September greetings from Kansas City, Cedar Rapids, and Charlottesville where we are attending a family wedding (picture is of the Rotunda at the University of Virginia). A terrific celebration with family and friends and congratulations to the new Mr. and Mrs.

There is plenty of news to cover this week, and, after a brief market commentary, we will dive into two strategically important events, First, as we started in last week’s interim Brief (here), we will complete our analysis of John Stankey’s wide-ranging interview at Goldman Sachs’ Communacopia conference (link here). Then we will dive ino as much of last week’s T-Mobile Capital Markets Day as space will permit. Needless to say, we will have plenty of material for upcoming Briefs.

A big thank you to Shiloh Vance at INDATEL for the terrific interview/ webinar since our last Brief was published; here’s a link. And thanks to each of you who have supported and continue to support CellSite Solutions.

The fortnight that was

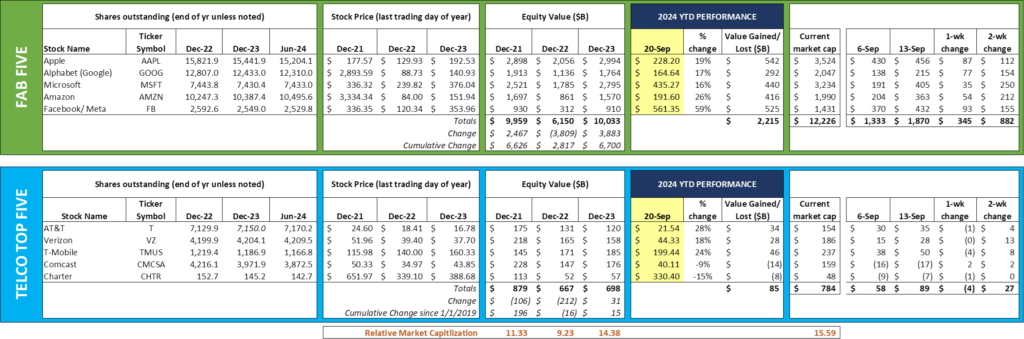

“If you don’t like our weather, wait a minute” is the popular phrase first attributed to a January 1909 Field and Stream article. The same could be said for Fab Five market capitalizations. In the last Brief, we noted that the Fab Five had lost close to $600 billion over the two weeks ending September 6. Since then, they have gained $880+ billion with most of that coming before the recent Fed interest rate cut. Total market capitalizations are where they were at the beginning of July, and, as the numbers show, the worst performing stock of the group is up 16% (which in Microsoft’s case represents $440 billion in gains). Barring a significant change to market sentiment or some specific event, it’s highly likely that they will grow $2-3 trillion in market capitalization this year.

Meanwhile, the Telco Top Five is experiencing a renaissance, holding on to $85 billion in year-to-date 2024 gains. As we have discussed in previous market commentaries, this represents a $108 billion in wireless/ telco gains offset by $22 billion in cable communications company losses. With dividends, each of the large wireless companies are poised to return more than 20% to shareholders in 2024. That trifecta has not happened since 2017.

Apple had their iPhone 16 announcement, and we will publish our first look at backlogs later today in a separate on-line Brief post. There are many good summaries available on what has changed with the iPhone 16, but we found CNET’s to be the most comprehensive (link here). The photo comparisons in that article also show how far Google’s Pixel 9 has come in camera quality, particularly with outdoor and low-light environments.

T-Mobile has already indicated that their iPhone 16 sales volumes are ahead of 2023 iPhone sales; their backlogs, however, are about the same as last year. Our take is that it will be a promotions-driven cycle (as opposed to an AI-driven cycle): a good but not great showing for Cupertino.

