January greetings from Missouri and Iowa, where one of the two states received a foot of snow (and the other, their northern neighbor, received a small amount yet participated in a string of freezing temperatures). This week’s Midwest’s weather incidents pale in comparison to the tragedy continuing to unfold in Los Angeles – our hearts go out to each person affected.

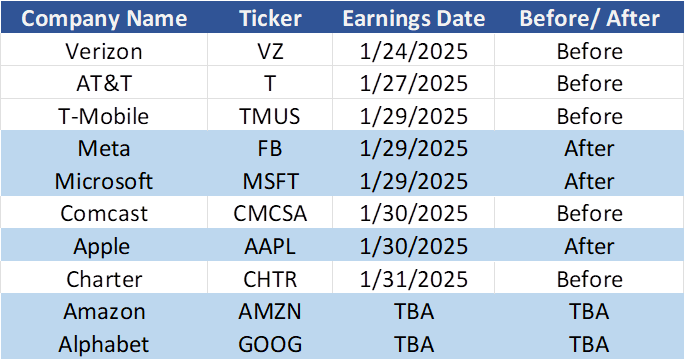

After a brief market commentary, our focus will be on earnings (see nearby chart of the fourth quarter earnings calendar – Verizon has decided to announce the Friday before AT&T). Rather than attempt to provide new insights into existing long-term trends (e.g., the three-way battle for customers between fixed wireless, cable DOCSIS, and fiber to the home (FTTH) which has existed for at least three years), we will instead highlight 1-2 items each company needs to “prove” to investors this quarter. These are very different for Verizon and AT&T, as shown below.

The fortnight that was

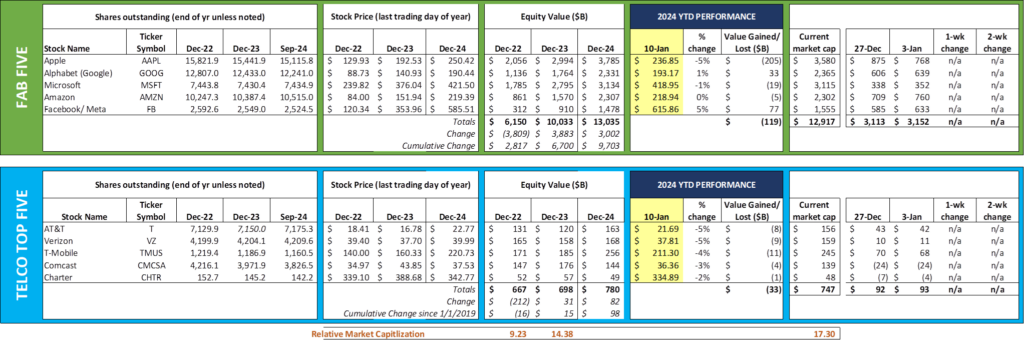

Note: This is the awkward beginning of the year Fab Five vs. Telco Top Five schedule. By the next full Brief, we will have the one and two-week market capitalization changes and will update share counts by early February. End of year share prices, market capitalizations, and 2025 gains and losses are reflected in the above table.

January did not usher in a wave of buying that has been common in previous years. In fact, the only thing that seems to be in demand from a market perspective is short-term bonds/ commercial paper. Markets tanked on the good news that the economy created more than 250K new jobs in December (with minimal November and October revisions), and the unemployment rate dropped to 4.1% (which would be considered full employment by most economists). Long-term Treasury bonds appear to be headed for 5%+, and commodity prices (particularly natural gas and crude oil) are jumping because of cold weather and better than expected industrial production.

