The Middleprise market ripens for in-building wireless technology adoption

As market education efforts have started to stick, venue owners are becoming acutely aware of the need for robust indoor cellular coverage to satisfy tenant and guest connectivity requirements not to mention the looming First Net public safety imperative.

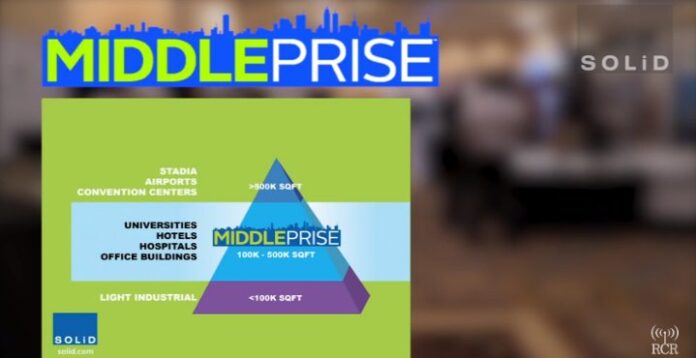

Distributed antenna systems (DASs) are firmly established as the technology of choice for large venues like exhibition centers and stadiums while small cells, based on ease of installation and comparatively low price point, are a mainstay for ramping up capacity in small buildings. But what about the venues that don’t fall into either category?

This emerging middle-enterprise space or “Middleprise” has an estimated total addressable market of $19 billion on the line and is becoming ripe for capitalization.

Mike Collado, vice president of marketing for leading wireless infrastructure provider SOLiD, defined the space: “This is the market segment of 100,000- to 500,000-square-foot venues where typically the technology toolkit, the business models, the design and infrastructure, and the need to fulfill and satisfy public safety mandates is a new challenge for the market and industry.”

He told RCR Wireless News that less than 2% of global Middleprise venues are currently penetrated with in-building solutions. “It’s wide open and it’s there for the taking.”

Earl Lum, president of ELJ Wireless Research, said that the Middleprise market isn’t just 10 or 100 potential customers, but rather tens of thousands.

It’s a seemingly natural migration of technology, however, SOLiD is quick to point out that the challenge for all of the Middleprise stakeholders are the multiple barriers that require new thinking to reduce complexity and ensure financial viability of deployments.

Technology and Network Infrastructure Variables

To date we have painted the Middleprise picture with a broad stroke. But the reality of the space is that there are myriad building types, market verticals and applications. This diversity simply means that no one solution is a perfect fit. Middleprise owners are facing more choices, design and infrastructure limitations, and end user requirements than they can imagine.

In-building deployments run the gamut of installation issues including RF inhibiting construction materials, installing cabling within historic or aesthetic architectural elements and space limitations for equipment including power, carrier BTS and remote units.

Nazim Choudhury, a software support and sales engineer for iBwave, highlighted some of the challenges during the recent DAS Congress and Small Cells Congress Middleprise tour. He stressed the need for comprehensive planning, with a keen eye on RF propagation metrics, prior to undertaking a DAS deployment. Understanding interference patterns and attenuation mitigation schemes helps break down barriers before field work starts, he said.

“It’s very important to get good RF information about the venue you’re serving.”

The Middleprise market will no doubt take full advantage of the multiple technologies and solutions available including DAS, small cells and possibly Wi-Fi. However, these multiple solutions combined with end-user requirements and varying building materials, create further complexity and barriers to Middleprise adoption of IBW technologies.

Lum said the new class of in-building solutions, said the industry has reached a make-or-break “inflection point where huge change is happening.” Technology vendors that “want to survive and make it to the next level, they’ll have to adopt and adapt.”

Lum commented that the fast pace of innovation has resulted in product options geared toward the Middleprise that previously weren’t available and that’s good news. “There are a lot of different options for solutions to the operators that didn’t exist one or two years ago,” he said. “Every one of these venues has to make a choice now.”

It’s critical that building owners make the right choice to ensure not only the proper performance of the solution but the competitive viability of their property in the market.

Funding and Ownership

Yesterday’s in-building wireless business models are falling under extreme scrutiny. The pressures of Total Cost of Ownership (TCO) are certainly an early barrier to Middleprise deployments. Developing a funding and ownership model that meets the venue owner’s ROI expectations, as well as the associated carriers’ financial impact is key.

Bob Johnson, senior director of communications and infrastructure and global strategies for Duke University, recently took part in the SOLiD-led in-building tour at DAS Congress. Johnson emphasized the ability of an in-building network to host multiple carriers, thereby maximizing the reach to end-users, while also spreading the cost of installation and maintenance across multiple parties.

Of course this implies those carriers, building owners and, possibly, the end users share in the expense of the network. And, while the Duke University model is carrier-funded, Duke owns the DAS. Johnson said,“We brought the carriers together, they agreed to pay their pro-rated share of the build out. This is cost neutral to Duke.”

Just like the variable associated with application and design, there is no silver bullet, one-size-fits-all approach. This is where new thinking will be required.

Emerging Middleprise ownership and funding models include venue-owned and operated systems and potential third-party solutions based on hoteling of headend equipment to support multiple buildings and campuses. Each deployment will no doubt have unique requirements and each stakeholder will need to examine the ROI both financially and competitively.

The Wild Card – Public Safety

As buildings get “smarter” we rely on technology to make them safer. In-building wireless public safety networks are slated to guarantee seamless first responder communication. However, these fire fighters, police and EMT personnel are often left with gaps in wireless radio coverage and a loss of cross-functional coordination. Emergency stairwell exits, underground parking structures and equipment rooms all require a responder to have access, but are often dead zones for two way radios. Distributed antenna systems are well-positioned to solve the problem; however, as local jurisdictions begin to adopt and implement new in-building wireless fire code requirements, building owners are left scrambling to meet the code requirements to insure occupancy and meet insurance requirements.

Chief Alan Perdue, executive director for the Safer Buildings Coalition and 36-year public safety veteran, indicated during the recent SOLiD Middleprise tour that DAS supports modern public safety needs by providing coverage in emergency egresses serving as the primary corridor for first responders.

“When we have an incident, this vertical shaft is what we utilize to get place-to-place. It’s critical that this environment stays a protected environment and that the coverage in this area is sufficient for them to communicate.” In response to a funding and ownership question, Chief Perdue added, “I think the key thing is not what does it cost to do it. What I would look at if I were a building owner is what does it cost me if I don’t do it.”

“Public safety is really the wild card in the Middleprise” Collado of SOLiD said. “Given the challenge of complying with public safety code requirements and the concerns – such as liability – among other stakeholders, it can potentially be an obstacle or catalyst for in-building cellular service.”

Typically, public-safety and commercial cellular are supported through separate, parallel networks, primarily because of code enforced performance and installation requirements. However, with the venue owner playing a key role in funding and ownership within the Middleprise, there likely will emerge an interest in leveraging a shared infrastructure to minimize in-building network investment costs while also meeting both code and competitive market forces.

The Middleprise Tour

SOLiD recently sponsored a unique tour and introduction into the Middleprise ecosystem. Guests at the 2015 DAS and Small Cells Congress toured the hosting 128-year-old hotel with key stops to discuss the challenges, opportunities and objectives of the Middleprise. Along the tour, SOLiD highlighted the installation of their solution installed in time for Super Bowl XLVII. If you missed the tour during DAS and Small Cells Congress, the tour highlights have been recorded and can be viewed here.