FWA is paying the bills, but the 5G market is still chasing dreams. For all the frustration about 5G money-making, FWA has been a revelation for operators; here we consider the impact and implications of FWA for telecoms, plus network gains with NSA and likely service gains with SA. (Note, this is an excerpt from a new 5G Market Pulse report, available to download for free here; the original introduction and initial discussion have been published online here and here.)

Chart smashes – Fixed Wireless Access (FWA) is a surprise cash cow for 5G operators, with fast rollouts, strong ARPUs, and sticky customer engagement.

Heritage flops – otherwise, 5G services, mostly on NSA, are familiar 4G-plus exercises, affording little network or service differentiation and few monetization opportunities.

Sleeper hits – private 5G networks and new public 5G (SA) features promise speculative gains, but their revenue impacts are unproven and unevenly distributed – for now.

But it is not so clear, actually (see previous section) – neither in terms of NSA money-making until now, nor SA money-making in the future. On the first score, so-called fixed-wireless access (FWA) broadband, which uses 5G NSA/SA in place of fibre for wireless-hub backhaul in homes and businesses, has been a revelation. Spirent has a line graph showing global FWA launches on a steepening path, between its NSA and SA numbers (see page 5); it reads 162 launches at the end of 2024, meaning FWA is being offered on 46 percent of NSA networks, and 25 percent of all networks. “It is not a different version of 5G, but it is worth highlighting because of its success,” says Douglas. “Which will grow with later 5G releases.”

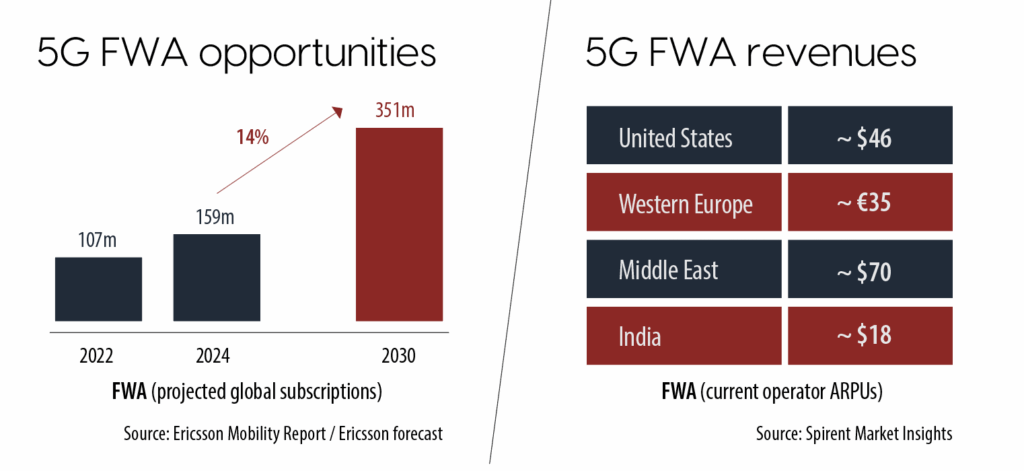

Ericsson expects the number of FWA connections to more than double from 159 million to 350 million in five years (see below). Speaking at a pre-MWC event in London in February, the Swedish vendor told a packed house that FWA broadband connections are growing at a three-times faster rate than fibre broadband connections. “We underestimate the business opportunity and the traffic profile significantly,” says Erik Ekudden, chief technology officer at the firm. “Eleven percent of all the world’s fixed broadband connections already use FWA technology today. In five years, that will grow to 18 percent. And there is a reason FWA is such a great service: it is priced in the right way, and it is flexible – and you order it and get it immediately. More importantly, [carriers] get a higher net promoter score.”

That, and the fact that FWA, more than any other novel 5G service, brings home the bacon.

Douglas rejoins: “A lot of operators are not only meeting their FWA subscriber targets, but also extending their FWA bases in a substantial way.” He has another graphic (above), which shows top-line ARPUs on straight FWA subscriptions: carriers in the US are charging about $46 per subscription, on average; operators in Western Europe and the Middle East are taking the equivalent of $35 (€32) and $70, respectively; providers in India are scraping $12 per month. But these numbers do not reveal its real value to carriers. Its secret sauce, so mysterious to 5G, is the chance to upsell and cross-sell additional services to homes and offices – “mobility plans, family plans, security services,” says Douglas. “The real ARPU from FWA is perhaps even two times higher than the straight service subscription. It is very lucrative.”

More than this, it is a good churn machine for mobile operators – “like, one carrier might convert you from a rival handset subscription to a family plan, and take deals for four or five devices on top – and then upsell another package for premium content”. There is a major drive on additional home security services, he says. “A lot of them are doing this exceptionally successfully at the moment.” On his firm’s workbenches, carriers are testing how to retain their new advantage – to stop the churn machine turning the other way. “A lot of the focus in testing is around customer retention – to try to make sure they don’t lose any FWA customers. Because they see FWA as a big opportunity to grow and expand customers in terms of the amount they spend. It is a massive focus.”

