As referenced amid a bunch of stats in the preamble to RCR’s new editorial report on private 5G in Industry 4.0 (see image below), market research firm SNS Telecom & IT, based out of Dubai, has said the private 5G market is one of the “few bright spots in the gloomy telecoms industry”, and suggested total spending on private 4G (LTE) and 5G networks will $6 billion by the end of 2027. Which is a marked slow-down, it might be noted, on its previous forecast, which said the market would be worth $6.4 billion by 2026, based on an 18 percent compound yearly jump (CAGR) over the period. So growth is maybe slowing, versus old forecasts at least.

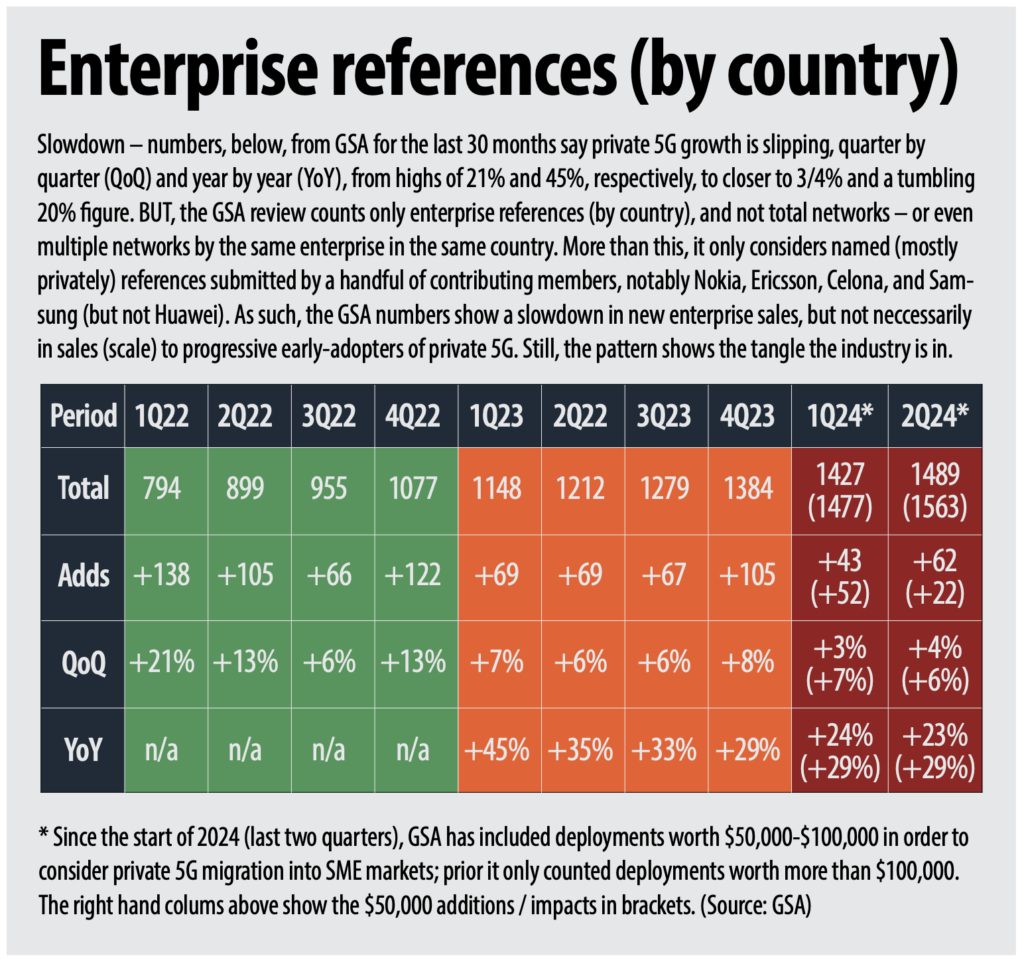

This is also what the latest GSA quarterlies suggest (as also referenced by RCR in the new report, as well as the intro to the latest Industrial 5G Forum; available on-demand): sales have slipped quarter-on-quarter and year-on-year from 21 percent and 45 percent at the start of 2022 and 2023, respectively, to just four percent and 20 percent at the start of 2024 (see below). As RCR told Industrial 5G Forum: “[This] can be explained away because GSA counts enterprise references (by country) and not total networks – which means existing deployments may be going nuts, multiplying upwards and outwards. But it also says new customers (‘logos’) are harder to find.”

