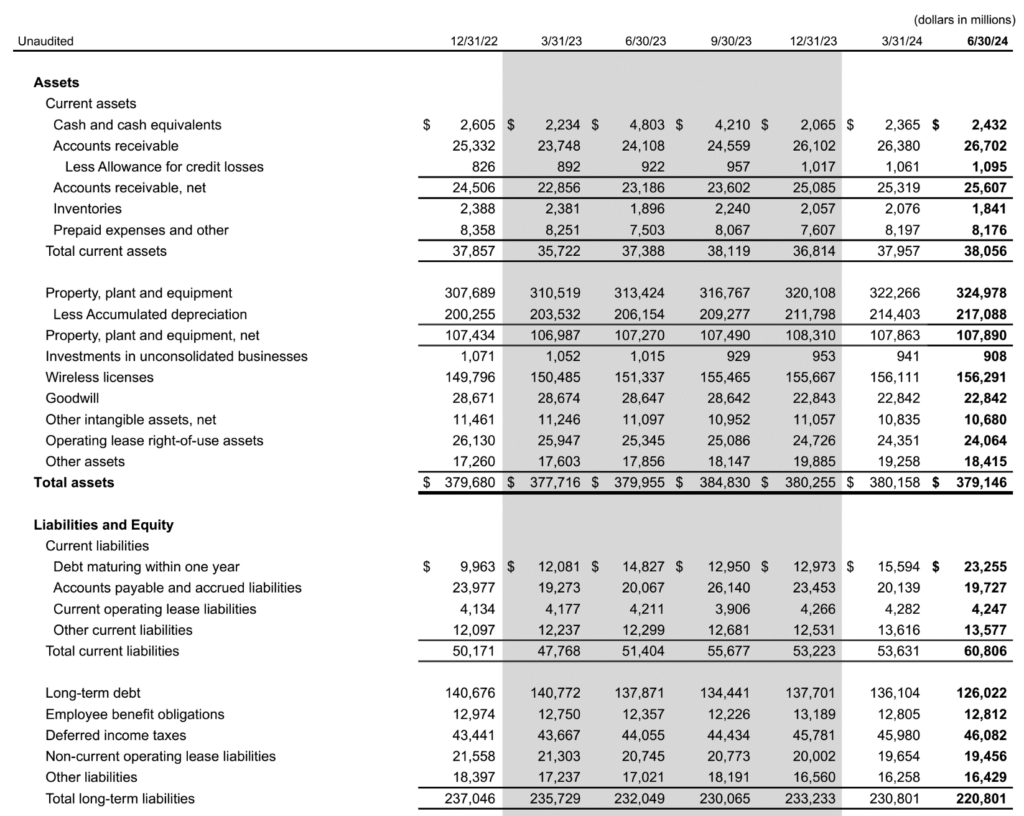

The debt theme really struck home when looking at Verizon’s recent balance sheet (from their earnings detail):

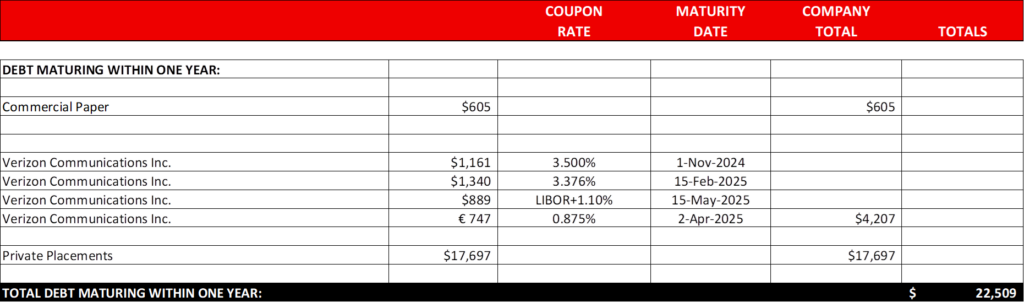

Verizon has been deftly managing their debt maturities, but the doubling in debt maturing within a year puts the company in a very delicate position. Will interest rates fall, and how far? Should the company reach for a longer maturity to match the useful life of the spectrum (assuming the C-Band auction is what created their current debt load)? Per their investor relations website, here are the debt tranches that are being refinanced:

Note: Current LIBOR is ~5.5-5.6%. While we do not know the details of the private placements, we do know that Verizon’s overall blended debt rate (per their 2Q 2024 income statement and balance sheet) is slightly more than 4.5%. T-Mobile issued 2 billion in Euro-denominated notes in May at coupons ranging from 3.55% – 3.85% (5, 10, and 15-year durations) with little difficulty. But that was from a different overall leverage and operating cash flow position.

