GSMA found that only around 15% of operators in Europe with live 5G networks had launched 5G SA by the end of Q3 2024

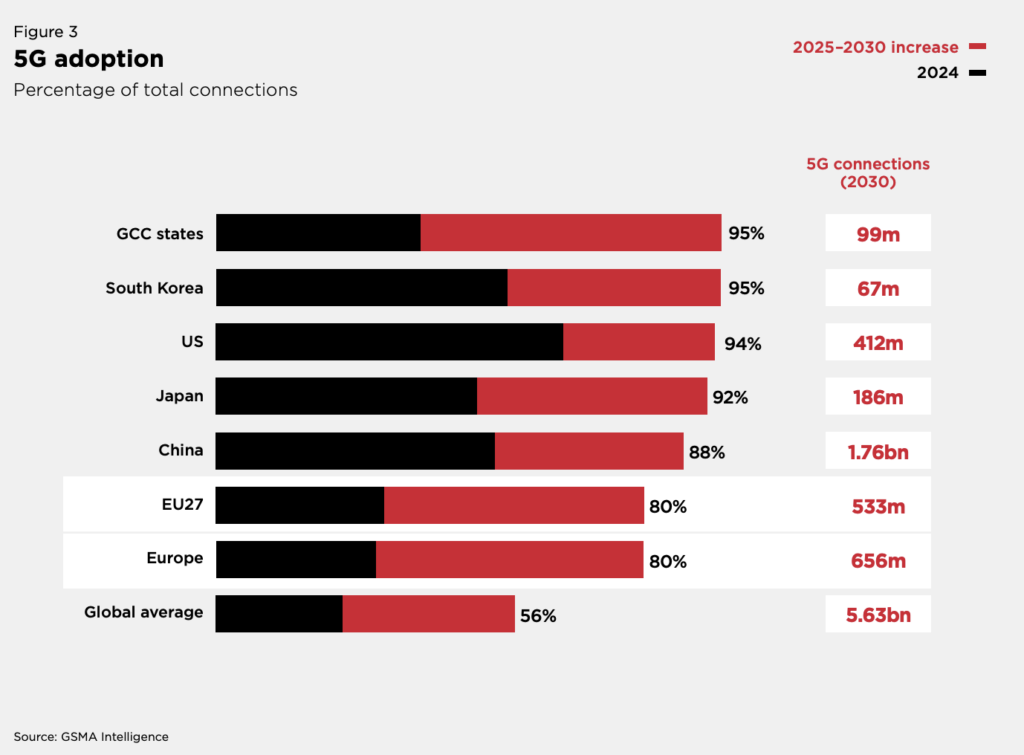

A new GSMA report focusing on the mobile economy in Europe shows that while 5G will become the dominant mobile technology in Europe by 2026, the continent lags behind other regions including North America, East Asia and the Gulf Cooperation Council (GCC) states, where the firm says attention is now being turned to 5G standalone (5G SA) and 5G-Advanced (5G-A).

More specifically, only around 15% of operators in Europe with live 5G networks had launched 5G SA by the end of Q3 2024, compared to more than 30% in Asia Pacific and North America. “This is indicative of the difficult operating conditions facing European operators,” commented GSMA. “Recent 5G SA launches by EE in the UK and Free in France suggest 5G SA deployments are gathering pace, but the speed of rollouts remains slower than many industry players anticipated a few years ago.”

