Something and nothing, here, but worth a look: the team at CCS Insight – which crosses over, individually, with the Global mobile Supplier Association (GSA), and so has double-dibs on private 5G thinkery – has polled 500-odd IT “decision-makers” in key industrial sectors (manufacturing, mining, logistics, utilities, healthcare etc) about private 5G (and 4G/LTE), and drawn some conclusions. And they are helpful, and worth memorialising in a cribbed re-write – under a header that is, probably, a little punchy. Because most of the downsides, the ‘reasons it sucks’*, are really just about market immaturity. But you’re here, now, and we soldier on…

The research covers enterprises in the US, UK, Germany, Asia Pacific, and Latin America. Writing in a blog post, Luke Pearce, senior analyst at CCS Insight (and GSA rep), explains: “The market is still in its infancy, with significant hurdles to overcome. Yet, for those who have invested, the returns are clear: transformative productivity gains, cost savings, and enhanced operational capabilities.” Which just about sums it up; but let us flip-flop on top-line benefits, and start with the bottom-line challenges. Which are fairly numerous – just because the technology and supplier markets are young, and most of the customer markets are cautious, conservative, and as old as the hills.

“The reality is more complex,” writes Pearce. So here they are: four reasons private 5G sucks (or reasons it is not going faster), and one reason it rules – as a definitive connectivity platform for industrial change in a mad-paced new digital era. All the quotes are from Pearce.

Four reasons why private 5G sucks*

1 | A long road to travel – expensive, complex, hard-to-find

These are the big items in the deficit column. “Market maturity remains a barrier, with high initial costs and the complexity of deployment deterring wider adoption. Respondents emphasised the need for easier, integrated solutions,” writes Pearce. The findings quote one “interviewee”, who said: “‘We don’t see many off-the-shelf fully 5G integrated solutions available to us. We shouldn’t have to build this capability. We want to buy it off the shelf’.”

Which is an understandable position for an IT department, and even a specialist OT department which knows its channels.

Pearce continues: “For vendors, the message is equally clear: simplifying deployment, addressing ecosystem gaps, and demonstrating real-world return on investment will be critical to driving broader adoption.” There’s the gauntlet, then, on the hardened-concrete floor of Industry 4.0; a message for the supplier industry, starting with the tech makers, to deliver simpler Wi-Fi-like out-of-the-box connectivity solutions, even if they are intended for higher-grade workflows. And we know this, too; the whole market turns, for now, on large national and multinational supply deals.

If private 5G is to properly scale, it needs to be in the hands of small-and-medium sized enterprises (SMEs), often struggling just to keep the lights on. That is the Industry 4.0 engine room, in the end – and not global car makers, regional utilities, vast unknowable mining operations. And for that, it has to be cheaper and simpler: cash-and-carry, plug-and-play, with easily telegraphed returns in 12 months, and an idiot-proof (gen AI assisted?) management interface. Or something like. “[There is] an urgent need to… offer simplified deployment options,” says Pearce.

2 | In thrall to its own mythology – the killer is connectivity

In the end, the inherent value of private 5G technology is very simple: it is connectivity. What else would it be? Well, marketing departments have been so focused on drumming-up new applications and services, and dovetailing deployments with dreamed-up industrial AI scenarios, that they have lost sight of a most pressing need in enterprise venues: that stuff and things don’t connect – ‘over here and over there, in that corner and in that room’. Boil it down, and 5G should be an easy solution and a simple sale – if it wasn’t so expensive and complex, as above.

Pearce writes: “Industry evangelists often focus on advanced applications like robotic automated guided vehicles and remote-operated machinery, but our findings reveal that the real ‘killer’ use for private 5G is surprisingly straightforward: sitewide connectivity. The ability to seamlessly connect mobile devices, sensors and cameras across indoor and, especially, outdoor environments is a key driver of adoption.” To be fair, most sales teams in most suppliers know this – that robust connectivity in industrial black-spots and not-spots will swing the deal.

