There has been no shortage of news affecting the telecom and wireless industries. First, as many expected, a three-way merger among Charter, Time Warner Cable and Bright House Networks was announced last Tuesday. Many, if not most, of you are versed on the details of the transaction – $78.7 billion value for Time Warner Cable and an additional $10.4 billion for Bright House Networks; 48 million homes passed and 23.9 million customers across 41 states; TWC shareholders will end up with 40-44% of the value of the new Charter.

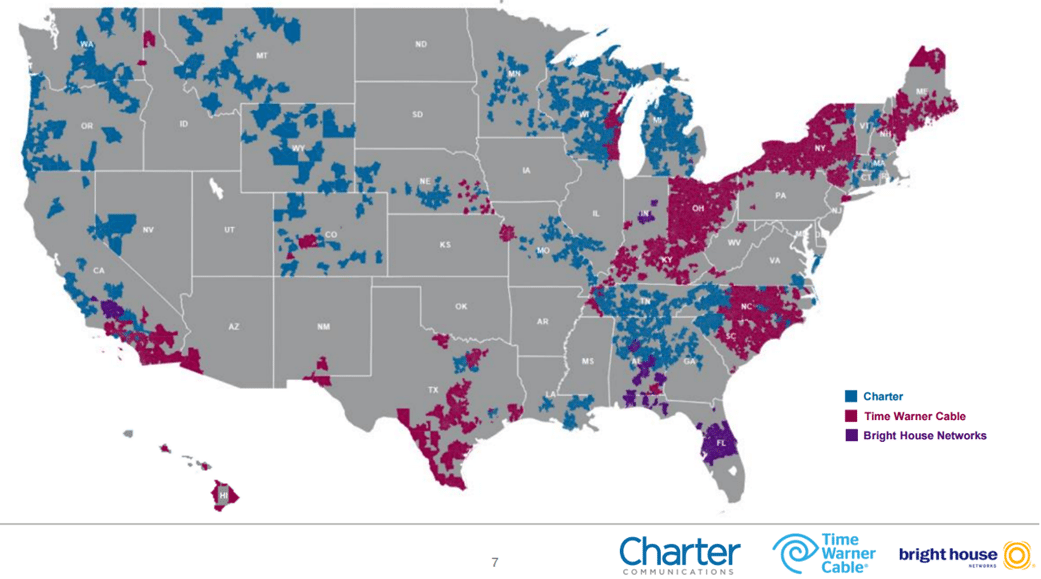

The release is a big win for TWC shareholders who found themselves without Federal Communications Commission approval after a year of waiting. This transaction looks like it will be approved by both the FCC and the states that the new Charter serves. As the map of the combined company below shows, there will continue to be a substantial presence in the upper Midwest, Southeast and Texas. The combined presence will bolster business presence and allow the new company to serve a larger footprint.

The map shows just how dispersed Charter’s footprint was prior to the announcement. Outside of St. Louis, there were few metro service areas where Charter set the rules. Now, they will be the largest broadband provider in North Carolina, South Carolina, Kentucky, Ohio, Texas, Maine New York, Hawaii, Missouri and Wisconsin. They will have a substantial presence in California, Colorado, Michigan, Tennessee, Alabama and Florida. That’s 15 more states with substantial presence than Charter had prior to the transaction. For advertisers, this is very welcome news. It also sets the stage for further territory swaps that could broaden/tighten their territory clusters even further. Overall, it’s an opportunity for broadband growth to flourish and for content delivery concentrations to improve.

Beyond the Charter/BHN/TWC news, last week was one of chipset-maker consolidation with Broadcom last Thursday agreeing to be acquired by Singapore chipset producer Avago for $37 billion, or about 4.5 times 2014 revenue (more details here). Many of us remember Freescale Semiconductor’s acquisition last March by NXP Semiconductors for $12 billion. This transaction improves Avago’s relationship with Apple, since Broadcom is a major chipset supplier.

On top of these two announcements, it is rumored that June will begin with Intel’s largest acquisition in its history – buying Altera for $54 per share or $17 billion (more details from The Wall Street Journal report here). This would allow Intel to more tightly integrate future chipsets with Altera’s field programmable gate arrays, something that would strengthen Intel’s near lock on chipsets for the server industry.

Finally, there’s the acquisition of Liquid Web by the folks at Madison Dearborn (full release here). Best wishes to Jim Geiger and the rest of the management team as they continue to strengthen Liquid Web’s value proposition and distribution partnerships.

