A lot of journalistic ink was spilled last week as media pundits tried to explain the mood of investors. “Don’t panic” was the most common theme through all of the gyrations, which included a brief period on Monday when Apple stock dipped below $93 per share – it closed Friday above $113. Most investors agreed, and markets began to stabilize, at least temporarily, by the end of the week.

Traditionally, the effect on the U.S. telecom market, and particularly the local exchange carriers, is muted. On Monday, no company was immune, with Consolidated Communications (ticker = CNSL), Telephone & Data Systems (TDS), and Fairpoint Communications (FRP) selling off at the market open. Each of these dividend-rich stocks closed at least 6% higher than Monday’s intraday lows by the end of the week. Given the fact that these companies are probably the least impacted by a slowing Chinese economy than any in the telecom space, it was good to see them close higher for the week.

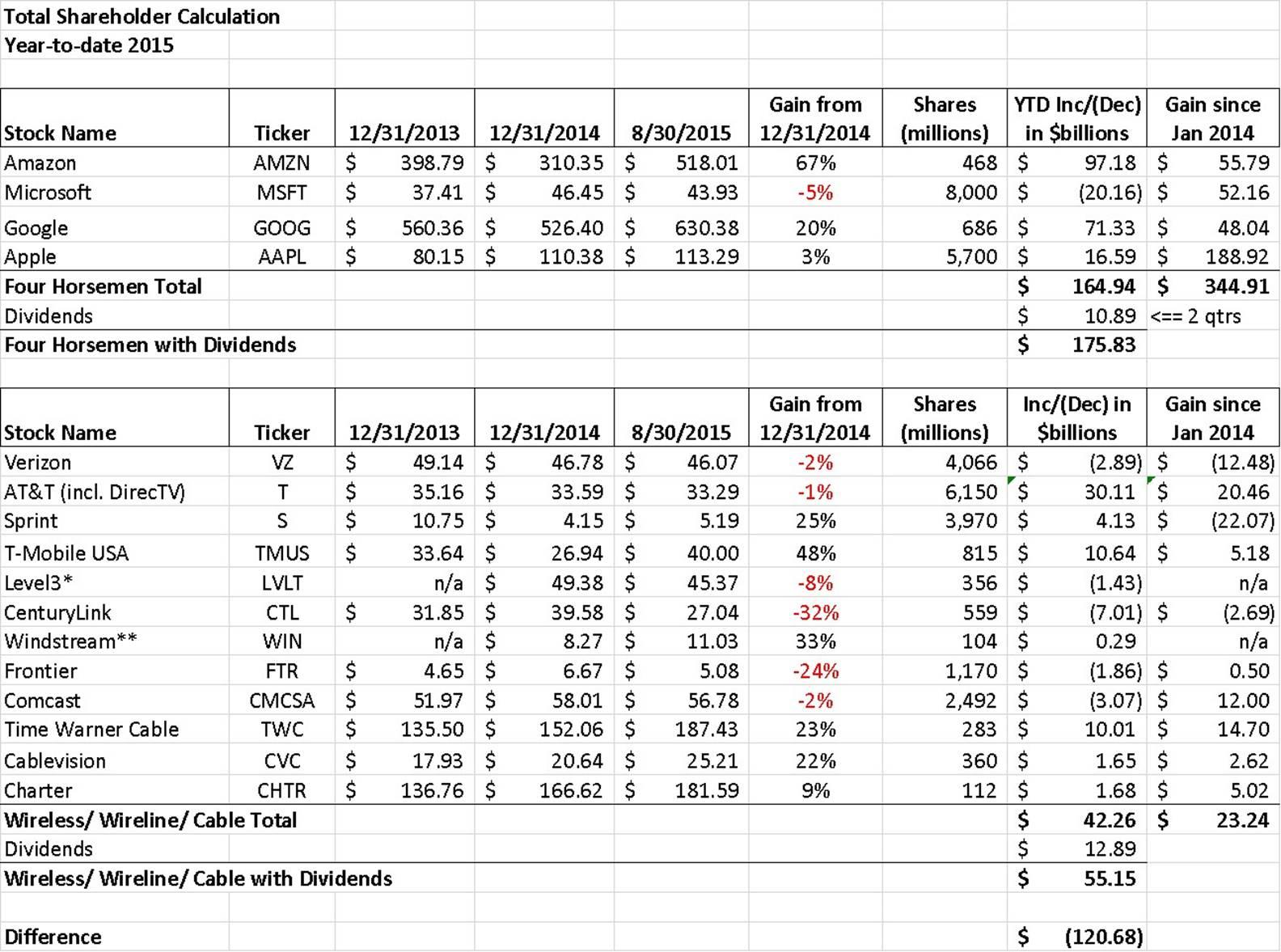

Twice a year, we look at the larger telecom players and gauge where value shifts are occurring between emerging models (Microsoft, Amazon.com, Google, Apple and occasionally we add in Facebook) and the bandwidth/services models (Comcast, Verizon Communications, AT&T, Time Warner Cable, T-Mobile US, Sprint and others). For many of you, these periodic looks (as well as the twice-yearly Android World issues) are the favorites of the year.

It’s important to keep in mind that this blog (and specifically the value-creation issues) should never be used as a stock-picking guide. The purpose of this issue is to see whether bandwidth providers – commonly known as the wireless, telco and cable industries – are adding value compared to the four or five largest business model challengers. We have no idea what long-term terminal value growth rate should be applied to any of these stocks, and gladly leave that up to others to determine.

A brief summary of how calculations are determined:

1. All stock information is sourced from Yahoo Finance and double-checked through Bloomberg.

2. For share quantities, we assume that market capitalization from Yahoo and Bloomberg are correct and include the appropriate share classes.

3. Rather than use an average number of shares during the period, we use an ending number and adjust as necessary (which you will see we had to do with AT&T for the DirecTV merger).

4. We adjusted the Windstream stock price for comparison purposes to include one-fifth of a share of their leasing company (that was what the WIN shareholder received on or about April 20, 2015). CSAL closed at $20.50, so $4.12 was added to the WIN closing share price to determine an equivalent amount.

