AT&T pushes fiber future, Samsung overwhelmed with iPhone users

AT&T recently held an analyst day to present a revised view of the company as a result of the DirecTV purchase (full deck and link to individual presentations can be found here). AT&T said a lot in a short amount of time, and, as this column has previously indicated, maintained the broadest objectives of any telecom company in North America. Here are some observations from a couple views of the conference:

1. Outside of fiber deployments, which were carefully outlined by John Stankey, CEO for entertainment and Internet services; the Mexico LTE buildout, detailed by both Stankey and CFO John Stephens; and the upcoming 600 MHz auction, which was not discussed at all during the analyst day, there are few new capital-intensive initiatives on the horizon. AT&T appears fully committed to fulfilling its merger obligations (we have written before that AT&T probably welcomed this condition), and went on to emphasize that in the process of bringing fiber to 14 million residences, they would also be connecting an additional 1.5 million new small and medium-size businesses.

The 14 million Gigapower homes passed include multidwelling units, many of which are served by DirecTV today through either a landlord/building owner agreement or through focused marketing efforts. One of the metrics that will be interesting to track is to see how AT&T presents offers to MDUs going forward. It would be entirely feasible to see the economics of high-speed Internet (gigabit speeds), wireless and in-building Wi-Fi services, and rich content (e.g., free HBO for “Sesame Street” fans) to be a part of any new deal. How far AT&T goes in its deal making (e.g., setting up the entire building as a data-free hot spot for residents) remains to be seen, but Stankey did not seem willing to rule anything out.

Because of its fiber expertise as a local exchange provider, no one sees AT&T’s new fiber initiative as an unachievable hurdle. Given the lessons learned/relationships developed from the recently completed Project VIP, however, this execution risk gets ratcheted down even more. Absent borrowing constraints, AT&T’s fiber commitment carries low risk and cements its ability to compete with cable across a large swath of their territory.

2. The revenue synergies from its merger with DirecTV are more than numbers on a page. Here’s what AT&T presented as the revenue synergy opportunity:

AT&T has already begun its targeting efforts for the 15 million existing DirecTV customers who are not already AT&T subscribers by offering $500 in incentives – $300 in bill credits and $200 in smartphone credits – for each smartphone ported. AT&T has also introduced a compelling two-way bundle, which goes three-way if you live in an AT&T high-speed Internet territory, that starts at $200 per month for four wireless and four high-definition digital video recorders and $230 to $250 if you add in AT&T U-verse. AT&T is automatically offering a $10 per month discount when customers bundle two products on one bill.

A 5,000-store network will help AT&T achieve these objectives in the short term, and it is clear that they have additional content and bundling promotions in development. Stankey alluded to the fact that certain content viewed over AT&T devices may end up being included in the wireless service price to the end customer. He did not elaborate any further.

3. Once the new home broadband platform has been established, AT&T appears to be willing to open it up to third-party content providers on a wholesale basis. While a lengthy quote, here’s Stankey on the wholesale opportunity from the question-and-answer session:

“[We will] also have unmanaged capabilities for distribution. That allows the platform to do things like wholesale capacity out to other folks who want to put video and entertainment on the platform. Why would you be interested in doing that? Well, the more consumption you get on video, the more bits it drives, the more dynamics that you get out into the mobile environment that helps customers engage with our mobile services, and on a usage-sensitive basis that’s a good thing.”

One example of a content partner could be the adult entertainment industry, which used to generate a lot of cash flow for the cable industry and was an early adopter of Internet technology. Another example could be unique sports content, such as live cricket matches from India or rugby matches from New Zealand delivered with 4K quality , or even an overlay “Texas Friday Night Football” network for zealous alumni. AT&T’s commitment to deliver a programming “channel” to the masses with high-resolution quality erases a large adoption barrier. This is only possible with an integrated platform.

During the Q&A, Stankey had an interesting unscripted moment when he established the definition of bundling success as “I want Comcast to regret the fact that they do not own a wireless asset and maybe have to do something about it.”

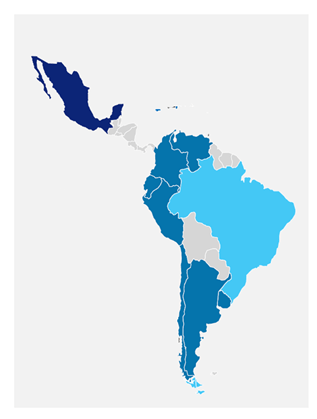

4. Latin America is the new frontier. Stankey included the map below of Central and South America for a reason. With wireless, broadband and content delivering increasing cash flow, AT&T is going to use the insights they gain from Mexico to expand southward.

One final observation that dawned on us after viewing the presentation a couple of times is that CEO John Donovan’s strategic network and IT capital needs are going to be disproportionately coming from Stankey and less from Ralph de la Vega. The Mobile and Business Solutions unit is increasingly being looked to for returns on the existing (VIP-led) invested capital (monetize LTE, deploy AWS spectrum, make Cricket more successful, etc.) while the entertainment and Internet services unit is being scored on realizing value and making new investments. This is not a blanket statement (and associating value generation between units in a bundle can be very difficult to delineate), but after few hours of watching the video we came away with a much better understanding of AT&T’s new structure. It will be interesting to see how this structure impacts its ability to execute.

