January greetings from Minnesota, Missouri, Kentucky, Ohio and Iowa — back on the road drumming up business for CellSite Solutions even with Arctic Chill weather. But never too busy to stop for lunch with Jeff Moore (pictured), founder of Wave7 Research and a former colleague from the Sprint days. If you want field-based competitive intelligence that is accurate and informative, Wave7 is as good as it gets.

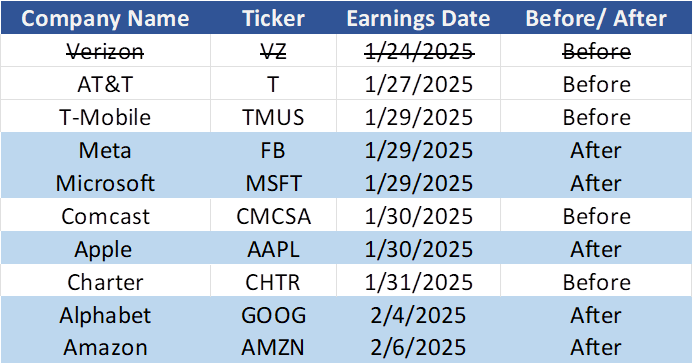

We have had one earnings report in the 4Q cycle (Verizon) with the majority of the the companies we track reporting next week. There isn’t a lot to extrapolate from Verizon’s report, but we will evaluate two comments on the call that we found insghtful.

Our focus this week will be the continuation of what each of the remaining companies needs to prove: T-Mobile, Comcast, and Charter. Note: we have separated Charter from Comcast as we believe that proof points are different for these two broadband titans. An updated and now complete earnings schedule is nearby.

One last item: If you have not pre-ordered Dan Caruso’s book Bandwidth: The Untold Story of Ambition, Deception, and Innovation That Shaped the Internet Age and Dot-Com Boom on Amazon (here) or your favorite bookstore, please consider doing so (release date is Feb 4). Dan also has a terrific podcast called “The Bear Roars” which is available through the hyperlink or through your favorite podcasting service. This week’s guest was none other than Gillis Cashman of M|C Ventures (link to YouTube playback here). Dan, Gillis, John Seigel (Columbia Ventures), Jim, and many other Sprinters all worked together on a Zayo/ Sprint fiber-to-the-tower deal in the early days of Zayo.

The fortnight that was

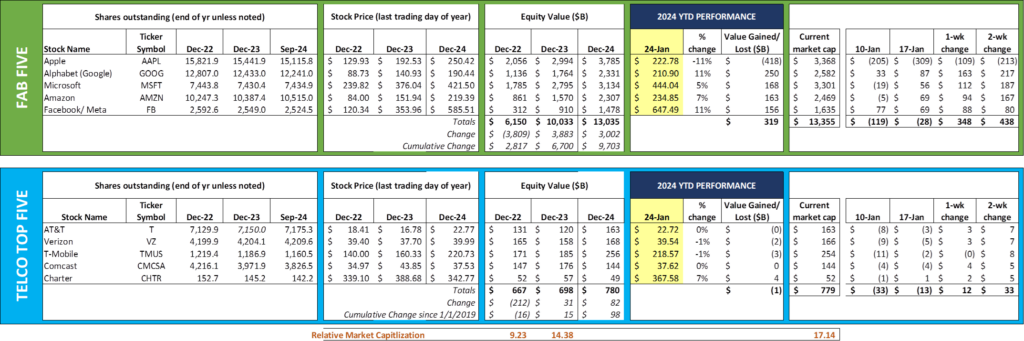

Note: End of year share counts will be updated by the February 21st Brief.

What a difference a fortnight makes. After a very slow start to the year, the Fab Five have gained $438 billion in value to start 2025. Without Apple, that figure would be ~$650 billion. Whether this is driven by earnings expectations, interest rates, the US dollar index, AI-related capital investment, AI-related valuations, or something else remains to be seen. What is readily apparent is that, apart from Apple, the rest of the Fab Five is off to a strong start.

The Stargate project was announced this week – a $500 billion AI-focused investment that will be financed through Softbank and others, and operated by OpenAI, who is partially owned by Microsoft (announcement here and picture nearby). Oracle and NVIDIA are also contributing financial and in-kind resources to the project. What this announcement covers (outside of data center builds and fiber connectivity) is unclear, but it’s going to be big.