All is not roses for Apple, however, with the European Commission ordering Apple to pay Ireland $14 billion in back taxes. Ironically, Ireland was actually defending Apple in the case. Per this BBC article:

“The original decision covered the period from 1991 to 2014, and related to the way in which profits generated by two Apple subsidiaries based in Ireland were treated for tax purposes. Those tax arrangements were deemed to be illegal because other companies were not able to obtain the same advantages. That ruling came at a time when the Commission was attempting to clamp down on multinational giants it believed were using creative financial arrangements to reduce their tax bills. It was overturned by the lower court of the ECJ in 2020 following an appeal by Ireland. However, that verdict has now been set aside by the higher court, which said it contained legal errors.”

Ireland is Apple’s HQ for Europe, the Middle East, and Africa, and the benefits of hosting the world’s most valuable electronics company is significant. What they will do with the windfall is anyone’s guess, and whether the $14 billion Apple paid to the US (instead of Ireland) is subject to a refund is anyone’s guess. As reference, the Emerald Isle collected 24 billion Euros (roughly $27 billion) in total corporate taxes in 2022 (more info here).

If that isn’t enough of a headscratcher, we awoke Friday to the news that Constellation Energy is being paid $1.6 billion by Microsoft to reactivate Unit 1 of the Three Mile Island nuclear facility in central Pennsylvania (Unit 1 was not impacted by the 1979 disaster and Unit 2 will continue to be decommissioned on schedule). As the news release linked above indicates, the Redmond-based company will be purchasing all of the energy produced by the plant for the next two decades. The exact value of the exclusive purchase of energy from a facility capable of producing 837 megawatts of electricity for twenty years is not known, but its impact to central Pennsylvania is going to be meaningful. We expect this to spawn additional innovative energy arrangements from Microsoft and their peers.

Energy sourcing is going to be an extremely important part of critical infrastructure development over the next decade. Also, developing more energy efficient buildings (particularly where the grid is challenged) is going to be required. NB: it’s one of the biggest challenges being tackled by the team at CellSite Solutions.

John Stankey goes organic at Communicopia

There were many terrific speakers at the Goldman Sachs Communacopia + Technology conference held on September 9-12. We listened to several, but thought that AT&T CEO John Stankey (link here) had the greatest insights. He begins with the premise that more computing power (driven by AI) is going to generate more bandwidth requirements, and that to facilitate that demand, a fiber backbone is required.

John then goes on to talk about why their fiber + wireless product (which he admits is going through a transformation) has better long-term prospects than that offered by cable competitors (see the interim Brief link here for the full quote). There’s a lot to debate in his statement that space does not afford in this Brief edition, but we believe that there is a lot of room for both cable and AT&T (and T-Mobile and Verizon) to acquire customers in areas where AT&T is the incumbent wireless and wired infrastructure provider. Having a great wireless backup helps, but so does having attractive prices and a value proposition that encourages trial of applications and content.

The most intriguing statement made by Stankey, however, are his comments about capital and balance sheet investments:

“…we may run at a bit of an accelerated higher than maybe traditional levels of capital investment in the business. It’s come down from peak and it will continue to drop down. We may run a little bit higher than where we’ve traditionally been because it’s mostly organic. And we’re focused on organic play as opposed to inorganic work outside that kind of comes in big chunks. Where you go when you call on the balance sheet all at one time and then you’re working through three or five years of transition. So I feel really good about where we are in that. I’ve never been in this business where I’ve seen as much organic opportunity in front of us to run the business better. I like that because doing things organically, you don’t have to go and show up at a regulator and you don’t have to thread the needle on legal issues, and you don’t have to show up in 25 states to get approval to do something and everyone wants to collect their toll when you show up and every special interest wants to have their back scratched around something.

The management team is focused on executing what we have in front of us and what we’ve consistently had as the place for the last four years, and we’re getting better and better and better at doing it, and that’s what we need to do. And I think we’re set up very well to do that. And I think we’re going to have a good equation of capital allocation moving forward.”

Besides the obvious dig at Verizon’s acquisition of Frontier (which mirrors a lot of the concerns we have about the transaction – see the last full Brief here for more), Stankey’s statement sets the stage for more fiber spending (maybe with BEAD money, but we don’t read any sort of dependencies into his statement), and therefore higher capital levels than their peers.