Which means – probably; maybe, at last – the market is getting into the real business of long-tail growth. “Which is right, and right where it should be,” said RCR at Industrial 5G Forum. But SNS Telecom & IT, which claims (like RCR, as it goes) to have counted the market since 2016 (since “well before it garnered mainstream attention”), says it has a database of over 7,300 private 4G/5G engagements in 130 countries, as of the end of 2024.

These are listed, named and anonymous, in the eighth edition of its private-networks report, available here. Its revised forecast puts the CAGR-rate at 20 percent in the period to 2027.

What else does it come up with? Well, close to 60 percent of its $6 billion guesstimate (about $3.5 billion) will go on ‘standalone’ private 5G networks – which means, in the context, in the end, both on-prem all-edge 5G installations, and also 5G SA technology. “[These] will become the predominant wireless communications medium to support the ongoing Industry 4.0 revolution for the digitization and automation of manufacturing and process industries,” it says. By 2030, private 4G/5G networks could account for as much as a fifth of all mobile network infrastructure spending, it suggests.

“Unprecedented growth is likely to transform private 4G/5G… into an almost parallel equipment ecosystem to public [4G/5G]… in terms of market size by the late 2020s.” The references to “standalone private 5G” are a little confused, perhaps. It writes: “5G core infrastructure for standalone 5G connectivity services has been deployed by less than a tenth of the world’s approximately 800 public mobile operators… [It] is experiencing far greater success in the smaller but burgeoning private 5G segment where performance and efficiency advantages… are more easily consumable in the short term.”

It makes comparison in the above quote with “advantages” of “non-standalone 5G networks” – which refers directly to the in-between NSA-version of 5G. The point, to discuss the confusion, is only that edge-based SA networks are the big focus. It references, quite randomly, productivity and efficiency gains for “manufacturing, quality control, and intralogistics processes in the range of 20-to-90 percent, cost savings as high as 40 percent, and an uplift of up to 80 percent in worker safety and accident reduction”. There is a whole bunch in there that anyone reading RCR will know very well, but its lists and suggestions are useful.

It names moves by regulators, say, to make dedicated spectrum available to enterprises to deploy private 4G/5G networks in: Australia, Bahrain, Brazil, Canada, Finland, France, Germany, Hong Kong, Ireland, Japan, the Netherlands, Norway, Poland, Spain, Slovenia, South Korea, Sweden, Switzerland, Taiwan, the UK, the US. It says big operators (with “extensive spectrum”) retain a “significant presence”, essentially as consultancy and integrator firms, without ranking or naming them. Otherwise, new classes of 4G/5G providers include: “Boldyn, American Tower, Boingo Wireless, Crown Castle, Freshwave, and Digita”

Key specialist integrators are named as: NTT, Kyndryl, Accenture, Capgemini, EY, Deloitte, KPMG. The big hyperscalers – AWS, Google, Microsoft – are all offering managed private 5G services (“by leveraging their cloud and edge platforms”) – although it might be noted that Microsoft has shut down its Metaswitch experiment. Of the vendor market, it says: “Although Nokia, Ericsson, Samsung, and Huawei continue to lead the private cellular market in terms of infrastructure sales, there is much greater vendor diversity than in the public mobile network segment.”

Again, it suggests some likely protagonists, notably (in order): Celona, Baicells, Druid Software, Fujitsu, NEC Corporation, JMA Wireless, Cisco Systems, Airspan Networks, Telrad Networks, and HPE/Athonet. Helpfully, it also takes the time to highlight a number of large-scale recent private 5G deployments – coverage of which can be found here.