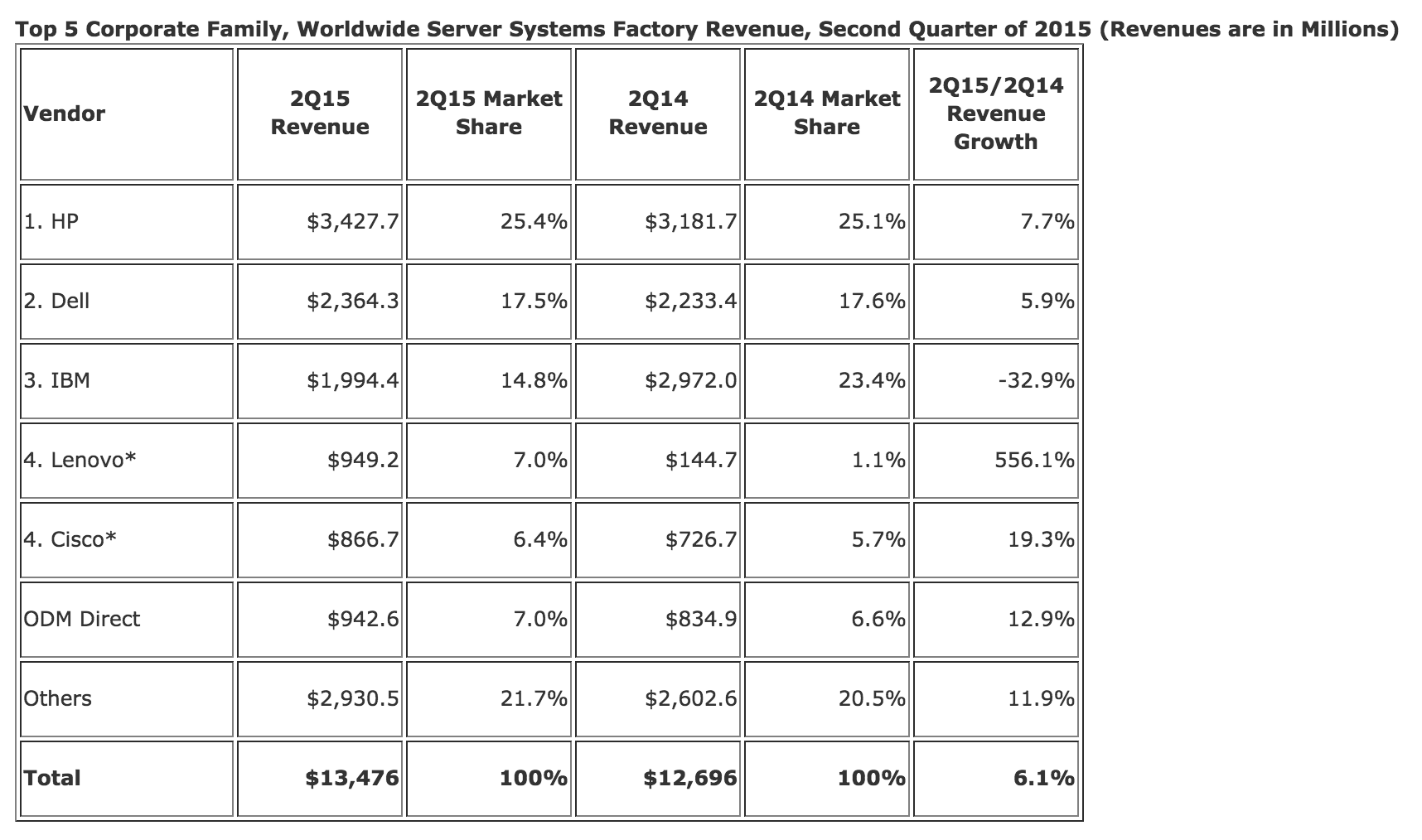

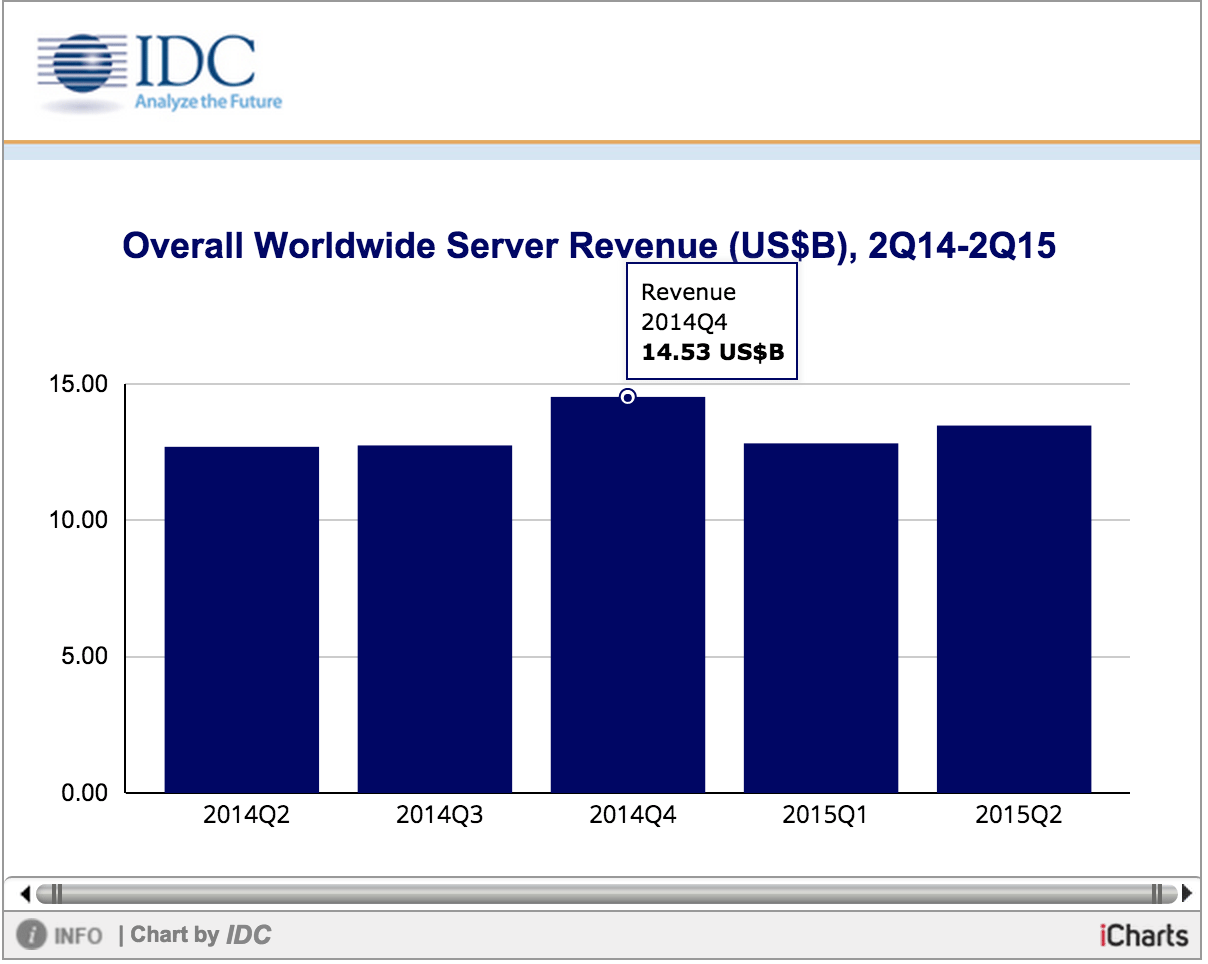

With the growing demand to store more data and increase processing power, server space is becoming prime real estate. According to IDC, revenue in the worldwide server market has increased by 6.1% over last year, raking in $13.5 billion in the second quarter of 2015.

The report found that revenue grew in rack-optimized, blade and density-optimized form factors, while towers declined slightly.

“The recent growth trend in the server market is confirmation of the larger IT investment taking place, despite dramatic change occurring in system software thanks to open source projects such as Docker and OpenStack,” Al Gillen, program VP of servers and system software at IDC said. “While we do anticipate an impact on product mix and potentially on volumes, it is too early in the adoption cycle for these new software products to have a material impact on servers today. In the meantime, the market demonstrated healthy revenue and shipment growth this quarter.”

Hewlett-Packard led the way with a worldwide market share of 25.4% in the second quarter of 2015. The company’s overall revenue from server services grew by 7.7% over last year. Dell grew 5.9% and now holds a 17.6% market share. IBM took the third spot with a market share of 14.8% losing 32.9% from the first quarter of the year in overall revenue. The fall is due to the unsustainable pace that IBM set with its z13 refresh.

“After a huge surge in revenue in the first quarter of 2015, IBM’s z13 refresh predictably continued into the second quarter at a more modest pace,” Kuba Stolarski, research manager of Enterprise Servers at IDC said of IBM’s slide. The study notes that IBM’s revenue is now associated with its POWER and System Z product lines.

Lenovo and Cisco came in at a virtual tie for fourth place in overall market share.

Other important findings from the study include the Asia/Pacific region, which has historically been dominant in revenue, being eclipsed for the second straight year by U.S. markets.

Demand for the x86 server also grew again with an 8.2% increase over last year while non-x86 servers declined by 1.4% from last year.

IDC’s Server Taxonomy maps the 11 price bands within the server market into volume server, midrange server and high-end server price ranges.