Mobile backhaul is a critical component of any mobile network, as it is the link supporting voice and data transport between the core network and Radio Access Network (RAN) sites. Wireless backhaul (i.e., microwave) continues to be a key technology — ABI Research estimates that around 60% of mobile cell sites are backhauled by microwave today — so this article examines some of the key developments and innovations in the microwave industry.

Key Industry Trends

- Demand for data capacity continues to grow

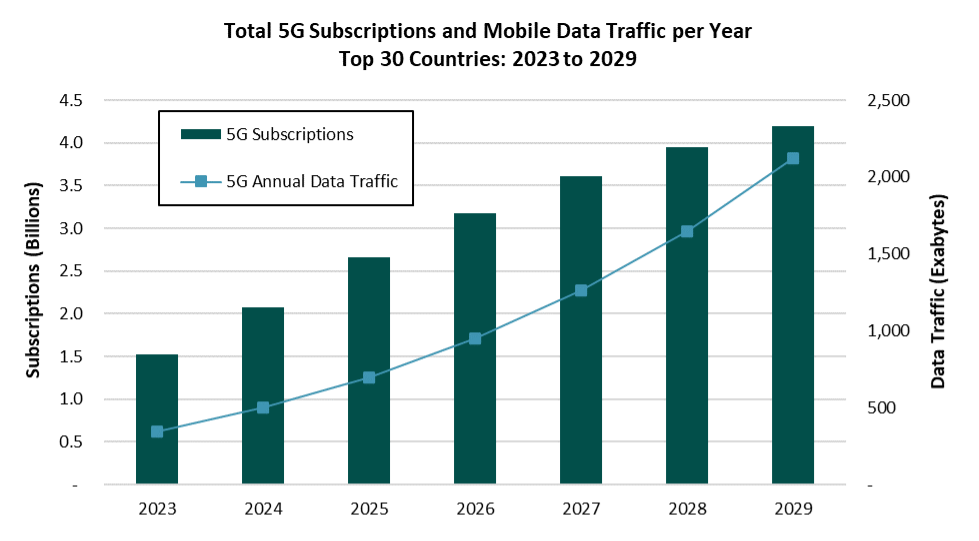

Annual 5G subscriptions from the top 30 countries monitored by ABI Research reached 1.5 billion at the end of 2023 and are expected to grow to over 4.1 billion by the end of 2029. Accordingly, 5G data traffic is also forecast to increase from over 340 exabytes in 2023 to 2,100 exabytes in 2029 (at a Compound Annual Growth Rate (CAGR) of 35%) as the growth in high-resolution video, both downloads and uploads, as well as Artificial Intelligence (AI)-enabled applications, ramp up.

- Challenges in addressing the digital divide

Beyond urban areas, Communication Service Providers (CSPs) also face the challenge of enhancing the quality of mobile connectivity in rural areas, where lower population density often means lower Return on Investment (ROI). This issue is a global one, affecting both developed and developing countries. For example, studies by Opensignal have shown the large gap in 5G mobile broadband download speeds and availability rates between urban and rural areas across multiple European countries. Similarly, challenges were also reported in Asian countries like Malaysia, Indonesia and the Philippines.