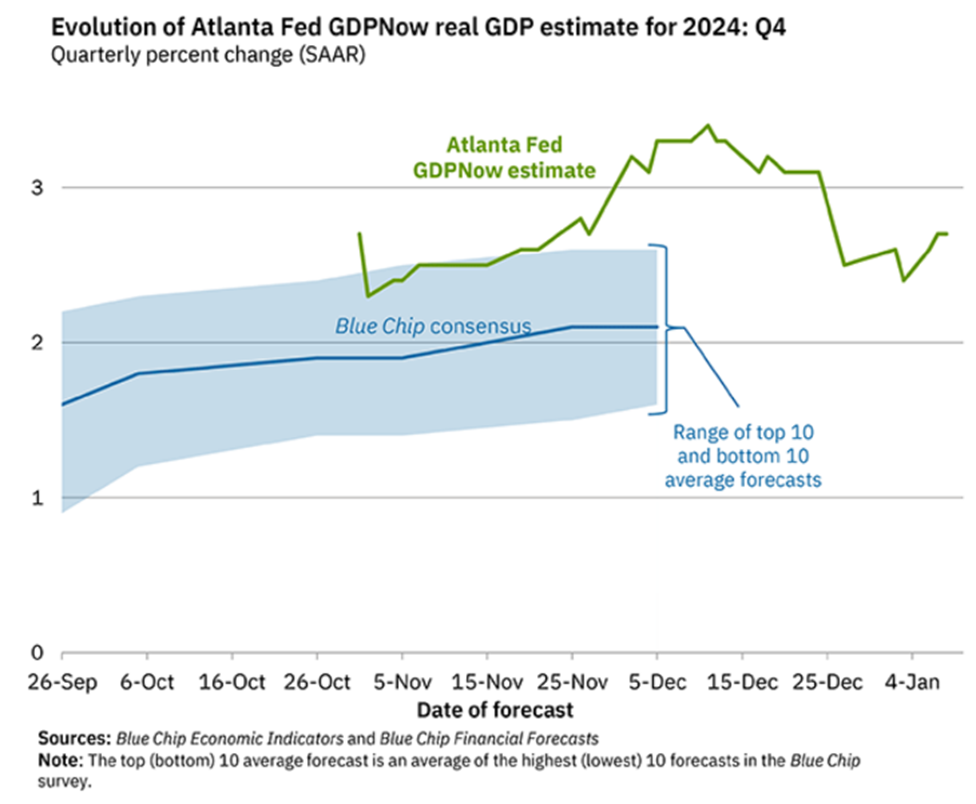

The best way to summarize the varying views of market economists is shown in the latest Atlanta Federal Reserve GDP estimate (note that it was updated prior to the jobs report – we will have to wait for the January 16th update to see how the green line changes):

At the end of December, there was nearly a 140 basis point difference in Q4 GDP estimates between the Atlanta Fed and the Blue Chip consensus. We anticipate that the jobs report (as well as additional economic reports that will be released in January) will show that the economy is actually growing much faster than economists expected and that the actual figure will more closely resemble the Atlanta Fed figure.

While this is not great news for folks who were hoping to see lower interest rates in 2025, it is very good news for the companies that power the economy. Housing affordability is down, but disposable income is up. Even food prices are slowly decreasing (see the USDA Food Price Outlook that was updated on January 8 here). 2025 is the first year since 2019 when the USDA is including deflationary scenarios in their at-home and combined “all food” intervals – see link for more details.

Why is this important to telecom? A stable jobs environment likely results in increased consumer confidence which drives purchases of new devices (including gaming consoles, televisions, and the like) and plan/ bandwidth upgrades. This feeds the prospects of companies like Apple, Samsung, LG and even Microsoft.

As we talked about in last week’s Brief, M&A activity is likely to increase materially in 2025 because of the changes in Presidential administrations (and 2024 had many announcements in telecom). Last week, Disney and Fubo settled their differences and decided to merge the Hulu + Live TV division into Fubo (announcement here). This will create a more effective competitor to Google’s YouTube TV, and likely help the core Hulu franchise (which is remaining with Disney) in the process. Fubo shareholders are happy with this week’s 245% share price appreciation (back to mid-2022 levels.

After the Disney + Fubo transaction was announced, the three parties that were combining to create a sports-focused channel called Venu cancelled their efforts (see ESPN.com announcement here). This was a real surprise given that Fubo and Hulu + Live were now combining, but shows Disney’s focus on delivering their own sports streaming service through the new and improved ESPN app (just in time for the fall 2025 college sports season).

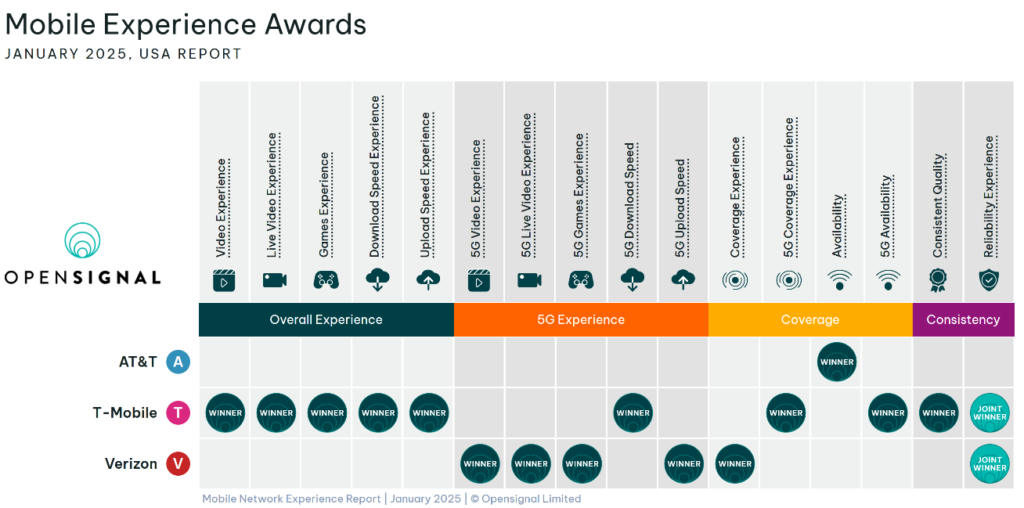

Finally, Opensignal released their Mobile Experience Awards last week (full study here). Here are the summary findings:

