March greetings from Iowa and Missouri. This week’s picture is a throwback to what we were all doing five years ago. Humans and dogs looked for any opportunity to get out, and both received plenty of steps in 2020 and 2021. Fortunately, there were no social distancing limitations between pets.

This week, after a full market commentary, we take a look at each wireless carrier’s competitive vulnerabilities. There appears to be more to the story beyond recent comments of “one-time” Holiday promotion holdovers.

One final note – you’ll be able to hear a bit of The Sunday Brief in April on Roger Entner’s weekly podcast (likely right around the Easter holiday). For those of you not familiar with The Week With Roger podcast (Spotify link here; Apple link here), it’s a short-yet-sweet synopsis of key events in the telecom industry with occasional guests. It’s on our listening list and we hope you’ll consider adding it to yours.

The fortnight that was

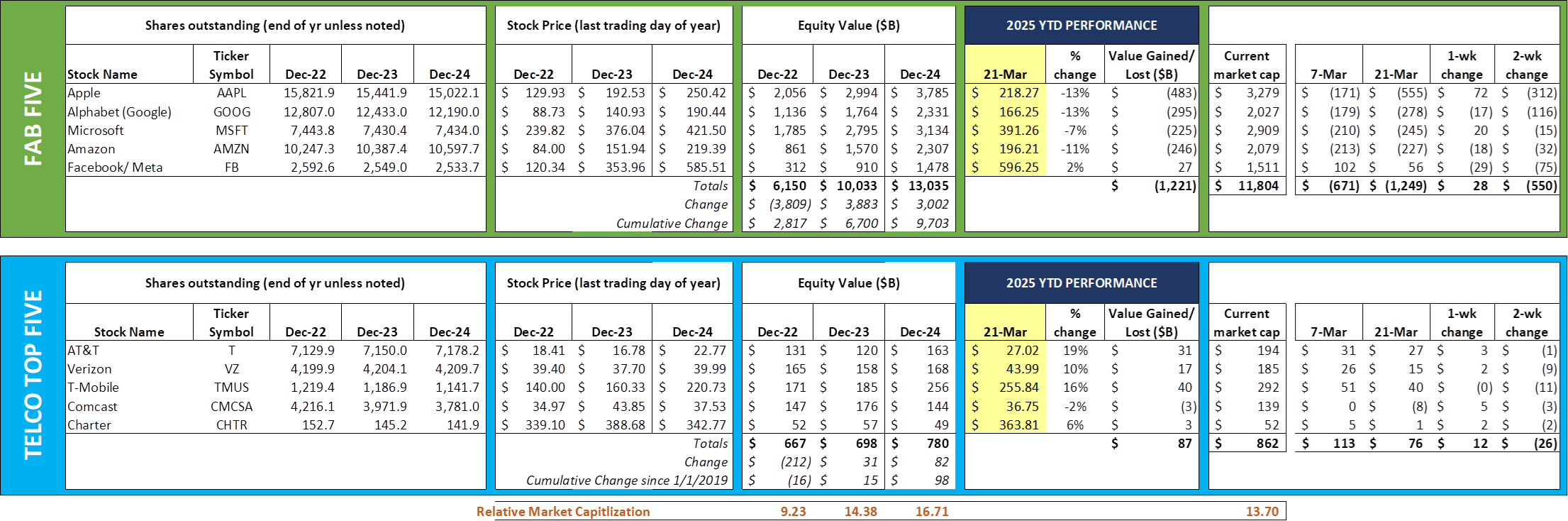

Both the Fab Five and the Telco Top Five finished in positive territory for the week. Two of the Fab Five (Apple and Microsoft) gained, while the remainder were largely flat. The Telco Top Five had four of five members gain this week with T-Mobile (already up $40 billion or 16% year-to-date) unchanged. So far in 2025, there has been a $1.3 trillion shift in relative market capitalization between the Fab Five and the Telco Top Five. Likely this will reverse as we go through the year, but currently the gap favors telecom over technology mega caps.

In the last Brief we discussed the issues Apple is having with their AI development. On Friday, Bloomberg’s Mark Gurman reported that Siri development leadership was going to shift from John Giannandrea to Mike Rockwell. More importantly, Mike will report to Craig Federighi, SVP of software engineering for Apple. Having Mike report to Craig should help with Siri’s integration into all Apple software.

