November greetings from Cedar Rapids and Kansas City. The picture will be a familiar sight for those in the fiber industry. Yes, we are getting a second fiber to the home (FTTH) provider for our 28-home community. The market is getting crowded in some places (the returns for the second provider in our community will be subpar) while others go unbuilt. Too many desktop analyses and not enough field verification.

After a full market commenary, we will provide some brief thoughts on the impact of the recent elections on telecommunications policy and then dive into the second part of our earnings analysis. This week, we analyze who has momentum with fiber deployments and wireline broadband.

We have had several dozen new additions to the Brief readership over the last month, and greatly appreciate any and all referrals. Given our focus on the operating performance of CellSite Solutions, the schedule does not permit consulting or speaking opportunities for the forseeable future, except for those directly related to telecom shelter remanufacturing or associated civil construction services. There’s a lot going on in critical infrastructure as latency requirements extend to secondary and tertiary markets, and CellSite is in the middle of many of those discussions. For now, time only permits expressing our thoughts through this column.

While we will not be publishing a full Brief in two weeks (our interim online Brief in two weeks will have links to three long-form pieces of content), we will continue our standard bi-weekly cadence through the end of the year. We are going to be focusing our December Briefs on four foundational trends shaping the industry. These are more in-depth than 2000 words allows, so we will be reviving the “Deeper” section of the online Brief for folks to access additional publicly available information. We will also intersperse each December Brief with some thoughts on capital priorities for each of the major telecommunications providers.

The fortnight that was

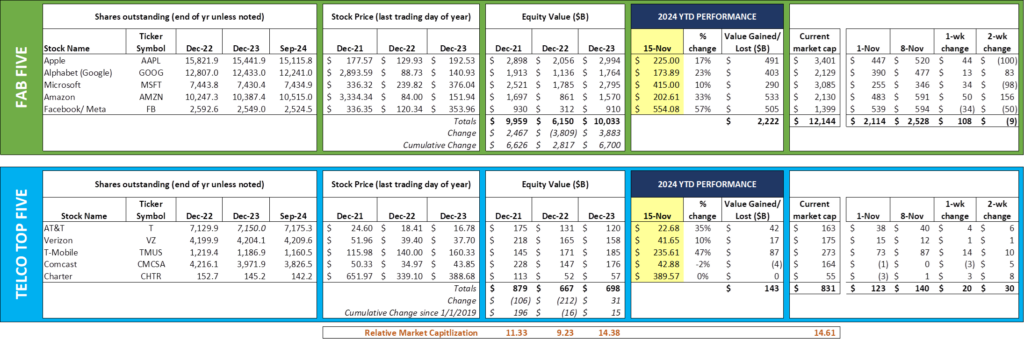

This was a surprisingly good week for the Fab Five (+$108 billion) and the Telco Top Five (+$20 billion). The theme of “small gains across the board, with one laggard” holds for both groups. It’s hard to feel too bad for Meta (the Fab Five laggard this week), however, as they are enjoying another stellar stock run (+57% year-to-date). As a group, the Fab Five have gained $2.22 trillion in value this year and $6+ trillion over the last two years – remarkable performance given increasing global regulatory scrutiny and their sheer size.

