August greetings from Cedar Rapids and Kansas City. This week’s opening picture comes courtesy of the 49th Annual St Jude’s Sweet Corn Festival held from August 9-11 in Cedar Rapids. The weather and food were quintissential Iowa. Next up: experiencing Iowa Hawkeye football – stay tuned.

This week, after the market commentary, we will close our two part series on parallel trends, with a particular focus on bundling strategies and debt/ liability management.

A schedule note – we will not publish an interim Brief on Labor Day weekend but will share the updated spreadsheet in the online version of the September 8th full Brief.

The fortnight that was

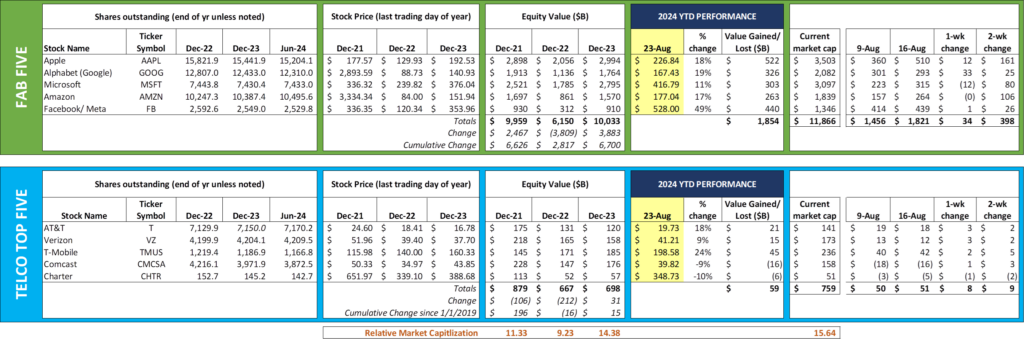

When we penned the market commentary two weeks ago, we used a roller coaster analogy. Since then, it’s been slow but steady recoveries for both the Fab Five (+$398 billion over the last two weeks) and the Telco Top Five (+$9 billion). While the S&P 500 index is up 1.4% over the last month, the Fab Five gains over the past four weeks have been just over one percent and the Fab Five are still ~$950 billion or so from their mid-July peak. As we discussed in the previous Brief, the Fab Five are less exposed (positively or negatively) to interest rates given their large cash and equivalent balances on their respective balance sheets. Lower interest rates help their customers, however, and some rate cuts appear to be around the corner.

Every Fab Five stock is higher, with Microsoft slightly trailing their peers on a percentage basis (11% vs. 17-19% YTD gains for Amazon, Google, and Apple). Growing a $3 trillion market cap company in a constrained regulatory environment isn’t as easy as it looks, and, as we describe below, Microsoft has had a few hiccups with their AI integration.

The Telco Top Five story, however, is different. Even with a remarkable Charter comeback (up 9% in the last month), the wireless/ fiber stocks seem to be outpacing their cable peers. Including half a year of their 5.63% annual dividend yield, AT&T is up over 20% in 2024, and T-Mobile is tracking to a 25% gain (both are driven by earnings growth, although T-Mobile also has the impact of buybacks). There has been a meaningful value shift in the last twelve months, with AT&T stock up 39% and Comcast down 12% over that time (including dividends, the gap is well above 50%) – see nearby chart courtesy of Yahoo – link here. Even with changes to their network (which we are confident Comcast will implement as quickly as possible), the metric of “fiber customers returning to Comcast” must be depressingly low.

Since the last Brief, Google announced their latest round of Pixel phones, the Pixel 9, the Pixel 9 Pro, and the Pixel 9 Pro XL (the dual sizes of the Pro is new). We noted in last week’s interim Brief that the 42 MP front-facing camera (announced with the Pro lineup) is going to work its way through other devices in 2025 and 2026, placing additional constraints on those networks not engineered for material upstream traffic.