T-Mobile won nine of the sixteen categories outright and tied with Verizon in another. The chart that surprised us the most was 5G availability. Even after a year of C-Band deployments, Opensignal found that AT&T customers only accessed 5G 14.7% of the time while Verizon customers (presumably including Comcast and Charter) accessed 5G networks even less (10.6%). T-Mobile customers, in contrast, access 5G 71.7% of the time. That’s a very big difference and likely drove the overall (4G + 5G) experience scores higher for T-Mobile in 2025.

That said, when Verizon customers were able to access a 5G signal (roughly 11% of the time), they had an outstanding experience. And AT&T customers were able to access some data (likely 4G) more often than T-Mobile, highlighting the need for the US Cellular assets or broad-based coverage improvements. This report is very encouraging for Magenta, provides a clear roadmap for Big Red, and highlights the level of 5G deployment still needed in the US wireless industry.

Q1 earnings preview—what each company must prove (Part 1)

We have been following each Capital Markets/ Analyst Update day in detail, and also tracked Apple iPhone 16 Pro and Pro Max sales until early November, when backlogs were largely eliminated (see our final iPhone report here). Each of the Telco Top Five companies has made a lot of claims: What evidence must they now present in their Q4 earnings to show that they are on the right track?

In today’s Brief, we will cover proof points for Verizon and AT&T. In the January 26th Brief, we will cover cable and T-Mobile.

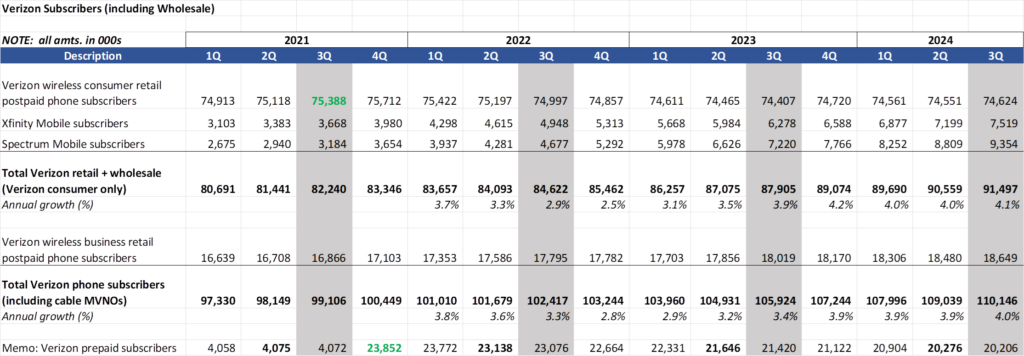

- Verizon: Are they a pre-paid, value and premium wireless leader? Can they (Do they need to) be everything to everybody? November 2024 was the three-year anniversary of the closing of the Tracfone acquisition (total transaction cost of ~ $6.25-6.5 billion). One of the benefits of the transaction was Verizon would now participate across all customer segments. To see just how that has unfolded, here is a schedule we distribute with each interim Brief:

This is a full representation of Verizon’s “network as a service” strategy. On postpaid (which we assume is a proxy for the value and premium segments), Verizon has been growing their base faster in 2024 than they did in 2023. In fact, including cable MVNO subscribers, they have added 3.6 million net new consumer subscribers (4.2 million including retail net additions). The economics of each segment may differ, but for those who allege that the cable MVNOs destroyed Verizon’s postpaid retail business, the data clearly shows that Verizon’s network scale is growing, not shrinking (and Verizon’s consumer postpaid retail base is only about 1% smaller than it was three years ago). It looks like Verizon might have struck a healthy portfolio balance with these two segments.

The verdict for prepaid is not as clear. Subscribers peaked just after the transaction closed, and, while the ACP-linked product (SafeLink) appears to be a large source of losses in 2024, they were also a part of the $6+ billion valuation in 2020/ 2021. After most of the ACP-driven dust had settled, they reported 80K of non-SafeLink subscriber growth in 3Q. Will net additions top 100K in 4Q, or will the management team guide to a robust Q1 driven by strong tax refund-driven promotions? Is the quest for prepaid distracting from other postpaid items? With retail in general in decline, how will Verizon/ Tracfone emerge as the undisputed leader versus Cricket and Metro?

There’s a lot to like about Verizon’s wireless and operations strategies, but their track record on acquisitions (including Tracfone) is suspect. This is why we are very interested in any additional updates they have on Frontier (which is ~ 4x more costly than Tracfone).

