Spectrum auction is latest attempt by Canada to bolster wireless competition

On the heels of its southern neighbor conducting its most lucrative spectrum auction ever, Canada this week is set to kick off bidding for 50 megahertz of spectrum in the 1.7/2.1 GHz band, also known as the AWS-3 band.

The move is the latest by the Canadian government to inject new entrants into the country’s mobile space, which is dominated by three nationwide operators in Rogers Communications, Telus Communications and Bell Canada. Qualified bidders for the AWS-3 auction include the three large operators, as well as Saskatchewan Telecommunications, MTS and Videotron, Bragg Communications, TBayTel, Data & Audio-Visual Enterprises Wireless and Wind Mobile.

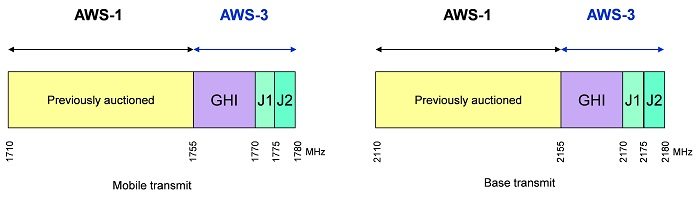

Unlike the recent AWS-3 auction in the U.S., Industry Canada is lumping together its G-, H- and I-Block, 5-megahertz licenses into a single 15-megahertz license under the GHI-Block heading. Industry Canada noted the move would allow licensees to “benefit from increased throughput, capacity and network efficiencies,” of the bigger spectrum channels, while still being able to tap into the equipment ecosystem forming around the separate bands.

Industry Canada is also breaking apart its J-Block licenses into a pair of 10-megahertz licenses (J1 and J2) instead of offering it up as a single, 20-megahertz block as done by the Federal Communications Commission. The single, J-Block license was the biggest driver of revenue for the U.S. auction, which generated nearly $45 billion in total potential winning bids.

The GHI-Block targets new entrants into the space, as current operators with 10% or more of nationwide market share, or more than 20% in the corresponding licensed area, will not be allowed to bid on these licenses. However, GHI-Block bidders will have to be currently providing wireless services using licensed spectrum in the area they are bidding with coverage of at least 10 to 25% of that region’s population.

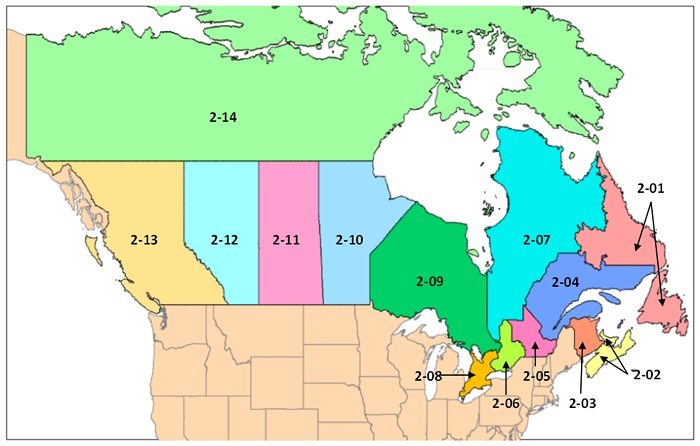

Geographic license sizes will adhere to Industry Canada’s Tier 2 designation, which consists of 14 “large” service areas covering all of the country. The government had gone with a mix of Tier 2 and Tier 3 designations for the AWS-1 auction in 2008, with Tier 3 containing 59 regional service areas.

The auction process itself will use a sealed-bid format, with package bids allowed for the J1 and J2 bands. Combined, all of the licenses will have a reserve price of $162.45 million ($129.45 million U.S.). Each license will have a lease term of 20 years, with the need to show a level of build out between 20 and 60%, depending on the license, within eight years.

Latest attempt at greater competition

Canada’s attempts to infuse new competition into the market have met with mixed results. A report released last summer by Wall Communications and commissioned annually by Industry Canada and the Canadian Radio-television and Telecommunications Commission, found that pricing for low-end, voice-only wireless rate plans increased 16% year-over-year, while the price of higher-end, data-heavy wireless plans dropped 15% compared with last year’s report. The report noted that “the price of a typical basket of mobile phone services – including voice, text, call display and voice mail features” remained basically the same.

The pricing changes appeared to have been driven by new entrants into the space, with the report finding prices between 10 and 50% less compared with incumbent price plans, with the largest difference seen in unlimited talk, messaging and larger data bucket plans. Those lower prices were also seen from value-branded offerings from incumbent operators, which were priced between 20 and 34% lower than branded plans.

The report also cited the CRTC’s “wireless code” as putting “upward pressure on service plan prices” due to mandatory shorter terms on wireless contracts. The code, which went into effect in late 2013, requires that all new contract customers be able to get out of 3-year contracts without having to pay a cancellation fee; requires carriers to cap data overages at $50 per month and international data roaming charges at $100 per month; allows customers to unlock devices after 90 days of service or immediately if the device has been paid in full; provides a 15-day return window for customers signing up for new service; and receive a contract that “is easy to read and understand.” The code applies to all new contracts signed beginning with implantation of the regulation, as well as to existing contracts that were renewed or extended or where the “key terms” were amended. The code also applies to all wireless contracts as of June 3, 2015, regardless of when they were signed.

However, the report found that downward pressure had been applied through the recent introduction of “bring-your-own-device” plans that offer a per-month discount on service for consumers bringing their own paid-for device to a carrier.

Overall, the report noted that Canada’s wireless pricing remains at the “high side of the average” among the seven countries also surveyed, and that cross-border roaming rates between customers in the U.S. and Canada have remained consistent year-over-year.

Canada attempted to increase competition in the space with its AWS-1 auction in 2008, which witnessed a number of potential new entrants winning licenses. However, many of those potential new entrants eventually sold off their licenses to the established players, while those that did manage to launch services have been focused in just a handful of larger markets.

The country tried again with last year’s 700 MHz auction, which was dominated by the three largest operators and failed to generate a nationwide challenger. Auction rules did result in a new entrant garnering valuable spectrum assets in every market, which the government considered a victory for competition.

Industry Canada is also set to conduct an auction of 2.5 GHz spectrum licenses in April.

Bored? Why not follow me on Twitter

Photo copyright: / 123RF Stock Photo