Top 10 events of the first quarter: recap of Pt. 1

We started the first quarter review before the Easter/Passover holidays with five events.

1. Sling TV announced at Consumer Electronics Show: Our bottom line was that this was a big idea with decent implementation, amazing use of the existing Hopper and Sling infrastructure. Sony and Apple have real competition.

Update: Sling launched HBO as a $15 per month premium product to their baseline service. More in this article.

2 (and 3). The Federal Communications Commission Auction 97 ends, and Verizon sells off more of its local properties: Dish came to play, and, while many are not taking them seriously, they (and perhaps Google) pose the largest threat to today’s industry structure. The benefit of the Verizon sale of the California properties is going to accrue to Frontier Communications. (Some of you speculated that Verizon would continue to gain scale in the content market because a wireless subscriber watching broadcast video would add to their totals. This is a good thought that should be validated by the broader analyst community.)

4. The Apple Watch launch date and features disclosed: Our view of the Apple Watch is that lots of advertising and a “supply constrained release” would create a lot of hype for the phone. What’s most important is that the developer community has stepped up with some very interesting applications. Our additional view is that the Watch price at the lower end needs to come down.

Update: For a great description of the Apple Watch Store buying experience, see the Ars Technica article here. Also, TechCrunch has an article describing fairly lengthy delays in the shipping process for many devices here.

5. Samsung Galaxy Note 6/6 Edge introduction: Our view was that good reviews influence early adoption, and the wireless carriers appear to be solidly behind promotion. This is going to be a very good selling phone for Samsung (and Google Chromecast/Netflix). Turns out this was right as Samsung announced they would have higher than expected quarterly earnings due to the Galaxy launch. See this Reuters report for more information.

Top 10 Events of Q1 – Pt. 2

6. The FCC passes the Open Internet Order: There has been a lot of analysis of the Open Internet Order, its effect on interconnection (which the Order clearly states will be decided on a case-by-case basis), as well as last-mile regulation (which will be governed by “bright line” rules surrounding throttling, blocking and paid prioritization).

As many have noted, the Order sets up a complaint process to determine what is an “unjust and unreasonable” practice. This could apply to any aspect of the Internet provider’s operations related to providing broadband services (see Sec. 202(a) and page 12 of the Order for the FCC’s justification). Broadband providers are most worried about lawsuits that challenge their pricing models, particularly for unlimited packages.

As we noted in one of the first columns on the topic, offering an unlimited Internet product becomes too risky under the Order’s framework. While capped broadband pricing existed prior to the Order’s release (we cited AT&T and Mediacom packages), it’s likely that if challenges to the Order are refuted, few broadband service providers will offer an unlimited package (this includes wireless). The effect of this on consumer viewing habits, considering the changes occurring in over-the-top programming, is unknown.

Though my Sunday Brief columns, we were one of the first publications to explore the implications of the Open Internet Order on telecommunications services, specifically Apple FaceTime, Google Hangouts and a host of other directory-based services. These services were considered “enhanced” because they were carried by “enhanced service providers.” However, they are now carried by common carriers, and, according to the Telecommunications Act of 1996, should be regulated in a similar manner. This includes equal access (interconnection between Google and Apple), directory services, emergency services and a host of reporting requirements. When FaceTime was first introduced with the iPod, the combined product was described by Steve Jobs as “the iPhone without a contract.” It will be interesting to see how Apple defines the phone services in the context of the Order.

The Order was introduced into the Federal Register on April 13. Look for the lawsuits to start shortly thereafter and to continue throughout 2015. While the FCC is confident that it will hold up to legal challenges (and it is likely that they will), it is equally likely that broadband service providers will be granted a stay until the court process is completed. More on this throughout the summer.

