Greetings from Chicago, Philadelphia (pictured – Bill Gravette from StepOne outside of Pat’s Steaks), New York City, St. Louis, Louisville and Dallas. Many thanks for everyone’s comments on last week’s Android World column. In keeping with the theme – we moved exclusively to an Equipment Installment Plan methodology last week – both Verizon Wireless and AT&T Mobility announced this week that they will not sell subsidized phones in their (or Apple) stores any longer. If you want an iPhone, you need to move to AT&T Next or Verizon EDGE. It seemed inevitable and, while I would like to believe that this change is occurring because of the awesome functionality (and unsubsidized price) of the September version of the iPhone, I think it has more to do with keeping the sales process simple, since Verizon’s EDGE and AT&T’s Next plans already add enough complexity. Read more on the change in this DSL Reports article.

In addition to the news of the loss of subsidized phones, it has also been reported this week that Apple is going to change the revenue split with the app developer community for certain types of applications (see article from the Financial Times here). This change will positively affect the amount of revenue that music and video applications receive from Apple. More on the changes were revealed at Apple’s Worldwide Developer Conference on Monday.

Driving the Apple revenue split change is the anticipated launch of the company’s revamped streaming-music service. A lot has been written on what the service will include (free vs. paid, DJ-assisted vs. unassisted, etc.) but the story here is a lot simpler than the articles imply: To be successful, Apple needs to do three things: 1) Develop the best music listening algorithms (historically the domain of Google/ Spotify/ Pandora); 2) Leverage the existing global iPhone base of over 200 million users (and the corresponding local ad machine that Apple has improved since their 2010 Quattro acquisition); and 3) Concurrently release a version of whatever streaming service they develop on the Android platform.

There are only a few examples in which Apple has fallen flat on a product release in the past decade, but two of them have been in the apps arena: iTunes Radio, which was released in 2013; and Apple Maps, released in 2012 and promptly declared one of the “Tech Fails” of the year by CNN. Based on feedback, both of these applications would be classified as “highly mobile,” meaning that more than 85% of the time users will reach for their iPhones to use the application, but it’s probably more than that for Apple Maps. The product, therefore, needs to be designed for mobile usage first, with any additional functions and features adopted for larger screens second.

Product is going to play an important role in any streaming-music launch. It will be very interesting to see how much of a rules-based vs. machine-learning (“Mississippi Queen” by Mountain costs less to play than The Allman Brothers Band’s “Ramblin’ Man,” so select that one next) approach Apple takes here. A rules-based approach is more hard-coded and driven by the things like Pandora “thumbs up/down” logic. It might look like this:

If Listener is playing “Freebird” by Lynrd Skynrd, and Listener has indicated “thumbs up” on “Ramblin’ Man” by the Allman Brothers, then play “Ramblin’ Man” next.

A machine-learning approach looks at the total inventory available and uses that to select the next play:

If Listener is playing “Freebird” by Lynrd Skynrd, play the live version of “Mississippi Queen” by Mountain because it’s lower cost.

To those of you who are long-time Pandora listeners, this logic makes complete sense. My wife’s Blondie channel plays ’80s tunes with regularity – no long ballads by Meatloaf or “Green Eyed Lady” by Sugarloaf. B-52’s, Go-Go’s, Joan Jett and others are the standard. For Pandora, this is based on nearly a decade of curation. The requirement to be continuously better, especially for a paid subscription, is going to be critical.

I will cover the other two points announced at WWDC in a future column, but it’s very clear that Apple has a major opportunity to develop a deeper engagement with its customers, and to use it to entice Android users to the Apple family. Apple has the music legacy and relationships – now it’s time to develop predictive playlists.

Before moving on to our main topic, I would be remiss if I didn’t ask for one thing out of iOS9: an Incoming Call Control API. Unlike Android – and Blackberry and Microsoft and Tizen – iOS has decided not to allow developers to access incoming call detail information, specifically the 10-digit phone number. This prevents iPhone users from identifying the caller or texter if not in your contact list, and their context (for all calls whether in contact list or not – think “last exchange” on Google Android that you see for each incoming call). This issue existed six years ago when Apple was still exclusive to AT&T, and its failure to release an API that enables applications that let you know your summer swim coach is calling to tell you your daughter injured herself at the pool is a failure of omission. It’s a big miss that is symbolic of Apple’s misunderstanding of the importance of contextual identification in a real-time communications world.

The urge to merge

As we discussed in last week’s column, the telecommunications space is rife with merger discussions. When will the AT&T/DirecTV merger get approved? Why does the Charter + Time Warner Cable + Bright House merger make sense, and where does this leave Cox, Cablevision and Mediacom? Can French telecommunications provider Altice, which recently announced that it would purchase Suddenlink Communications, execute a rollup of the U.S. industry? What are the implications of Frontier’s announcement that it would issue stock as opposed to debt to finance its most recent Verizon properties acquisition? Is T-Mobile + Dish the next Pugs Bunny?

Having witnessed the crippling effects of the Sprint/Nextel merger (one of the worst in telecom history), and the Sprint/Centel merger (one of the best in telecom history), here are some thoughts on what changes should drive increased merger activity in a relatively low cost-of-capital environment:

Cost synergies. While perhaps the most despised words in corporate America, it is, however, the reason why most mergers succeed. One operator that is extremely operationally efficient and has the margins to prove it, such as Bright House Networks, buys a weaker provider, such as Charter Communications, and improves the operations of the acquired business. Except in this case, Charter is buying Bright House (and Time Warner Cable), thanks to the leadership of John Malone and Liberty Global.

