October greetings from Virginia, Iowa, Missouri and Massachusetts. Our hearts go out to those impacted by Hurricane Helene. CellSite is providing civil construction services to several tower companies and service providers impacted by substantial flooding. Even though the storm hit last Saturday, there are still many cell sites that cannot be accessed due to road washout or trees/ debris. The communications infrastructure rebuilding effort will be substantial, particularly in rural areas.

The American Red Cross Helene site is here and the Convoy of Hope site is here if you wish to contribute financially to the relief effort. As most readers of the Brief know, the impact of storms like Helene lasts years after government agencies and news cameras are gone. Our prayers continue on behalf of the families and first responders working diligently to acelerate search and rescue efforts.

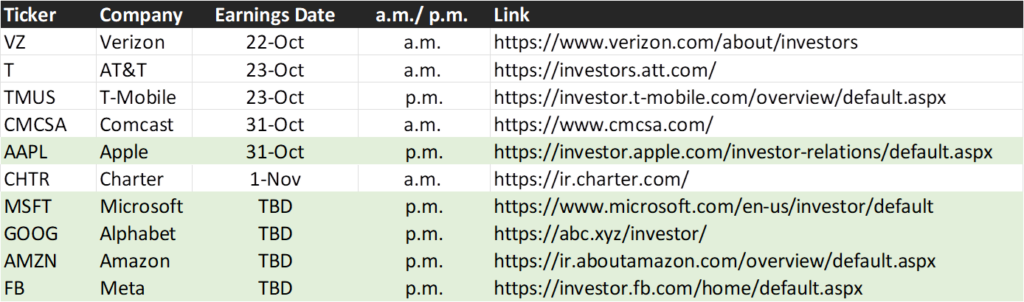

This week’s Brief focuses on several earnings questions we think should be addressed with telecommuncations carriers. The current earnings calendar is nearby. While each of the Telco Top Five has reported their next conference call time and date, the Fab Five is taking their time. It’s particularly interesting that the wireless carriers (and traditional telco/ fiber providers) are announcing 8-9 days ahead of Comcast and Charter (and Apple). This wide gap is less common and will allow analysts to parse comments related to cable’s MVNO growth and Apple’s iPhone 16 launch (our inaugral issue of the iPhone 16 Pro and Pro Max tracking, a online-only feature, was published last weekend and is here).

The fortnight that was

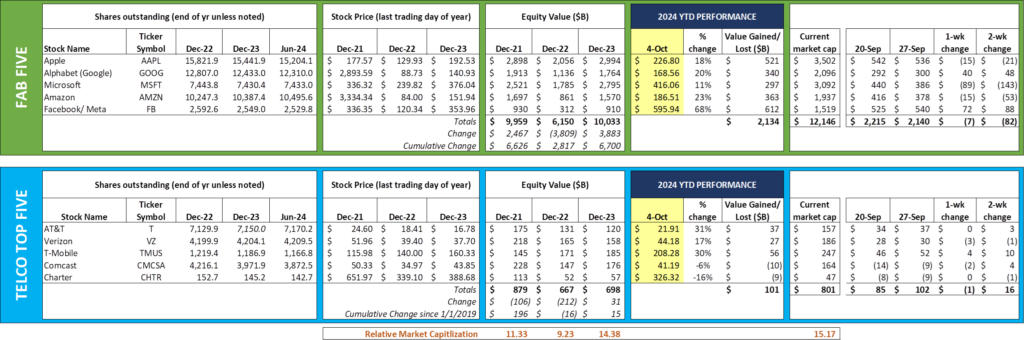

A quiet two weeks for both the Fab Five and the Telco Top Five as investors are determining the impact of a strong jobs number (here) on inflation and ultimately interest rates. The good news is that the Telco Top Five is up $101 billion in market capitalization so far in 2024 – should this level hold, it would be their best showing since 2021.

