Annual shipments of cellular IoT antennas, including both internal and external antennas, totalled 598 million units in 2023, and will spiral at a compound rate (CAGR) of 14.9 percent per annum in the period to 2028 to top 1.2 billion, according to IoT analyst group Berg Insight. The market is led by a combination of major electronic component manufacturers, plus a number of specialist antenna brands and pure-play IoT antenna vendors.

Its forecast for the antenna market might be set against its broader research into the cellular IoT market at large. Sweden-based Berg Insight, which has been tracking the IoT market since it mostly went under the M2M moniker, said last year there will be 5.3 billion IoT devices connected to cellular networks worldwide by 2027. The top 10 mobile operators had a combined base of about 2.3 billion cellular IoT connections at the end of 2022.

The comparison is a year out of whack, but basic envelope maths says the cellular IoT device market is growing at about 660 million units per year (three million over five years, to 2027), and the cellular IoT antenna market is growing at a rate of something-less than 100 million units per year (about 600 million over five years, to 2028). The disjunct is not clear. Total revenues for the market will be €21.4 billion in 2027, it says, more than double the 2022 total.

The cellular IoT antenna market is interesting on the grounds that innovation is to do with squeezing as much performance out of constrained low-power IoT sensor devices. Unlike other electronics, notably smartphones, cellular IoT device makers do not have the resources or scale to design antennas in-house, notes Berg Insight; instead, they rely on specialised antenna vendors that provide off-the-shelf antennas, as well as custom antenna design services.

These providers supply either internal and external antennas, explains Berg Insight; device makers make their choices according to their target applications, and a combination of the size, cost. and performance that they permit. Which is the same calculation for every step of IoT design. “The ideal antenna has a small form factor, low cost, and excellent performance. [But] trade-offs must be made [and] there is generally no one-size-fits-all solution,” says Berg Insight.

Notable brands among internal antenna vendors are Ignion, Abracon, Ezurio, Unictron and Walsin Technology. The market for external units is more fragmented, says Berg Insight. “Few vendors have substantial presence in more than one region,” it says, ranking Panorama Antennas, Parsec Technologies, and PCTEL (acquired by Amphenol in December) as the “market leaders”. It also lists Amphenol Procom, Poynting Antennas, Huber+Suhner, and Airgain.

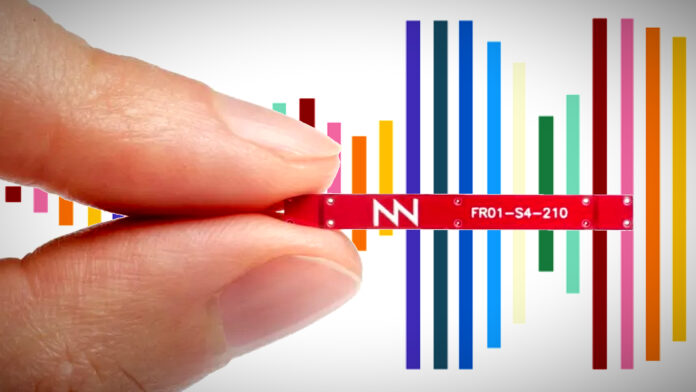

Otherwise, the vendor market can be split in various ways, the company reckons; some are major electronic component manufacturers (TE Connectivity, Kyocera, and Amphenol are cited), some are specialist antenna makers (discoverIE, which owns the 2J Antennas and Antenova brands, plus Pulse Electronics and Quectel, notably), and some are pure-play IoT antenna specialists (Taoglas in Europe and North America, and Sunnyway Technologies in China.)

Berg Insight has a report all about it, starting at $1,500 a pop – which is the going price for its research into all the different aspects of the cellular IoT game.