July and August greetings from Nashville, Boston, Cedar Rapids, St. Louis, and Kansas City. Pictured is our wonderful view from the Cardinals-Royals game on Saturday No one complained about the cooler than average August temperatures. And, after a heartbreaking loss on Friday, the Royals came from behind to win a thrilling victory on Saturday and win the season series. What a great family time.

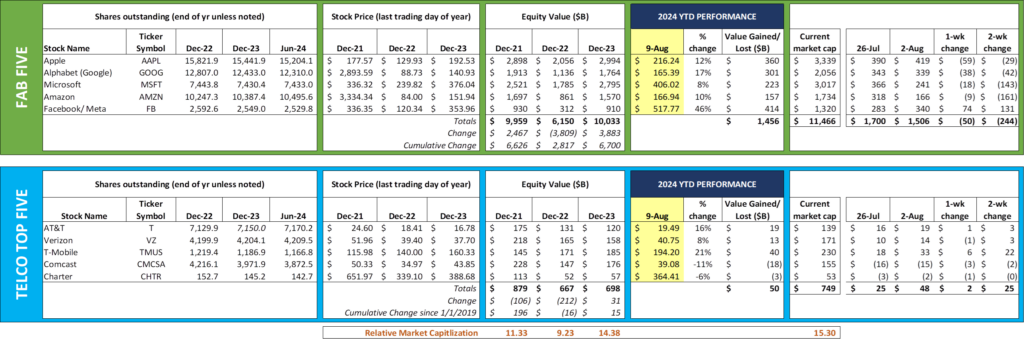

We have finished second quarter earnings reports for most of the telecom community. We titled this week’s Brief “When History Rhymes” because a lot of the events that have sparked headlines are reminiscent (but not exactly duplicative) of the past. We also have extensive analysis of net debt balances for the Fab Five as well as some thoughts on the Google antitrust decision.

A schedule note – we will not publish an interim Brief on Labor Day weekend but will share the updated spreadsheet in the online version of the September 8th full Brief.

The fortnight that was

“Skip the family vacation to Cedar Point (an amusement park in Sandusky, Ohio) – you can experience the thrills of the stock market roller coaster on CNBC.” That phrase, uttered by one of the network’s Midwest-raised hosts, aptly summarizes the week in the markets.

Looking at Friday’s closing figures (Fab Five -$50 billion, Telco Top Five +$2 billion), one might think that it was a typical vacation-influenced sleepy August week. It was anything but. Apple opened Tuesday morning at $202/ share (and had a 7+% recovery in the subsequent four days). Microsoft started the week below $391 per share (then rose 3.8% the remainder of the week). Amazon opened Monday below $156/ share after a brutal end to the previous week (followed by a 7+% recovery). Each of these stocks are lower than their respective peaks reached in mid-July, but not far off from their closing prices in the last week of July (Apple closed at $217-218/ share, Amazon at $179-182/ share, and Microsoft at $418/ share).

We think Amazon’s earnings prospects should be lower if the US economy is contracting. This blog has been consistent (since 2020) in highlighting the increasing dependence on consumer credit (credit card rates remain startlingly high – see yesterday’s Lending Tree article here), and the lower half of households are faced with many difficult decisions even with rising incomes. Consumer purchasing should abate if debt levels remain high and inflation fails to revert to pre-Covid levels.

