September greetings from Kansas City and Cedar Rapids. Pictured is the CellSite Solutions indoor gantry crane moving one of September’s remufacturing shelter projects into place (twenty tons of project in this case). The team completely rebuilds each one to customer specifications, then delivers to the site all within two months, saving customers money while also reclaiming tons of concete from landfills.

This coming Thursday we will be leading a webinar on trends in telecom and utility shelters. Conducting the webinar will be INDATEL’s head of marketing, Shiloh Vance. More details here if you are interested in joining.

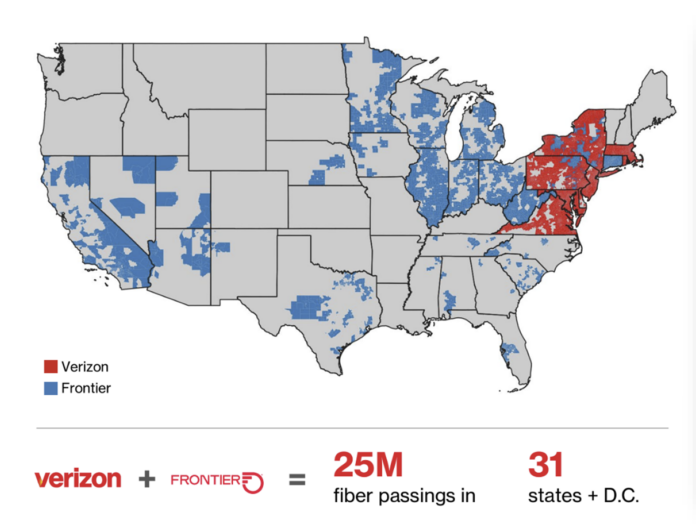

After an extended market commentary we discuss last week’s announcement that Verizon plans to acquire Frontier for $20 billion. Also, the updated market valuation spreadsheet normally included at the end of each interim Brief will be included at the end of the online version of this week’s Brief (we did not publish an interim Brief over the Labor Day holiday).

The fortnight that was

This was a very bad week for Fab Five market capitalizations (-$527 billion). Despite this week’s disastrous performance, the group remains up $1.33 trillion for the year, with the worst performing stock (Microsoft) still up a respectable 7%. Apple, who has a big event on Monday (more on that below), is up $430 billion or 15% in 2024. Facebook, even with last week’s losses, is still up 41% this year, adding $370 billion (this YTD gain is slightly less than that of the current equity values of T-Mobile + Comcast). It’s getting harder to grow profits at the expected magnitudes, and, as a result, multiples are decreasing.

Apple has a special announcement on Monday which will be focused on the iPhone 16 and the integration of Apple Intelligence. The best preview of those events is from Bloomberg’s Mark Gurman here. Rather than rehash the article, we will spend some time in the September 22nd Brief looking at the announcement details and answering the question “How super will the iPhone 16 cycle really be?”

The Telco Top Five is going through its own value rotation. As we have pointed out in several Briefs over the summer, AT&T is steadily marching up the capitalization table and is now a mere $7 billion in value from Comcast. This spread was $56 billion at the beginning of this year. With an annualized dividend of 5.3% a total return of 30% or more is possible for Ma Bell. John Stankey, Jeff McElfresh, and the rest of the AT&T team are extracting a degree of discipline from the dinosaur not seen in many years (if ever). And AT&T has broadband subscriber upside due to secular growth trends. Their metamorphosis is not an illusion.

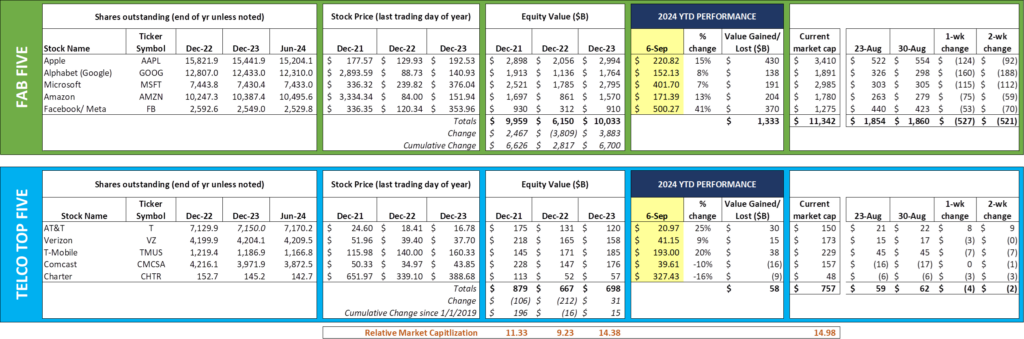

Speaking of broadband, Starlink got some good news over the last two weeks as the NTIA proposed that the service should be able to be considered for BEAD funding. It’s not a full-throated endorsement, however, as this figure from their proposal shows:

