October greetings from Boston, Cedar Rapids, and Kansas City. It was great to meet with Troy Doom, the CEO of Ice House America, one of Fort Point Capital’s investments (more on the company here) in Boston earlier this month. Third quarter earnings start next week and continue into November, providing investors with 2024 and 2025 priorities for the telecom and infrastructure sectors. After a short market commentary, we will focus this week’s Brief on questions we would ask Comcast and Charter. Whie their legacies are rooted in linear video, their futures are highly dependent on wireless services and broadband.

Here is the final earnings presentation schedule with links to each of the investor relaitons websites. If you have not had a chance to read the last Brief (here), we suggest you do so prior to Tuesday when Verizon kicks off the earnings parade.

The fortnight that was

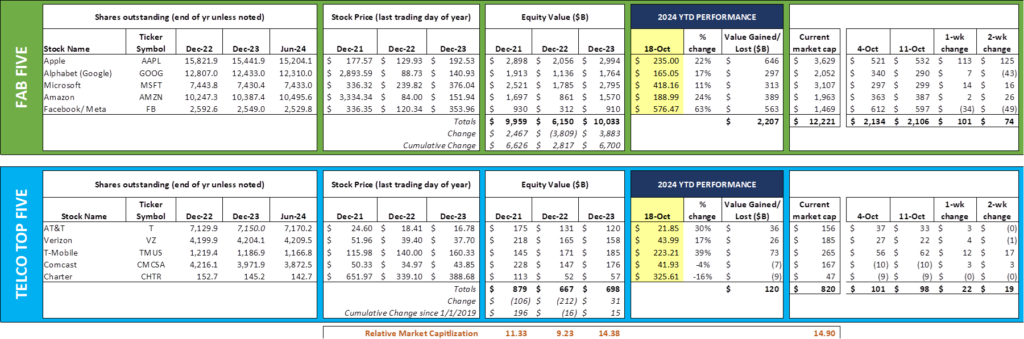

While the Fab Five and the Telco Top Five were both up in the aggregate over the last two weeks, all or nearly all of those gains were driven by two stocks: Apple (+$125 billion) and T-Mobile (+$17 billion). Of the ten stocks we track, T-Mobile and AT&T are currently the second and third-highest percentage gainers for 2024, outpacing Google, Apple, Amazon and Microsoft. Yes, a dollar invested in AT&T on January 1 has returned more value than in each of the Fab Five stocks except Meta/ Facebook. We would not be surprised to see Ma Bell overtake Comcast sometime in the next 6-9 months as the third most valuable US telecom. AT&T is a remarkable story that appears to have legs.

The Chinese hack that impacted many carriers including Verizon, AT&T, and Lumen is continuing to attract lawmaker interest. According to this Broadband Breakfast article, Congressional Democrats and Republicans on the Energy and Commerce Committee sent the heads of Verizon, AT&T and Lumen a series of questions with responses due by last Friday. The magnitude of this breach, based on our conversations with analysts, was greater than others because it may have enabled the Chinese to learn how the government monitors communications activities. For background, the original Wall Street Journal article on the breach is here and the follow-up article from The Washington Post is here.

Finally, while we think that Verizon is overpaying for Frontier’s assets, there are many Frontier shareholders who take the opposite view. According to this Reuters article, Glendon Capital Management, who owns nearly 10% of Frontier shares, has publicly announced that they will be voting against the deal. Cerberus Capital Management, who owns more than 7% of Frontier shares, has voiced concerns but has not gone as far as indicating a “no” vote.

3Q earnings questions (Part 2)

In the first part of our earnings questions (link above), we focused on Verizon’s prepaid business transformation, their Frontier acquisition rationale, T-Mobile’s postpaid churn challenge, and AT&T’s business wireline woes. Overall, wireless is challenged by the value proposition of current and future technology innovations. In short, 5G has not created the step function in value creation for investors that other investment opportunities (e.g., Artificial Intelligence) have. We are entering the sixth year since deployment, and the customer-facing benefits are still emerging.