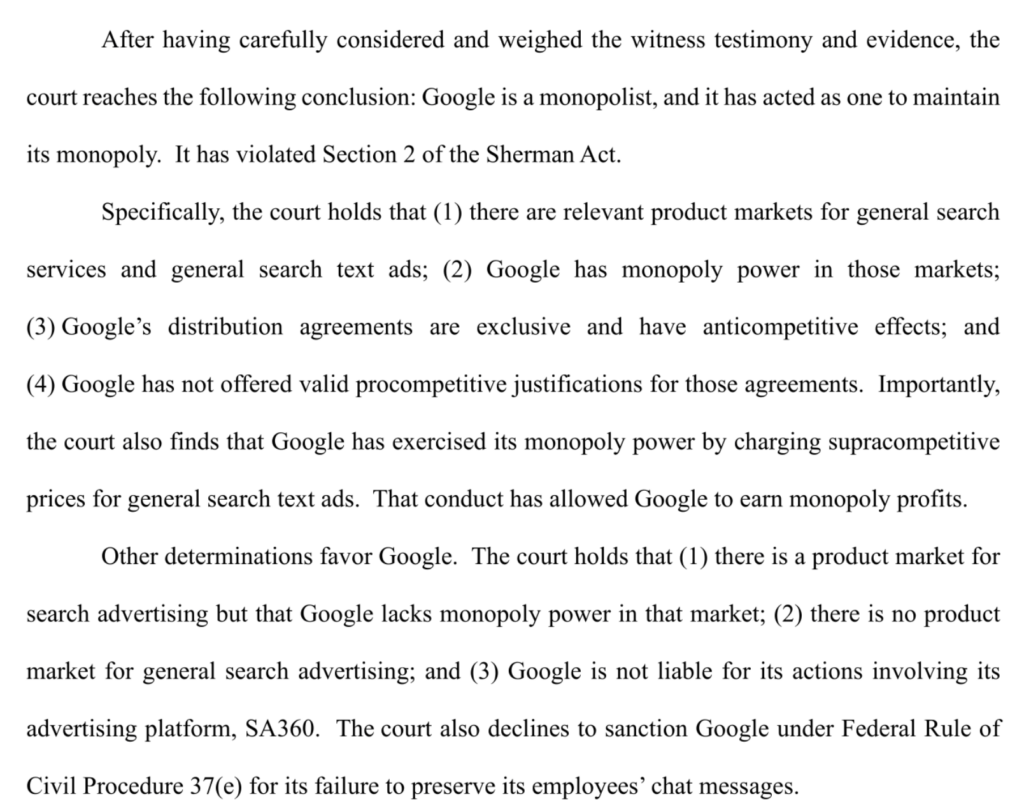

Then there’s Google, intentionally left out of the stock analysis above because of last Monday’s ruling (excellent summary from The New York Times here). While lengthy, this excerpt from the judge’s decision delineates where Google is at fault:

The differences between search, search text ads, and search advertising are outlined further in the ruling. Specifically, Google is called out for exclusivity in its revenue sharing agreements with Apple, Samsung, and the wireless carriers. As mentioned above, it is also accused of using its monopoly power to charge high prices for general search text ads.

The long-term ramifications of this ruling to Google, handset providers, and wireless service providers are not clear, especially in a world where artificial intelligence is eating into search dominance. What is clear is that Google’s search share will diminish from any court-ordered remedies, and that some of the efforts to ensure that result will be borne by those parties who previously received revenue share dollars from the search engine provider. More parties than Google will be penalized.

One remedy that has been proffered is to have the search engine results become round-robin randomized, meaning that one time the search result comes from Google, the other time Bing, and the next DuckDuckGo. But what if other search providers want to be included? Must Apple integrate any search engine into Safari? If that search engine returns a (slightly) different result, will that confuse the user? What if that search engine has a (slightly) different algorithmic bias (see controversy over whether Google would even acknowledge that the former President had even been assassinated from this AP fact check here)? Should equality of search results trump precision and accuracy?

Another suggested remedy is that Google offer decades of its search information results to competitors in hopes of building a parity (or, with AI improvements, improved) competitive product. The release of this information would continue for several years. We aren’t quite sure how the use of troves of information would be used (especially if in the wrong hands) but at least it doesn’t create a stiff burden on Apple or Samsung to incorporate round-robin search results in their browser (and should improve the quality and similarity of results).

Bottom line: The entire communications ecosystem is impacted by Monday’s Google ruling. How Apple will need to configure Safari will change. How Samsung and the carriers operate will change. And revenue sharing will diminish to Apple, Samsung, and others. Monopoly powers will diminish, and legal scholars will debate how this ruling was or was not an example of “fighting yesterday’s war.”

Furthermore, we do not think that the FTC/ DOJ will stop with search: Google Maps will be scrutinized next (including the purchasing of GPS data from the carriers), and we think that the “hand in glove” argument will not stop with Google – this ruling directly makes the case for accusing Apple of being dominant in smartphones (the “brick by brick” sequencing strategy that is being pursued by the DOJ and FTC) . The ramifications of that ruling make Google’s impact puny.

Fab Five cash flowing… but to where?