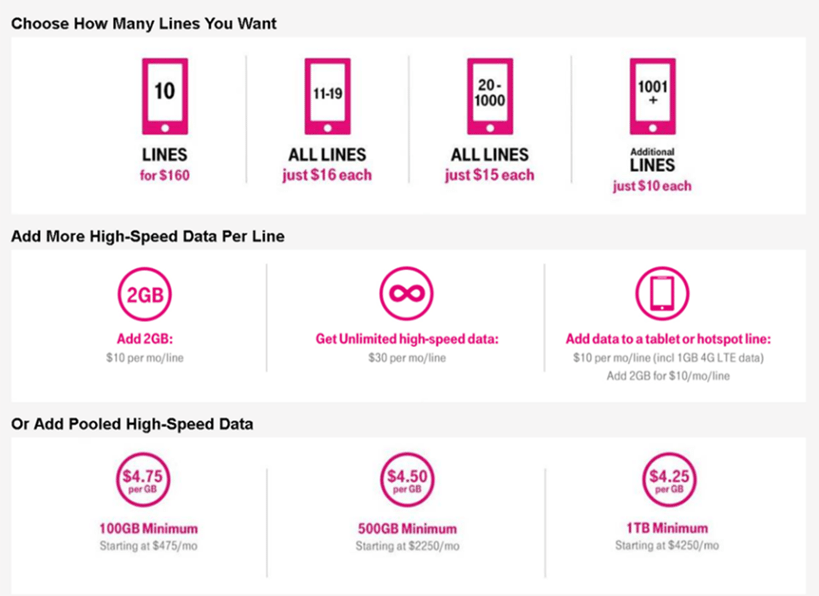

7. T-Mobile US introduces business offerings: While this announcement likely had a small impact in the first quarter, the effect of T-Mobile US’ business plan pricing will impact the industry’s results through the rest of 2015. As the “bring-your-own-device” phenomenon comes into full bloom (and also as mobile security improves), more emphasis is placed on corporate reimbursement as opposed to direct purchase of devices and plans.

When we wrote about the plan (see “T-Mobile US Means Business” Sunday Brief here), we highlighted that business customers received a dual benefit – lower pricing (see graphic), and lower pricing for employee-liable family plans. How this is being explained to businesses by T-Mobile US sales reps was not available when we originally wrote the column, but we have confirmed that the tactic is resonating with small businesses and their employees in that the second benefit is that the employee line functions as the first line purchased in any T-Mobile US Family Plan, creating a $20 discount for the first line and $20 for all subsequent lines.

8. Facebook’s announcements at their F8 conference surrounding Messenger: The behind-the-scenes battle for the default notification platform has begun, and right now it’s a three-way war among iOS (Apple), Android (Google) and Messenger (Facebook). Interestingly, Facebook is not trying to control all notifications in its initial vision, but only those that directly relate to communication, For example, calendar notifications were not mentioned in the presentation, perhaps because it is so closely integrated into the mobile operating system framework.

Facebook announced it would be opening up Messenger – with 700 million monthly active users – as a platform for developers. This seems like a small development, but it’s important to remember how pervasive Facebook has become as a default sign-in platform. For example, Federal Express could use a Messenger API (programming interface) to notify you that the package was left at your door, even providing photographic evidence that they did so. It would be secure, private and, best of all, requires no additional sign-in/authentication.

What this sets up is a business-to-consumer model where all authentication and communication flows through Messenger. It also could allow businesses to get a better view of the total customer needs universe. For example, FedEx package delivery plus a series of airline communications through Messenger could map to a particular user profile that makes the customer a likely candidate for hotel or rental car deals.

The Messenger updates are a big move and could impact how Messenger interfaces with iOS and Android in the future. Opening up the interfaces to third-party developers is a very big deal. More from these articles in TechCrunch and The Verge.

9. Delays plague the approval of the Comcast/Time Warner Cable deal: This has been a running storyline throughout the first quarter as Comcast originally thought the FCC and Department of Justice would provide their blessing in late 2014 and the transaction would be closed within a year of announcement. To see more background on the extension, read this Multichannel News article. This was revised because of court challenges made by broadcasters about the examination and potential public release of programming contract details.