Belkhit at ABI Research calls FWA a “pillar of 5G monetization”, already. Indeed, leading US operators have updated their FWA targets, he says. “Growth is expected to continue.” SA upgrades will bring “more differentiated” services, he says. “There is increasing focus on the enterprise market for FWA [too],” he notes. His colleague, Matthias Foo, leading ABI Research’s research in the Asia Pacific (APAC) market, suggests “strong FWA growth” is also expected in India, where the likes of Reliance Jio and Bharti Airtel are “investing significantly” in the technology. “Initial reports show growing momentum for FWA adoption in the country,” he says. But FWA is an outlier, so far, in terms of 5G’s money-spinning credentials. “Beyond FWA, there’s not much to cheer about,” reflects Bolan at Dell’Oro Group.

Certainly, if you consider the industry’s own forecasts from five years ago about a surge in data traffic on 5G smartphones, the turnaround has not materialised. In 2019, Ericsson said in its bi-annual ‘mobility report’, which works as a yardstick and a tub-thumber for the market, that data traffic on consumer devices in North America would reach 45 GB per month with 5G by 2024, from an average of closer to 20 GB; five years later, its most recent instalment says data traffic has topped-out at about 22 GB. Douglas responds: “Yeah, but you’ve got to watch with those figures. The vendors care more about data usage than the operators. It doesn’t really impact the operators whether people use all their data or not. Their packages sell out; there’s only so much you can consume, after all.”

He adds: “The challenge with 5G is the same as it was with all the advanced 4G releases – where consumers struggled to discern any benefit. Nobody has come up with a service that only works on 5G; you can do most of it on a good 4G network. It’s only these private enterprise cases that are different – because they need SA capabilities, especially on the uplink. And so (except for FWA) 5G has morphed around the opportunity to optimise networks and spectrum… Lots of capabilities will only be unlocked with release-17/18; most operators today are only on release 15, with a smattering of 16. Most don’t have a lot of 5G features yet.”

And actually, despite SA networks going into enterprises at a faster clip, most private ‘5G’ networks are 4G networks, and most ‘5G’ apps work fine on them.

Which returns to this idea, voiced by Pongratz at the top, that 5G might be considered “mostly-on-track” so long as it is judged by its inward ability to bring new efficiencies rather than its outward ability to create new services. Its network gains are largely down to large-scale multiple-input/output (massive MIMO) technology in sub-6 GHz spectrum – so large antenna arrays drive network capacity and spectral efficiency to serve multiple users simultaneously, and generally to improve performance. Pongratz chimes in again: “Massive MIMO has exceeded expectations, scaling more quickly and broadly than anticipated… It has played a crucial role to extend coverage, allowing operators to leverage 4G infrastructure and reduce data delivery costs.”

In London, Ekudden tells media and analysts that the pieces are in place and the future is within grasp. “We’ve been living through this journey – connecting everyone, building-out the mobile internet and cloud over many years. But this would be a relatively flat outlook if we don’t see more usage and opportunities. So what is the inflection point? It is for those operators that are building out 5G as much as possible – mid-band, with massive MIMO, carrier aggregation; upgrading to SA – [to make] sure that the network is fit for all these new use cases and experiences: fan experiences, points-of-sale, mission critical workers, medicine. It is really [about] unleashing a next wave of innovation in new use cases, new sectors, new business models, and new capabilities beyond connectivity,” he says. (See pages 17 and 19.)

The networks might be getting fitter, by degrees, as 5G SA lands, but not much else has really changed, agrees Pongratz. “It is mostly a 4G-plus story, and operators and enterprises are struggling to move beyond existing use cases. 5G is allowing operators to reduce the cost and expand the pipe. But the ARPU-upside with existing use cases and the revenue growth beyond them are both limited – and too small to change the trajectory. While 4G also failed to change the revenue trajectory, it did improve the user experience – and the expectations to move beyond (just faster) mobile broadband (MBB) were not as hyped. So when we say things are on track, it is because we never expected 5G would change the revenue trajectory for the carriers – this initial phase was all about MBB efficiencies.”

And there, at once, the joke is on anyone who believed the crazy 5G hype in the first place. His analyst firm didn’t, the message goes – and it doesn’t buy it, now, just because industry money is finally going on proper 5G capabilities in SA architectures. “You have to calibrate expectations and align investments with what is paying the bills today, and the likelihood potential new use-cases will materialise for the masses,” says Pongratz. When it finally comes, in a wave on global 5G SA networks, 5G-Advanced will provide “more tools to improve efficiency”, he says, while “also addressing shortcomings that could realise more aspects of the industrial 5G vision”.

But note the modal auxiliary: ‘could’. Anything could happen. Note, also: this enterprise story, referenced several times, already, will be revisited.

To be continued; the full report (5G – a game of two halves) is available here.