It’s a big move, and Apple is behind. The article linked above also mentions several other executives who have been transferred from other Apple divisions to help with product management and software development. Their annual development conference (WWDC) is less than 60 days away and Apple is losing mindshare to Open AI, Anthropic, Grok and others. It’s time for Apple to get back on track.

Thought M&A was dead? Google announced their largest acquisition in their history this week with a $32 billion all-cash offer for Wiz (here). Per Google’s blog post (here), here’s what Wiz does (management team pictured):

“Wiz is different from the services we offer today – it delivers a seamless cloud security platform that connects to all major clouds and code environments to help prevent incidents from happening in the first place. Wiz’s solution rapidly scans the customer’s environment, constructing a comprehensive graph of code, cloud resources, services, and applications – along with the connections between them. It identifies potential attack paths, prioritizes the most critical risks based on their impact, and empowers enterprise developers to secure applications before deployment. It also helps security teams collaborate with developers to remediate risks in code or detect and block ongoing attacks.”

Last year (May 2024), Wiz raised $1 billion at a $12 billion valuation. This funding round was co-led by Andreessen Horowitz, Lightspeed Venture Partners, and Thrive Capital. The company was working towards an IPO but decided on Google instead (smart move). The leadership team at Wiz previously led Microsoft Azure’s Cloud Security Group.

High margin, customer-focused, multi-cloud, terrific team. Given that Google has very few of these cross-platform, multi-cloud cybersecurity capabilities today, it’s likely that the purchase gets approved quickly (As we mentioned in the Interim Brief last week, incoming FTC Chair Andrew Ferguson’s interview with CNBC earlier this month lays out his blueprint for approval of any merger. This one seems like it should get a speedy look and likely get approved). Restarting M&A activity after multiple years of stagnation is taking longer than may expected, but the ball is now rolling.

Speaking of sales, T-Mobile announced that they have found a buyer for their (legacy Nextel) 800 MHz spectrum. Per this announcement, Grain Capital will pay an undisclosed sum and will work closely with Kansas City-headquartered engineering firm Black & Veatch to “market the 800 MHz spectrum portfolio to utilities, other critical infrastructure industry operators, rural and regional operators, and other enterprises, meeting crucial unfulfilled telecommunications needs.” This spectrum has already been completely re-banded (re: Sprint’s significant expenses nearly 20 years ago totaled north of $3 billion – more here), and our understanding is that it could be immediately used for a private application. Could a network management and operations agreement with Southern Linc follow? We can only hope.

Per the announcement, T-Mobile also receives additional B and E block 600 MHz spectrum that can be put to immediate use. More details on where Grain’s NewLevel, LLC, holding has 600 MHz spectrum can be found on the Spectrum Omega website here. A detailed analysis of this transaction and recent spectrum swaps from LYA can be found here.

On a final note, in the wake of Zayo’s acquisition of Crown Castle’s fiber assets (great analysis here), it was announced that Sunit Patel was transitioning from his Board position to become the CFO of Crown Castle. Sunit is a long-time friend of the Brief, and we wish him the best in his new position. It also will return him to the hometown of his alma mater, Rice University (go Owls!).

Q1 wireless competitive dynamics

There has been a lot of discussion concerning Verizon’s announcement at a recent (March 11) investor conference that the quarter would not meet postpaid expectations (see our LinkedIn post on the topic here). Verizon’s stock took a 10% hit from the news, and there was concern about a wide-scale price war in the industry.

So far no such war has ensued, and, as we prognosticated in the above link, the extension of Holiday marketing promotions had more to do with oversupply of the iPhone 16 than anything else. However, we are not entirely sure that the event is a one-timer.

Here are some additional comments made by Verizon’s Consumer Group Chief Revenue Officer, Frank Boulben, at the Deutsche Bank conference (transcript here):

- Verizon is beginning to experience their first three-year device anniversaries. Needless to say, this generates an incrementally larger pool of potential switchers than existed in 2023 or 2024 (Frank referred to this as a “significant” increase).

- Most customers coming out of their device payments are not upgrading instantly but choosing instead to keep their devices for an additional 5-10 months past the last device payment. This represents a vulnerable window for the company (and an opportunity for AT&T and T-Mobile to present attractive offers to Verizon’s base).

- Verizon expects postpaid net additions of around 8.5 million across the industry in 2025, down slightly from 9 million in 2024. About 6.8 million of these will be in consumer, and slightly less than 4 million of these will be due to prepaid-to-postpaid migrations (which could, in Verizon’s case, come from Total Wireless or another Tracfone brand).

