The U.S. telecommunications industry is undergoing its largest transformation in decades as the perennially overused “convergence” is finally becoming real. The new convergence reality is that end-user gear is increasingly working seamlessly together. Apple’s messaging convergence on iPhone and Mac, Androids increasing integration into Microsoft Windows and that customers increasingly buy their mobile and internet solution from one provider. Comcast and Charter through its MVNO agreement with Verizon plus smaller cable companies like Cox and Mediacom have separate agreements with Verizon making major inroads in the mobile market, being jointly the fastest growing players in the mobile market. At the same time, the wireless companies are making major inroads in the home and business broadband with their fixed wireless offers, growing faster than fiber providers and taking customers at a faster rate than cable providers (cable) can add through footprint expansion. The question in a lot of people’s minds is how much more cable can expand in the mobile market and how much can mobile providers expand in the home and business broadband market.

Recon Analytics provides the largest, fastest, most flexible customer insights service available. In the telecom segment, we survey more than 5,000 mobile consumers, more than 5,000 home internet customers and many hundreds of businesses every week. Among the many things we ask consumers is how satisfied they are with their service along 16 dimensions of their customer experience. Customers from all four fixed wireless services we track (Verizon, AT&T, T-Mobile, and Metro PCS) report higher satisfaction scores and fewer service issues than the best cable operator. Partially this is due to the easy set-up and return policy of fixed wireless. A customer gets the fixed wireless router – often while still having service with a wired provider they are not perfectly happy with – and sets it up in their home. Fixed wireless either works and the customer is very happy or if the does not work the customer returns the router within a few days and therefore does not show up in the statistics. Having a cable, fiber, or DSL connection is generally a more durable relationship, sometimes happy and sometimes less than happy, with the resulting negative impact of the satisfaction scores.

One of the nuances to remember when looking at the cable companies is that the customer relationships are at an account level whereas the mobile lines are on a line level. Furthermore, only Charter and Comcast broadband and/or video customers are allowed to sign up for their mobile service. Charter mentioned at its Q2 2024 earnings call that 8% of total passings have mobile lines and therefore approximately 16% of its residential customers are converged. Charter has 29.6 million residential customers as well as 8.5 million residential mobile customers. By multiplying out the numbers we calculate that Charter has 4.75 million converged households implying just shy of 2 lines per account.

Comcast has 31.6 million residential customers in the United States and almost 7.2 million mobile lines. Using the same lines per account figures we assumed for Charter, we get that about 11% of US Comcast customers have mobile lines and are therefore converged.

When we look at the large mobile and residential telecommunications providers (telcos) with their fixed wireless and fiber offers we see that fixed wireless is the best in class for convergence with up to 80% of fixed wireless customers also having mobile lines. When we compare the cable providers with the telcos who have offered fiber and DSL for decades, we see that the telcos have achieved between that 30% and 40% of their home internet customers have also purchased mobile service from them. Cable companies have traditionally been the best bundlers and have the potential to surpass what the telcos have achieved. On the high side, Charter could end up with somewhere between 17.8 million and 29.8 million mobile lines and Comcast between 18.9 and 31.5 million mobile lines. This would be an additional 10 to 21.8 million mobile lines for Charter and 12 to 24.6 million additional mobile lines Comcast, representing at $25 ARPU per month at 40% wireless adoption an upside of more than $14 billion per year, with the mobile network operators losing roughly the same amount at an, according to CTIA’s most recent Industry Indices report, industry-wide ARPU of $34.56. If we assume that Verizon gets $10 per month for each Charter and Comcast customer, Verizon’s upside would be around $5 billion in profit, offset by their loss of customers that would switch to Charter and Comcast to have a lower priced service. If Charter and Comcast can keep their 2023 pace of 2.1 million new customers per year then cable has about 5 to 10 years more growth in store.

When we look at the broadband side, Verizon and T-Mobile will make their 5 million and 7 million FWA customer goals by the end of the year. Both are working on significantly enhancing the ability to accept more FWA customers on the network. Even without more spectrum, both T-Mobile and Verizon have significant fallow spectrum in rural areas, where they can dedicate 150 to 200 MHz of spectrum to FWA providing them with three to four Mbps per cell sector of capacity. With the low population density in rural America FWA can beat cable and fiber on speed at substantially lower cost to build out. FWA satisfaction has also led to some remarkable improvements with churn. Based on our survey results we estimated last year that Verizon’s FWA churn was around 4% and T-Mobile’s FWA churn was around 6%. Looking at our current results we triangulate that the FWA churn is now close to 1%, significantly below cable, but still above mobile postpaid churn.

This leads us to the question of how many cable customers are unhappy with their service? We talked to 45,220 Charter home internet customers and 50,156 Comcast home internet customers over the last year and got their feedback.