The biggest headline in the telco world happened on Friday when the Wall Street Journal reported that AT&T, Verizon, Lumen and other telecommunications carriers appear to have been the subject of a Chinese cyberattack which focused on determining how the CALEA (wiretapping) process/ protocol worked. Per the WSJ:

“For months or longer, the hackers might have held access to network infrastructure used to cooperate with lawful U.S. requests for communications data, according to people familiar with the matter, which amounts to a major national security risk. The attackers also had access to other tranches of more generic internet traffic, they said… The widespread compromise is considered a potentially catastrophic security breach and was carried out by a sophisticated Chinese hacking group dubbed Salt Typhoon. It appeared to be geared toward intelligence collection, the people said.”

If China could duplicate or spoof the wiretapping process, then they could potentially surveil smartphone keystrokes, conversations, text messages, and more. More to come (hopefully more will be published on how they penetrated these systems) but this appears to be very serious.

On Thursday, AT&T Chief Operating Officer Jeff McElfresh announced that the head of AT&T’s network organization, Chris Sambar, will be leaving the company on October 11. Without trying to read too much into the internal notification (republished in this RCR Wireless article), it sounds like Chris will be leaving for another company (and not retiring after 22 years with Ma Bell). We wish him well in his new position.

Also on Thursday, Verizon announced the hiring of Santiyago (“Yago”) Tenorio as their Chief Technology Officer and SVP of Technology Strategy and Enablement (his predecessor, Ed Chan, left Verizon in January to go to Crown Castle). Yago is best known for his work on Open RAN (O-RAN) while at Vodafone. He will be reporting directly to Joe Russo, Verizon’s President of Global Networks and Technology (GN&T). Fierce Wireless has an insightful article (here) on how this appointment might change the trajectory of an open access architecture at Verizon.

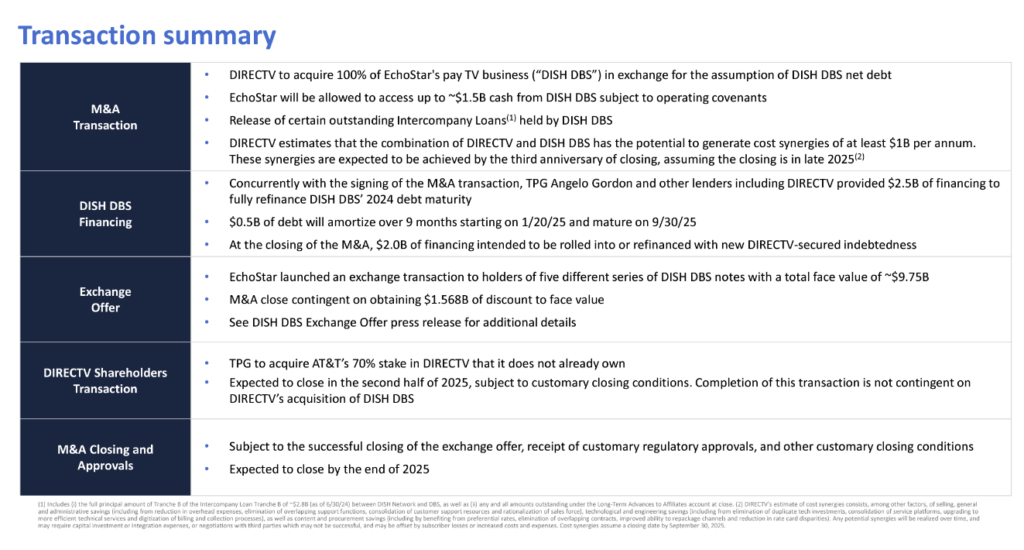

The major M&A news of the week was DirecTV’s announcement that they intend to purchase Echostar’s video distribution business (both Sling and Dish). The transaction summary presented by both Dish and DIRECTV is below (and here):

Yes, Charlie Ergen sold Dish for $1 and the assumption of just under $10 billion of debt. Existing Dish bondholders will need to take a $1.6 billion haircut on the total debt owed in their approval of the deal, and Echostar will receive money from TPG (the private equity firm that owns DIRECTV) to make a $2.5 billion debt payment this year. The best proxy for approval is the Sirius/ XM merger (which took 17 months to get approved – more in this Wikipedia post). We think the process will be lengthy, but it will eventually be approved by a Lena Khan-led FTC.