- Tower rentals imposing additional burdens on CSPs

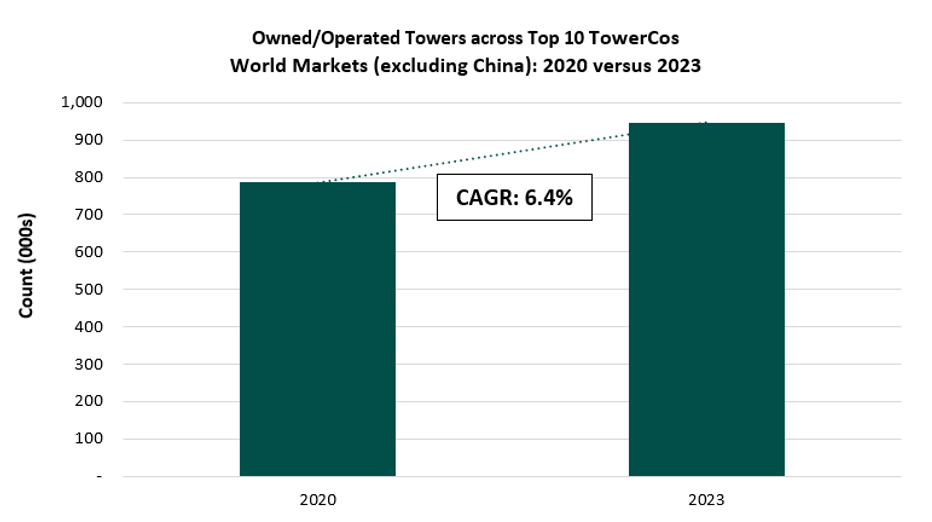

Another key trend observed in the market is the continuing divestment of CSP tower assets to Tower Companies (TowerCos). Announcements of telco tower sales are continuing in developed markets and accelerating in emerging markets, with deals being executed across geographies, including the Philippines, South Africa, Bangladesh, India and Egypt. While microwave solutions typically have lower deployment costs compared to wired backhaul solutions, there are increasing concerns from CSPs regarding the rise of Operating Expenditure (OPEX) due to accumulating tower-related telco equipment rental costs. As a result, reducing wind load, quantity and weight of microwave equipment has become a key priority for both Network Equipment Vendors (NEVs) and CSPs alike.

- Network topology evolution to support network densification

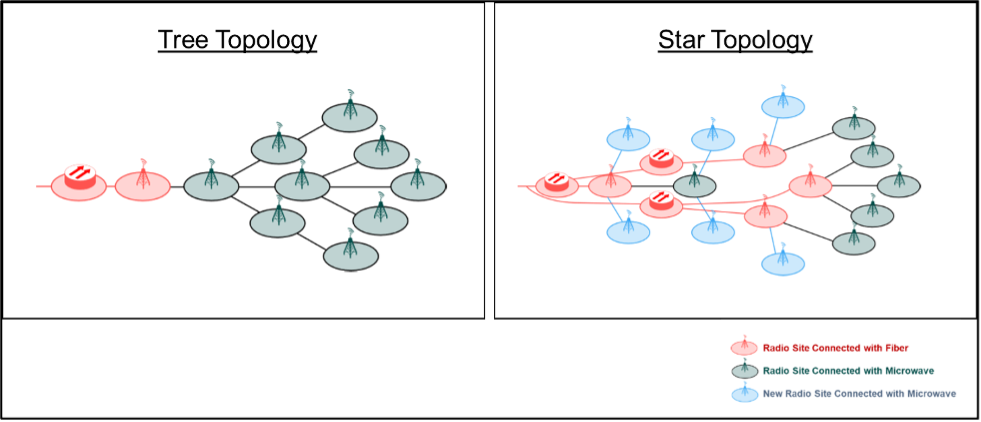

“Star” topologies represent an evolution from the traditional “tree” topology where a central hub transceiver links to multiple small cells, with each small cell sharing the hub transceiver bandwidth. In this topology, for every N microwave link, only N+1 radios are required, giving rise to Capital Expenditure (CAPEX) and OPEX savings over the Point-To-Point (PTP) connectivity used in “tree” topologies. The “star” topology is intended for the backhaul of heavy mobile traffic sites in urban locations, where small cell densification is growing.

Meeting Backhaul Requirements with Microwave

According to the European Telecommunications Standards Institute (ETSI), 5G transport networks will need to meet capacity requirements of 3 Gigabytes per Second (Gbps) for rural, 5 Gbps for suburban, between 5 and 10 Gbps for urban and more than 10 Gbps for dense urban environments. Additionally, latencies of below 5 milliseconds (ms) and 1 ms must also be met for Enhanced Mobile Broadband (eMBB) services and Ultra-Reliable Low Latency Communications (URLLC) mission-critical applications, respectively. Many telcos have yet to meet these performance metrics.

5G-Advanced networks are also starting to be deployed. In June 2024, The 3rd Generation Partnership Project (3GPP) announced that Release 18 specifications — the first release for 5G-Advanced technology — was ready to be frozen, setting in place the necessary environment to facilitate large-scale commercial rollouts of 5G-Advanced-compliant solutions. Many operators around the world, including, but not limited to Optus (Australia), Maxis (Malaysia), du (United Arab Emirates) and China Unicom (China), have begun trials of the 5G-Advanced technology, thus signaling the growth potential for the technology. With 5G-Advanced expected to support even higher downlink and uplink speeds of up to 10 Gbps and 1 Gbps, respectively, the future requirements for mobile backhaul can only increase.

- E-Band continues to play an important role in supporting advanced networks

The E-band is, and continues to be, an important technology to support wireless mobile backhaul. First, operating in the higher frequency ranges of between 71 Gigahertz (GHz) and 86 GHz, and coupled with wide channel sizes, E-band wireless links can support more than 10 Gbps capacities with low latency, making it an ideal option for wireless backhaul in dense urban and suburban scenarios. Second, CSPs can also benefit from the generally lower spectrum costs of deploying E-band links, where a tiered spectrum pricing structure for licensed E-band links is commonly observed. Third, the capabilities of E-band solutions are also improving, with multiple vendors offering 1) high-power radios and high-gain antennas; 2) beam tracking; 3) Band and Carrier Aggregation (BCA); 4) Cross Polarization Interference Cancelling (XPIC); and 5) AI solutions to enhance the capacity, link distance and energy efficiency for the E-band.