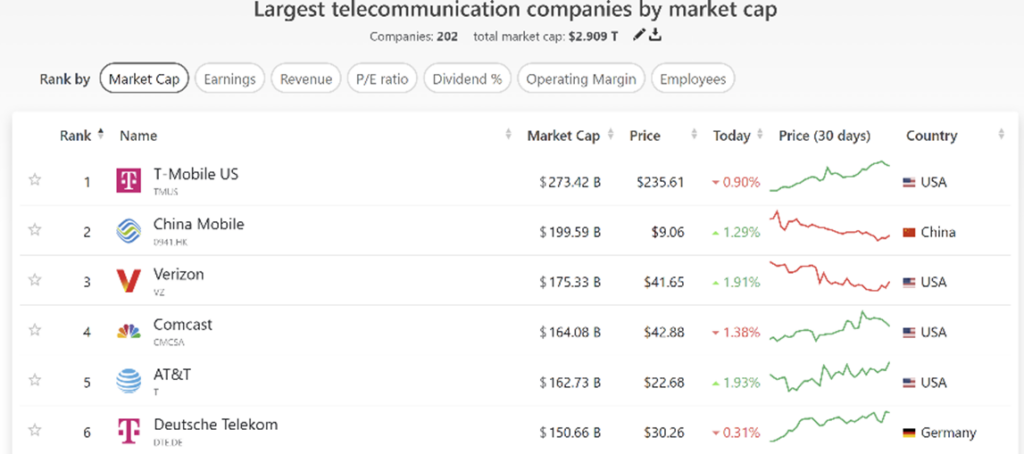

What is very interesting are the value migrations occurring in the Telco Top Five. T-Mobile’s stock continues to outperform most of the Fab Five on a percentage basis (+47% year-to-date). They are now the most valuable telecommunications company in the world by a very healthy margin (more here and in the nearby chart). Interestingly, T-Mobile is quickly approaching 10% of the total global telecom market capitalization. And, as we know from their Capital Markets Day, there are increased buybacks on the horizon.

While T-Mobile’s breakout is notable, so is the ascent of AT&T (more on why below). They are a mere $1.25 billion in market capitalization from overtaking Comcast, and $13 billion from besting Verizon. Many of us gave Ma Bell up for dead in 2020 as they grappled with poorly executed acquisitions, and while we did not toss them in the same trash heap as Lumen (who is also recently showing signs of life) and Frontier (who managed to get acquired by Verizon – shareholders approved the offer), we saw a complicated and tricky turnaround. A little over four years later, they are contending for third place on the league table – a noteworthy feat that we will elaborate on below.

Post-election implications for telecom

Many of you asked for our thoughts on the election (which, believe it or not, occurred less than two weeks ago). To quote the late Donald Rumsfeld, here are the “known knowns”

- The Federal Trade Commission (FTC) and Federal Communications Commission (FCC) leadership is going to change, enabling a friendlier M&A environment. Whether this applies to Comcast (current owner of MSNBC, a relentless critic of anything Trump) is a question, but the next four years present a unique window to get deals done. Did Comcast CEO Brian Roberts and the Comcast board demonstrate astute foresight when they announced on October 31st that they are contemplating a spinoff of their cable networks? At a minimum, additional re-clustering could take place (the New York metropolitan area, including Connecticut, could benefit, as well as the Washington DC and SoCal markets). This brings Cox and Altice into the equation. If Altice is in play, the long-awaited Mediacom/ Suddenlink deal could finally get over the wall, creating a rural-focused cable system that would be an effective competitor to fixed wireless.

- The NTIA will change, and many of the NTIA guidelines that chased away would-be Broadband Equity Access and Deployment (BEAD) bidders will be loosened. This is good for competition, helping companies like Charter, who are already bringing broadband to many rural locations thanks to their Rural Digital Opportunity Fund grants, expand their footprints with more sensible rules. More on how this will change in the discussion of Senator Thune’s election as Senate Majority Leader below.

- Scrutiny over net neutrality will decrease, but governmental editorial investigations under the guise of “censorship” will increase. As gigabit speeds to the home increase, the government’s focus will shift from blocking or prioritizing packets to evaluating algorithms. While we aren’t sure if octogenarian Senators can even understand how these algorithms work, this will not stop them from pontificating on where Google or Meta are at fault. Section 230 of the 1996 Telecom Act (that reduces legal liability to social media companies due to published content) will likely get revised – how much depends on the potential impact to President-elect Trump’s Truth Social business.

There are many more implications (China policy, CHIPS Act revisions, Department of Government Efficiency potential actions, etc.) for other Briefs. Bottom line: M&A gets a lifeline, as does BEAD competition. Everything else depends on the Congressional appetite for change, which appears at the moment to be great, but might wane as 2025 approaches.

Senator Thune becomes majority leader

Last Wednesday, Senate Republicans selected South Dakota Senator John Thune as their next majority leader. We view his election as a positive for rural broadband deployment (a copy of his June 2022 comments on rural broadband is here). One of the opportunities that the Senate could tackle is streamlining the broadband loan/ grant process. With the rise of state broadband offices, we think the time is right for reengineering and consolidating federal programs. Given all of the mapping analysis and associated planning underway for BEAD, the states are best suited to fulfill broadband objectives.

This theme also applies to topics like Davis-Bacon (labor rate) administration and compliance, low-cost broadband requirements (including pricing), and environmental mandates. The Senate should strongly encourage the Department of Commerce (where the NTIA is housed) to clarify each rule – quickly. Greater flexibility will increase the number of bidders and lower costs to achieve each state’s broadband goals.