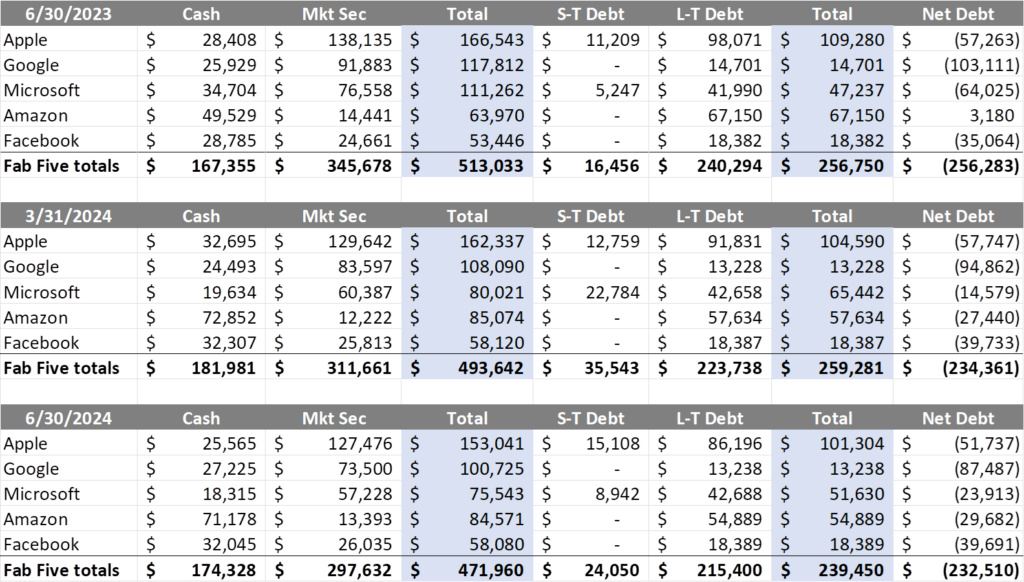

With the earnings season complete, we were able to compile the net debt balances for each of the Fab Five. Below is a comparison of 2Q 2023, 1Q 2024 and 2Q 2024 net debt levels by company and component (note – this data is included in the interim Brief spreadsheet updated every other week on the newly revamped Sunday Brief website):

It’s important to note that Apple, Google and Meta were actively repurchasing shares (see the trend in the opening market capitalization schedule). M&A activity has been minimal (Microsoft’s $69 billion purchase of Activision Blizzard last October being the exception). And each of the Fab Five had strong cash flows from operations each of the last four quarters (e.g., Microsoft had $118 billion, and Amazon had $108 billion in operating cash flows over the last 12 months).

So where is the cash going if Amazon and Microsoft are not buying back shares? Capital spending is accelerating, and more and more of it is going into data centers and associated infrastructure. Microsoft’s capital spending was $44 billion for the past 12 months, up from $28 billion in the same period June 30, 2023. Amazon had $59.6 billion in capital expenditures for the last 12 months, slightly higher than the $58.6 billion for the period ending June 30, 2023. And Facebook had both $21 billion in share repurchases over the last six months and nearly $15 billion in capital expenditures ($29 billion in capital over the last 12 months). This level of capital spending is unprecedented – more than $170 billion annually across Microsoft/ Amazon/ Meta/ Google alone (things get more convoluted with Alphabet/ Google because of GFiber but it’s safe to say they spent at least $40 billion in the last year on data center infrastructure).

That Microsoft would spend an additional few billion to secure fiber from Level3 Lumen seems perfectly logical against this backdrop (announcement here). We think there may be a few more announcements coming based on Lumen’s conduit availability.

2Q earnings review—when history rhymes

“History doesn’t repeat itself, but it often rhymes.” – Mark Twain (attributed)

We have listened to and analyzed earnings from each of the telecom carriers (as well as Lumen, given their meteoric rise last week) and, while we see a lot of events that look similar to other periods in the telecom industry. There are at least five rhymes, but space dictates that we look at two this week. The remainder will move to the August 25th edition.

As a quick reminder, here is what we covered in the last Brief (“Facts are Stubborn Things”):

- Verizon’s network, as measured by wholesale and retail subscribers, is larger than ever. The growth of the cable MVNO is an effective hedge for Big Red even as they continue to invest in consumer retail.

- Comcast’s broadband subscriber base generates more revenue today than in 2019 (pre-COVID surge). Cable’s stagnant growth is not the largest worry we have about the Philadelphia communications giant. Theme parks, streaming and blockbuster movie reliance pose greater threats.

- Debt matters – a lot – and there needs to be more discussion about interest costs after financings. Verizon quickly tamped down the rumors that they would be repurchasing shares on their earnings call, which is a good thing as they have more to worry about in an increasingly fibered world.

- AT&T should be performing better on fiber penetration given the market dynamics of their territory. While they posted robust growth, we think they left market share gains on the table in 2Q as they pursue a “hunker down” bundling strategy focused on their existing mobile base (see earlier elevated debt levels point).

Here’s where we see “rhymes”

- Roll ‘em up. Despite the assurances that T-Mobile is not pursuing a fiber-focused rollup strategy through a private-equity focused approach, it sure looks like it. In response to a question from Bank of America’s David Barden on whether a $10 billion transaction was next, CEO Mike Sievert went out of his way to describe their fiber strategy:

“First of all, I’ll just go back to my comments from a few minutes ago and reiterate our appetite for further transactions in this space is limited. We really like the ones we’ve done. They give us a material footprint and we’re not currently working on something else like it. That being said, we’re open-minded. You hire us on your behalf to be pragmatic, practical, strategic. And I think people can see our strategy. And if there’s the right partner, the right asset, the right pricing on it, the right strategy, a bias and preference for pure play, we would be open-minded but with a limited further appetite.