It’s (still) an Android world – May 2015 edition

This week’s column is a favorite for many and is definitely one of our favorites to produce. Since 2009, we have been tracking changing handset offers from each of the major wireless carriers. We have moved from handset exclusivity to homogeneity, from basic phones to smartphones (and wearable devices such as watches), from 3G to LTE networks and from heavy carrier subsidies to equipment installment plans.

These changes have come quickly and created an expectation of change among the smartphone population. Many of you have asked me: “What will happen when the pace of smartphone feature/network change slows down?” It’s impossible to tell, but if printers and personal computers are any indicator, the end game is not pretty.

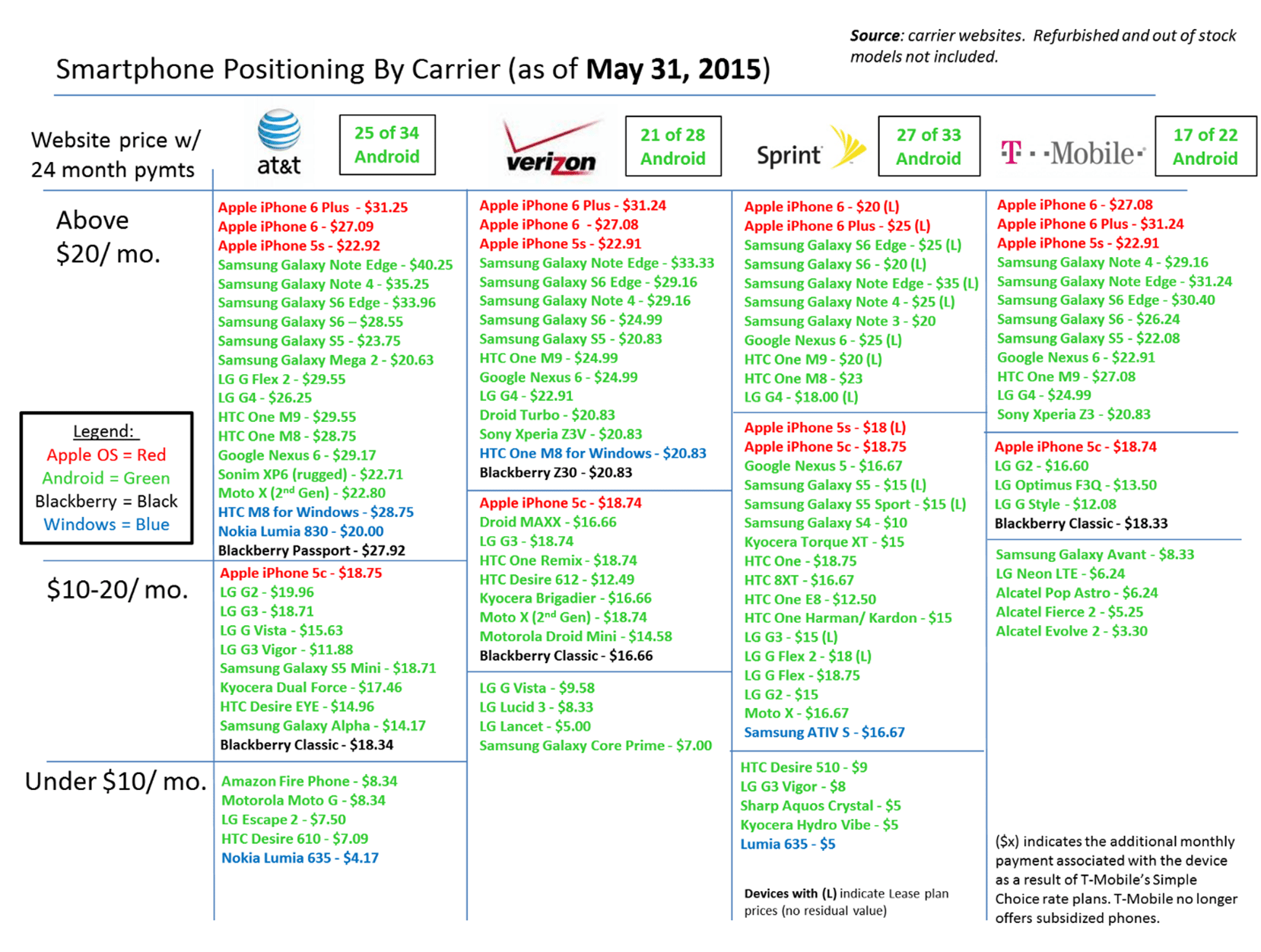

Before diving into the most recent snapshot, a few notes about our methodology as it has changed from November’s assessment. We have changed our AT&T Mobility view to show the 24-month pricing for all handsets (AT&T Mobility’s most commonly advertised rate is a 30-month purchase plan). This allows a better comparison between AT&T Mobility, Verizon Wireless and T-Mobile US.