Here are the conditions for “Other Broadband Technologies” described in the NTIA proposal:

“Given the service limitations that led to the omission of these technologies from the definition of Reliable Broadband Service, it is particularly important that Eligible Entities carefully consider the capabilities of existing Alternative Technology network services and existing enforceable commitments to deploy such technologies. To accomplish this, Eligible Entities must determine: (1) Where an existing or completed enforceable commitment to deploy an Alternative Technology is subject to ongoing network performance monitoring (Section 3.1); (2) Where an existing Alternative Technology provider can demonstrate that it currently meets the BEAD Program requirements (Section 3.2).

If neither of the above scenarios apply, locations within the project area may fall into a third scenario (Section 3.3), where the Eligible Entity may identify costs for Alternative Technology projects that are reasonable and necessary to ensure coverage of all unserved and (where financially feasible) underserved locations within their jurisdiction, as required.”

For the most rural parts of the country (e.g., less than five homes per mile of fiber deployed in a fully wired scenario), LEO/ Starlink is not only the most economic proposal, but likely the only way many states can complete a universal broadband speed requirement and stay within budget. We think that there is a point, even in a situation where a rural electric cooperative could build a cost-effective fiber overlay, where satellite is the best way to allocate scarce funding resources.

More details are in this CNET article which has link to the NTIA proposed technology guideline change. Comments to their proposal are due by September 10th with a final guideline due by the end of the year.

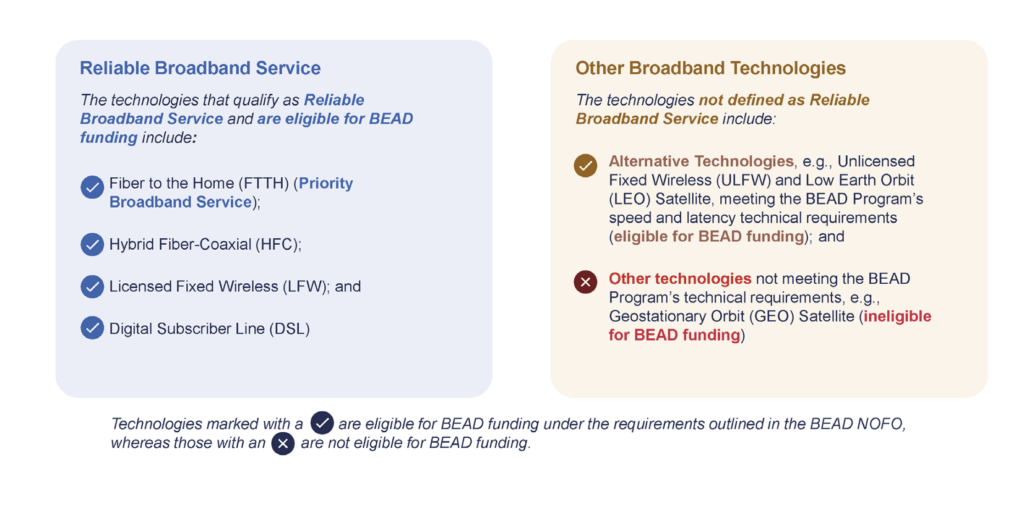

Verizon to buy Frontier for $20 billion – Why Frontier? Why now?

Starlink was not the only company making broadband news since our last Brief. Verizon, who was partially created through the merger of GTE and Bell Atlantic in 1998 (see this New York Times recap of the announcement), sold much of the GTE assets to Frontier in 2009 for $8.6 billion (which we documented in our 2019 “Fiber Always Wins… Until it Doesn’t” article as one of the worst merger integrations of all time). Now Big Red is buying those assets back for slightly less than $21 billion ($9.59 billion in equity + $11.25 billion in debt – news release with full details are here).