In conjunction with the DIRECTV/ Dish merger news, AT&T announced that they would be selling their 70% stake to TPG for $7.6 billion. This transaction is not subject to government approval and could close as early as this year. The cash could be used in several ways, including debt reduction, increased investment in Gigapower, or increased Fiber to the Home (FTTH) spending (above the 30 million homes passed commitment). Any of those outcomes would be positive for the company, and our hunch is that CEO John Stankey will use it to reduce AT&T’s indebtedness today, with an eye to increase leverage only when the FTTH expansion case is as compelling as possible.

Bottom line: “Housecleaning” might be a good way to summarize recent telecom news. AT&T will soon be free of DIRECTV, completing the unraveling of the Randall Stephenson/ John Stephens value-destroying acquisition strategy. Charter is buying back Liberty Global’s investment in a stock-based exchange. We also will be looking to the FTC’s response to the DIRECTV/ Dish transaction for hints of hope for more cable industry consolidation.

3Q earnings questions (Part 1)

In just over two weeks, the telecommunications carriers announce their quarterly results. We have many questions, but here are three with “high priority” designation:

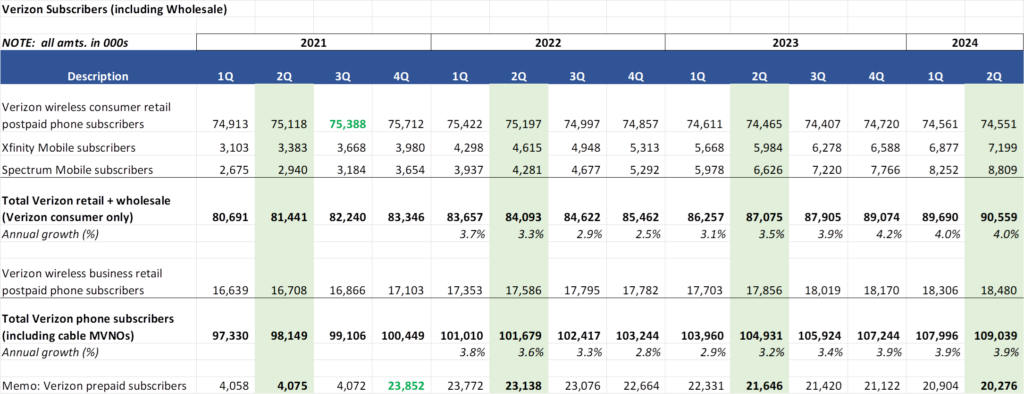

- Can Verizon grow their Prepaid business? Here is our 2Q analysis of Verizon’s shareholder base from the July 28th, 2024, Brief (link here):

While Verizon’s postpaid base (using Comcast and Charter growth as wholesale surrogates) has grown at a steady clip (~4.0% annually), the retail prepaid base has languished, down close to 3.6 million subscribers or 15% since the transaction closed in 4Q 2021. While some of this loss is attributable to the end of the Affordable Connectivity Plan (ACP), it’s a relatively small portion.

Churn management is also critical. At 4.49%/ mo. (3.59% without the ACP-weighted Safelink product). T-Mobile’s 2Q prepaid churn is 75 basis points lower than Verizon’s figure without ACP. AT&T’s 2Q prepaid churn is 2.57%, a full 100 basis points lower per month. All of this nearly three years after closing the transaction.

We have no doubts that the company is effectively migrating existing subscribers to the Verizon network and achieving the cost synergies that they laid out when they purchased Tracfone for $6.25 billion (announcement here). T-Mobile indicated that Verizon was pulling customers from the Magenta network in their recent Capital Markets Day. It’s hard to believe, however, that the rationale of “We now cover all segments” was properly fulfilled the past three years. We look for indicators that investments in Visible and Total by Verizon are actually yielding results.