But the price is high-ish, the return is long-ish, and it does not stop them piling-in with all kinds of additional products and services – which the enterprise probably can’t afford, and probably doesn’t need anyway. So the picture gets skewed, for the whole market. ‘No, thanks – really! I don’t want your compute system and software apps, and your second network and seven-nines!’ Which is not a quote from the CCS report – just an imagined response from a confused customer. Burned. The message is that private 5G connectivity works – really well. So make it simple.

Predictive maintenance and inventory management are also gaining traction, notes Pearce. But these are age-old IoT cases. The real killer is reliable connectivity. He writes: “The value of reliable, secure, extended coverage shouldn’t be diminished. Solving these connectivity and coverage problems is of value to our interviewees.”

3 | Just another network – a better one, but not the only one

Private 5G is better than Wi-Fi – says everyone. But again: the supplier market must not be prideful, implies CCS Insight. It is better, yes; but it is not a solitary infrastructure. It is not a replacement for Wi-Fi. Which is another myth that was created by the cellular industry in its formative grand-standing, as it made out like 5G would solve everything. Pearce writes: “Respondents overwhelmingly recognised private 5G’s superior reliability, security and coverage… [It] is increasingly favoured for mission-critical applications.”

But he adds: “That said, Wi-Fi still plays a crucial role. Nearly all respondents reported using Wi-Fi alongside private 5G, often assigning each technology distinct roles.” ‘Nearly-all’ is 97 percent in the survey – so everyone, basically. A quarter (24 percent) of its industrial IT sample said they use private 5G “exclusively” for mission-critical functions and Wi-Fi for less-critical tasks; half (48 percent) use Wi-Fi indoors and private 5G outdoors. “This hybrid approach underscores the complementary nature of the two technologies,” remarks Pearce.

This much is plain, perhaps; it is less about why the tech sucks, as it is about how the early marketing and mythologising sucks – and how both suppliers and customers are living with the consequences, somehow surprised that these are complementary technologies with their own unique business cases.

4 | The ‘build’ and ‘run’ – critical trust and integration

Remember that silly Gartner survey – which placed mobile operators at the top of the heap? Well, CCS Insight agrees that it got it all wrong – because it asked the market, and the market told the truth: that, for the supply of private 5G platforms, system integrators are in and mobile operators are out. Which is because they are hard to build and run, according to every different customer’s different disciplines and priorities. Enterprises want “trusted partners” – always and every time, especially when their critical operations, where 5G is directed, are at stake.

Pearce writes: “To navigate the complexities of private 5G deployment, most respondents turn to managed service providers and systems integrators. Systems integrators are seen as trusted partners for their expertise, reputation, and ability to manage network intricacies in industry-specific scenarios… Mobile operators… consistently rank near the bottom for consideration. Outside China, [they] have struggled to establish themselves in this market, especially in countries where spectrum is leased out to enterprises directly.”

Curiously – versus the Gartner report, and also versus a parallel study by Kaleido Intelligence – CCS Insight lists AWS, Cisco, and IBM as “better equipped to deliver private 5G”. The surprise is only at the lack of crossover – that these three don’t feature in those other summaries, and that their integrators don’t appear here. And maybe also that AWS is named, at all, as an elite-level direct supplier of private 5G. But all told, the sense is the integrator market is enormous, across trades and countries – which, again, just says how hard private 5G is.