This flexibility should include the ability to fund/ subsidize wireless solutions when alternatives are costly (and arm-twisting efforts have failed). Maine recently announced the Working Internet ASAP program which will provide Starlink terminals to as many as 9,000 homes and businesses (CNET article here). At current retail rates, this would total a $2.7 million upfront investment, a fraction of the cost of FTTH. Finding solutions for the last 2-5% of homes that have extraordinarily high alternative price tags should be encouraged, and the process to fulfill objectives should be reengineered and streamlined.

Who’s got momentum (Part 2)

In Part 1 (link here), we began our earnings analysis with a broad overview of the state of the industry. Rather than rehash that section, we will add some details that will help make the case for our selection as the momentum leader in the wireline/ broadband industry.

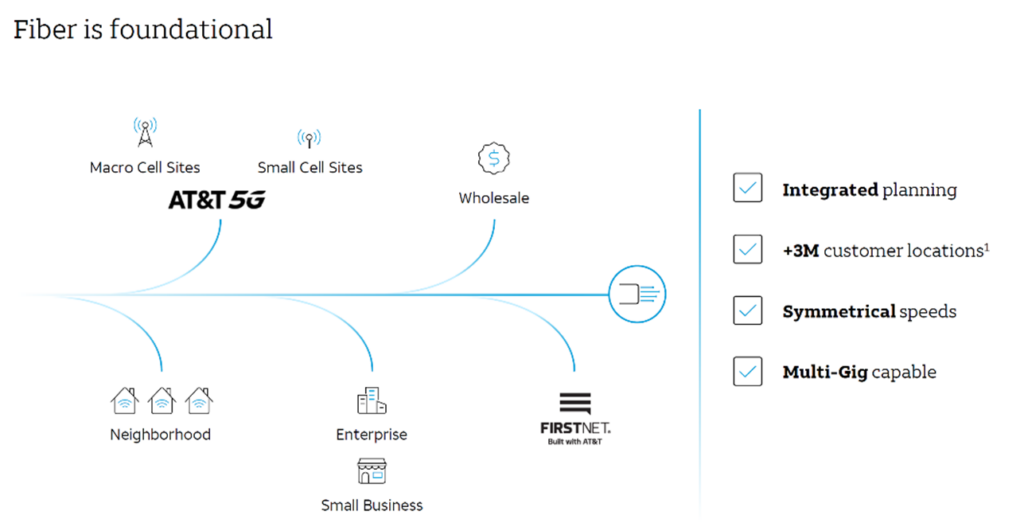

Behind all residential or commercial broadband deployments (wireless or wireline) is a fiber-based architecture. Behind that architecture is a forecast, as well as a keen understanding of network construction step function costs (e.g., what’s the cost of dropping in a second, empty conduit along certain routes to have capacity for growth).

Most fiber/ bandwidth providers are keenly interested in providing bandwidth to all customers along the route (see picture from AT&T’s 2021 Investor Day nearby). In some cases, they may even work with a third provider who has better network monitoring or security capabilities to serve major enterprises or wireless carriers. More users of the same fiber de-risk the capital investment and improve discounted cash flow paybacks.

Once a wireless carrier has either a) self-provided fiber; b) third-party leased fiber; or c) a long-term bandwidth circuit agreement that may or may not flip to a dark fiber lease, they can plan for tower/ cell site growth. This could include fixed wireless services for residential or business customers. In the case of some rural towns, fixed wireless is often the most cost-effective solution.