- Why buy Frontier now? We have listened to the conference call multiple times explaining the rationale, and certainly commend Frontier’s current management for significant progress converting their copper base to fiber.

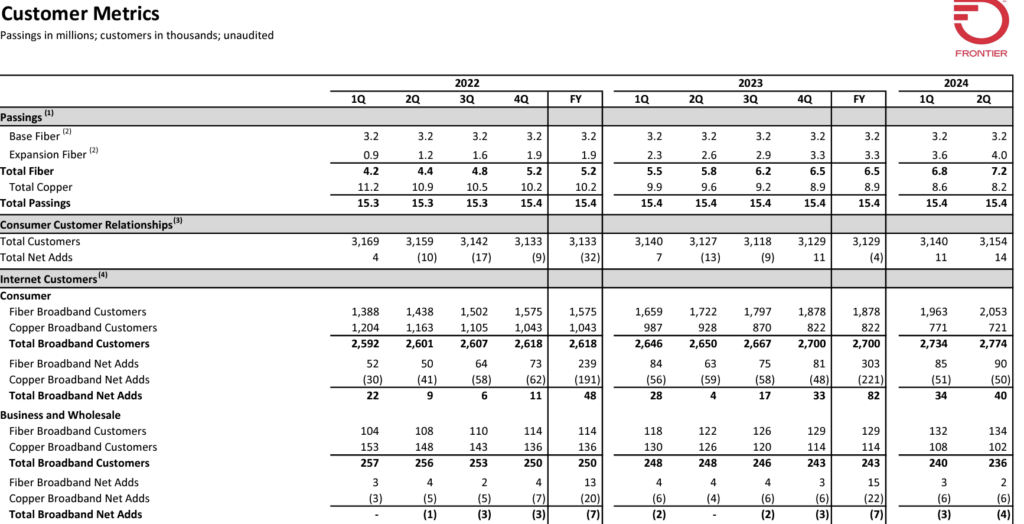

Here are the key customer metrics from Frontier’s second quarter earnings call:

Expansion fiber customers are growing faster than copper/ DSL losses. But there is less conversion of customers from one Frontier technology to another, thanks to 10% penetration in fiber markets when they are converted. Verizon’s rationale is that they can market the converted fiber footprint to their base (~40% market share) and lower the cost to acquire/ convert customers.

That may be true, but Verizon is likely paying $7.7K per customer (assuming the total fiber base grows at the same rate as the previous year, about 350K net new customers). Wouldn’t it have been cheaper to have converted the remaining Verizon copper base rather than inherit another?

Bottom line: We think the value for Frontier is rich, and that the copper base that is not converted to fiber has negative value to the business. Verizon needs to show their work here, as T-Mobile did in their Metronet and Lumos transactions.

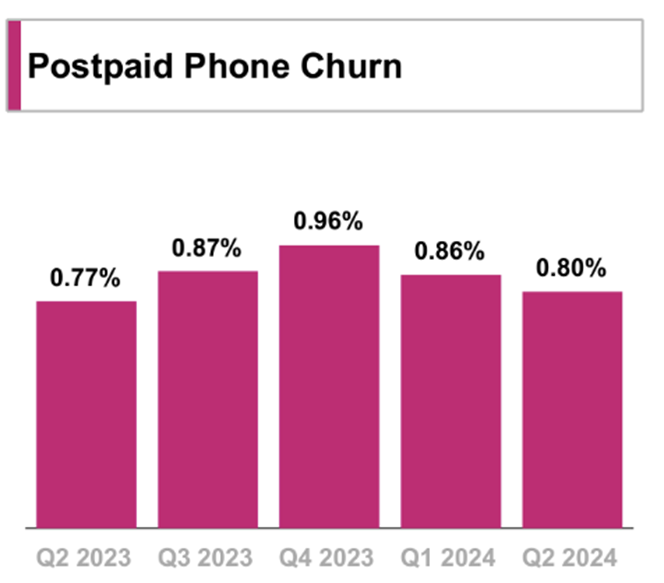

3. Can T-Mobile lead the market in postpaid churn? We could write multiple Briefs on T-Mobile’s Capital Markets Day, which we thought laid out achievable three-year goals. One stat that sparked our interest was postpaid phone churn, which T-Mobile maintained was the lowest in the market for two quarters in 2023.