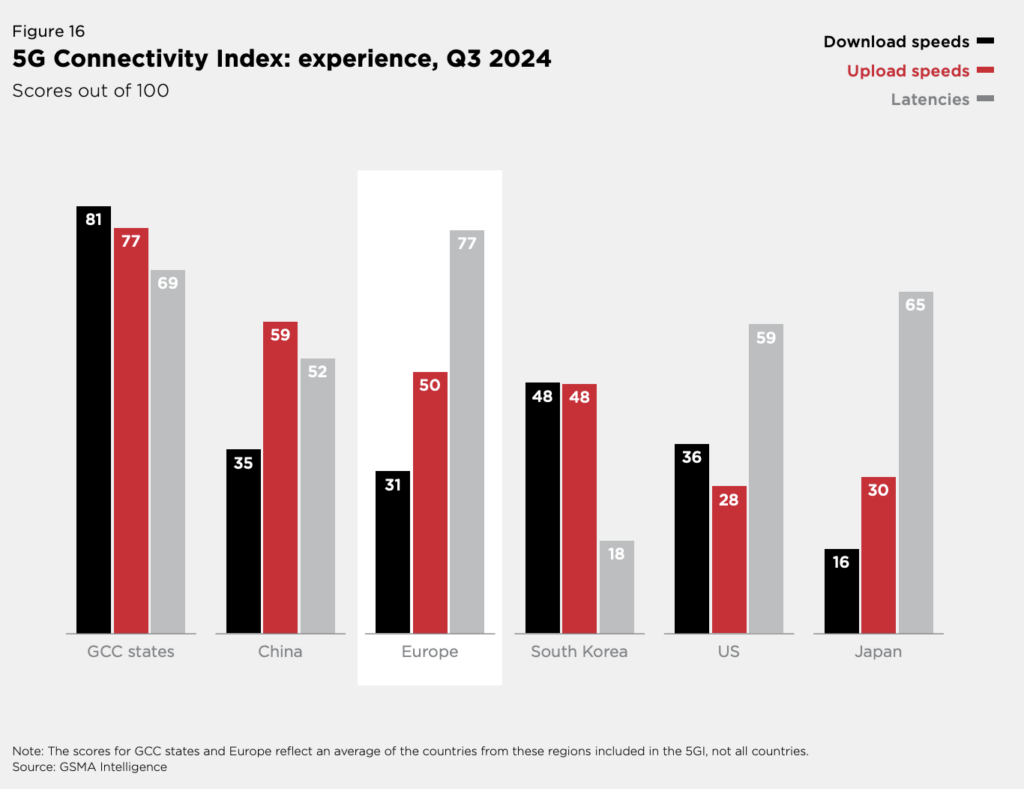

And when it comes the 5G experience, Europe is also falling behind — the average 5G download speeds by the end of 2023 in the region had reached approximately 230 Mbps. While a more than fivefold increase from the 44 Mbps of 4G speeds, the GCC states and in developed Asia Pacific continue to surpass those seen in Europe, particularly when it comes to download speeds.

At the close of last year, 5G accounted for 30% of mobile connections in — equivalent to 200 million connections. Denmark, Finland, Germany, Norway, Switzerland and the UK showed themselves to be leaders, with each country achieving a more than a 40% 5G adoption rate.

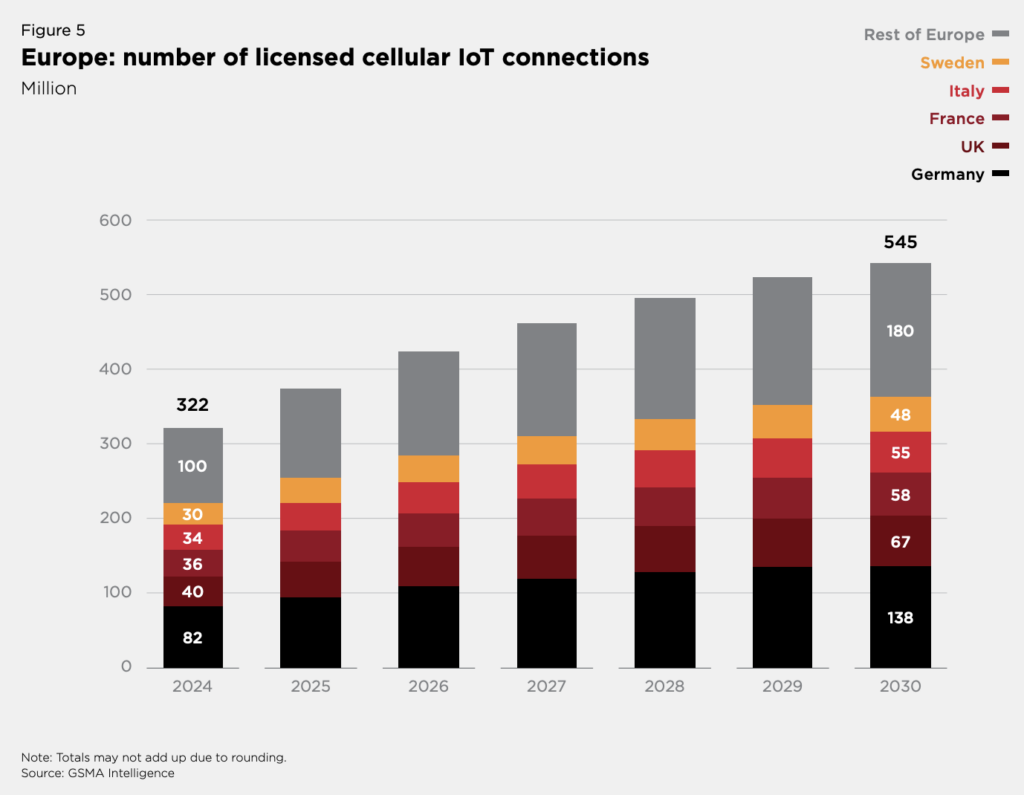

Other key takeaways include a cellular IoT outlook, with GSMA predicting nearly 550 million licensed cellular IoT connections in Europe b7 2030. Germany will account for around a quarter of these, it said, while the UK, France, Italy and Sweden will each account for around 10%. The firm also said that operator investment in AI, including generative AI, is picking up in Europe and cited several recent announcements including Orange adding network AI to its operation center, Deutsche Telekom tapping AI to support its security and EE improving its network reliability with AI.

Despite its disappointing position on the 5G adoption leaderboard, the overall 5G outlook in Europe looks good, with GMSA expecting adoption to hit 80% by 2030, boosting the economy by €164 billion ($168.7 billion). But, it warned, it can’t be done without policy reform to ensure that telco can securing critical network investment.

For a global take, the GSMA found that worldwide 5G connections surpassed 2 billion in 2024. Notably, the technology hit this milestone just five years after its arrival, making it the fastest-growing mobile broadband technology to date.