We also have changed our tiers to correspond to the EIP monthly payment levels: 1) $20-plus; 2) $10-$20; and 3) less than $10. All handsets have been obtained through an examination of each carrier’s website and do not include refurbishments or specials (or the new Nokia 620 device).

Sprint’s comparison is a little trickier due to its leasing plans. As a reminder, with leasing, there is no residual value for the consumer after the lease term expires – the difference in the monthly rate roughly equates to an acceptable residual value. Sprint also bundles its plans with its “Unlimited” offerings, which may not be the same as traditional EIP plans. All devices for which the lease is promoted have been designated with an (L). As you can see, the list has grown significantly from last November’s look.

With those caveats, here’s the snapshot:

The first observation most will make from this chart is the “sameness” for Apple products. With the exception of Sprint’s leasing option, they are equal to the penny. In the subsidy-driven world, the carriers began to promote Apple devices more heavily, especially during the holidays and back-to-school seasons. This will be a tougher in a world where $1 to $2 per month in savings does not move the needle as much as a weekend special with $100 off any device.

The carriers are making up for new phone sameness with reconditioned iPhone “while they last” promotions. T-Mobile US and Verizon Wireless have become more aggressive in their selection of reconditioned iPhones on their websites, and the savings is usually $6 to $12 per month, which is 30% to 45% off new. While they are not included in the chart above, the rise of reconditioned devices is a real trend that leads to the “when the music stops” question described earlier.

On the topic of sameness, look at the pricing for higher-end smartphones between T-Mobile US and Verizon Wireless. They are the same devices, with the exception of Verizon Wireless Droid line, and very similar prices, but note that there are some circumstances in which Verizon Wireless’ EIP rate is lower than T-Mobile US’, likely a reflection of purchasing power more than anything else. With T-Mobile US aiming its “Never Settle” guns at Verizon Wireless, it should not be a surprise that this is the case, but the similarities are nonetheless striking.

What is interesting is that AT&T Mobility is able to command pricing premiums to Verizon Wireless for popular Android handsets. As a reminder, we are looking at the AT&T Mobility Next 24-month pricing, which requires that customers pay at least 18 months at the advertised rate before upgrading. The corresponding rate plan is for 24 months. AT&T Mobility advertises a 30-month plan, which requires 24 months of payments prior to upgrades. Look at the Samsung Galaxy S6 Edge – Verizon Wireless’ pricing is $4.86 per month lower than AT&T Mobility. The same holds for the Samsung Galaxy Note Edge – nearly $7 lower.

For comparison, look at the November 2015 listing (page 2), which shows AT&T Mobility’s 30-month Next pricing vs. Verizon Wireless’ 24-month Edge pricing. That should give you some idea that this is not a fluke – AT&T Mobility is commanding a small EIP premium.

While we have highlighted this in previous Android World columns, it’s worth noting that inventory obsolescence is heightened with EIPs. Look at the pricing differences among three generations of the LG flagship line (LG 2, 3 and now 4). At Sprint, there’s $3 in monthly costs among three generations. At AT&T Mobility, it’s about $7.50 and Verizon Wireless does not carry the LG G2 any longer (interestingly, the LG G3 is sold out at T-Mobile US). It used to be easier to clear the shelves of older-generation devices with limited-time “free” promotions. Now it’s not so easy, and, while the Android world assessment reflects online as opposed to in-store offerings, generational inventory is a big issue for the carriers in a monthly payment plan environment.

With the announcement of Google’s “M” operating system at its I/O conference last week (which we will cover in detail during June), the world was reminded of how important the Android ecosystem has become. Thinking about how the above chart translates into the retail store environment it’s easy to see how operating systems are driving layouts. On one side, the Apple allure. On the other side, the Samsung brand, with LG/HTC/Droid/others fighting for recognition. In the back, it’s BlackBerry and Microsoft/Nokia. We have settled in to a duopoly, at least for now, with applications integration, network performance and plan promotion driving carrier differentiation.

Wait six months, and it’ll all change again. It’s still an Android world, but other forces are about to change buying decisions. More on that in next week’s column.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.