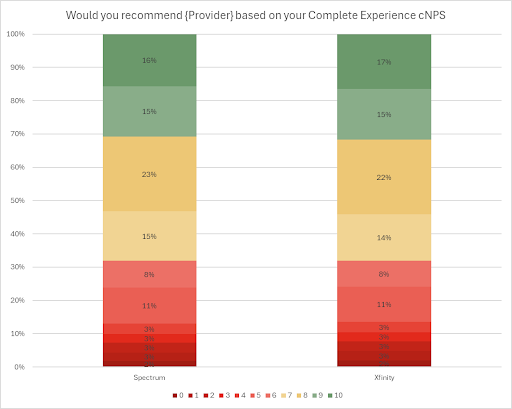

We ask each of our respondents our component Net Promoter Score (cNPS) battery of questions which includes how likely they are to recommend the service to others from 0 of not likely at all to 10 highly likely. Customers who rate the service 0 to 6 are considered detractors who are going to talk negatively about their provider, people who rate the service 7 and 8 are neutral and will not talk about their provider and people who rate the service 9 and 10 are promoters who will talk positively about their provider. The net promoter score is the difference between the percentage of people who rate the service 9 and 10 and those who rate the service 0 to 6. Those rating their service 7 or 8 are considered neutral. For Spectrum and Comcast the net promoter score is zero – as many people talk badly about the service as talk positively about it – which is not a good number. On the bright side, these scores today are the best scores for cable providers we have recorded since we have started the service. Almost one third – 32% – Comcast and Charter customers do not like their service and could be considered a flight risk, but not all people who don’t like their service are going to leave. We have done extensive research for our clients on why customers who dislike their service are not leaving even when they have other options with some eye-opening insights.

How will it all play out? Essentially the battle will be in two dimensions: How many of cable’s residential customers will pick up mobile service from their cable provider and how many disgruntled cable customers will jump ship and get FWA. For simplicity’s sake we are ignoring the impact of fiber, which currently is gaining customers from cable providers.

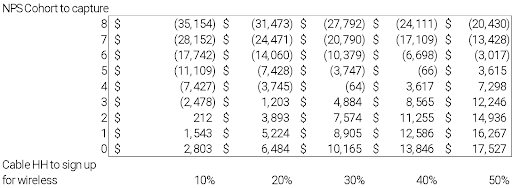

The table below describes how the two conflicting forces are shaping the fortunes of Comcast and Charter. They have to play offense of mobile while holding on to their internet customer base.

Cable’s break-even point is around 30% to 40% mobile adoption while holding on to all of their customers who have today net promoter scores of more than 4 or 5.

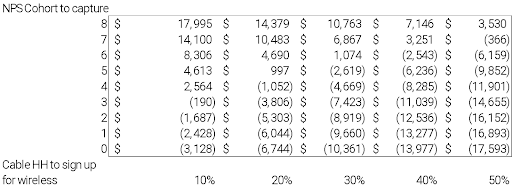

On the flip side, mobile operators need to curtail cable’s offensive into mobile, which stands today around 11% and attract as many unhappy and neutral customers to their fixed wireless offers.

At face value, mobile operators have a comparatively steeper hill to climb as we can see from the table below, which assumes a mobile ARPU of $34.56 and FWA APRU of $35.

What the table above ignores is that the mobile operators offering fixed wireless service probably have pricing power. Fixed wireless cNPS is head above should of that of cable providers and even if fixed wireless would be offered at higher rates – while lowering cNPS as we see a generally that cheaper service drive higher satisfaction – would not dramatically lower adoption. The same holds true for mobile service, where even though Verizon charges more than Comcast and Charter, Verizon customers are more satisfied with their service than that of the cable providers.

When we look at winners and losers the following long-term watershed picture emerges:

If the mobile operators are able to increase the monthly cost to $50 per month for fixed wireless service, the top row of lose/lose turns into a win for mobile and a loss for cable.

A lot of things can happen over the next five to ten years. DOCSIS 4.0 will be able to deliver symmetric speeds on par with fiber. Furthermore, cable’s reliability can become significantly better with DOCSIS 4.0 than it is with DOCSIS 3.1. This will be an opportunity for the cable companies to shift customers from old DOCSIS 2.0 and 3.0 to DOCSIS 4.0 and provide a vastly better user experience as it could then also support state-of-the-art Wi-Fi all the way to Wi-Fi 7. Fixed Wireless and Fiber customers report substantially better reliability metrics than those from the cable providers. The table above shows what is at stake with the fight for more licensed spectrum on Capitol Hill. Mobile operators are looking for more licensed spectrum to provide fixed wireless services to consumers. The cable industry is looking to get more unlicensed spectrum to have faster Wi-Fi than the fixed connections can support and prevent mobile operators from getting more licensed spectrum to provider more and faster fixed wireless services. The Department of Defense meanwhile does not want to give up anything. The outcome of this battle for spectrum will shape how consumers and businesses alike will access the internet.

In the meantime, both mobile providers and cable providers alike are working hard to provide their customers with a better customer experience. Over the last two years, we have seen consistently improving customer satisfaction numbers for almost all providers.