Why would Verizon, who still has a lot of legacy copper to overbuild, decide to purchase a company who still derives half of its revenues from copper/ DSL? Joe Russo, Verizon’s President of Global Networks and Technology, and Sowmyanarayan Sampath, the CEO of Verizon’s Consumer Group, were participants in the Citi Global TMT Conference on the same day that the transaction was announced (September 5th). Here was Sampath’s answer to that question:

“Our fundamental strategy is around bringing premium broadband and premium mobility to American customers. That’s been our fundamentals. Those are the 2 tailwinds we are running. Those are the big secular trends we are building on is mobility and broadband. This is doubling down on that. So this basically expands our fiber footprint, 7 million on homes, now 10 million by 2026. So basically, by the end of 2026, we will have 30 million homes of the best fiber on earth. So that’s step one. Then on top of that, you complement that with fixed wireless access, 60 million homes will have access to fixed wireless access. The combination of that is we’ll be able to bring high-quality broadband to a large portion of America. Then on top of that, you overlay our mobility network, we have the #1 mobility network. And when you combine the 2 things, you get incredible value both for customers and for us. To give you a sense, when you bring wireless and fiber together, we see a 50% reduction in mobility churn. And then we also see a 40% reduction in fiber churn as well that comes with it… The last one is for our Frontier customers, we’ll be able to give them access on myHome and myPlan offerings. That’s a really — it’s a differentiated world-class platform where we have connectivity. We have perks that you can’t buy from anywhere else, nonconnected services, then access to our loyalty program… we see is a 400 to 500 basis point higher wireless share in markets where we have fiber.”

There is a lot to unpack in that quote, but where this leaves Verizon is with around 45 million homes passed, with 15 million of those being copper (nearly all of that rural) and 30 million with fiber by the end of 2026. This number matches AT&T’s current goal (on a base closer to 60 million homes), although we expect that AT&T will increase that goal to 35-40 million with a few BEAD deals.

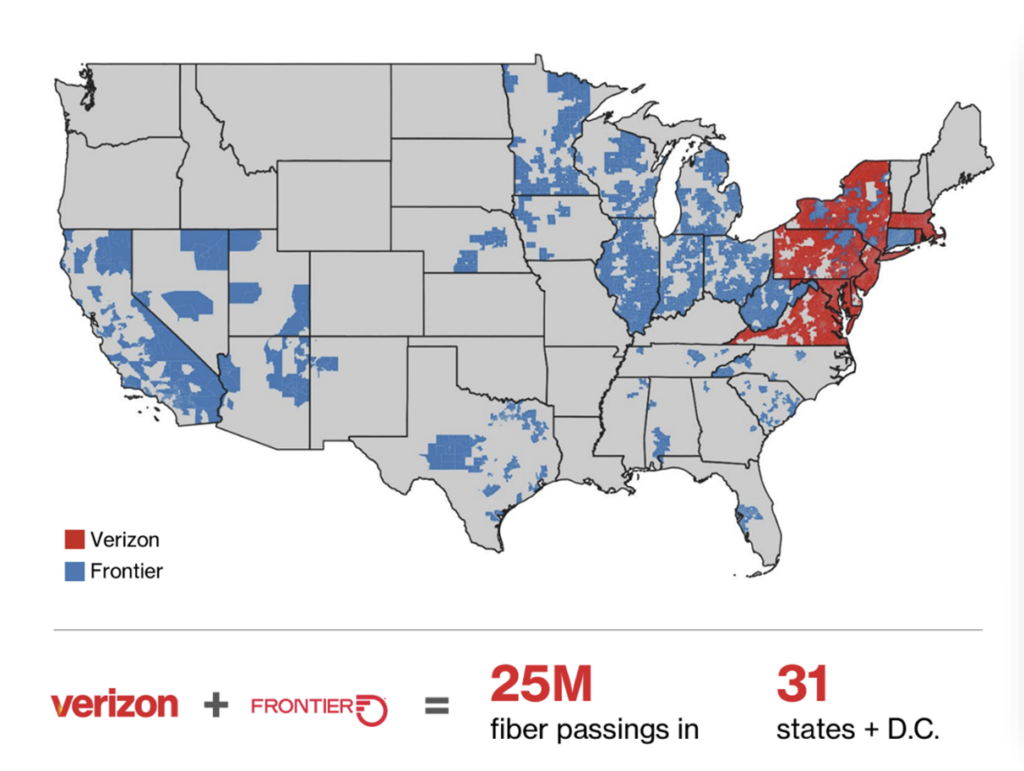

Here is the map that was presented in Verizon’s conference call to discuss the Frontier acquisition:

Frontier increases Verizon’s total fiber footprint by 40-55% (today vs. 2026). That’s a large opportunity to grow Verizon’s existing bundled offer and achieve material retail synergies.

