Digging into this new Cisco survey about the state of networking in the Industry 4.0 sector, which says the industrial c-suite is being driven to distraction by the risk and reward of artificial intelligence (AI), reveals certain things. They are hardly revelatory; but, again, they are probably worth writing down. To that end, RCR Wireless has looked at the results, as they have been made available, and simplified and concluded that five obstacles make the difference between success and failure for big enterprises in the digital era.

In no particular order, these are: people, technology, money, security, and a whole bunch of outside macro-economic buffers. In the end, process and product, input and output, efficiency and productivity will all be determined by how these obstacles are hurdled by enterprises – or else crashed into. Let’s consider each of these in turn, using the Cisco research study as the basis for our assumptions and conclusions.

1 | People

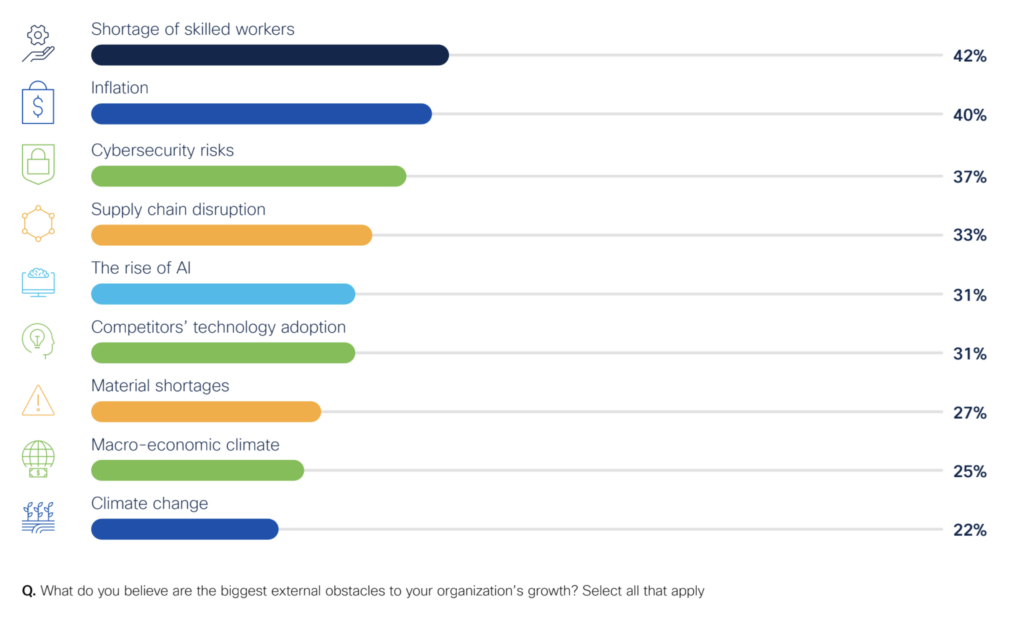

Ah, people – always the problem, always the solution. Hiring the right staff is ranked as the number one external challenge for industrial enterprises. Two in five (42 percent; see below) told Cisco that a shortage of skilled workers is their biggest headache – and most others, presumably, know the symptoms. The flipside poll, about internal obstacles facing Industry 4.0, has staff-related issues at number three – and number one, actually, in North America. Cisco puts the regional chaos down to “market maturity and distribution of skills”.

Cisco quotes Deloitte: “The labour market remains tight, and the resulting applicant gap may continue. This could impact the ability of manufacturers to fully capitalize on [the] recent growth in public and private investment.” The implication is that money, to go on AI-associated technology, to raise productivity and security, is not worth much without the right people to build and manage it. Between hiring and keeping staff, there are concerns about training them to handle challenges with security and technology, which rank first and second among internal obstacles.