T-Mobile’s current postpaid phone churn rate from their Factbook is shown nearby. The increase in churn from Q2 2023 to Q2 2024 is attributed to increased rate plan optimizations.

Seasonality plays a factor in churn, and T-Mobile has consistently said that iPhone launches are good for net adds. If the current trend holds for the iPhone 16 launch (good but not groundbreaking), however, other carriers might have lower postpaid churn and choose to stay where they are until the iPhone 17 (or the latest Pixel or Galaxy device) comes out.

For T-Mobile to lead the market in postpaid phone churn, they need to make sure that existing customers have a device that showcases T-Mobile’s layered network. If economic conditions are deteriorating for certain T-Mobile segments, then customers are going to hold on to their current devices longer, and the best network perception may or may not be fulfilled.

Bottom line: More “1-on-1” assessments of current devices, determination of the best device, and flexibility when possible to make the purchase affordable to the customer needs to take place. With Apple sales likely flat to down this quarter, there’s no time like the present to start those discussions. T-Mobile will lead in postpaid churn when they individualize the churn reduction process.

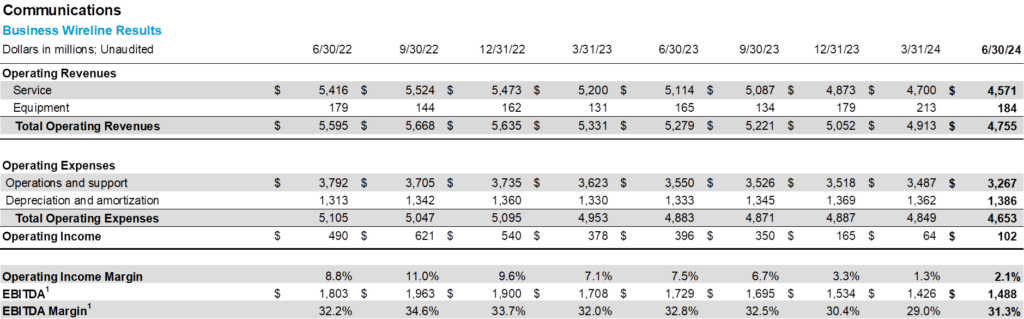

- When Will AT&T Business Wireline Turn Around? We have written extensively on AT&T’s consumer (specifically FTTH) wireline progress. No one is attributing Ma Bell’s increased market capitalization to a resurgence in wireline business orders. With all of the fiber investment going on in the suburbs, why isn’t AT&T capturing more small business and enterprise customers? Here’s the latest P&L for AT&T Business Wireline:

Revenues are down 10.6% year-over-year. Operating income is down 74%. Depreciation is rising because of AT&T’s business unit absorbing some of the overall costs of the FTTH buildout. Fiber connectivity is a high-margin business. What is preventing business customers from purchasing with the same volume/ trajectory of the homes in the same vicinity? We think this is one area the company should address.

There will be a lot of talk about fixed wireless net additions sustainability, and about C-Band deployments, ARPU growth and debt reduction. All of these metrics appear to be going in the right direction. AT&T will even surprise (again) with another beat on their own fixed wireless product. But below the surface, each company has problems that can’t be swept under the rug.

That’s it for this week. Look for the third week of Apple iPhone 16 availability charts tonight on the website, and in the next Brief, we will pose four additional questions focused on cable. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Finally – go Sporting KC, Kansas City Chiefs and Kansas City Royals!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.