We wonder what Charter’s reaction was to the merger announcement as Frontier currently overlaps 11% of their footprint (namely Tampa and Rochester, but also some California and Dallas suburbs). Verizon is already gaining wireless market share in Charter’s territory, but this will further the “heads I win/ tails you lose” argument.

From the map view, it also appears that there will be meaningful synergy opportunities with the former Southern New England Telephone (SNET) who will now be on their fourth owner since 1998 (SBC, then AT&T, then Frontier, and now Verizon).

Frontier also does not own and operate a national backbone. Verizon will provide an immediate and significant synergy opportunity (low costs are critical for long-term broadband success). In turn, Verizon will also pick up more on-net business locations from Frontier which should have both cost and revenue synergies.

But the storyline is about acquiring and growing customers who want to purchase a converged fiber + mobile offering. Our view is that vision can be fulfilled but that the costs are far greater than the $20 billion purchase price. Back to the math above – Frontier, per their 2021 presentation as they emerged from bankruptcy, has roughly 15.2 million total passings, and they have currently built out to a little less than half of these (7 million, up from a 2019 level of about 3.2 million). That still leaves 5 million more homes to build out, and we assume much of these will be in “underserved” areas as defined by the BEAD rules.

Verizon, on the other hand, will have about 10 million homes currently served by DSL (and 19-20 million served by Fios) by the end of 2026. This leaves ~15 million homes currently underserved or unserved by Verizon.

Each state broadband director is under pressure to deliver as much fiber to the home as possible even with the door opening for satellite. The FCC handed many of these directors a gift with the additional $18+ billion in Enhanced ACAM funding announced in late 2023, but Verizon’s proposed transaction may have even greater value.

In particular, the broadband directors for New York ($665 million in BEAD funding), Pennsylvania ($1.162 billion), Illinois ($1.040 billion), Virginia ($1.48 billion), West Virginia ($1.211 billion) and Maryland ($268 million) must be salivating. They now have a new source of leverage (and specifically a new pot of money) to ensure that as many homes are served by fiber as possible. Our guess (and it’s only that) is that Verizon could be on the hook for at least 3 million additional homes to get the transaction approved at a cost (to Verizon) of at least $2,000 per home (this actually assumes a 2:1 State/ Verizon match). Six billion of additional expenditure is a lot more in capital than was communicated at the announcement.

It will be particularly interesting to watch the dialogue between Verizon and the states of Illinois, New York, and California, both for underserved commitments but also for long-term pricing. The Affordable Care Plan might be altered by Congress in 2025, but these states will make sure it lives on if Verizon is going to complete the merger. There will be implications for broadband ARPU as a result. Whether the states expand the ACP pricing standards to Verizon’s fixed wireless access technology is anyone’s guess, but we think that Illinois, New York and California will try to weave in a technology-agnostic solution for a period of time.

Bottom line: We understand the opportunity that exists for Verizon with respect to Frontier’s fiber customer base. Upselling them to Big Red should be an easy task. However, the regulatory approvals that are required to upgrade the cooper base and also provide an ACP-esque solution seem to be insurmountable hurdles. Frontier is a terrific turnaround story with impressive leadership and strong execution – wouldn’t a partnership short of an acquisition make more sense?

While Verizon is focused on regulatory approvals, T-Mobile will be expanding with both their Lumos and Metronet acquisitions (also subject to the same risks described above but over far smaller footprints). They have a lot more retail wireless to gain in rural Virginia and North Carolina (see our analysis in the May 5th Brief) than Verizon has in these areas. T-Mobile will also be working on approval of the US Cellular transaction (while more complex, that transaction is constructed in a way that should enable a faster approval process than an outright acquisition).

Meanwhile, AT&T will hit their 30 million goal, continue to bundle (without a lot of streaming perks – at least yet), and announce another 10 million brownfield expansions which will likely include BEAD monies. Who has the easiest execution path? It’s likely AT&T at this point, followed by T-Mobile and Verizon. The Frontier acquisition opens up scrutiny into Verizon’s copper base.

That’s it for this week. The sundaybrief.com website has a new look and feel, and we welcome your comments on the site. In the next Brief, we will discuss the implications of the iPhone 16 launch for the wireless carriers (including cable MVNO). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Finally – go Sporting KC, Kansas City Chiefs and Kansas City Royals!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.