Commerce Secretary Lutnik signaled in an interview with Broadband Breakfast on March 5th, 2025 that the U.S. government will rethink the BEAD program so that Americans “get the benefit of the bargain.” He elaborated that it could mean that homes get broadband through satellite instead of fiber. “We want the lowest cost broadband access to Americans,” he said.

Secretary Lutnik gets it. Connecting a location to broadband for $10k-$30k makes more sense than spending $60k to do the same thing. By approaching the issue from a technology-neutral perspective, we can connect a lot more people overall while improving connectivity and satisfaction with the connection.

From February 28th, 2024, to February 28th, 2025, Recon Analytics surveyed 160,848 people in the United States and asked them about the broadband experience with their current provider.

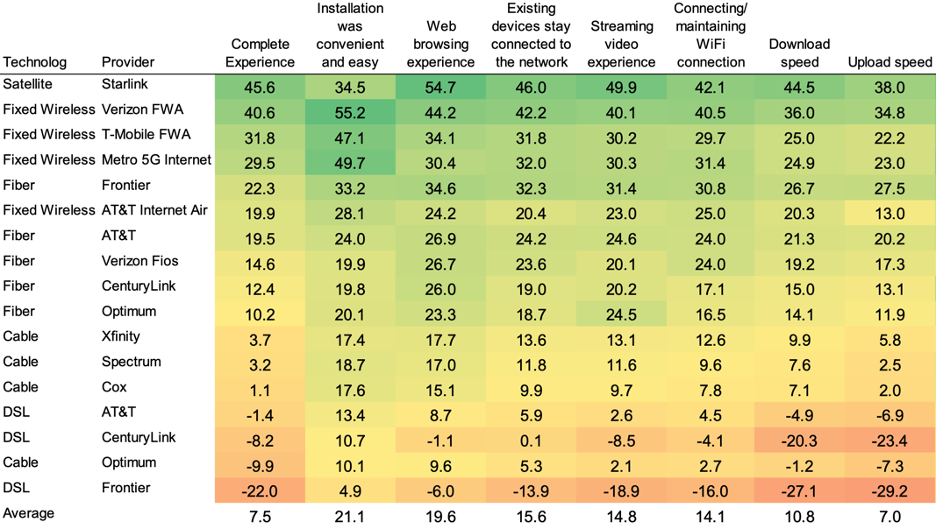

To determine satisfaction with their service, we asked consumers a standard net promoter question as developed by Bain, but modified to ask about specific components of the customer experience. Below you see a heatmap of Recon Analytics’ component NPS scores for connectivity. I omitted the customer interaction part of the heatmap for readability.

The 1,113 Starlink subscribers we interviewed over the last year were the most satisfied, followed by consumers of fixed wireless (FWA) with cable, and DSL customers being the least happy. Why are Starlink customers and FWA customers happier than cable and DLS?

While Starlink and FWA can be slower than speeds over cable, most consumers are not engineers or economists who make decisions based solely on technical merit or price. In the case of both Starlink and FWA, our data confirms that customers value the fact that the technology solution is easy to install and easy to get rid of if the consumer is not happy. In Starlink’s case, we have about three times as many former Starlink customers as current Starlink customers. This indicates that there are quite a few people who were unhappy with the solution and swapped out for a different one.

At the same time, the people for whom Starlink or FWA works are very happy with it, especially in comparison to what they had before. Interestingly, we consistently find in our polling data that the higher the cost for a service, the lower consumer satisfaction is, all other things held equal. The low satisfaction scores for cable, even though cable internet service is substantially cheaper than fiber, is a clear indication that cable needs to do a much better job in serving its customers. As confirmed in the quarterly reported financial data, customers leave services with low satisfaction and join services with high satisfaction. In the home internet case, customers are choosing a more expensive service because, in their experience, the cheaper service is not worth it.

We are also seeing in the data that the Starlink and FWA routers are state-of-the-art equipment. Investment in good routers leads to better scores for how well existing devices stay connected to the Wi-Fi network and how easy it is to connect to Wi-Fi. It also aids in every other connectivity and customer issues metric. This is demonstrated again in the table below.

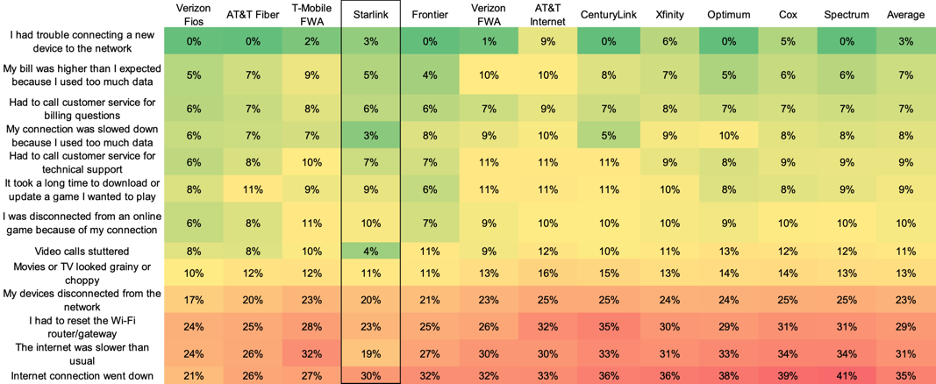

We are also asking all of our home internet respondents how often they have subjectively experienced internet issues in the last 90 days. The data below is again from the 160,848 people we surveyed over the last year.

What is striking is how well Fiber, FWA and Starlink are performing when it comes to reliability. When looking at reliability from a customer perspective, it is the interplay between the connection, which is determined by network technology; the router used or supplied; and the end user equipment. The end user equipment is the same for every customer — a mix of smartphones, laptops, desktops and other connected devices. While Verizon FiOS and AT&T Fiber customers report fewer instances of their internet connection going down, the FWA and Starlink routers are able to mitigate a lot of the more difficult connection technology challenges.

When comparing the data presented in this research note with what was presented six months ago, the Starlink scores for connectivity increased as the company launched more satellites during that period. As Starlink continues to launch more satellites, its scores will change depending on what increases faster — the number of satellites or the number of customers.

Furthermore, it is interesting to see where Starlink customers came from. Eighty-five percent of Starlink respondents are from rural areas, consistent with Starlink’s reporting of where it sells. Almost 31% came from small ISPs. For more than 11% of respondents, Starlink is the first home internet provider that they have, followed by CenturyLink, Charter, Frontier and Comcast, who provide a lot of internet coverage in rural areas.

Recon Analytics data shows that a technology-neutral approach is the right way to go for allocating federal dollars to get broadband out to as many Americans as will take it. There are many Americans, especially in very rural areas, who are very happy with Starlink’s service. Fixed wireless is also solving the broadband rubric for many customers in a satisfactory way. Satellite and fixed wireless are especially valuable in less densely populated areas, where ample spectrum and thereby speed and capacity is shared among fewer people resulting in higher speeds. Fiber, without a doubt, is the workhorse technology for more densely populated areas, where satellite and FWA do not have sufficient capacity given the current licensed full-power spectrum constraints to serve customers well.

What we need, and what Secretary Lutnik rightfully alluded to, is a technology-neutral approach where Americans can choose their service based on their needs for speed, price and individual circumstance.