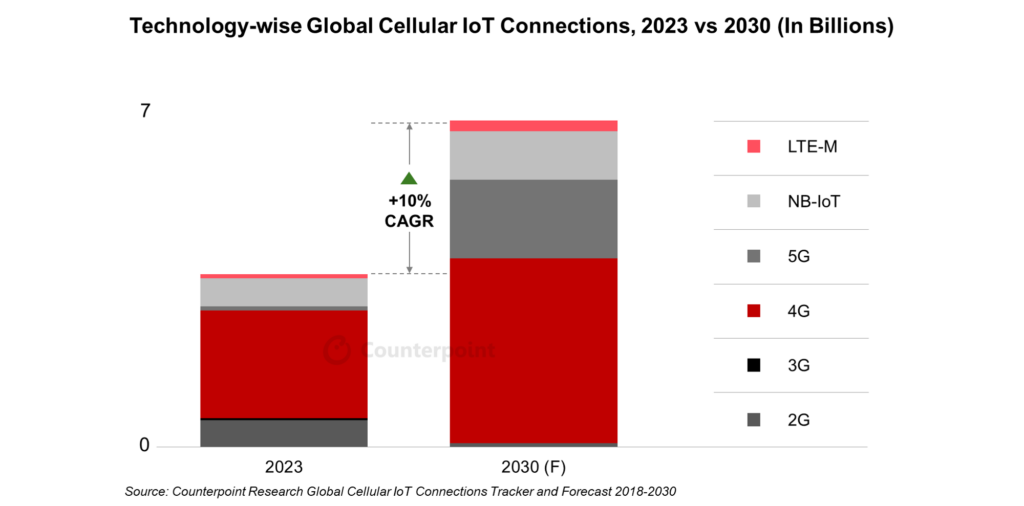

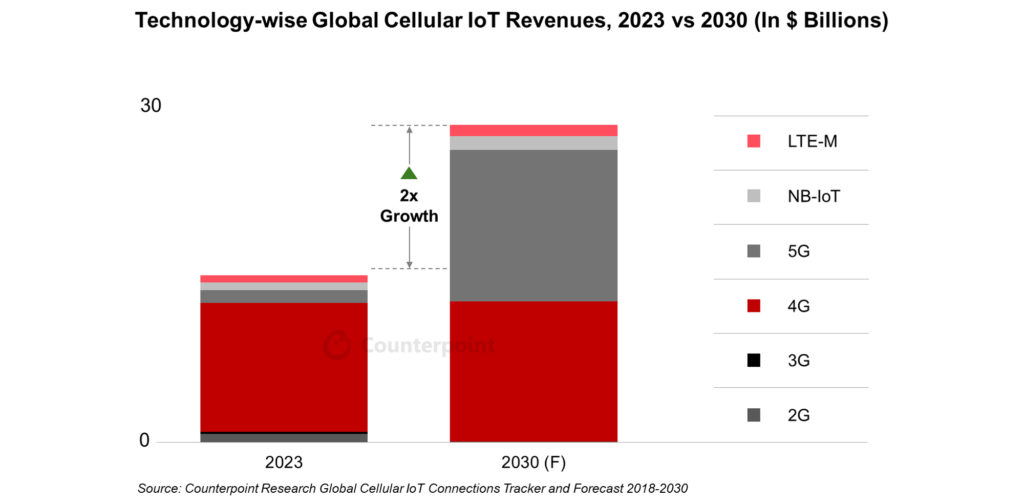

The number of global cellular IoT connections jumped 24 percent in 2023 to finish the year at 3.3 billion; the number will increase by 88 percent (at a compound growth rate of 10 percent per year) to reach 6.2 billion by 2030. So says Counterpoint Research, which has updated its IoT Connections Tracker to also forecast that total revenues from cellular IoT will surpass $26 billion by 2030 – which is up 90 percent from $13.7 billion in 2023, which is up 17 percent, in turn, on 2022.

The average revenue per user (or ‘thing’; ARPU) on cellular IoT connections has continued to decline, but should stabilize in the “latter part of the decade”, said the firm. At the end of 2023, China retained the lion’s share (almost 70 percent) of the cellular IoT market with 2.3 billion connections; the figure, up 26 percent on 2022’s count, surpasses the number of mobile phone subscribers in the country. At the same time, China only contributes about 36 percent of global cellular IoT revenues.

Mohit Agrawal, research director at Counterpoint, commented: “China continues to roll out low-cost IoT plans for rapid deployment. A sizable portion of connections in China operate on 2G and NB-IoT networks, with ARPUs lower than $2.2 per year. Looking ahead, we expect ARPUs to stabilize, particularly with the advent of 5G and growth of 4G Cat-1 bis solutions as China will continue to expand its connections into the automotive, smart meters, and smart retail sectors.”

Counterpoint expects 5G to account for nearly 50 percent of cellular IoT revenues by 2030, catering to high-demand applications including autonomous vehicles, industrial automation, and immersive smart cities, it said. But connected cars, utility meters, and retail equipment, mostly POS devices, dominate, in terms of IoT applications; and they will account for more than 60 percent of the market by the “end of 2030”.

“These sectors will drive the growth of IoT, transforming industries with real-time connectivity and efficiency,” it wrote. It added: “The market is highly consolidated, with the top 10 operators dominating absolutely. This trend is expected to continue for a while. However, operators from emerging regions are gaining momentum. As digitization and network expansion accelerate, these regions are set to grow their IoT subscriber bases, driven by rising demand for IoT solutions.”

Siddhant Cally, research analyst at Counterpoint, said: “We are witnessing a significant increase in cellular IoT use cases such as utilities and connected vehicles. Many emerging nations are implementing digital transformation plans that prioritize the deployment of public service solutions. The advent of 5G will play a crucial role in driving connectivity-based revenues, as operators capitalize on the potential of massive machine-type communications (mMTC), particularly as 2G and 3G technologies are phased out.”