Deciphering the top trends of any quarter is difficult, and the second quarter of 2015 is no exception. There’s a lot of “reading between the lines” to figure out what’s really going to move the needle. This week’s trends are based on several conversations over the past month with analysts and industry executives. For the next two weeks, we would like to hear from you. What’s moving the needle with your company/industry? What are the ripple effects of these decisions, and when will they be felt? Here’s your chance to (anonymously) make your thoughts known.

Trend 1: AT&T to Mexico – “Hablamos su lengua”

When AT&T CEO Randall Stephenson is not talking about DirecTV synergies (the deal was announced on May 18, 2014, and is still awaiting final approvals), he is talking about Mexico. For those of you who missed it, AT&T purchased two carriers in the past nine months, Iusacell (approximately 6 million subscribers; between 20 and 25 megahertz of 800 MHz spectrum; 39 megahertz of 1900 MHz spectrum) and business-focused Nextel Mexico (2.8 million subscribers; 20 megahertz of 800 MHz spectrum; 30 megahertz of 1.7/2.1 GHz spectrum). Both transactions have closed, and new AT&T Mexico CEO Thaddeus Arroyo is moving quickly to transform the acquired spectrum and customers into an AT&T-compatible network.

AT&T has a strong understanding of the network capabilities it has acquired, both current capabilities and the promise of LTE. However, it will have a lot to learn about buying habits – data plans, smartphone demand, disposable incomes – and municipal licensing (we take this for granted in the U.S. – Department of Transportation rights-of-way are not as easily granted). To start, AT&T is allowing corporate customers in Mexico to roam in the U.S. when they are traveling north. This is a far easier move than having AT&T’s massive enterprise base crush the Nextel and Iusacell networks by allowing them to roam for free when they travel south. But that benefit is coming – soon. It will impact the strength of AT&T’s corporate offerings for the 4 million to 5 million cross-border business travelers.

Next, AT&T will need to develop a coordinated retail presence in Mexico. Copying its success in the U.S., it’s likely it will have a mix of company-owned and dealer stores. AT&T will be uniquely advantaged with purchasing power across new devices for corporate customers and high-income individuals, but its real advantage will be in enabling an entirely new market for refurbished/off-contract smartphones. Given the 3G orientation of Iusacell’s network, and the limited budgets of many consumers, an Apple iPhone 4S might be a popular starting solution. And there are a lot of iPhones coming available thanks to AT&T’s Next plan adoption.

AT&T has expanded its distribution and market understanding through the acquisition of Cricket, which recently passed 5 million subscribers. With 3,000 stores in the U.S., and the fact that Cricket is the same word in English and Spanish, we might even see a brand expansion. On top of the Cricket experience, AT&T also did a stellar job of integrating the Centennial Wireless assets into its Puerto Rico holdings and currently control 38% of the total wireless market on the island, where they compete against America Movil and its Claro brand. While it will take several years to materialize, it would not surprise me to see coverage throughout Mexico’s population centers that looks like that of Puerto Rico (LTE coverage pictured).

Where does AT&T’s strategy leave T-Mobile US, and specifically, how should T-Mobile US respond to AT&T’s inclusion of unlimited calling/messaging to Mexico for selected Cricket/GoPhone plans? Would Carlos Slim be a better boss for John Legere than Charlie Ergen? To what extent will AT&T use America Movil’s towers (more on that opportunity here)? How far will AT&T’s enterprise play extend, and will we see capital spending include an inter-city fiber network? Most importantly, how will AT&T’s U.S.-based capital spending be impacted by additional requirements from DirecTV and Mexico (see here for a fairly damning article on AT&T’s residential capital shortfall and its impact on DSL availability). There are many questions to discuss over the next several quarters, but it appears that Mexico is going to be a top priority for the company for years to come.