And part of that is we’re balancing all of our objectives. You heard Peter talk about our capital allocation strategy. We take that seriously. We think our investors like the fact that we have a pure-play elegant model. As we step into fiber, we’re keeping the elegance of that with a pure-play fiber model. We want to be an outstanding execution machine that’s able to execute really, really well in the marketplace. And we don’t have any interest in changing the complexion largely of who we are as a company because we perform so well.”

This reminds us of the earlier days of cellular, specifically the early days of T-Mobile:

- 1999: Western Wireless spins off GSM unit, VoiceStream Wireless

- 2000: VoiceStream buys Omnipoint (Northeastern US wireless provider – GSM)

- 2000: VoiceStream buys Aerial (largely Midwest US wireless provider – GSM)

- 2001: Deutsche Telekom purchases both VoiceStream and Powertel (Southeastern US – GSM) for a combined $59 billion. The combined company is named T-Mobile USA

- 2007: T-Mobile USA purchases SunCom. National coverage is complete

Building a nationwide GSM footprint took eight years to complete and required five different transactions and a spinoff. The result was a challenger network good enough to be the target of AT&T after four years of integration.

Technology unity. Regional focus. Minimal subsequent investment required (at least until the next spectrum auctions or BEAD requirements). T-Mobile’s fiber purchase pattern looks like a similar situation but not for the same reasons as the earlier days of T-Mobile. The use of private equity as opposed to traditional debt financing is one material change, and, because all retail operations are going to transfer to T-Mobile, the impact to their retail operations will be significant and positive.

We love this strategy and see plenty of opportunities that fit the criteria described by Mike Sievert above. We also appreciate the fact that prices of any asset can overinflate, and that there is no reason for T-Mobile to signal anything to the market.

- Overbuilders never succeed. We continue to admire Charter’s bold mobile and video strategies but are puzzled by the company’s recent comments concerning fiber to the home providers. On their most recent earnings call, CEO Chris Winfrey reiterated the “non-threat” that fiber providers pose to the company in response to a question from Sebastiano Petti (Editor’s note: we have omitted a part of Chris’ response related to wholesale access models):

“When I talked about maintaining our competitiveness, it means having a similar impact despite the fact that you have an expanding footprint. So you could — if I was being bullish, I would argue that, that’s an improvement as opposed to just staying steady. And so we’re competing well, both in the wireline overbuild space, which is more permanent as well as the cell phone Internet space as well…

… And there’s still economics that need to be deployed, and those economics, in my mind, are not very good, and they haven’t been for decades of the economics of an overbuilder for — on an existing footprint.”

This is not the first time that Chris or his predecessor, Tom Rutledge, have made comments about current overbuilder performance based on “decades” of experience. As the saying goes, however, “Past performance is not indicative of future results” for many reasons:

- The largest overbuilder threat in Charter’s footprint is AT&T, who has a large wireless customer base that is very receptive to a fiber bundle. As stated earlier, they are not marketing to the extent they should be. If AT&T strikes an exclusive deal with long-time partner Microsoft (another historical “rhyme” – think Motorola StarTac or Apple iPhone) related to a gaming broadband application, how will Charter respond?

- T-Mobile has the same base consideration with Lumos and Metronet, as well as their use of private equity as opposed to debt-financing. But they also have a secondary (and increasingly important) need – cell site backhaul in non-metro areas. As we discussed in the May 5th Brief (here), that is not insignificant. Competing against a new entrant fiber brand is one thing, but competing against Magenta is an entirely different story.

- The need for a video bundle (which carried the greatest scale advantages for Spectrum and Comcast in the past) has diminished with the rise of streaming. Smaller cable providers could not match the value of a Spectrum triple play because their video retransmission agreements had uncompetitive economics. As we have noted in many previous Briefs, cable’s single-play (or double play with wireless) metrics have been growing, and video has been shrinking. Without the video advantage (and landline voice bases shrinking rapidly), where’s the scale advantage vs pure-play fiber providers? It’s around advertising, which both T-Mobile and AT&T remove.

Overlaying the past results of coax and fiber overbuilders with today’s fiber models risks underestimating the power of the AT&T and T-Mobile brands. The economics have changed from the 2000s, and the financing mechanism is different. History is replete with incumbents who misread the impact of challengers. Unlike Comcast, who takes all fiber overbuilders very seriously, Charter appears to be leaning on outdated assumptions.

That’s it for this week. The sundaybrief.com website has a new look and feel, and we welcome your comments on the site. The next Brief will focus on additional historical rhymes. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Finally – go Sporting KC, Team USA, and Kansas City Royals!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.