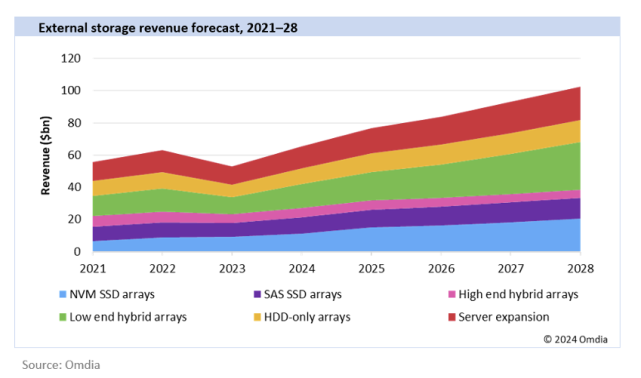

Another day, another forecast; this one from Informa-owned analyst company Omdia, which says global market revenue from “mission-critical” data centre storage will reach $103 billion by 2028. The projected growth is down to more sales and higher prices, it said, as digital transformation extends across the global economy, and enterprises seek expanded cloud storage and computing to manage company workloads.

It is unclear from the press note whether the market is actually for “mission-critical” cloud storage in the Industry 4.0 sense, or whether it is simply a review of the cloud storage market at large, and the term is being used to reflect the higher perceived “mission-critical” value of cloud services as enterprises stake more on their digital-change efforts. Either way, the message is that a surge is coming – to the point annual sales will almost double.

Revenue from data centre storage, across the edge-cloud continuum, was $53 billion in 2023, which was down 16 percent on 2022, and would be almost half of Omdia’s projected 2028 forecast. The 2023 slump was down to “economic challenges”, forcing “decreased IT spending”. Original design manufacturers (ODMs) saw sales decrease by over 30 percent in 2023, as data centre equipment spending “temporarily shifted away from storage”, it said.

OEM vendors, focused on traditional storage, saw a smaller single-digit year-on-year decline in sales. “Cloud storage shipments faced constraints as cloud service providers allocated significant portions of their budgets to the purchase of costly GPUs,” as the AI bug swept the vendor market, noted Omdia. Its forecast, available here, covers external storage revenue from both arrays and server expansions (see graphic).

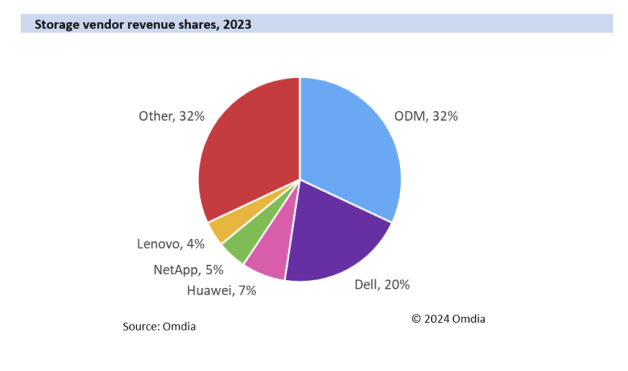

It shows the market was dominated by ODM vendors in 2030, with a 32 percent share of revenue volumes. Of OEMs, US-based Dell EMC took a significant 20 percent share, with Huawei in third on seven percent, NetApp in fourth with five percent, and Lenovo in fifth with four percent. Unnamed “others” held 32 percent of the market collectively.

But “the storage market” (at large?) is “poised for a resurgence”, said a statement, because of “ongoing digital transformation, rapid growth in data volumes, advancements in AI, and the urgent need for storage modernization”. It said: “As industries become increasingly data-dependent, the storage market’s downturn is likely to be short-lived. These factors will collectively revitalise the storage market, ensuring a return to a growth trajectory.”

Dennis Hahn, principal analyst for data storage at Omdia, said: “Storage and data management are strategic components of modern digital enterprises, which will ensure continued long-term investments in storage. Storage vendors have been adjusting their acquisition models to be more cloud-like, adopting a pay-per-use approach and focusing on overall data needs rather than just storage. Ransomware protection and AI-driven data set creation are becoming essential features in storage solutions.”