5G has a money problem – partly just because 5G does not properly exist yet; here we look at progress with NSA-to-SA rollouts, as the industry gets to grips with 5G monetization. (Note, this is an excerpt from a new 5G Market Pulse report, available to download for free here; the intro section has also been published online here.)

In sum – what you need to know:

Limited NSA monetization – around 350 5G NSA networks have been deployed, offering better performance, but not much in the way of new revenue – and less in some markets.

Slow transition to 5G SA – most operators are still deploying NSA to save on costs, with full SA only expected to dominate in 2028/29; few regions have started with 5G-Advanced.

Gambles in the 5G casino – operators are behind on 5G’s monetization potential, and are forced to make scattered gambles on niche features and apps to make it pay.

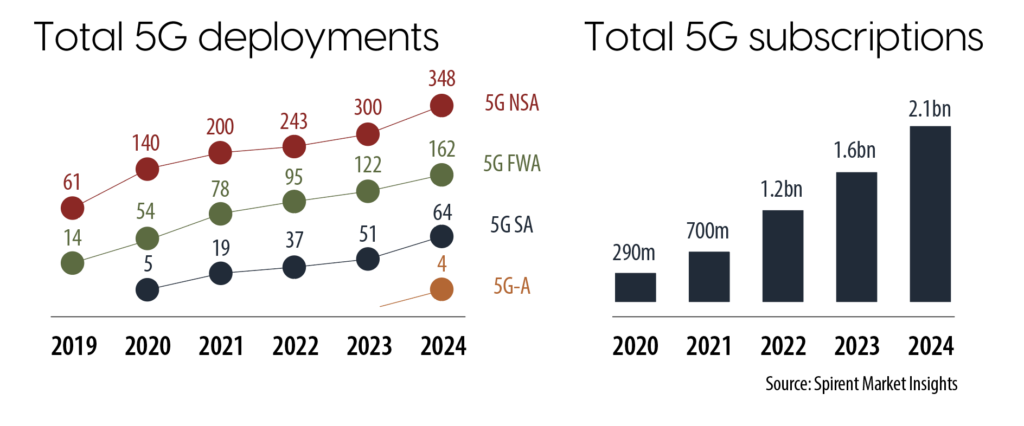

There were 348 deployments of cellular 5G NSA technology in public mobile networks at the end of last year (2024; see below) – out of 650 operator networks, globally. “It is well past the halfway point, and 5G NSA has been very successful,” says Stephen Douglas, head of market strategy at test and measurement company Spirent. Indeed, for about 12 months, the telecoms industry has been blowing the whistle to call half time on the 5G game, and to reflect on progress. (Ericsson used the analogy at MWC 2024 early last year, in defence of its early showing in the private 5G game.) Conveniently for this paper, Spirent is live on air with its own half-time report to discuss all the latest action, as the market lurches between ‘non-standalone’ (NSA) and ‘standalone’ (SA) 5G, and shapes to shoot at 5G-Advanced – probably, deep into injury time.

Because the next game for Telco Utd is a 6G one, of course, and new rules of engagement are being set. As such, there is some urgency; the team talk at the interval reflects decent build-up play, but a lack of goalmouth action. But let’s park the football (soccer) analogy for now; the telecoms market is in a dynamic phase of evolution, marked by this shift between NSA and SA systems, specified in releases 15 and 15/16 of the 3GPP roadmap, respectively. To be clear, the former has enabled operators to piggyback their new radio access (RAN; NR) hardware on 4G (LTE) functions in core networks. In other words, 5G NSA is a mongrel tech; it is not proper 5G, as offered by 5G SA. But it has allowed operators to quickly deploy expensive 5G RAN hardware without investing in 5G core networks, and without migrating customers en masse from 4G spectrum.

In one sense, these NSA tactics have been good; but such a review also depends upon your start-position. Stefan Pongratz, vice president at Dell’Oro Group, says: “5G is mostly on track – although its success varies according to whether we assess its impact on known or unknown challenges. When it comes to established use cases, 5G has made significant progress. A key distinction between 3G/4G and 5G is that, where 3G/4G focused on the user experience, 5G mostly benefits the operators. The difference in user experience between 4G and 5G is minor, but for operators, 5G reduces delivery costs and expands network capacity. In this regard, it has been a major success.” The players are in decent nick, then, as they suck on their half-time oranges, but the crowd is not hugely entertained.

For “significant progress” with “established use cases” read more efficient delivery of familiar services on proto-5G (NSA) networks, compared with old-school 3G/4G ones: fatter and faster 5G radio ‘pipes’, clever 4G/5G core network sharing, smarter spectrum management, plus the ability to limber-up with new service-based cloud architectures in preparation for 5G SA – as well as release 18-level 5G-Advanced, starting now, and post 20-level 6G sometime after 2030. Spirent estimates there are 2.1 billion monthly 5G subscribers globally (at the end of 2024; see above), mostly on NSA networks. The total is growing at a rate of about 500 million per year, running a little higher in 2024. Which represents faster subscriber growth than with 4G, previously. “It has probably gotten to that number two years faster.”

Douglas goes on: “So even if it is not bringing in huge amounts of money, a lot of people are using it.” We will return again to this issue of 5G money-making throughout this piece – which is the difference, essentially, between network efficiency (impacting expenses) and subscriber activity (impacting income). But we should consider the live rollouts of 5G SA and 5G-Advanced infrastructure besides, and whether the steady rush on NSA has put these others on the skids, to some degree. “The next wave of 5G SA is way behind,” says Douglas – and everybody.