In particular, XPIC is seen as a key technology for the E-band. XPICis done by propagating two signals horizontally and vertically over the same channel, increasing channel reusability and thereby overall link capacity. With the use of XPIC, E-band links can provide up to 20 Gbps capacities in urban environments. XPIC technology also reduces costs by removing the need for additional hardware equipment and optimizes spectrum usage efficiency. This technology is expected to become increasingly important to support high-capacity requirements, especially because the majority of E-band channel sizes around the world are less than or equal to 1,000 Megahertz (MHz).

- Traditional microwave bands remain essential for long-haul microwave backhaul links

Traditional microwave bands continue to play an important role in microwave networks, especially in supporting long-haul links for rural areas. Utilizing technologies such as BCA, which bonds different carriers and/or frequency bands together, microwave solutions can achieve higher capacity, range and reliability, while reducing equipment quantity, size and power consumption. However, a key consideration here remains how to introduce minimum footprint for on-tower equipment that optimizes data throughput and range, while keeping tower rental costs low.

- Higher aggregation capabilities on hub sites to address site densification

As opposed to fiber deployments, microwave links allow for more flexible deployments due to reduced complexity of installations and avoidance of potential right-of-way issues. However, to effectively address the increasing densification of cell sites in urban and dense urban areas, microwave hub/aggregation solutions need to support higher traffic aggregation capabilities with lower link spatial separations.

Microwave Technology Evolution Trends

To adequately address CSPs’ concerns on backhaul capacity and tower rental costs, microwave solutions continue to evolve to meet these changing needs.

- High-power and dual-carrier E-band solutions

To increase data capacities, higher-powered E-band solutions are being introduced with 25 Gigabit Ethernet (GE) interfaces. Additionally, to overcome the typical limit of 1,000 MHz for E-band channel sizes, there have been introductions of dual-carrier E-band solutions (2T Outdoor Units (ODUs)) that support data throughputs of up to 50 Gbps with the use of both dual-channel and dual-polarized transmissions, via a single unit of equipment. Such innovations effectively balance the need for increased data capacity, while keeping tower rental costs low.

- Innovations being developed for long-haul microwave backhaul links

While BCA is not a new concept, NEVs have continued to introduce new innovations to their long-haul microwave backhaul solutions to drive increased efficiencies and tower rental cost savings:

- Multi-band antennas address the issue of tower space and weight constraints by enabling a single antenna to support multiple frequency bands, as opposed to deploying a separate antenna for each frequency band. Recent innovations by backhaul vendors, such as Huawei’s SuperLink solution, have demonstrated how a single antenna can now support up to four frequency bands, thereby reducing the total number of antennas needed on the tower.

- Carrier aggregation enables a single radio to support multiple channels simultaneously, thereby enabling higher data throughput without the need for additional equipment. In this regard, several NEVs have launched 2T2R microwave Radio Frequency Units (RFUs) that can support up to four carriers on a single hardware unit.

- Band aggregation bonds different frequency bands together, such as the E-band with traditional microwave band links, to increase the range and reliability of higher-frequency Millimeter Wave (mmWave) bands. For example, by bonding a microwave band (e.g., the 18 GHz band) with the E-band, mobile operators can more than double the propagation range, with the link in the lower band being used to assure carrier-grade availability (i.e., 99.995%). The introduction of multi-band branches also helps reduce the quantity of equipment needed to support horizontal and vertical polarization for multi-band deployments.

- Higher aggregation capabilities on hub sites to address site densification

New microwave hub/aggregation solutions that support frequency reuse at reduced spatial separations—as low as 15°—are being introduced to support “star” topologies. This reduced spatial separation allows CSPs to deploy more microwave links in more directions via a single hub site, thereby both reducing costs of deployment and increasing spectrum efficiency. Additionally, these hub solutions also feature high switching capacities and 25GE interfaces. As a result, CSPs will be able to deploy dense microwave networks quickly to address the increasing demand for data in suburban and dense urban areas.

Summary conclusions

In conclusion, microwave technology continues to evolve with the changing requirements of mobile access technology and is expected to maintain an important role in providing reliable mobile backhaul connectivity, as a standalone solution or as a redundancy option for fiber networks. With increasing demand for data and the burgeoning AI market, modern microwave solutions are designed to not only help CSPs meet the requirements for higher backhaul capacity, but to also reduce tower load and OPEX. CSPs will need to consider how they can modernize their backhaul networks to meet future mobile requirements.