In the private 5G market, many applications are waiting for IoT devices to be ready. RedCap devices are very slow in coming to market…despite standards frozen more than two years ago. Some applications are starting to move ahead with the early devices…but any devices with special frequency band support or other tweaks must wait for months or years to be developed.

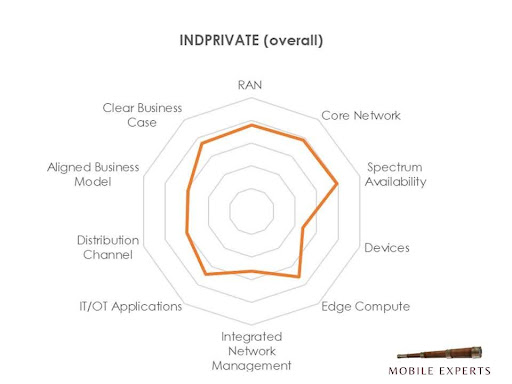

The Mobile Experts Readiness Wheel is one way to visualize this. Other factors, such as networks and spectrum and edge computing are in place, but the devices are not mature. This makes the “wheel” look like it has a flat tire, and the market doesn’t “roll.”

Here’s an idea: because private 5G network vendors and managed service providers stand to make billions of dollars in this market, what if the network guys subsidized the specialty devices that are needed?

The cellular IoT module suppliers will not develop thousands of customized modules for low-volume applications unless they have an incentive. According to our recent forecast, they are busy chasing a few high-volume applications like asset tracking, which will lead to a market of more than 4B units shipped per year in 2034. Those units are mostly used on wide-area networks and don’t benefit local private cellular. The smaller private opportunities simply don’t get the attention of the module vendors.

Let’s look at an example: say that you’re trying to automate a seaport with 20 large cranes to offload container ships. The network will cost a few million dollars, and the managed service provider will make millions of dollars on the operation of the network. But the IoT module vendor only gets to sell 20 modules for $50 each: $1,000 in revenue. That doesn’t pay for the module R&D or even the FCC filing.

I propose that in a case like this, the network vendor and/or MSP should step up to pay the R&D cost for the IoT module to be customized. My guess is that this would cost about $300-600K. The IoT module vendor gets another product in its catalog, which may or may not lead to high volume in the future.

With the complexities of different air interface standards (Cat-M, NB-IoT, Cat-1, Cat-1.bis, RedCap, eRedCap), 40 different frequency bands, and many different MIMO and duplex variations, the RF section of the module has billions of possible combinations. If the industry waits for each variation to be developed based on its immediate demand, we will need to wait years to get a broad enough portfolio of IoT modules. Let’s short-circuit that process by thinking about the big picture.

I believe that a coalition of companies could solve this problem and make the market grow faster.