In the cable industry, and in the case of AT&T/DirecTV, cost synergies drive lower programming and equipment costs. They also drive efficiencies in handset procurement in the wireless industry (ask ALLTEL, who was acquired by Verizon). Cost synergies provide the foundation for all other value creation. That’s why scale-driven mergers are better received by the acquiring parties’ shareholders than any other type – they are the easiest to track.

Revenue synergies. Simply put, more sales resulting from more salesmakers and better products. This could be driven by expanded geographies (e.g., AT&T can expand their presence in South and Latin America because of DirecTV’s presence in the region; Comcast and Time Warner Cable would have generated more commercial services revenue because of their expanded market presence) or by the presence of two separate embedded bases (e.g., AT&T will sell more in rural markets because of DirecTV’s relatively strong rural market presence).

Revenue synergies are harder to identify and harder to track over time due to changes in market conditions. It’s also harder to distinguish between lower costs to acquire customers (a cost synergy) vs. merger-driven revenue synergies. When evaluating a potential merger, many analysts ask “What does the combination of these drive above and beyond that of a commercial agreement or partnership?” If it’s hard to clearly answer this question, the synergies are likely soft.

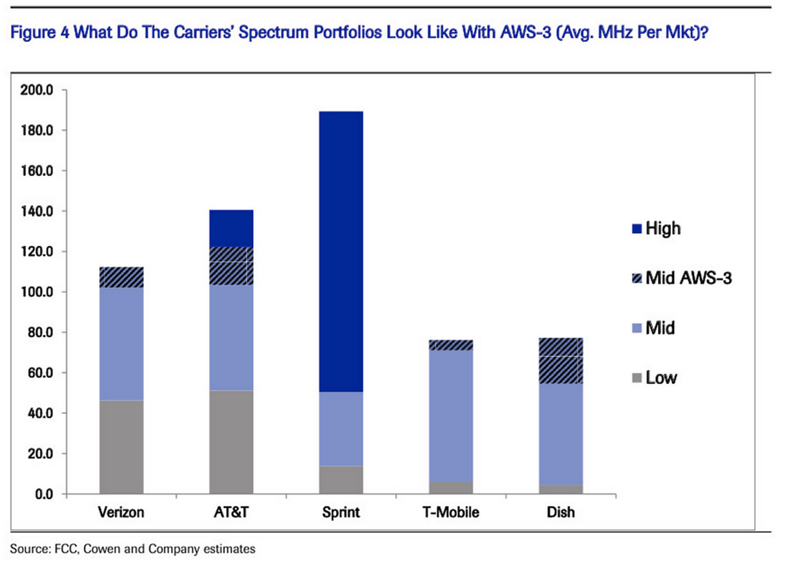

Asset scarcity. This is an ambiguous term as any scarcity argument should form the basis for a higher level of sales or profitability. However, as has been the case with spectrum-related merger arguments in the wireless industry (with the exception of Metro PCS – see below), some have argued that the mere perception of scarce assets (in the case of T-Mobile being purchased by Dish Networks, that would be midband or AWS spectrum) drives value.

Quite frankly, with spectrum or any other kind of asset (exceptions being natural resources like diamonds or gold or oil, or office space on a densely populated and growing island – in short, items for which there is a finite known quantity), there is no such thing as long-term asset scarcity. No telecom asset should be valued in the same manner as gold or diamonds. For example, the right to operate a cable franchise has a finite life. The probability that any franchise will be renewed is high, but there’s the persistent threat of over-the-top providers. Can Charter predict, for example, that its $6 billion in franchise assets will hold its value over the life of the asset? Probably, but to the extent those licenses are driven by video growth, there is risk in their overall value because of changes in the marketplace.

The story is even more confusing when valuing spectrum. As we have discussed many times in the column (see Verizon-focused Sunday Brief from earlier in the year here), it’s not the quantity of spectrum that matters, but the quality and the deployability of that spectrum. Medium spectrum capacity coupled with best-in-class local deployment capabilities is more valuable to shareholders than mass quantities of spectrum without local expertise.

One example where asset synergies worked is in T-Mobile’s acquisition of MetroPCS. The acquired company had solid 1900 MHz spectrum holdings which were perfect for T-Mobile’s growth needs. After extensive farming, Metro’s asset drove higher revenue and profitability for T-Mobile. The presence of compatible spectrum drove the purchase price for the assets. This example is the exception, not the rule, however, for most asset scarcity arguments.

When capital is cheap, and the threat of capital costs increasing appears imminent, mergers and acquisitions activity tends to spike. Valuations become more dependent on things that far exceed the useful life of known assets (also known as the perpetual value of the acquired company), and peer/recent multiples become the measuring stick for determining prices. Mania sets in. We are living in such a time and, without meaningful cost synergies, most M&A arguments are strained and should be carefully scrutinized.

Next week, we’ll start the discussion of the Top Ten events of the second quarter. Until then, if you have friends who would like to be added to The Sunday Brief, please have them drop a quick note to sundaybrief@gmail.com and we’ll subscribe them as soon as we can (and they can go to www.mysundaybrief.com for the full archive). Thanks again for your readership, and have a great week!

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.