We think that Verizon’s coupon rate will be slightly higher than their current 4.4-4.5 % average and that the new refinance rate will increase borrowing costs for this tranche by 60 basis points. That translates into $135 million in additional annual interest expense. At today’s share count, that would imply an additional $0.03-$0.04/ share of pressure on yearly earnings. This may sound small, but, when combined with all of the other pressures Verizon is facing, it’s not.

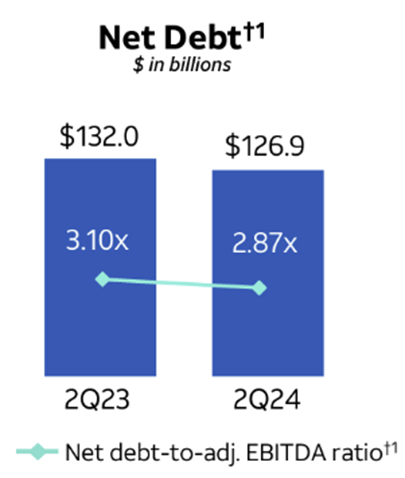

AT&T is also in a deleveraging mode, with over $5 billion in net debt reduction over the last year (see nearby pic from their 2Q earnings presentation). But they still have a little over $3 billion in current maturities (much less than Verizon) which need to be paid or refinanced over the next year (debt schedule here).

Charter, Comcast, and T-Mobile do not appear to have any near-term debt issues, and, as we have discussed with respect to T-Mobile, have believable short and long-term free cash forecasts. As we will discuss in more depth in the next Brief, T-Mobile appears to be using their balance sheet to their advantage.

4.AT&T’s fiber penetration underperformance.

We discussed this in detail in the May 19th Brief, but, if the latest census updates are correct, AT&T should be rapidly expanding their fiber footprint (and gaining fiber subs) because of the demographic shift from North and East to South and West.

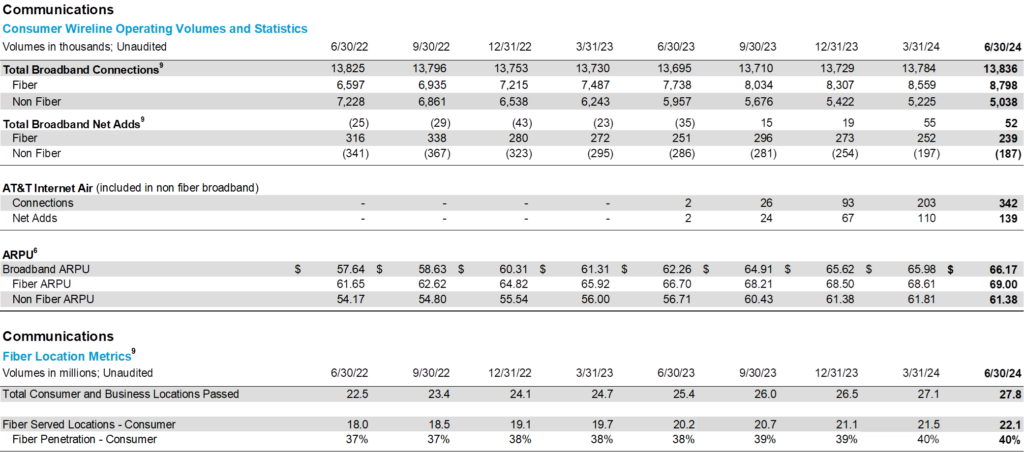

Here is AT&T’s latest schedule on their fiber deployments from their earnings package:

Total fiber connections grew steadily over the last four quarters, and revenue per customer has also improved by 3.4% to $69. Consumer locations equipped with fiber have followed the steady march, up nearly 2 million in the last twelve months.