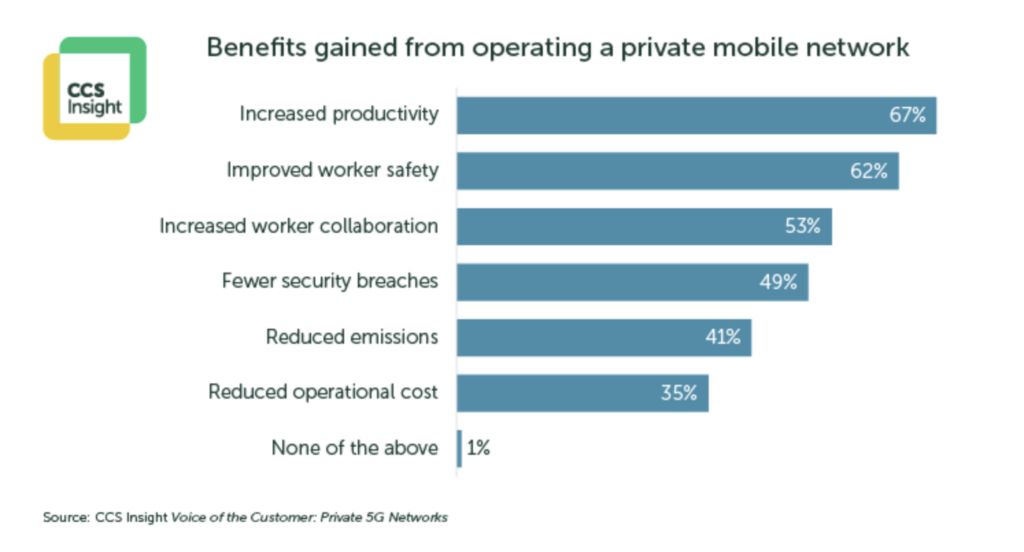

The one (and only) reason private 5G rocks

Because it makes a difference, and matters. In the end, this four-point suckery only lists rather minor complaints – which really just explain the strategic minutiae for an industry to come-of-age. The big takeaway from the CCS Insight research is that private 5G is making a difference, even if it is mostly mega firms with deep pockets that are putting it to work. Some proof points: more than half of ‘early adopters’ have achieved a return on investment in less than two years, and more than two-thirds have reported productivity improvements (see below).

“One manufacturing respondent told us that private 5G saved them $1.5 million over five years compared with Wi-Fi,” writes Pearce. Which, to an extent, is because 5G is a lower-volume hardware calculation – better coverage means fewer radios. Except that 5G radios are more expensive, so maybe you come out even. But multiply-in the performance upside over a period of time – more reliability and security means less maintenance and downtime (and crime fighting and losses) – and you come out on top with private 5G.

“By reducing the number of access points and associated cabling, installation and energy costs – and minimizing downtime – the business achieved significant operational gains,” says Pearce of the manufacturing company, up $1.5 million. Plus, there is comfort for enterprise investors to “future-proof” their businesses. “Private 5G is often seen as a foundation for Industry 4.0 – enabling data-driven automation, advanced analytics and smart sensing to boost productivity,” he says. And the above-listed teething pains are easing too, it seems.

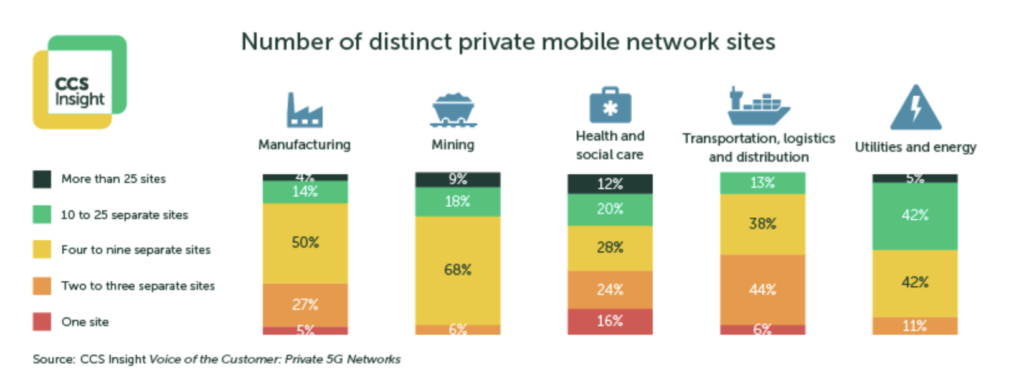

One one hand, Pearce writes: “The lack of fully integrated, off-the-shelf 5G solutions continues to hinder scalability and limits the technology’s potential across industries.” On the other hand, he says: “Among early adopters, multisite deployments are becoming the norm.” Indeed, nearly half of respondents are operating private 4G/5G networks at between four and nine different sites (see below) – “with plans to expand further once operational value and return on investment are demonstrated”.

Which says, in half of cases, confidence is high-enough to scale private 5G in multiple commercial operations, already.

* So yeah, private 5G doesn’t suck; it is actually pretty good.