The merger also has been unpopular with California and New York, two states that will have a large portion of the combined company’s customers. We discussed this extensively in a previous Sunday Brief (see here), and one of the California Public Utility commissioners came out against the merger last week. Space does not permit a full analysis, but here’s a good article by the Los Angeles Times on the objections and counterproposal.

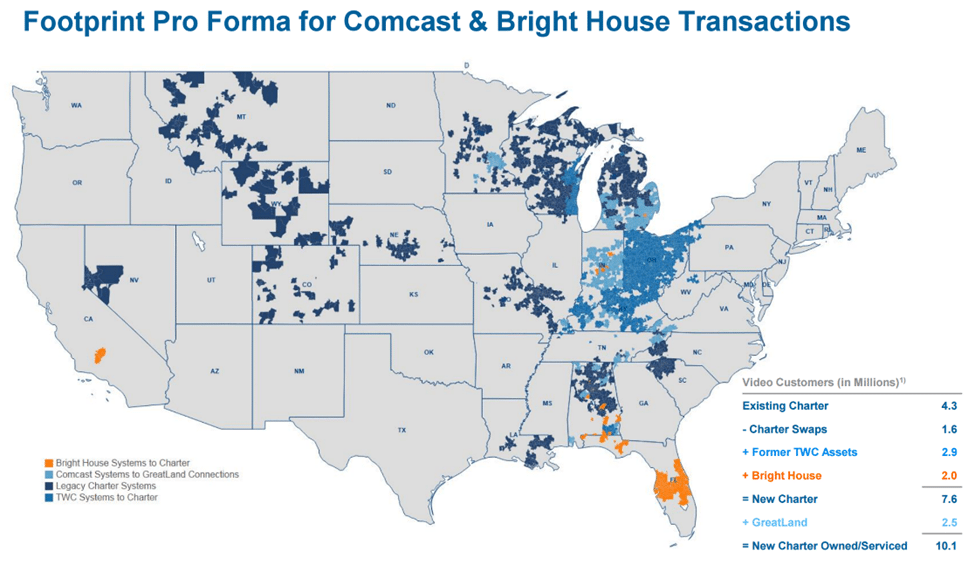

It’s not certain how vigorously Comcast will fight to complete this deal. It has never been financially stronger, and it’s likely that Time Warner Cable will be acquired by Charter Communications (partially owned by Liberty Global) if their merger falls through. If Comcast were to acquire another cable company, both Bright House Networks (Florida) and Cablevision (Long Island, New Jersey, Connecticut) would form stronger clusters. Or TWC could merge with Cox, Bright House and Cablevision to form a second Comcast and leave Charter with no partner.

It’s likely we will get closure on the outcome – or have a much higher probability one way or the other – by the end of June. Either way, Comcast is in a strong position.

10. Charter announces Bright House acquisition for $10.4 billion: When we decided to split the top 10 into two parts, I thought there might be something that would cause me to feel good about that decision. I had no idea, however, that Charter’s announcement would be the reason.

Charter is acquiring one of the consistently highest-rated cable companies in the United States – J.D. Power’s 2014 residential phone results are here. Bright House had similarly strong rankings for high-speed data, but Verizon FiOS won that award. One of the reasons Bright House has such strong ratings is due to its concentration in central Florida (see pictured pro forma map). This has allowed it to focus on service to a greater extent than its peers.

Charter also inherits a profitable operation, likely more profitable than its current operation, that has experience from several years of FiOS competition. While Bright House does not provide the geographic reach of Time Warner Cable, it brings a customer experience franchise that will undoubtedly make Charter a stronger competitor.

It’s important to note that this transaction is contingent on the successful closure of the Comcast/Time Warner Cable deal. However, assuming that comes to pass, the resulting Charter will represent the greatest transformation of a communications company since the breakup – and reconstitution – of AT&T.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.