There will be a shortfall of 3.8 million manufacturing jobs by 2033, says Deloitte – half of which will remain unfilled if the “skills gap and the applicant gap” are not addressed. But it is not just about skills; it is about culture, says Deloitte – which, in the end, dictates how easily new skills are unleashed. “These barriers are primarily operational, rather than technical: representing human factors such as resistance to change which can lead to difficulties upskilling and retaining a fit-for-purpose workforce.” Given proper reign, with new culture and new skills, technology will help.

Which is the kicker; the classic chicken-and-egg dilemma in the innovation game. It is also where AI, and really conversational generative AI, will close the gap, Industry 4.0 reckons. “Technology is seen as an enabler of, rather than an alternative to, the workforce… The top way [industrial firms] are mitigating against internal obstacles… is through upskilling or reskilling [and] by adopting AI.” Their motivation to stump up cash for AI is to reduce manual tasks, speed up processes, and, crucially, to increase IT/OT collaboration – and to get around the skills gap that way.

2 | Technology

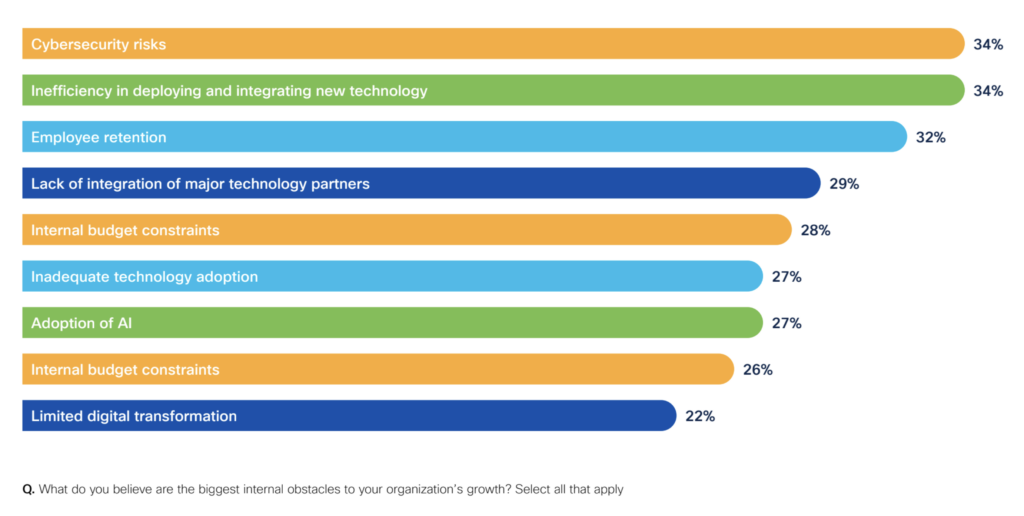

Ah, technology – all mouth, no trousers. The Cisco survey tells a familiar tale: that technology (mostly AI these days) promises dreamy stuff for pinched enterprises, but that technology (mostly the gear and code to make it work) delivers a nightmarish mess of mis-matched equipment and wide-open security flaws. Its poll of Industry 4.0 obstacles is littered with tech problems: challenges with “the rise of AI” and rivals’ adoption of it (actually, just “tech adoption”) rank five and six among external issues; almost every other entry in the internal analysis (see below) is about technology.

To wit: a lack of efficiency when deploying and a lack of integration between deployments rank second and fourth, both cited by about a third; inadequate adoption of technology generally, limited ‘digital transformation’ internally, and intended adoption of AI specifically are all cited as problems, by about one in four in each case. Which means, surely, that technology is a problem – that the solution is the problem. To woo: the clamour for AI, to inject strange digital superhero juice into industrial systems and processes, is ever-higher as a consequence.

“Almost half (48 percent) believe AI is the emerging technology likely to have the biggest impact within the next five years, while around a third (32 percent) cited cybersecurity solutions,” writes Cisco, presenting the yin-and-yang of the new digital-world order – as AI-enabled security systems police AI-enabled production systems. “Organisations who fail to refresh their industrial networking for AI to optimise efficiency, harness data for AI models, support over-stretched staff, and defend against cyberattacks, will struggle to compete,” says Cisco. Well, sheesh.