Trend 2: Cable consolidation and the role of programming

In case any of you forgot, during the second quarter the Federal Communications Commission blocked the merger of the two largest U.S. cable companies, Comcast and Time Warner Cable. This allowed TWC to be included in the existing merger plan between Charter and Bright House Networks, which was originally announced on March 31. This three-way merger was announced on May 26 (full presentation here).

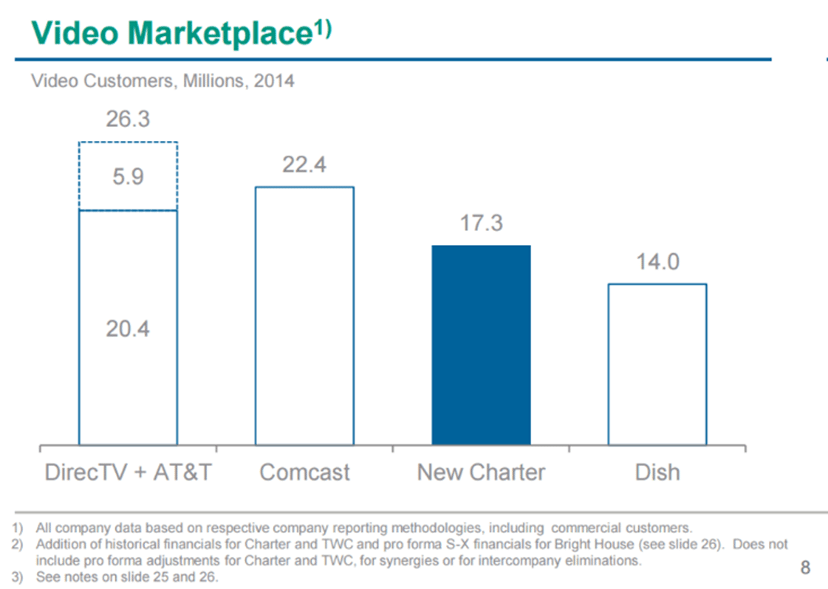

There are several reasons why these three companies are merging, but none is as big as programming leverage. In the synergy section of their combined presentation, cost synergies are promised based on “combined purchasing and elimination of duplicate costs.” While combined marketing and product organizations will save some money, this is primarily a case for increased programming savings due to scale. As the nearby chart shows, Charter will be slightly smaller than Comcast yet slightly larger than Dish. That puts Charter into a different league than they were as a separate company with 4.3 million subscribers. TWC’s programming costs of $1.4 billion in Q1 2015, made up 57% of total video revenue, and grew 8.5% vs. total revenue declines of 1%. Something’s got to give here, and more scale delivers Charter a stronger hand when it comes to negotiations.

Outside of management decisions, which appear to be more of a “best person for the job” than is seen in a traditional merger and acquisition transaction, there’s a lot of equipment purchasing power that can result in additional cost efficiencies. More scale may also drive more enterprise – and wireless carrier – decisions to cable, although all three companies are already working in tandem on nationwide enterprise opportunities.

There’s value to scale in asset-intensive industries. The new Charter will definitely enjoy a lower cost structure than TWC, Bright House or Charter experienced previously. But the merger will be considered a flop if they cannot squeeze 10-20% out of existing programming costs, or achieve other changes to the contracts that allow them to offer the “skinny TV” package options that Verizon announced in mid-April.

While AT&T and DirecTV share the same objective as the new Charter, the new AT&T entity will be applying its scale across North America. I would not be surprised to see additional consolidation opportunities emerge with Canadian operators Shaw, Videotron, Cogeco and perhaps even Rogers. On top of this, it’s highly likely that this merger will accelerate the Wi-Fi footprint for the combined entity (re: Charter is not a current member of the Cable Wi-Fi consortium).

We’ll write more about the state of cable next week, but the bottom line for the new Charter is this: Lower programming costs and grow existing opportunities faster, especially in commercial services. That will be a well-watched talking point for several quarters to come.

Next week, we’ll continue the trend discussion and talk more about Sprint’s and T-Mobile US’ trajectories (hint: one is not moving as quickly as the other).

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.