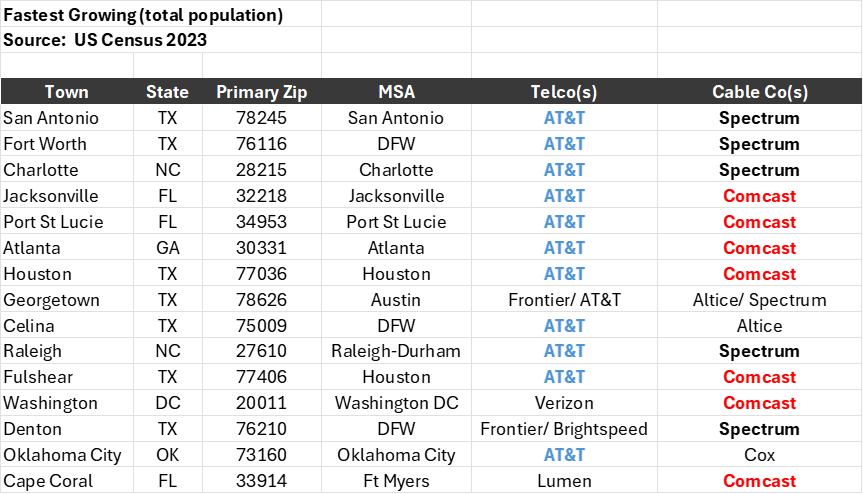

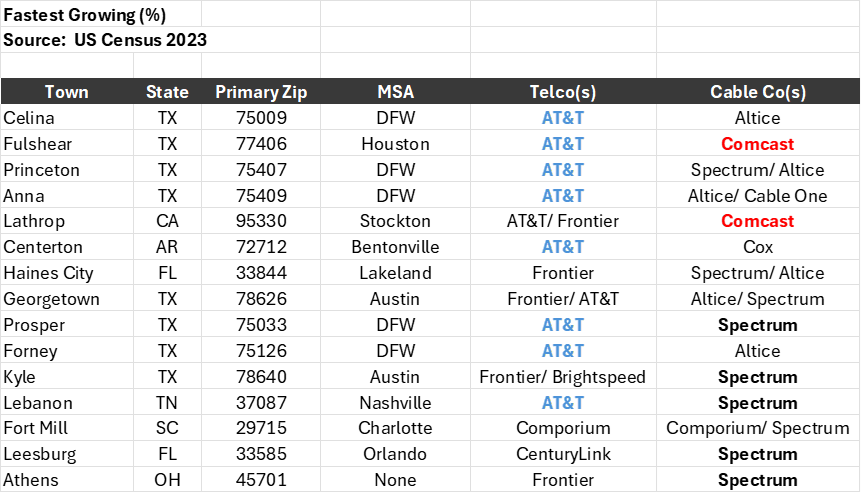

This, combined with the surprising growth of AT&T Internet Air, was the brightest part of the AT&T message. Our question is “Could it have been even better?” From the May 19th Brief, here are the fastest growing metropolitan areas by a) percentage growth, and b) total population growth (Census data here):

AT&T is the incumbent broadband provider in 10 of the 11 fastest growing areas in the US (and they share the 11th with Frontier). These are not small markets, and, as we can attest from 3+ years of FTTH deployments, fiber deployment is a lot easier during new construction than during retrofits.

We think that AT&T left 50K fiber additions on the table in these growth markets. They are now customers of Spectrum and Comcast, and, given their new plant, will likely be for the foreseeable future. Their performance was good enough, but AT&T holds a unique addressable market advantage over Verizon, Frontier, and Lumen.

That’s it for this week. The sundaybrief.com website has a new look and feel, and we welcome your comments on the site. The next Brief will focus on T-Mobile – look for interim updates online as well. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Finally – go Sporting KC, Team USA, and Kansas City Royals!