We likened the magnitude of the change to the “oh no” moment wireless engineering departments experienced when Facebook launched picture and video uploads around 15 years ago. For those of you who do not remember that time, Facebook ended up limiting the picture tonnage to 1 MB per photo and SD quality (at best) for most videos (current limits are 30 MB per photo). Those images were not live, however, and compression algorithms were used heavily to keep wireless networks from being overwhelmed.

The other key feature announced by Google was that every Pixel 9 would include seven years of OS, Pixel Drops, and security upgrades (it’s also available for every Pixel 8 device but was announced after launch in October 2023). This compares to four upgrades for each Samsung Galaxy device. We applaud the movement from two upgrades which was commonplace until the COVID era.

Keeping on the smartphone theme, Apple is rumored to be announcing a new smartphone lineup on September 10th with a probable launch of the iPhone 16, iPhone 16 Pro and iPhone 16 Pro Max on September 20th (article from Bloomberg here). While the date is not a surprise, the nature of the Apple Intelligence demonstration on the 10th is anyone’s guess. Specifically, Apple will need to demonstrate how their AI cloud will protect privacy (more on Apple’s approach to Private Cloud Compute from the company here). More on what will be included (device size, battery, processing power) in the next Brief.

After months of testing, Microsoft announced that it will be releasing its AI-driven Recall feature for Copilot+ PC users in mid-October. The update was short but sweet:

“With a commitment to delivering a trustworthy and secure Recall (preview) experience on Copilot+ PCs for customers, we’re sharing an update that Recall will be available to Windows Insiders starting in October. As previously shared on June 13, we have adjusted our release approach to leverage the valuable expertise of our Windows Insider community prior to making Recall available for all Copilot+ PCs. Security continues to be our top priority and when Recall is available for Windows Insiders in October we will publish a blog with more details.”

As a reminder, Microsoft changed their Recall default to “off” on all new devices (more on the feature and the initial reaction from this CNBC article). The ability to intelligently analyze web usage could have significant impacts on productivity and operational effectiveness. It could accelerate time to troubleshoot service issues or even solve them prior to occurring in the first place. Forcing the recall feature to be used, however, was a step too far. Microsoft realized this and changed their approach.

Finally, we are revisiting the Google antitrust decision with this lengthy but informative post by Professor Erik Hovenkamp from Cornell Law School (see the previous Brief for background). Here’s his take on the possible remedies:

“The most likely remedy is an injunction terminating some or all of Google’s contracts. However, the court might permit Google to continue giving itself default status on Chrome. It might even allow Google to continue purchasing some default privileges from other firms, provided that such deals are sufficiently narrow in scope. For example, the court might permit Google to continue buying default status on Firefox, which accounts for only a small percentage of search queries. But its much larger Safari contract is destined for the chopping block.

“Note that an injunction of Google’s agreements would not stop Apple or other companies from continuing to make Google the default. It just prevents Google from buying default status. Nor would an injunction prevent rival search engines from entering into default agreements. In fact, allowing small firms or entrants to acquire some limited default privileges may actually be procompetitive, as it can stimulate entry or investment in search quality. However, to avoid legal trouble, such deals would have to be narrow in scope. The logic of the Google decision suggests that no one search engine should have defaults covering a large portion of search traffic.”

We found Professor Hovenkamp’s analysis insightful. Unraveling Google’s multi-sided business model is going to be difficult to do. Like the popular game Jenga, one extreme ruling can change how Google approaches Android or Gmail, something that would actually increase the price paid by consumers. Imagine the uproar if Google were actually forced to charge a monthly fee for Gmail to end customers – a highly unlikely event, but one maverick judge could set the wheels in motion that would drive the Mountain View company to take extreme measures.

2Q Earnings Review – When History Rhymes (Part 2)

In the last Brief, we covered two trends that appear to “rhyme” with previous telecom history:

- We think that the methodical fiber to the home (FTTH) roll-up strategy being pursued by T-Mobile looks a lot like that pursued by GSM providers VoiceStream, Powertel, and eventually Deutsche Telekom 20+ years ago. Technology-focused, patient yet methodically integrated. We contrasted this with the approach taken by Verizon (One Fiber, organic growth leveraging owned or deployed assets) and AT&T (brownfield overbuilds with a focus on cross-discounting).