Our immediate response when this was announced was “Who is missing from this announcement, and how do they join the party?” Or “Is this the only party?” Elon Musk (Grok AI) was not a part of the announcement. No wireless carriers or telecom providers (outside of Microsoft and a Japanese-based telecom provider) were a part of the announcement. No utility provider or energy company was a part of the announcement. How the US government will use the infrastructure to thwart cybercrime and protect the country from digital enemies, foreign or domestic, is unclear. All will be critical to Stargate’s success.

We view this as Chapter One in a very big book of public-private partnerships and will be tracking closely. A really good synopsis of analyst and expert conjecture on the deal from IEEE can be found here.

One of the executive orders in President Trump’s first week that set off a temporary panic in the broadband community centered around pausing funding for Broadband, Equity, Access, and Deployment (BEAD) projects. The Acting Director of the Office of Management and Budget, Matt Veath, released a clarification last Wednesday which states:

“The directive in section 7 of the Executive Order entitled Unleashing American Energy requires agencies to immediately pause disbursement of funds appropriated under the Inflation Reduction Act of 2022 (Public Law 117-169) or the Infrastructure Investment and Jobs Act (Public Law 117-58). This pause only applies to funds supporting programs, projects, or activities that may be implicated by the policy established in Section 2 of the order. This interpretation is consistent with section 7’s heading (“Terminating the Green New Deal”) and its reference to the “law and the policy outlined in section 2 of th[e] order.”

For the purposes of implementing section 7 of the Order, funds supporting the “Green New Deal” refer to any appropriations for objectives that contravene the policies established in section 2. Agency heads may disburse funds as they deem necessary after consulting with the Office of Management and Budget.”

How the Commerce Department will address/ enforce other elements of BEAD funding that they don’t agree with remains to be seen. The Senate should get a good idea of Commerce Secretary nominee Howard Lutnick’s perspectives on the topic when they hold his confirmation hearing next Wednesday. We think the $42.45 billion disbursement for rural broadband is going to continue unabated, it’s likely that fewer rules/ reporting/ enforcement actions will occur, and that technology alternative analysis (e.g., satellite or fixed wireless vs. fiber) will be designated to the states.

Verizon’s earnings: still flat

Verizon led off the 4Q earnings cycle with a rare Friday release/ conference call (materials here). Operating income was flat ($28.718 billion in 2023 excluding a $5.8 billion Verizon Business impairment charge vs. $28.686 billion for 2024). Debt is down over $6 billion ($150.7 billion to end 2023 vs. $144.0 billion ending 2024). Employees are also down 5,800 over the last year. But consumers upgraded slightly faster than they did during the last upgrade cycle, and that percentage is forecasted to increase in 2025. In short, there are puts and takes with Big Red’s results which netted to flat operating income.

The optimists take this as a sign that management can navigate through consumer and business headwinds. Fixed wireless grew their base by 45% in 2024, compared to a 2% growth of FiOS. Business adoption of fixed wireless as a primary access source is growing (54% unit growth in 2024), yet FiOS Internet for Business grew connections by a measly 4.2% (and that figure includes the last of the DSL customers to convert to fiber).

We think otherwise and believe that AT&T’s results on Monday will prove that both fiber and wireless can grow units at double digits. Verizon isn’t executing poorly, but, in the words of their former COO, Denny Strigl, “There’s always a higher gear” and we think the current team should be more oriented to higher unit growth, even if it means flat (short-term) EBITDA growth.

We also aren’t sure Verizon and AT&T are on the same page with a 50% residential fiber penetration goal (Verizon seems to be stuck in the high-30s to low-40s percentage goal), even though they are currently taking ~50% of net additions in their fixed wireless business (two different areas and metrics, but the enthusiasm gap between reactivating churned Fios and activating new FWA appears to be growing). And, despite more positive comments on Friday’s conference call, it does not appear that converting their existing copper to fiber appears to be a top priority.