Samsung – well rounded (and well noted)

Ten days ago, Samsung held an “Unpacked” event in New York City to reveal its latest large devices – the Galaxy S6 Edge+ and Galaxy Note 5. If ever there were two smartphones that were meant to be held sideways, these are it. The ability to record in 4K quality, exceptional display, wireless charging, a wireless keyboard attachment (read Ars Technica’s take on that feature here) and the S Pen make the Note an iconic device for both large smartphone screen fanatics and “phablet” fans.

This is also the first high-priced device to only be offered (except for AT&T Mobility) with a monthly fee: T-Mobile US, $29.17 per month; AT&T Mobility, $30.84 per month; Verizon Wireless, $29 per month; and Sprint, $30 per month for 24 months. AT&T offers the traditional subsidy pricing for $350 with a two-year contract.

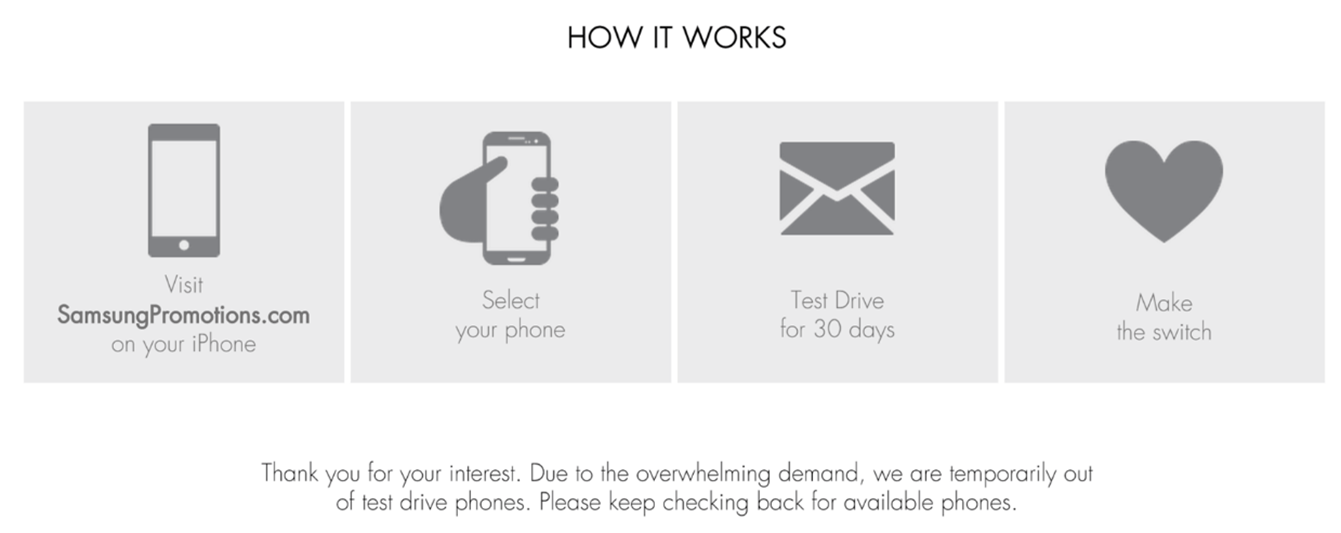

While the phone launched online and in stores last Friday, Samsung went a step further to attract Apple fence sitters (apparently there are many): Try the Galaxy 6 Edge+ or the Galaxy Note 5 for one month for $1 using your existing carrier. As many of you will remember, T-Mobile US tried a seven-day promotion about a year ago with the Apple iPhone 5S, and demand was good but not great. Note: Samsung’s promotional efforts with these devices is a separate effort from T-Mobile US’ and Sprint’s efforts to attract converts.

Within a few hours Samsung sold out of the devices it had allocated for this promotion (see picture below). The demand from Apple users – who had to sign up for the promotion from an iPhone browser – to see if the grass is truly greener was a lot more than anyone expected.

The Samsung Galaxy Note 3 was a terrific device – we had one with AT&T Mobility as the underlying carrier and used it daily for Evernote and also for an occasional conference call. It was a workhorse and hard to give up. We switched from AT&T Mobility to T-Mobile US and also switched to the Galaxy S6 Edge, which delivers stunning 90 megabits per second download speeds to our location in Dallas, Texas – the Note 4 had a different radio configuration. With an Otterbox case, however, the Note can be a bit bulky and definitely not for everyone.

Our guess is that Samsung was banking on a fairly high upgrade rate from the Note 3 base (if they had not already upgraded to the Note 4), and that no one estimated interest from current iPhone users. If you need to upgrade, expect to see a waiting line develop by September. Just as Samsung missed the popularity of the Galaxy S6 Edge, it’s likely demand for the Note will exceed expectations.

For two really good, balanced reviews of the device, check out this one by Mashable and this one by The Verge. If you recently upgraded to one of these two devices, we’re interested in hearing how you use them and your initial reactions.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.

Photo copyright: federicofoto / 123RF Stock Photo