This week, on top of earnings news we had a number of announcements across the industry. Comcast announced it would be launching 2-gigabit-per-second service to 200,000 homes in Chattanooga, Tenn. This news item would have minimal impact except for the fact that Chattanooga has been the subject of the Federal Communications Commission’s intervention as the agency seeks to spawn increased municipal network competition. It is widely expected that EPB, the Chattanooga utility, will match Comcast’s offer once pricing is announced. As we have previously discussed, Comcast plans to launch 1-Gbps services to 18 million homes by the end of 2015.

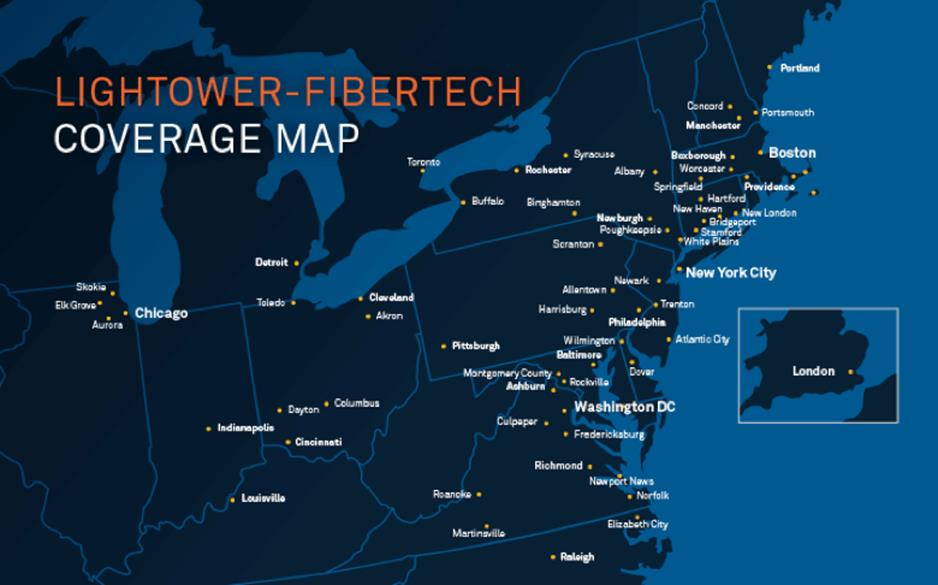

On the fiber backhaul front, we had two major merger and acquisition activities last week. Rochester, N.Y.-based Fibertech agreed to merge with Lightower for $1.9 billion in cash (see announcement here). Fibertech has an excellent reputation for broad (tower, end-office, in-building) coverage throughout the Northeast and will help Lightower expand throughout that sector. Their pro forma network map is shown.

In a more surprising revelation, Crown Castle announced the acquisition of Quanta Fiber, also known as Sunesys, for $1 billion. Sunesys has a very dense fiber network in the Mid-Atlantic region, with additional network capabilities in Chicago, Atlanta, California and Florida. This will boost Crown Castle’s ability to address small cell needs for carriers in these markets.

On the wireless side, there is a very major issue brewing that, not surprisingly, is not making it to the top of Google’s search list. In a nutshell, Android’s latest release, Lollipop, has something called a memory leak (more details here). This is impacting the availability of internal memory to run applications on newer devices, including the Samsung Galaxy S6/Edge. On top of this, it has resulted in more “stars” – an easy way for any individual user to affirm that the issue exists – than any other Android release in Google’s history. Forbes had the guts to move this out of Android-specific blogs into the mainstream with its article that quickly made it to Yahoo headlines this week. More to come on the fix, but those of us who were upgraded to Lollipop on our Galaxy S5s are not happy.

T-Mobile US Q1 results: Can it grow beyond smartphones?