Service revenue growth for the year was $1.92 billion against a backdrop of 956K postpaid phone connections, 958K total broadband connections, and 3.3-3.4 million cable MVNO connections (using a rolling four-quarter trend). Service revenue, which includes amortized subsidies, seems light given the growth of the business. Is that due to high promotion amortization costs, or increased legacy product churn, or something else? We aren’t sure, but it seems like their two larger peers are further ahead.

We end our Verizon analysis with two quotes from Friday’s conference call. The first comes from Sowmyanarayan Sampath, head of Verizon’s Consumer Group, concerning how Verizon should grow service revenues (emphasis added):

“We’ve always said we wanted to get to an 80-20 medium-term contribution from price and volume. It’s important for a long-term sustainable business and a subscription category to be in that framework. And we are on our way to do that. 2024 was a good start for us because we saw positive volume contributions across all our businesses: Mobility, FW and value, which has historically been negative for a few years for us. You’re going to continue to see volume growth in postpaid and the value and sustained momentum in broadband. So that takes care of the value — volume part of the equation.

Second is on price, which is an important component. There are 2 types of pricing levers that we have. The first is price-ups for more value that we provide to customers. We had 4 major price-ups in 2024, we’ve had 2 in 2025, because we are delivering more value to our customers and they feel very comfortable with the price structure that we have. We cannot, of course, comment on future price-ups. But we will look where we see lower churn, where input prices are a little higher, and more importantly, the value that we deliver to customers.

For 2025, the price actions that we’ve already done are in the hopper, more than $1 billion-plus of our service revenue growth is already baked in just with those price-ups. And you’re going to see, of course, pressure and help from the volume side.”

There are many insights to glean from Sampath’s response. First, price-ups have and will continue to be a critical part of achieving Verizon’s service revenue growth goals. Second, the value (prepaid) segment was a drag on service revenues in 2023 and 2024 (the first time we think the company has explicitly stated this). Finally, if Verizon grew their Consumer Group service revenues at 2%, that would translate into roughly $400 million in total growth. Assuming the $1 billion figure above is from consumer alone (re: cable MVNO growth is also included in the consumer metric), then Sampath is either 1) quickly headed towards the high-end of the service growth range (2.8% would be about a $2.2 billion total growth figure on the 2024 Consumer Group base of $76.88 billion) or 2) Verizon is planning even more aggressive promotions (which would mute the year-over-year service revenue figure).

The second quote is also from Sampath in response to the growth of accounts versus revenue per account:

“…We saw account growth in Q4. You see that. But I think at the end of the day, what we are focused on is building deep relationships with our customers. If you look at the way our offering framework works, is we start with connectivity. We want to offer the best connectivity products, both home and on-the-go and mobility and of course on the value side.

And then on that foundation of that relationship, we start selling more to those customers, whether it’s some of our entertainment products with perks, it gives you savings that others can’t give, our VMPr protection products, our cloud products. So we want to deepen our relationship with customers. And I think that’s the way we see long-term growth in our business.

You saw very strong ARPA growth in north of 4%, and underlying growth is of course much higher than that when you take care of promo amortization. So account growth is important to us, but what is important to us is profitable customers who value quality of the network and our offering framework. We want to grow in those.”

Clearly a difference in acquisition strategy versus T-Mobile (who reports next week and will likely show good account growth). Like the price versus volume equation, the answer to account vs. ARPA growth is usually somewhere in the middle. What this signals is that the myPlan perks will likely grow (a lot) in 2025 as Verizon tries to retain as many accounts as possible (the current construct helped in the fourth quarter, but for the first full year did not keep the company from losing accounts).

We have limited space to comment on Verizon’s AI announcement and will address in a separate Brief along with Stargate, Microsoft, Amazon, and other Telco Top Five spending.

Q1 Earnings Preview – What Each Company Must Prove (Part 2)

In the last Brief, we focused on what AT&T and Verizon need to prove to drive momentum. For Verizon, it was the ability to grow the Value (Tracfone) segment. For that item, we would give them a C+/B- grade. Churn decreased versus 4Q 2023, but so did ARPU.

For AT&T, we would like them to prove that they have markets above 40% penetration. A simple stratification (without naming markets) of average years in market versus penetration would go a long way to convince investors that 50% is achievable. We anticipate positive news on that front when they release results on Monday.

