Continuing its network convergence strategy, AT&T sees “a long-term, multi-decade play’

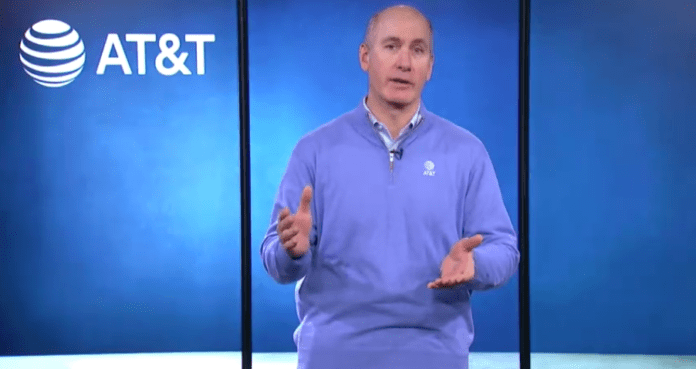

Speaking last week at the Goldman Sachs Communicopia and Technology Conference, AT&T CEO John Stankey blasted domestic policy around the auctioning and allocation of wireless spectrum. Speaking generally about the dynamics of mobile service pricing, Stankey called out the misalignment between data traffic growth and spectrum availability, and what that could mean for pricing over time.

Asked how pressing the issue of spectrum availability really is, Stankey said, “The urgency level is high.” Calling out where the U.S. fits in globally on allocation of mid-band spectrum for wireless services, he said, “You’re not going to lead in the technology race being 12 [or] 13. [And] we’re dropping further. Point blank, it’s a policy miss.”

The Federal Communications Commission has been unable to auction spectrum for more than a year. It’s auction authority lapsed in March 2023. There are some efforts by the FCC to allocate a mishmash of so-called “inventory spectrum, and legislative-led efforts to reinstate auction authority. But, if history is an indication, the timeline of auctioning, clearing and deploying new spectrum is subject to a number of variables that can significantly impact timelines.

He continued: “And it’s so extreme. We don’t even have an FCC that has authority to auction right now. I mean, how much can you mess it up? I think there has to be a fundamental shift. And what are we doing? We’re studying and we’re studying with long cycles on this stuff. And we all know technology moves pretty quick. Studying and coming to an answer of what we’re going to do on spectrum in two years is like saying, ‘We’ll get around to it in six years.’”

Stankey made clear that AT&T sees combining mobility and broadband as a strategic priority that will lower customer churn, help upsell existing customers and attract new ones. That said, he called out the time it takes to scale out a fiber optic infrastructure plant whether that’s via construction, joint ventures or third-party deals.

“When I think about what’s going to happen moving forward, this is infrastructure,” he said. “Some will say, ‘Well, yes, but you don’t have half the country yet.’ We don’t. But it’s infrastructure. And this is a long-term, multi-decade play. That kind of infrastructure doesn’t get built in a year. It gets built over a period of time.”

He compared the current state of fiber to the early days of wireless. “It’s a little bit patchy,” right now, Stankey said. “But when it’s all said and done, that critical infrastructure that will be out there, that will be the best-performing asset…It will just take some time for the industry to order those assets to make that happen.”

“My scale ambition is to be first and biggest as we go through this cycle because being first and biggest and being the best at executing on it, driving the best returns, allows us to call more shots as the industry forms in place over time. That’s the strategy. And it’s worked over time,” he concluded.