Editor’s Note: Welcome to our weekly Reality Check column where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.

Many – if not most of you – have seen earnings for AT&T, Verizon Communications, Comcast, Time Warner Cable, Sprint, and T-Mobile US over the past two weeks. While many of the headlines focused on what was discussed on conference calls, this week we will focus on what wasn’t said. Many times, omissions can ferret out poor or struggling investments. They nearly always highlight portions of the business where competitiveness is waning.

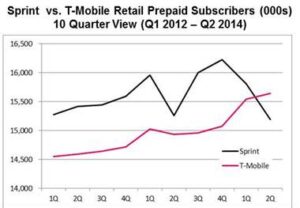

Headline No. 1: Sprint loses the prepaid pole position to T-Mobile US – is postpaid next?

We have discussed this narrowing gap in previous columns, and in Q2 T-Mobile US passed Sprint as the market leader in branded prepaid subscribers (T-Mobile US passed Sprint in total prepaid revenues in late 2013 due to an $8 to $9 average revenue per user advantage). Sprint’s retail prepaid customer base is now at Q4 2011 levels.

Just as recently as Q4 2013, the prepaid gap with T-Mobile US was over one million subscribers. Sprint experienced losses in the recertification of government-subsidized services (called Assurance Wireless). T-Mobile US also cited some pressure in growing prepaid branded subscribers because many of them were qualifying for (and electing to move to) T-Mobile US’ postpaid services.

The prepaid leadership change is significant because retail prepaid performance influences third-party dealer attention and focus. They smell success and want to play on the winning wireless team. With T-Mobile US and Sprint neck-and neck on LTE coverage (T-Mobile at 233 million potential customers covered, Sprint at 254 million), it comes down to pricing, handsets, promotions – and momentum.

![]()

T-Mobile US may also have an advantage as a GSM carrier. Given turnover in T-Mobile US and AT&T Mobility upgraded units, there could be more SIM-capable supplies of Apple iPhone 5, 5C and 5S models available in the second half of 2014 (new iPhone, new network compatibilities). Configuring a previously owned Verizon Wireless iPhone for Sprint’s LTE network is more difficult than a SIM card swap.

Sprint is certainly doing everything they can to regain their leadership position in retail prepaid, including this week’s announcement of Virgin Mobile Custom, a new product to be distributed through Walmart (and not through Virgin Mobile USA). More details will be available on this voice- and text-centric plan prior to its launch Aug. 9. Sprint also recently announced some important changes with their Boost pricing (including an entry point of unlimited voice/text + 500 megabytes of data for $40), which they indicated helped Q2 subscriber growth.

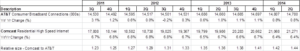

T-Mobile US is also closing the postpaid subscriber gap as the table below shows (note – table is in 000s):

![]()

If the current trajectories hold, Sprint will lose its postpaid advantage by the end of 2015. What is truly amazing is that T-Mobile US has erased 4.1 million of the subscriber gap in the past four quarters primarily through smartphone net additions (as opposed to tablets). This is definitely the harder path. As a result, T-Mobile US lags Sprint by about $320 million in quarterly earnings before interest, taxes, depreciation and amortization. However, if T-Mobile US’ monthly postpaid churn remains at 1.5% (and Sprint’s fails to fall to 1.8% to 1.9% in the second half of 2014), the EBITDA gap may be quickly a thing of the past.

Losing their prepaid leadership position is the last thing Sprint needs as it faces continued resistance to a combination with T-Mobile US. With Sprint Network Vision moving from deployment to augment/optimization, the opportunity is ripe to restore their prepaid legacy.