Spirent calculates there are 64 commercial launches of public 5G SA networks (see previous page). It is “slow progress”, agrees Nelson Englert-Yang, industry analyst at ABI Research; it is “slower than anticipated,” says Dave Bolan, research director at Dell’Oro Group.

As a note on figures: RCR Wireless is leading with the Spirent numbers in this report, tracked through its in-market engagements and investigations, and augmented as required (for subscriber numbers and revenues; see below) with data from carriers’ financial reports. This is because they mostly reflect the findings from top analysts anyway (Dell’Oro Group reckons on 63 NSA launches so far, for example), and because they are new (spring 2025), and provide ‘real-time’ context. Not all of those SA deployments are national ones, warns Douglas. “Only a few offer full national footprints – or match where 5G NSA has been deployed. Most offer only small pockets of coverage. 5G SA has a long way to go.”

There is little value to count-up 5G-Advanced rollouts, built on 5G SA – except to know the process has begun. There are just four commercial 5G-Advanced networks to date, says Spirent; three in China and one in the Middle East – “again, very small pockets of advanced coverage”. Englert-Yang at ABI Research suggests a 2028/29 timeframe for the global SA footprint to outrun its NSA forebear. “Many operators are opting to deploy a converged 4G/5G core while maintaining an NSA architecture, allowing them to introduce certain 5G core functions without fully migrating to 5G SA at scale,” he reflects.

Bolan at Dell’Oro Group (whose NSA total is actually down at only 270 deployments), says the same: “NSA has been the favourite way for most operators to deploy 5G… It is a lower-cost and more straightforward way to introduce 5G, primarily for higher throughput to meet traffic growth.”

But for a smattering of progressives (Dish, Rakuten, Reliance Jio), most operators have elected for a phased NSA-to-SA rollout of new 5G infrastructure. But most of the theoretical monetization opportunities with 5G come from its SA features, as defined in 3GPP releases 15, and particularly 16 and 17 – multiplying further in releases 18 and 19 with 5G-Advanced. As such, it is perhaps strange that operators have not made the leap sooner. Certainly, their money-making record with NSA is patchy.

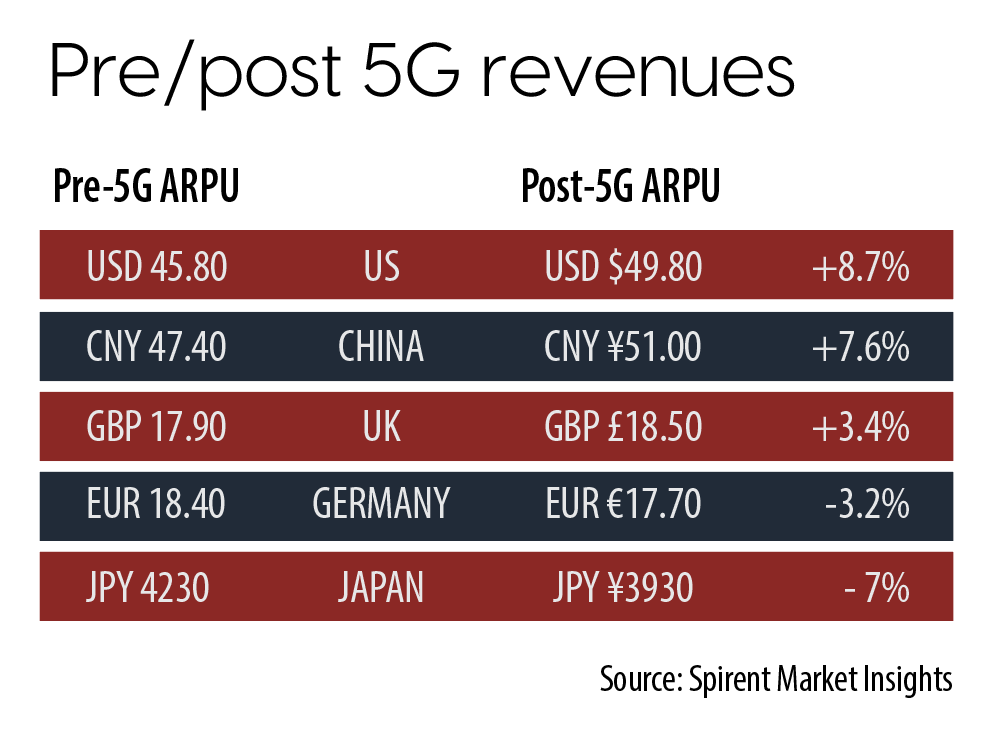

A slide in Spirent’s half-time report (see left) shows average revenues per user (ARPUs), aggregated across the global subscriber market, have gone from $45.8 to $48.8 per month in the US – so $3 for every monthly subscriber, on average, through the five-year transition from 4G to 5G.

This is the biggest global increase (8.7 percent higher) for any geography. Chinese and British carriers have seen uplifts, too: by CNY¥3.6 to CNY¥51 and by a whopping (!!!) 60 pence to £18.50 per month, respectively. Conversely, and curiously perhaps, German and Japanese carriers are taking less from their 5G subscribers; they are down by €0.70 and JPY300, respectively (to €17.70 and JPY ¥3930).

Douglas says: “You can sort of see some kind of movement in the market – both ways, actually.” But such marginal gains are impossible to attribute – “hand on heart” – to 5G in whatever form it takes; other “inflationary [impacts] and moving parts” are in play. He adds: “In the end, the message is there has not been a whole lot of movement. Nobody has unlocked huge additional revenue streams yet.” Which is the reason to go all-in on SA, surely?

The point is that spending will not suddenly spiral upwards; operators are not about to gamble the house on niche services on vague promises of incremental returns…

This article is continued and expanded in the new 5G Market Pulse report, available here.