The point is, presumably, to get the right people in from the start – to scope, design, build, and run all of this refreshed industrial infrastructure. Which means training and hiring – and appointing clever vendors, says Cisco. Well it would, right.

3 | Money

Ah, money – doesn’t talk, it swears. To quote Bob Dylan. The curious thing about the Cisco survey – or not, because it polled a thousand $100 million companies in various hard-nosed industrial sectors – is that the money is there; these companies are ready to invest, they say, in all of this new-fangled edge computing infrastructure, private networking technology, industrial AI apps and systems, and whatever else. Inflation is clearly a challenge for many; two in five (40 percent) put it as the biggest external challenge they face.

But three in five don’t, and three quarters (74 percent) say growth is not being impacted by internal budget constraints. Cisco writes: “[This suggests] a recognition that investment must be made in order to capture opportunities and remain competitive.” It perceives that the majority have increased their investment in operating technology (OT), to connect machines, systems, and processes on the shop floor. Almost two-thirds (63 percent) of respondents have “ramped-up spend” on industrial infrastructure over the past year.

“Organisations [recognise] the need to invest more in OT to capitalise on Industry 4.0,” it says. Of those ramping-up, one eight (16 percent) spent “significantly” more than “last year”; the figure rises to one in four (24 percent) among the really big beasts of industry (“those with revenues of over $30 billion”. But “internal budget constraints” also rank fifth (and, weirdly, also eighth – in the copy of the report RCR Wireless received) among Industry 4.0’s biggest internal obstacles. And, of course, sooner or later it all comes down to money. To quote Bruce Sringsteen.

4 | Security

Ah, security – hard to love, impossible to ignore. This is the biggest single internal challenge for industrial companies, says the Cisco poll. It is also, after global economic inflationary impacts and labour shortages, the biggest external challenge. Both ways, about a third (34 percent and 37 percent, respectively) cite it as a major worry. “We see businesses struggling with cybersecurity risks,” writes Cisco. It could also write that most (two thirds) of businesses are pretty cool with it, of course; but the sense is that angst is only spiralling one way: upwards.

The research quotes Statista, that manufacturing firms suffered the highest share of cyberattacks in 2023. In a couple of sentences, it explains the whole story: “Industrial networking offers a large attack surface via industrial IoT connected assets… Cybersecurity [is] the second-highest OT investment area, after AI-enabled devices. AI devices may themselves be seen as a double-edged sword. While AI offers OT benefits such as process optimization and threat detection, bad actors are also using adversarial AI techniques to turn the technology against firms”

Again, the bigger the company, the bigger the risk. Two in five say the big problem with industrial infrastructure is cybersecurity, rising to one in two when revenues pass the maga mark ($30 billion, in the sample). “The task to defend against cyberattacks increases as businesses get larger and more complex,” it writes. A “lack of standardisation [and] disparate vendors”, as mentioned above, does not help. One in five more (22 percent more) say cybersecurity compliance is “extremely important” this year, compared to 2023.

Nine in 10 (89 percent) say it is “very or extremely” important in OT. “The sense of urgency is growing,” says Cisco.

5 | Economy

Ah, the economy – always the economy. The global macro-economic climate is the perfect excuse, of course. Thing is, in recent years, it is a genuine one, too. “Businesses have faced macro-level challenges ranging from supply chain issues to a global pandemic,” writes Cisco. Inflation ranks second among their external obstacles to growth (cited by 40 percent of respondents); supply chain disruption ranks fourth (33 percent), material shortages rank seventh (27 percent), the general macro-economic climate ranks eighth (25 percent), and the climate itself ranks ninth (22 percent).

There are minimal regional variations, it says. You can’t argue with that.