- Port ratios for cable MVNOs flattened in the fourth quarter (for Verizon).

- Immigration impacts prepaid net additions far more than postpaid because of identification and credit check requirements.

- (lack of) Battery life is the primary factor driving Verizon’s device upgrades.

- More than half of the Verizon consumer postpaid retail base is already on the myPlan platform. Selling more perks to these customers (Verizon is targeting a doubling of the perks sold in 2025) is critical to revenue growth per account (and profitability).

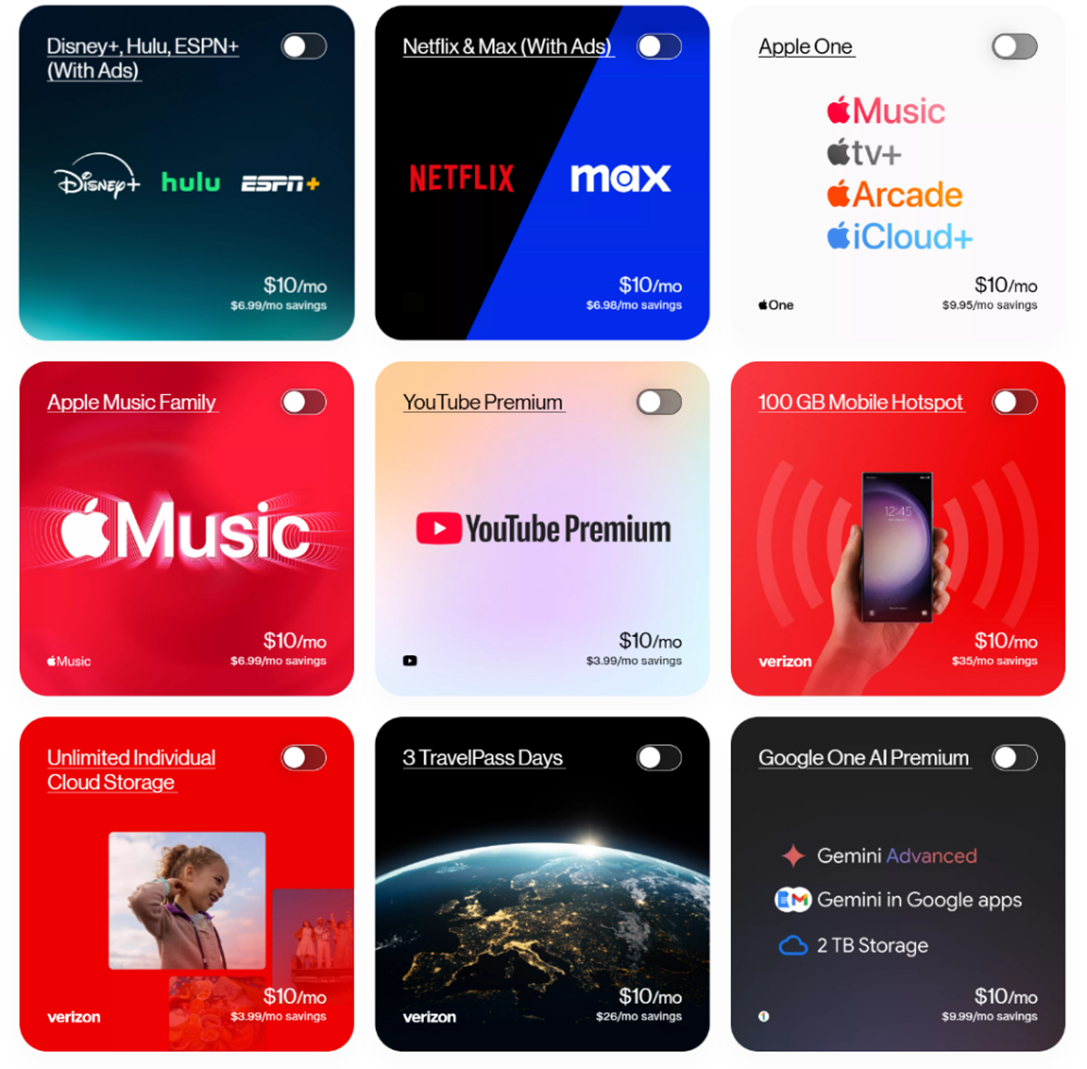

Without a breakthrough device, Verizon is highly dependent on advancements in their myPlan perks. Here is the current lineup (note – premium plans already include the travel pass option shown below):

These are very compelling digital life perks with some more applicable to the Android or Apple platforms than others. But is this enough for a doubling of perks growth?