Headline No. 2: AT&T is not gaining on cable in broadband – yet

This headline was perhaps the most surprising to me, as AT&T has made a big deal about their U-verse Internet growth (1.5 million subscribers over the past eight quarters). Comparing AT&T to Comcast, however, shows that AT&T is merely treading water as Comcast solidifies their high-speed Internet incumbency:

As the chart shows, AT&T’s overall consumer broadband connections (U-verse + DSL) have been relatively flat for the past 10 quarters. U-verse growth of anywhere from 150,000 to 250,000 customers per quarter has been roughly offset by an equal loss in consumer DSL connections. Meanwhile, cable continues to grow in more of a seasonal pattern than U-verse, with second quarter net additions for Comcast of 156,000, 187,000 and 203,000 customers in 2012, 2013 and 2014, respectively. Like U-verse, Comcast also tends to see faster growth in the second half of each year and we continue to have a growing economy in many Comcast locations (Atlanta, Houston, San Francisco, Seattle and South Florida are growing very rapidly). Comcast’s high-speed Internet ARPU experienced 3.1% annual growth in the second quarter, which follows ARPU trends being demonstrated by Verizon’s FiOS product.

U-verse has come a long way over the past five years. It seemed to be turning the corner at the end of 2013, but the first half of this year has not met expectations. While 1.5 million U-verse customer growth is good, Comcast has grown roughly 50% more (2.25 million over the same period). Given the level of upgrades that have been completed as a part of Project VIP (about $5 billion to $7 billion of incremental investment), the second half will be critical to the future of U-verse. The bandwidth freed up with a DirecTV merger would also be welcomed.

This is not a verdict on telco fiber as a product. No one doubts Verizon’s (FiOS) ability to attract customers, and, while video profitability continues to be challenging, few doubt the ability of FiOS to generate incremental cash flow for years to come (overall penetration should top 45% in 2015). However, the lack of growth in U-verse compared to its cable counterparts is noticeable. AT&T’s relative disadvantage versus cable is growing despite billions of dollars of additional investment. Something’s gotta give.

Headline No. 3: Double-digit revenue declines in transport mean big trouble for the ILECs

When I ran sales for the wholesale division of Sprint’s ILEC (now a part of CenturyLink), we watched transport yields and terms with great diligence. As mobile data boomed from 2007 to 2012, so did the quantity of access and transport circuits to wireless cell towers. Many of these circuits were purchased on long-term agreements (five years or more). They are now up for renewal, and incumbent carriers face a threat from both cable providers (Brighthouse, Cablevision, Cox, Charter, Comcast and Time Warner Cable) and independent access providers (Zayo, Fiberlight, FPL Networks, Fibertech, Towercloud, Lightower and many others).

While cell site and building access is capital intensive, the resulting EBITDA margins tend to be very healthy, especially in the last years of a contract. If the renewal process is orderly, no one notices, but, if it isn’t, the consequences can be significant.

The best proxy for what is occurring in the access and transport world can be seen in AT&T’s earnings where they show revenues from this product. Here’s the twelve quarter trend:

![]()

Using a rolling four-quarter view of transport revenues, what was a $9.2 billion revenue stream as of Q2 2012, is now $7.7 billion. That’s a 16% decline which will likely grow throughout 2015.

Billion-dollar revenue declines happen in telecom (look at the “mass markets” line for Verizon), but it’s rare that, a) they are high margin, and b) that they are not accompanied by a greater revenue increase in another area. AT&T has a strategic services unit which captures products like Ethernet and VPN (and this category has grown $710 million over the same 12-quarter period), but these are not five year “install it and forget it” long-term deals with other telecom carriers. Over the past four quarters, the decline in transport has actually been slightly greater then revenue gains in strategic services. This is one of the drivers behind the Project VIP business connectivity initiative and the initial results are not encouraging.

Beneath the surface, there are a lot of troubling signs. Incumbency is less important than it was in the past. Legacy is more likely a liability than an asset. The milking schedule for cash cows is now quarters, not years. Out of these shifts, however, emerges a tremendous period of innovation and value creation for those companies who demonstrate focus and resolve. We’ll be sure to highlight these companies over the rest of the year.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – Business Development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was President – Wholesale Services for Sprint and has a career that spans over twenty years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice.