Lots of plane time last week, which means lots of time to think about earnings announcements and trends. On top of this, last week was heavy on non-earnings news, with T-Mobile US’ innovative smartphone approach to credit-challenged customers (see more here), to Google Fiber’s southern fiber expansion announcement (see blog post here), to Dish Network’s surprising second-place finish in the AWS-3 auction bidding (see analysis of the results here).

These three news items would be enough to fill three columns. Believe it or not, we’ll only tangentially touch on them in this week’s column, and focus instead on AT&T and Time Warner Cable earnings.

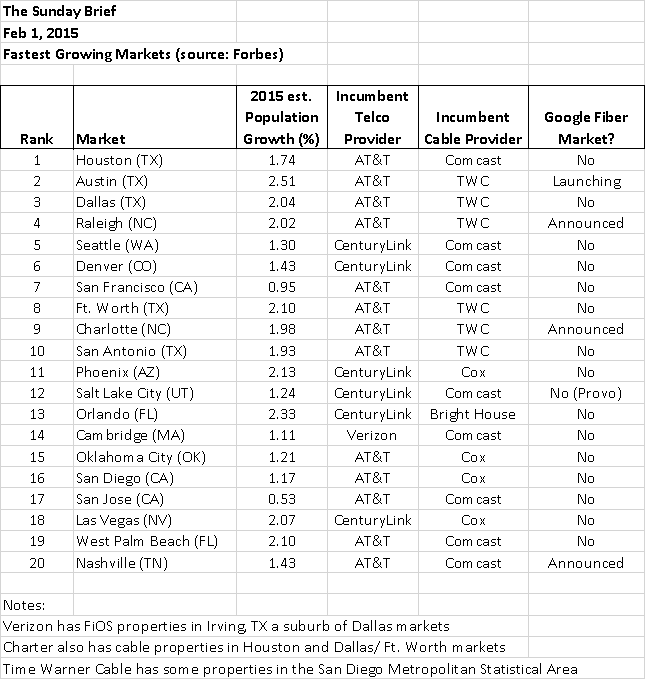

As a backdrop for the earnings discussion, a recent article from Forbes magazine listed the 20 fastest-growing U.S. cities (full article here). If you are not familiar with the term DASH – which stands for Dallas-Austin-San Antonio-Houston – you should add it to your telecom lexicon. Including Ft. Worth, which is sometimes included in the Dallas market, these markets account for half of the fastest-growing cities in the United States.

Several interesting insights emerge about the results:

1. Not surprisingly, AT&T is the primary local incumbent telco provider in 13 of the 20 markets. While they did not state this on their earnings call, it’s likely that the wireline part of the Velocity IP (Project VIP) has been focused in these areas. This means more fiber, faster speeds and better in-building coverage to smaller footprint buildings, 100,000 to 400,000 square feet, for example. The answer to the question “Why is AT&T more focused on wireline than Verizon?” can be answered with this chart. No. 1 is that fewer people are moving into Verizon Communication territory than into either AT&T or CenturyLink markets. Simply put, the quantity of decisions and the cost to add are less when there is more moving. This is what makes the Verizon (FiOS) vs. Cablevision (Optimum Online) market share/switching battle in the Northeast such an interesting one to watch.

2. Six of the 10 fastest-growing markets are in the Time Warner Cable footprint. Four are in Texas and the other two are in the Carolinas, but there also is some growth in San Diego – as noted. Time Warner Cable should be booming, but, as we will see from their results, they are not. AT&T is grabbing its highest U-verse market share in Texas. TWC has nowhere to go for growth after the top 10 with Cox and Bright House Networks splitting the No. 11 to No. 20 spots with Comcast.

3. Finally, there is CenturyLink as the incumbent in six of the top 20 markets. Compared to its fellow high-yielding peers – Windstream and Frontier – its growth horizon is much greater. Is CenturyLink missing out on opportunities to create increased shareholder value with only $3 billion in spending in the last four quarters? What are the effects of decelerated capital spending on Comcast’s, and Bright House Networks’, market shares in these markets?

This table and other items within the Forbes article, help to frame the addressable growth markets for broadband and wireless. Texas is the place to be, North Carolina is a close second, with California third.

AT&T’s ‘future forward’ message

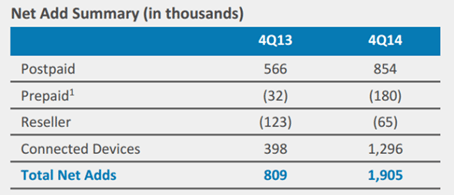

AT&T reported earnings last Tuesday and the results were mixed. While total retail wireless postpaid subscribers rose, the phone portion of those net additions shrunk by 115,000 connections. Prepaid and reseller subscribers also fell in the quarter, although Cricket gained a small number of customers; these two segments combined have lost more than 1.1 million subscribers over the past four quarters, with most of them coming from the AT&T-branded GoPhone losses. Were it not for AT&T’s continued brilliance and strength in the connected-device segment, driven by 800,000 automobile connections with free trial periods that begin to expire during the first quarter, the wireless picture would have been solely focused on low-average revenue-per-user tablets. Even when accounting for Next – phone installment – payments, total phone-only ARPU customers fell by 2.3%.

Fortunately, the U-verse picture was much brighter. Revenue grew 21.9% after accounting for the sale of AT&T Connecticut, driven by Internet net additions of 405,000 and video net additions of 73,000. AT&T reported 22% penetration of homes passed for video and 21% for broadband. While low, this is a clear indication that there’s still a lot of room to grow – Verizon FiOS’ comparable metrics are at 36% for video and 41% for broadband. Overall, broadband growth (U-verse growth less digital subscriber line declines) was positive for AT&T and U-verse is now a $15 billion annual revenue stream.

Voice declines are halting earnings before interest, taxes, depreciation and amortization improvements, both in business and consumer markets. The jury is still out on AT&T’s progress in their traditional DSL markets (75 megabits per second is now available in more parts of California, Ohio and Texas according to their earnings bulletin; 456,000 DSL losses this quarter). The transition from legacy SONET-based services to lower-priced Ethernet services is impacting business and wholesale margins. Few things at AT&T are in a steady state.

What to do when the core business is in decline but the balance sheet allows for additional leverage? Buy spectrum – $18.2 billion to enable a nearly nationwide swath of AWS-3 spectrum – and expand competitive advantage through acquisition (DirecTV, Iusacell, Nextel Mexico). AT&T established 2015 guidance of low- to mid-single-digit revenue and low single-digit EPS growth including acquisitions.

As we have discussed in several previous columns, new revenue sources directly attributable to Project VIP need to account for approximately $50 billion in revenue for the next five to seven years. Here’s the math:

• $60 billion invested over the 2013-2015 interval

• 8% post-tax cost of capital = $4.8 billion after-tax net operating profit ($60 billion * 8%)

• 35% tax rate = $7.4 billion pre-tax operating profit ($4.8 billion/1%-35% tax rate)

• 15% operating margin = $49.3 billion revenue generation required ($7.4 billion/15% margin)

That’s assuming a very conservative debt/equity mix (60/40), a 5% cost of debt and a 12.5% equity-holder expectation, roughly split between a 5.7% dividend and a 6.8% equity return.

Given these lofty expectations, AT&T has to expand. It needs a greater share of broadband decisions, which will be helped by people moving into Texas, California and North Carolina. It needs businesses to expand their wireless and broadband data and security needs – again helped by their geographic locations. It needs a rejuvenated AT&T Mexico to result in market share gains in California, Arizona, New Mexico, Colorado and Texas. Most of all, it needs content differentiation and cost reductions from DirecTV.

The list is long, and, while the Cricket integration is ahead of schedule, merging satellite and Mexican operations is a lot different from local wireline and wireless integrations. AT&T will lose market and investor confidence if they materially fail in any aspect of this multipart program. One misstep, and their cable and wireless competitors will be waiting to harvest additional gains.

Time Warner Cable earnings – triple play comes alive

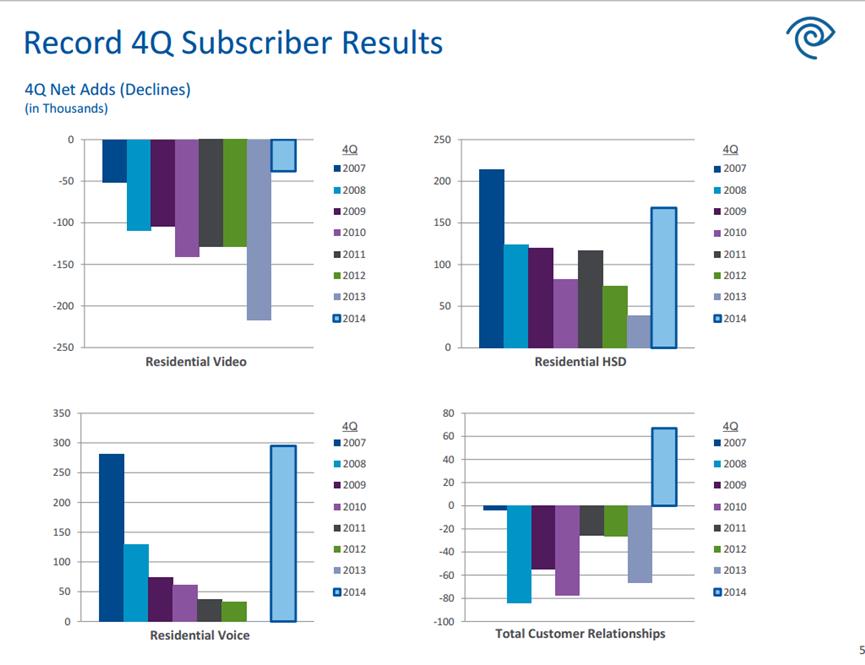

Time Warner Cable also reported earnings last week (full details here), with triple play (voice+video+phone) and business growth driving total revenue and EBITDA up 3.8% and 5.6% in the fourth quarter. The triple-play story has two parts: a) up-sell the single- and double-play base (namely to digital phone); and b) acquire a disproportionate share of decisions of movers.

Clearly, they did a very good job on both fronts. While single- and double-play customers fell in Q4 – 39,000 and 168,000, respectively – triple-play shot up 274,000 customers. Overall, voice revenue per unit continued its steady decline to $30.58, from $34.30 in Q4 2013, and $35.11 in Q4 2012.

Voice is a high-margin product when sold as a part of the triple-play, however. Think of voice as a narrowband application revenue stream riding over an existing voice or data stream. While the incremental gross margins are not as high as high-speed Internet, they are still meaningful.

Nowhere are these trends more apparent than in the nearby chart (note: this chart does not compare sequential growth, but rather changes vs. previous Q4 figures). High-speed data growth – best for a fourth quarter in seven years. Same story for residential video losses. Voice gains were the best on record.

This is exactly what Time Warner Cable should be doing ahead of their merger with Comcast – driving subscriber growth and customer relationships with a focus on high-speed data and voice acquisition, and leave further video penetration for the eventual introduction of Comcast’s Xfinity platform.

While this column has been critical of Time Warner’s failure to capitalize on opportunities in the past, it’s very clear from Q4 earnings that the company is placing its priorities on plant overhaul, connection quality and speed differentiation. Adding revenue-generating units to the mix is a heck of a lot easier with healthier New York and Los Angeles properties.

More on cable’s overall situation after Comcast’s earnings (Feb. 24). Most companies in Time Warner’s case would have milked the last couple of quarters of earnings. In this case, their “full steam ahead” activities in 2014 provides TWC momentum throughout 2015.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: Welcome to our weekly Reality Check column where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.