We warned about the 5G hype in July 2019, devoting an entire Brief to the topic: “About This Thing Called 5G.” We posited that the future of 5G depends on “More software, doing more things, faster and better.” Like LTE, 5G depended on innovative applications that would improve lives. There’s still time, but outside of fixed wireless as a wired alternative for both residences and businesses, it’s hard to point to mass market applications that have been transformed because of 5G. Shipyards might be more efficient, but your backyard hasn’t changed a bit.

This innovations drought has placed more pressure on wireless carriers like Verizon and T-Mobile to grow subscriber share (5G has helped improve network scalability and customer profitability). That value creation has come through two sources: a) Improved monthly revenues per wireless subscriber (ARPU) through changes in monthly subscription pricing structures, and b) Fixed wireless services to utilize excess capacity that should have been consumed by the software innovations described earlier.

That brings us to Comcast and Charter, two of the Telco Top Five that have had better years. Since the end of 2019, Comcast and Charter’s equity values have decreased by 27% and 58% percent. The Triple Play tiger (High Speed Internet + Linear Cable + Home Phone) of the previous two decades is now toothless thanks to Google (YouTube TV), Hulu (Comcast+Disney), Netflix, and wireless substitution. The same strategy used to reduce scale and profitability with incumbent telcos (create “Swiss cheese networks”) in previous years is now being used by fixed wireless and fiber to the home (FTTH) providers to limit cable’s scale economies. And the Affordable Connectivity Program (ACP) is gone.

Despite all of these headwinds, cable marches on. They still have scale. They have opportunities to expand into previously unserved geographical areas. They continue to grow their commercial business. They have wireless. In short, they have options and continue to have a higher market share than fiber or fixed wireless in their footprint.

Here are the questions we would pose to Charter and Comcast:

- (For both). How many gross additions are coming from fiber providers? These likely represent customers who have previously been double or triple play (wireless, not home phone) customers and are returning to cable. While there is no physical porting, this would be a good proxy for product superiority (a “port ratio” equivalent used in wireless).

Our view is that this number is very low. Cable is losing to fiber and customers are reluctant to return for many reasons. First, new networks have fewer oversubscription issues (cable nodes can become congested – think back to April and May 2020 during COVID). Second, there is an “investment” in fiber for most new customers – the multi-hour installation process. Finally, most FTTH deployments come with new Wi-Fi gear (many times integrated into the FTTH in-home equipment) that is Wi-Fi 6 or higher. Fiber can deliver a customer experience that is materially different from DOCSIS 3.1. That’s why the “port in from fiber” ratio is important.

We agree with the cable providers that fixed wireless might be more vulnerable. But neither T-Mobile nor Verizon invested in 5G for the purposes of solely providing fixed wireless. When multiple cash flows are feeding the economics of a tower/ town/ region, the impact on wireless providers can be transferred to other products and services.

- (For both). Whither Xumo? We listened to several recent investor conference updates from Charter and Comcast and their set-top box/ aggregation joint venture called Xumo was barely mentioned. Xumo streaming boxes started distribution in October 2023, so a 12-month review/ milestone announcement should have been made. So far, no news.

This is surprising as the Xumo platform is excellent (we have been using ours for 6+ months and greatly prefer it to Roku). Comcast includes one Xumo box for every new Xfinity Internet customer, and Charter allows customers to purchase the box outright for $60. Both offer the “equipment as a service” for $5/ mo. which represents a $6-8/ mo. discount to set-top box costs.

Xumo also has a line of televisions that are distributed through Best Buy (here) and Walmart (here). A follow-up question like “Why not give away a Xumo TV with selected bundles?” makes a lot of sense if a higher quality experience would create more affinity (pun intended) for traditional cable packages. With cloud DVR available/ included, the experience would be more mobile friendly than a set-top box. We struggle to see why both Charter and Comcast are not pushing Xumo harder and promoting the 2025 roadmap.

- (For both). Will cable purchase additional spectrum? Chris Winfrey seemed to hint at the Goldman Sachs Communacopia conference in September that future shared spectrum purchases and deployments might be in the offing:

“We’ve also purchased CBRS licenses for shared license. We think that framework is very pro-consumer, and it’s good for a lot of other participants in the spectrum space. And so, we expect to continue to be active in the shared-license spectrum space as well… In some sense, we’ve not been in a race [to deploy spectrum] because of the relationship and the setup that we have with Verizon and some of that build out is tempered by the relationship with Verizon. We also have a significant amount of other capital projects and work and labor that needs to take place. But we will fully deploy the CBRS, but we’re not in a rush to do it. Interestingly, the more lines we have, the better the return on investment for the build. So the return of deploying that spectrum and deploying these small cells just continues to get better.”

We agree with Chris that focusing on the shared spectrum space makes a lot of sense for cable and think that they should have a conversation with Dish about using their CBRS holdings to increase capacity.

- (For Comcast). When will Comcast fully mirror [Charter] Spectrum’s mobile pricing strategy and product offerings? Our guess is that Charter’s introduction of aggressive buyouts (more here) and their “Anytime Upgrade” inclusion in the Unlimited Plus Plan (here) is turning some heads and driving more gross adds than their Philadelphia-based cousin. Mike Cavanagh, Comcast’s President, made a comment that there was no “pride of authorship” with respect to Charter’s actions.

As a reminder, Charter had 1.6 million (22%) more wireless subscribers than Comcast at the end of the second quarter. Over the last four quarters, Charter has grown 80% faster than Comcast (2.18 million net additions vs. 1.22 million). For 3Q, we would not be surprised to see 200-300K more net additions for Charter than their counterpart. The primary reason for this difference is Spectrum’s focus on simplicity and switching promotions.

While not wireless, we would also suggest that Comcast mirror Charter’s recently announced inclusion of Peacock Premium with all Spectrum TV customers (announcement here). It is perplexing that Comcast has not extended their own streaming service permanently to their cable subscribers (see Peacock Premium promotions here – simplification required).

- (For Charter). How can shareholder value be improved through additional acquisitions? Chris Winfrey clearly articulated their capital allocation strategy at the Goldman Sachs conference:

“… our capital allocation priority, since I joined the company in 2010, actually hasn’t changed, which is first port of call is to have organic investments that produce good and better cash flows over time and preserve your terminal value. Second is, to the extent there’s M&A that’s more attractive than buying back your stock, you do M&A. Third, you buy back your stock. And fourth, if you really have nowhere to go and you want to just turn cash back over to investors so it can be taxed, you do dividends. And that’s never really been in our profile.”

We see a depressed Cablevision (part of Altice) asset as Charter’s next move. Both stocks are down 20+% over the past year (and Altice has lost 92% of its market capitalization over the last five years). Altice is plagued by problems with their parent company and financial woes – the time appears right for a transaction.

There might be a deal where Mediacom, another rural-focused cable provider (now in excellent financial condition), takes all of the non-Northeast holdings (or frankly whatever Charter doesn’t want). A transaction with additional re-clustering of assets between Charter and Mediacom is also possible (they did this with Comcast when acquiring Adelphia Communications). Bottom line: While many acquisition opportunities exist or will surface in the next year, merging Long Island and parts of New Jersey into the rest of the New York City metropolitan area would create value for Charter shareholders. Successful execution of synergy achievement is high given the recent experience with Time Warner Cable and Brighthouse.

We have long argued in this column that re-clustering of assets (telco, cable, wireless) creates synergies and competitive “moats.” Charter may have the opportunity to affect a transaction and should look at part/ all of Altice prior to buying back additional shares.

Charter and Comcast continue to maintain their broadband share, but the other three companies in the Telco Top Five are not idle in their fiber strategies. It’s time to take some calculated risks that are focused on creating competitive advantage. Comcast has more pieces to work with and, after a very successful Olympics, should rethink their playbook. Charter is actually playing their (weaker) hand very well, and will likely surprise on many fronts, despite AT&T’s continued FTTH deployment success.

That’s it for this week. Look for the fourth week of Apple iPhone 16 Pro and Pro Max availability charts tonight on the website, and in the next Brief, we will begin to digest each earnings report. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Finally – go Sporting KC, Davidson College Football, and Kansas City Chiefs!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.