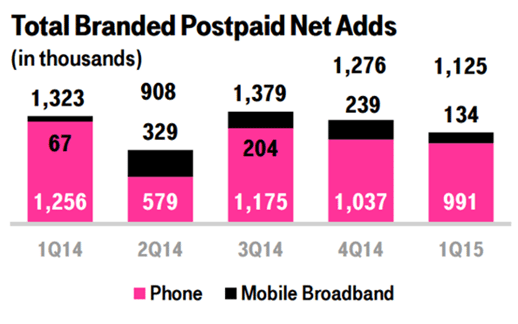

T-Mobile US announced earnings last week and, as expected, they had terrific smartphone metrics (1.1 million postpaid retail net additions), record low monthly postpaid retail churn (1.3%) and 11% year-over-year service growth when the effects of their Data Stash accrual are removed. On their 90-minute earnings call, they provided a broad view of the industry and convergence (full call details can be found here).

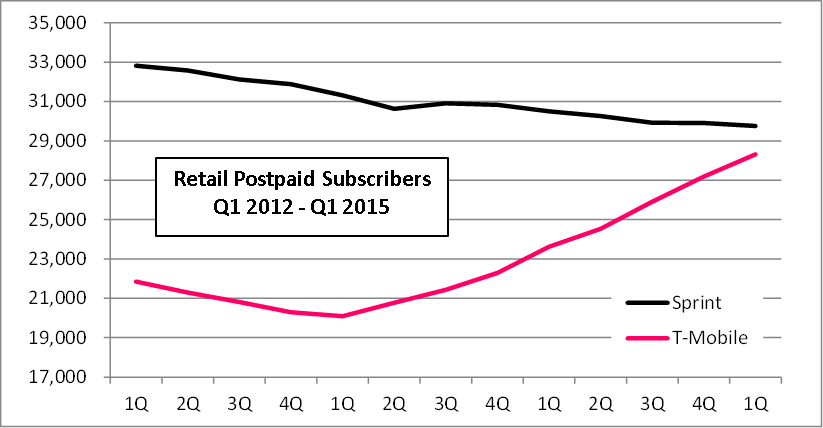

As shown by the graph (Sprint postpaid subscribers estimated to be slightly lower on a quarterly basis – more details when Sprint releases earnings this week), T-Mobile US has substantially erased the postpaid retail subscriber gap between themselves and Sprint (9.8 million of the 11.2 million, or 88%, of the gap has already been eliminated). Assuming Sprint does not incur a substantial amount of tablet net additions in the first half of this year, T-Mobile US should overtake Sprint as the No. 3 provider this summer.

Without a doubt, T-Mobile US has executed well on a strategy based on simple and straightforward pricing. It is now at handset parity – and in the case of Wi-Fi integration, at a competitive advantage. And they have reduced churn to levels unthinkable even by T-Mobile US’ current management team two years ago.

Not everything at T-Mobile US has turned to gold, however. As T-Mobile US CEO John Legere indicated on the conference call, the cumulative nature of the “Un-carrier” strategy is being lost on most customers. He cited the fact that most customers had forgotten that T-Mobile US offered free international roaming to many countries. The 7-day free trial of the Apple 5S was a flop. While Un-carrier 9.0 (Un-carrier for business) has been launched, there’s no indication that it will have traction above small businesses (T-Mobile US’ commercial Wi-Fi strategy is also MIA).

The biggest concern, however, is T-Mobile US’ lack of innovation and growth on the retail level with nonphone additions. Despite fantastic growth, T-Mobile US’ average revenue per account is $108, slightly down from Q1 2014. Verizon Wireless is also slightly down, but to $156. Not all of that difference is coming from excessively high pricing. Verizon Wireless averages 17% more connections per postpaid account. Even with additional wearables, tablets and other items attached to Verizon Wireless accounts, which one would think would lower average revenue per connection, ARPC is still 20% higher than T-Mobile US ($54.03 for Verizon Wireless vs. $45.21 for T-Mobile US). Reaching a more connected world is going to become more difficult under T-Mobile US’ current strategy.