For example, with Walmart+ membership no longer an option, is it time for an (ad-free) Amazon Prime offering? How about something with Spofity for those who do not want to switch to YouTube Music? Why not an “ultimate” package bundling YouTube TV and YouTube Premium for families? Or a perk that puts the power of the Xbox in customer hands (more on the current options available here)?

Verizon has set stringent limitations ($10 adders only, tight exclusivity parameters, etc.) on the myPerks program which was probably great for a controlled launch, but it’s time for expansion to include video and other products that materially improve the digital life.

We see Verizon’s dependence on perks as a risk while T-Mobile is deemphasizing perks in their marketing message (vs network quality). AT&T has no content offers with their product, and has experienced great success bundling fiber and wireless.

Speaking of T-Mobile, they had more churn vulnerability in 2023 and 2024 because they stuck with 24-month device payment plans (vs. 36 months for their two largest competitors). Even with this competitive gap, T-Mobile managed to lower their churn (more on page five in the 4Q Fact Book available here). Unlike AT&T and Verizon, T-Mobile will not grow its year-over-year pool of switchers due to contract expiration.

Like Verizon, however, T-Mobile needs to rethink their plan structure. Here’s an example of the myriad of plan types T-Mobile offers on their website today:

- For ages 55 and older (5 separate plans)

- For First Responders (4 plans)

- For Military and Veterans (4 plans)

- Everyone else (5 plans)

Eighteen plans in all. While there is a common construct around device upgrade eligibility, each of these plans is a little different. Free Wi-Fi on planes, AAA insurance, quality of streaming for everyday use, quality of the Netflix picture, number of months Apple TV+ is included – it seems like a lot for people to learn (and maintain). Some plan simplicity would make T-Mobile even more successful.

We anxiously await how T-Mobile will bundle their fiber and wireless offerings with Metronet and Lumos once JVs are completed in 2025. We anticipate something very innovative: speed upgrades for wireless+fiber customers, Xbox offerings/ inclusions, included wireless backup and free 4K streaming on device or TV for all products (including Netflix). As a reminder, T-Mobile will be the retailer for all of the Lumos service area (the Lumos brand goes away) and fiber will be in every store. This will allow many more customers to try and buy fiber (and, if fiber customers already, to upgrade to T-Mobile wireless).

If T-Mobile’s wireless offering (network quality, price, etc.) does not match the stellar fiber experience, bundling will be minimized. Per their recent comments, however, T-Mobile has been upgrading their wireless network in each Lumos and Metronet town and appears to be ready for disproportionate communications market share gains post approval.

T-Mobile’s greatest vulnerability (even though they are currently leading in the Ookla rankings for the overall and 5G categories) is network consistency. 5G speed awards have long been associated with T-Mobile, but their ability to consistently deliver combined (4G and 5G) speeds better than Verizon is relatively new. And Verizon and AT&T are continuing to densify their C-Band networks, particularly in secondary and tertiary markets. If T-Mobile loses their consistency leadership, churn will rise and results will suffer.

That leaves AT&T. They are truly playing another game than either Verizon or T-Mobile. 36-month device financing, no content perks, and heavy focus on cross-product bundling. On one hand, their “rinse and repeat” marketing formula once 70-80% of the market has been passed with fiber appears to be wildly successful. On the other hand, they still have many markets left to build. As a result, AT&T is more vulnerable in an area like Philadelphia or New York City or Boston than they are in Houston, Charlotte, Chicago, or Los Angeles. We really like AT&T’s value proposition where they have fiber, and scratch our heads on their continued success in out-of-fiber markets.

Bottom line: Q1 was a blip because the anticipated iPhone 16 super-cycle did not come. Based on comments made in the media this week, Apple may not be able to completely fix Siri/ Apple Intelligance issues in 2025. But consumer and small businesses need an overhaul, and product simplification and easily demonstrable value need to be critical objectives. We think all the Big 3 have vulnerabilities, and that Spectrum and Comcast need to double or triple marketing to improve their net additions.

That’s it for this week. In the next Brief (April 6th), we will compare the latest network quality metrics and analyze additional trends impacting Q1 earnings. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Finally – Go Royals, Sporting KC, and Davidson Basketball!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.