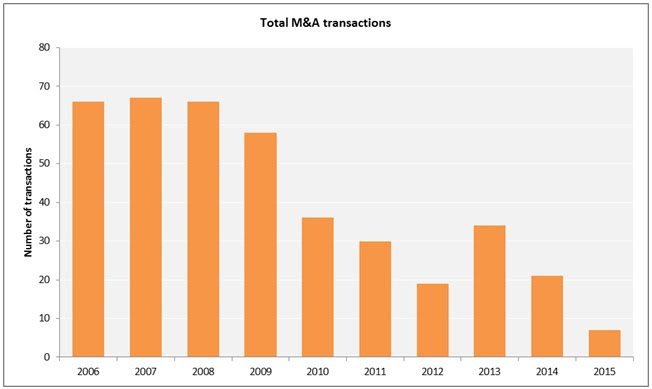

A new report from Ovum found 2014 telecom M&A deals less than one-third of 2007 high, cite increased competition

A new report from analyst firm Ovum claims a sharp drop in mergers and acquisitions across the global telecom market, which it said has led to increased competition and left investors with less cash in which to fund acquisitions.

Ovum claims the number of M&A deals dropped from 67 transactions in 2007 to 21 transactions last year. However, last year’s results were up from a low of just 19 transactions in 2012, though down from 2013 when 15 new acquisitions in Asia-Pacific and six in Eastern Europe fueled activity.

In addition to less money being made available to fund such deals, Ovum explained “many operators have also been spending heavily on next-generation fixed-line and 4G networks, leaving less money for acquisitions.”

So far this year, Ovum cited just a handful of deals being announced.

“M&A activity in 2015 only accounts for transactions in [Q1], of which the most significant was the sale of Global Telecom’s 96.81% stake in Orascom Telecom Algeria, known as Djezzy, to the Algerian state for $2.6 billion,” explained Mai Barakat, senior analyst covering the Middle East and Africa for Ovum. “Global Telecom, which is a unit of Vimpelcom, has kept operational control of Djezzy.”

M&A transactions, 2006-Q1 2015 (source: WCI, Ovum)

Bored? Why not follow me on Twitter