- Dismissing overbuilders as a group. While the cable industry seems to be coming around on this issue, we focused on 2Q earnings call comments made by Charter executives that seemed to dismiss the impact of today’s private equity (and T-Mobile) funded overbuilders. We neglected to discuss the impact of BEAD funding versus the high-yield debt of the past but did mention the shift that had occurred with respect to the importance of linear video as a part of the competitive bundle. As mentioned earlier, the metric “percentage of current FTTH customers moving back to DOCSIS/ cable” should be asked of every cable company. If customers are not returning, then history is not repeating itself.

We add two additional “rhymes” to this week’s Brief:

- The increasing use of content promotions to drive gross additions. We are reminded of this tactic with Verizon’s announcement this week that they will offer an entire year of Netflix Premium and NFL+ Premium to customers for a one-time fee of $99.99. This latest promotion piggybacks on the NFL Sunday Ticket promotion started earlier in August (details here).

We have seen content bundling strategies ebb and flow for the last several years in the wireless industry: Netflix on Us (T-Mobile), MLB.TV + T-Mobile, Amazon Prime + Metro PCS (T-Mobile), Spotify + AT&T, HBO + AT&T, and others. The cable industry has also used premium channel promotions (Showtime, Starz, HBO, others) to either drive linear cable or premium service additions for years.

Verizon, however, has taken content bundling to an entirely new level with their investment in the +play platform. Their most recent announcement linked above includes an entire NFL Playbook that outlines promotions for ESPN+, Peacock, Paramount+, and YouTube TV. The only games not covered are on Amazon Prime (that relationship has been strained since Verizon’s addition of the Walmart+ perk).

On top of the NFL, Verizon also has aggressively bundled Apple products and services for the last several years (link here to the latest offers). They also recently began to offer YouTube Premium (music streaming, no ads on YouTube) for $10/ mo.

Contrast that with AT&T, who has absolutely no content promotions, choosing an aggressive cross-product discounting strategy of owned assets (DIRECTV, Fiber, Wireless) instead (see here for their latest offers).

Verizon’s strategy directly takes on Roku, Amazon Fire, Apple TV and other TV-focused content platforms. So far, it seems to be both an excellent retention and acquisition tool. But content promotion rates are likely to increase along with post-promotion monthly subscription fees. How Verizon balances rate inflation with acquisition remains to be seen. Historically, when telecom providers try to promote products and services outside of the immediate ecosystem (who can forget Sprint’s “free TV” promotions), they are unsuccessful and eventually unprofitable. Verizon’s commitment to content bundling, first implemented as a fast follower to T-Mobile, continues to impress. And AT&T’s discipline to forego the promotional parade also deserves a hat tip.

- Deleveraging focus (at least for now). Every large telecom provider (except T-Mobile) is actively paying down debt and taking steps to increase their EBITDA. Verizon has set a goal of returning to an historical leverage of 2.4x (meaning there is $2.40 of debt for every dollar of trailing 12-month adjusted EBITDA) and they are getting closer every quarter (current is 2.6x when total net debt is used as the numerator).

Deleveraging (and share buybacks once the appropriate levels are reached) is going to occur until the next spectrum auction is announced. We fully expect that AT&T and Verizon will begin aggressive share buybacks when they reach a 2.4x level (or lower). Both companies should reach this healthier leverage level by the end of 2025.

Charter has historically lived with more leverage and has started share buybacks faster. We anticipate that more aggressive buybacks will begin when their revenue hits the low 4.0x leverage ratio.

While it is doubtful we will see any major telecom provider reach a negative net debt level anytime soon, each passing quarter’s leverage is improving.

That’s it for this week. The sundaybrief.com website has a new look and feel, and we welcome your comments on the site. In the next Brief, we will focus on network coverage claims and Apple’s forthcoming iPhone 16 launch. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Finally – go Sporting KC, Kansas City Chiefs and Kansas City Royals!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.