Without a doubt, T-Mobile US should be commended for its continued smartphone progress. It has all of the momentum, which should continue throughout 2015 with more spectrum coverage and 300 million potential customers covered by its LTE footprint. It’s not clear that they can grow beyond smartphones, however, and with data connectivity across a myriad of household devices in queue for 2016, they need a strategy refresh if they are going to penetrate Verizon Wireless’ and AT&T Mobility’s family and business customer bases.

Time Warner Cable: The transformation has already begun

It’s a bit premature to declare Time Warner Cable to be the T-Mobile US of the cable industry. Less than a two months ago, it was conventional wisdom that they were going to be absorbed by Comcast and that “big cable” would just get bigger.

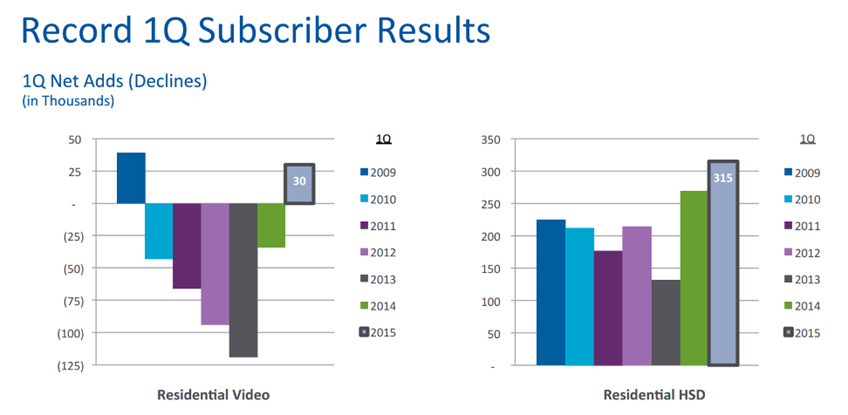

During the fourth quarter, however, things started to change for TWC. Capital investments started in 2014 were beginning to yield real results. Video losses were low, high-speed data connections were solid and phone additions were strong. Many of you called into question our comments that this could be a part of a sustainable strategy and called TWC’s end-of-year efforts “window dressing for Philly.”

TWC’s Q1 results clearly show that this is more than a temporal trend. The growth of 205,000 net additions for customer relationships is the metric that is most striking. The last time TWC had 14.716 million residential customer relationships was nearly three years ago, in Q3 2012. And a record-high 31% of these relationships carry all three services.

This is not an asset utilization exercise, either. TWC has spent $4.4 billion in capital expenditures over the past four quarters, which is comparable to Charter’s $2 billion spending given TWC’s relative size. While TWC did not provide capital guidance for the rest of the year (likely because they have to revisit their operating plans in light of the failed merger), CFO Artie Minson had this to say about spending:

“We continue to be really pleased with the returns we’re seeing on our capex spend. The proof is obviously in our operating performance, our customer metrics, where we sat last year. There were things we really wanted to accomplish when we made the investments, which was, improve our product reliability, improve our network reliability, make sure our customers had the best equipment in their homes for new customers, go into existing customers’ homes and take out equipment that we thought was not optimizing the experience. And I think the proof is in the subscriber results today. So to the extent we continue to see those results, which we expect to, I think that obviously requires capital, but there’s a great return on that capital.”

Sounds like TWC will be continuing to expand its capital plan throughout the year.

On top of this, TWC executed well with commercial services in the second quarter, growing by 17% year-over-year and generating $3.1 billion in annualized revenues – Charter grew by 14% and generated just under $1.1 billion in annualized revenues.

We talked a lot in last week’s column about what Comcast should do. TWC’s choices are broader, but it’s clear that one choice could be to build on the current momentum that it has started over the past four quarters and be the acquiring platform. What a difference a few weeks can make in the cable landscape.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.