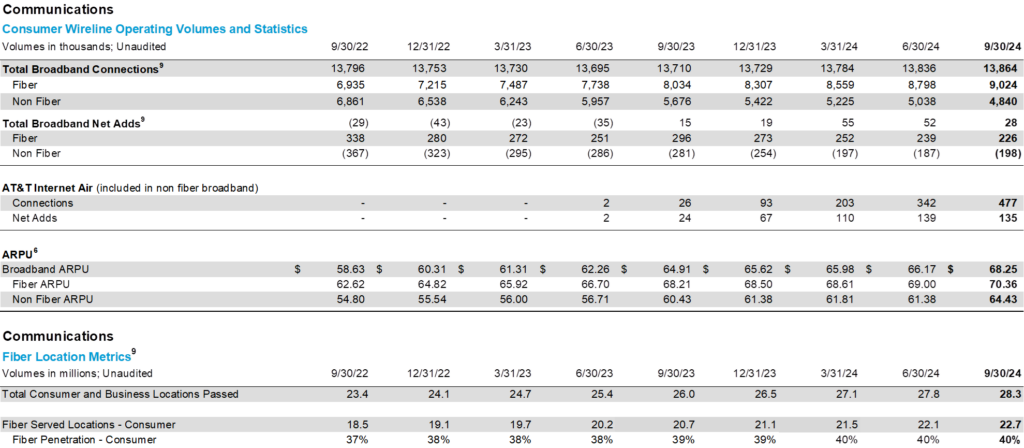

This setup leads us to our wireline/ broadband winner – AT&T. Here is their most recent consumer fiber trend schedule (earnings package here):

AT&T ended the quarter with roughly 9 million consumer fiber customers, up slightly less than a million from the third quarter of 2023 and up more than 2 million from the third quarter of 2022. The company is now adding 600K new passings per quarter in 2024, up from 400-500K in 2023. At this pace, they will reach their 30 million target in 2Q 2025, six months ahead of their goal.

When AT&T adds passings, they are quickly reaching the 40% hurdle. This is attributable to their bundling discount offered to existing wireless customers, as well as a “complete move to AT&T” bundle advertised to existing un/ under-satisfied broadband customers. AT&T, at least for now, appears to be focused on making sure new fiber deployments achieve the 40% threshold rather than going back to push the case to 45 or 50% (we anticipate that the economic equation to do that will come in 2025, however).

Unlike their cable counterparts, AT&T is not deeply discounting their fiber service to attract new customers. They have quickly tapped into a value mix that has allowed them to grow average monthly fiber revenue per household to $70.36. Our gross margin estimate is 90% on each fiber connection (provided it was installed correctly) due to the lower maintenance costs on the new plant. We think that the company will be articulating these and further insights at their December 3rd analyst day in Dallas.

Labor costs associated with installing new fiber continue to rise, but most of the materials cost increases have peaked from post-COVID highs. In addition, AT&T can now make more confident assumptions about fixed wireless (Internet Air) penetration to the region surrounding the fibered town. As we have mentioned in previous Briefs, we believe that AT&T was surprised at the demand for Internet Air from business customers, and that the quality of the connection has led many of them to put 50% or more of their total traffic through the wireless connection (for more details on yield and costs, see their pricing here). We think an $80/ month rate with the first 250 GB at a higher priority is good for now, but that the product will need to expand to include 500 GB and higher tiers (and we think that business customers will readily pay for these connections).

This leaves AT&T with a single, new fiber-fed architecture that is easy to maintain and highly valuable to customers. Thanks to their divestiture of DirecTV, they can provide multiple streaming options to customers, some of which might include live/ local broadcasts. Customers receive bundled discounts and, with additional penetration, wireless scale improves.

To improve their returns, AT&T has to go back to the already cash-flowing neighborhood (40% generally viewed at the level that will produce healthy cash flows for fiber providers) and attract additional customers. Like wireless deployments, this “densification” process is a lot cheaper and easier to implement than the initial “coverage” construction.

Best of all, AT&T is not distracted by merger approvals (and associated concessions to certain states like New York and California) and worried about synergy achievement. They need to focus on wireless and broadband saturation of the roughly 30 million additional homes in their footprint (we are assuming that 18-25 million are already served by cable, and that substantially all of these are served by Starlink). That’s an easier conversation to have with states as they are dispersing BEAD monies (cf: Texas and California represent $5.2 billion of the total $42.5 billion in allocations, and eight of the top nine states receiving BEAD monies are in traditional AT&T territories).

We think AT&T has the clearest path to achieving high returns with their current fiber deployments and anticipate that at least 10 million additional homes passed will be announced in December. The company would be wise to suspend any dividend increases and focus any additional cash flows on densification. We also reiterate our expectation that AT&T will take full advantage of the diaspora occurring from North to South, and East to West (our previous Brief on that topic is here).

Bottom line: It’s hard to see how AT&T can screw it up with John Stankey at the helm and Jeff McElfresh as the COO. Anything is possible, but we see lower execution risk with AT&T’s plan than with Verizon or cable. If only AT&T could go faster…

That’s it for this week. Only an interim (online) Brief over the Thanksgiving weekend, and then we dig deep into macro trends impacting the industry as we exit 2024. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Finally – go Davidson College Basketball and Kansas City Chiefs!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.