This spending is driven by increased confidence of higher penetration of wireless + wireline in those previously marginal areas. It also accelerates additional infrastructure investments because of improved broadband. Unlike previous cycles, fiber may precede asphalt or concrete (and in a few cases even robust wireless) infrastructure projects. That’s a big change.

How AT&T explains the size, speed, and investment projections of their next build (after the 30 million homes milestone) is going to be important. We are not convinced that they can achieve a realistic share in many markets without acquiring existing fiber providers in these markets or having meaningful regulatory reform (e.g., the resumption of the Affordable Connectivity Program) – costs have risen, and the mileage requirements for fiber have not decreased.

Bottom line: AT&T continues to plow ahead with their fiber-first strategy. Their next act will determine whether they can sustain and grow their market influence.

T-Mobile Capital Markets Day—what it takes to be a champion

Last Wednesday, T-Mobile hosted an investor day on their Bellevue campus. The theme of the day was “From Challenger to Champion” and the company outlined their plan to change to an innovative leader. Nearby are the pillars they plan to employ to deliver their champion strategy.

As stated nearby, T-Mobile’s greatest inhibitor to winning the champion’s crown is their ability to consistently execute new innovations. For example: a digital future where nearly all upgrades and most inbound service call reasons are handled with minimal/ no customer interaction. The degree of information technology investments needed to achieve these goals is significant. It requires rethinking each step in the process. If a customer needs to switch devices because of a customer-induced defect (e.g., a multi-story dropped smartphone), and therefore cannot access any of the phone’s information, how can/ should the service restoration process occur (assuming the customer cannot access any of the information such as the IMEI on the device)? As T-Mobile rethinks their digital strategy, dozens of processes could either be combined or eliminated. Sequencing and execution will be critically important.

While that is their biggest concern, we appreciated their discussion with Nvidia about excess capacity. Here’s the statement made by Jensen Huang, their CEO:

“So when — but when somebody doesn’t need it, that infrastructure is sitting there and it could be re-utilized. And so when we made a software defined, made it accelerated, made it able to run AI processing. We now turn that entire network into excess capacity when you need it for excess opportunities. And so this is going to be a great new growth opportunity for the telecommunications industry.”

This caught our ear given our wholesale background. Traditionally, wireless network providers only wholesale specific outputs like minutes, text messages, and data packets. What Jensen was speaking about, however, is actually wholesaling the computing platform for either MVNOs or other industries. Given the “carrier grade” of most wireless networks, we thought that was an intriguing concept (so did Walt Piecyk from Lightshed Partners, who asked a specific question to T-Mobile CEO Mike Sievert about the comment during the Q&A session. We found Mike’s answer to be less enthusiastic than Jensen’s comment above). To be a champion, T-Mobile will need to prioritize a large array of applications and use cases that drive revenue and increase customer satisfaction.

Lastly, T-Mobile introduced T-Priority for government customers (announcement here). We like the idea and believe that it could (and should) be extended to other applications, even if it means that they need to fight the perception that commercial priority equates to paid prioritization. We will go into this in greater detail in a post-earnings brief, but T-Mobile needs to have equal footing within the FCC and state PUCs with both Verizon and AT&T if they are to claim the championship mantel.

Bottom line: T-Mobile’s string of announcements placed the company in a “future-focused” category. To become an industry influencer, however, they will need to be able to execute where there is no precedent playbook, aggressively enable others to use excess capacity when available, and establish a reputation with government bodies that they are technology leaders who can establish priority lanes while increasing overall scale. This is a tall order for any technology company, but especially one who serves all segments.

That’s it for this week. Look for the first Apple iPhone 16 availability charts tonight, and in the next Brief, we will pose ten questions for third quarter earnings. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Finally – go Sporting KC, Kansas City Chiefs and Kansas City Royals!