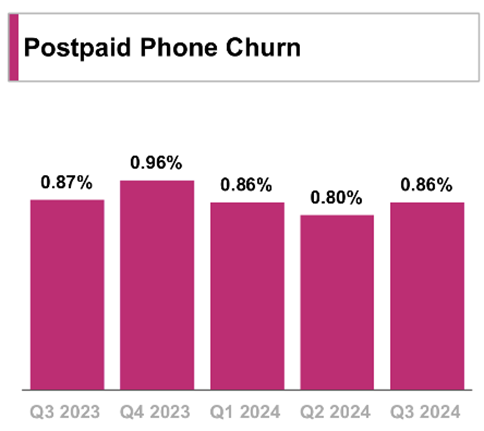

For T-Mobile, the key metric is postpaid phone churn (see nearby trend from their Q3 Investor Factbook). As we mentioned with Verizon, the price increases can create subsequent churn increases – this is apparent with T-Mobile’s 3Q result. A fourth quarter figure that is unchanged or lower than 3Q will go a long way to proving that they can not only deliver a fast, reliable 5G network (see the latest Ookla report – they are clearly doing it), but that they can translate their superior performance into a larger loyal base.

The second proof point is around retail prepaid, a long-time strength of Magenta. How did the acquisition of Mint Mobile help the overall business? How is Metro carving out a sustainable position versus Total Wireless, Straight Talk, and other Verizon brands? Will the immigration crackdown impact T-Mobile disproportionately? We aren’t sure of the answers to any of these questions but think that T-Mobile will likely slightly surprise to the upside on the back of a blockbuster Q3 print.

That leaves the two cable giants (and now-rumored merger partners) Comcast and Charter. If Verizon has an 80-20 view with respect to consumer wireless (price vs quantity), Comcast and Charter probably have a 90-10 (or higher) view with respect to broadband. Here are our proof points:

- For both: The ability to grow overall broadband revenues against the backdrop of unit/ churn pressure.

- For Charter: The ability to retain customers (customer relationship decline across the first three quarters of 2024 exceeded 800K excluding the gains made from their rural initiatives). While some of these were due to the ending of the Affordable Connectivity Plan (ACP), the company needs to grow their base if they are going to grow service revenues. We are also looking for commentary video losses and firmly believe that their strategy to integrate streaming services with linear is differentiating. We hope to be surprised by a meaningful difference between their video losses and Comcast.

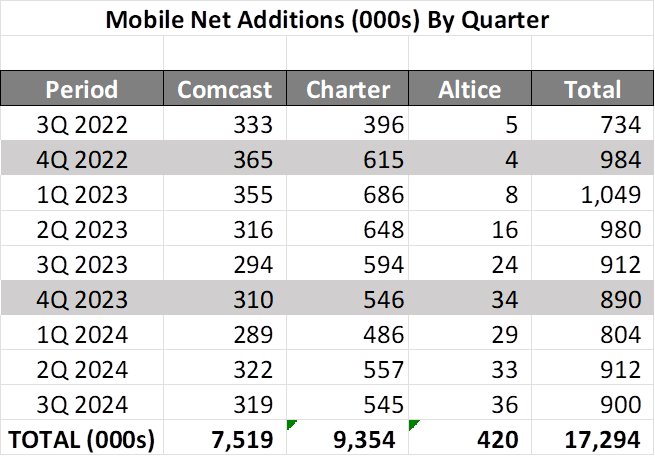

- For Comcast: After Thursday’s earnings report, if the headline read “Comcast is now serious about mobile” we would be very pleased. Nearby is a trailing nine-quarter view of mobile net additions for Comcast, Charter and Altice. As you can see from the fourth quarter highlights, Comcast started to fall behind Charter two years ago. This Holiday season they were more involved with device subsidies and trade-ins (see Jeff Moore’s Wave7 research for the underlying data). If Spectrum and Comcast stayed even, we would be pleased but fully expect that Comcast will fall short of their larger MVNO cousin on net additions for the ninth consecutive quarter.

That’s it for this week. We will have plenty to discuss in our next full Brief (February 9). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Finally – go Davidson College Basketball and Kansas City Chiefs!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.