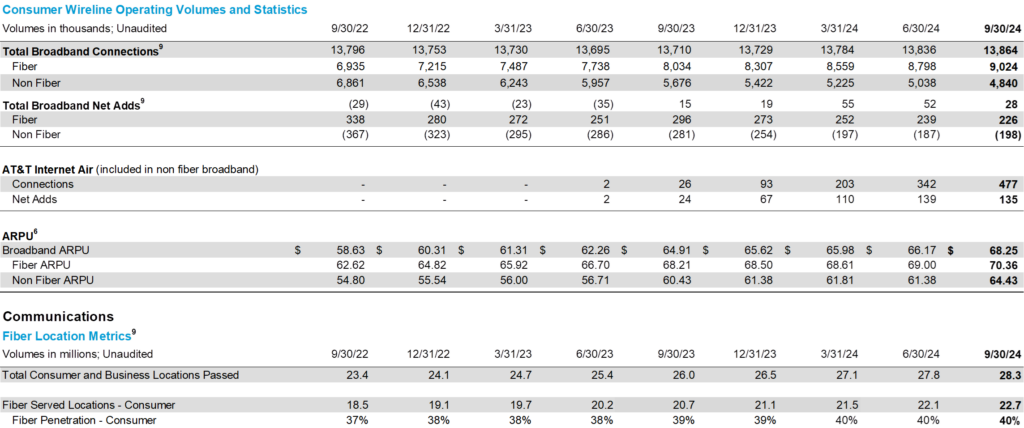

- AT&T: Can residential fiber subscriber growth extend beyond upselling to wireless customers? What’s the path to 50% penetration? Here are their latest fiber rollout statistics through 3Q 2024:

AT&T has a lot of momentum headed into Q4 earnings. They recently won a big victory from the FCC who ruled that their wireless telephony replacement can be used as a copper substitute (we think this helps Verizon as well and look forward to further executive commentary) – more in this Bloomberg article.

Last week, they introduced The AT&T Guarantee, which states “In the event of a network interruption, we will work diligently to restore service and make it right for fiber customers who experience 20 minutes or more and wireless customers who experience 60 minutes or more of a covered outage. Consumers will automatically receive a bill credit equaling a full day of service and we’ll reach out to our small business customers with options to help make it right.” While there are a lot of footnotes and caveats (including the fact that the wireless downtime must be caused by a single incident impacting ten or more towers), it’s a start in the right “put your money where your mouth is” direction.

While both of these events are positive, nothing compares to the long-term fiber penetration increase from 40% to 50% across their soon-to-be 45-million-homes-passed footprint (announced at their December Capital Markets Day – see slide 35 in their presentation here). That’s 3 million homes of cash flow upside from capital that has already been purchased and/or deployed.

This revised long-term penetration assumption was a principal driver of the 15 million homes expansion. From our experience in both wireless and fiber deployments, it seems plausible over the long term. But are there any indications that AT&T will deliver sustained 50% share in any existing markets soon?

For AT&T to deliver, they need to have a) low fiber churn, especially among “switchers” and b) competitive differentiation beyond cross-product discounting. They will need to achieve the 50% figure with less participation from DirecTV (which they will fully divest this year) and Warner Bros. Discovery (which they fully owned until 2022). How will AT&T achieve this result?

For those who have not followed AT&T’s tactics for nearly three decades, this statement may come as a surprise: We would not be surprised to see AT&T create exclusive agreements (including possible investment) with gaming companies in 2025. Gamers want every edge, and AT&T clearly has an opportunity to set the stage for low latency performance with minimal incremental capital investment. Microsoft might be a good place to start given the relatively strong relationship between Ma Bell and Redmond.

Beyond gaming, we would not be surprised to see AT&T flex its enterprise muscle and create a “work from home” offer to all medium and large enterprise customers. They could tout their latest security products and create a “private network” offering which could be linked to private AI instances. This would not necessarily carry a deep discount but would create a perk that would be difficult to break for cable and/or smaller FTTH providers.

We think that AT&T will likely avoid a content bundling deal (e.g., we would not see them overpaying to wrest Netflix from T-Mobile or trying to out-bundle Verizon’s current myPlan offers). If anything, we would see AT&T partnering with companies like Best Buy to improve the availability and affordability of consumer electronics to AT&T Fiber customers.

Bottom line: If AT&T can prove that they can achieve 50% penetration, they will rival T-Mobile as the most valuable telecommunications provider. The cash flow implications (which AT&T has already stated they will use to repurchase stock after they meet their leverage ratios) are too great.

That’s it for this week. We will dig into Verizon’s earnings and provide proof points for T-Mobile and cable in our next full Brief (January 26). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Finally – go Davidson College Basketball and Kansas City Chiefs!