5. AT&T added 960 million shares for the DirecTV acquisition since our last look. That’s about $32 billion in market value (or 1.5 Sprint equivalents) added from DirecTV.

6. Level3 figures now include the value created from their TW Telecom acquisition in June 2014.

7. Dividends have been accumulated for the first and second quarters and will reflect the entire year in our January issue.

With those caveats, let’s look at where shifts are occurring in the telecom and Internet sectors:

The bottom line is that the “Four Horsemen” have created $165 billion in increased market capitalization since the beginning of the year and $176 billion in overall value including Apple and Microsoft dividends. The telco industry has created value since the beginning of the year predominantly through the effect of one acquisition of one provider, i.e. the $32 billion DirecTV effect described above, which, if we had included the satellite providers in our original analysis, would have had a net minimal impact.

Bottom line: Bandwidth providers are less valuable today than their Internet software/product/services counterparts, and that gap is continuing to widen.

For the purpose of looking slightly longer than an eight-month period, and to attempt to even out dips and gains that can happen between years, we also included the market capitalization increase from the beginning of 2014. The numbers for the Four Horsemen are remarkably consistent – each (including Facebook) has produced $50 billion or more in market value since the beginning of 2014. And, while nervousness has continued to increase around long-term growth prospects for Apple, they have added more than 1.25 Comcast’s in total value since the beginning of 2014 (and, with their cash and marketable securities on hand, they could buy Comcast and T-Mobile US). This is a very different world than what existed 10 years ago, and the hundreds of billions in market value shifts are driving everything from neutrality policies (the demonization of cable companies by Google and others is laughable given the value shifts that are occurring) to merger approvals (Sprint+T-Mobile US; AT&T+DirecTV; Comcast+TWC). Apple + Google + Facebook + Microsoft + Amazon.com have a combined market capitalization of just under $2 trillion, all created within the last 30 years. While each is a remarkable story of entrepreneurial zeal, it’s important that their newfound power is properly balanced with that of the wireless, fiber and copper transport that enables their success.

Connect America Funding: who’s in and who’s out

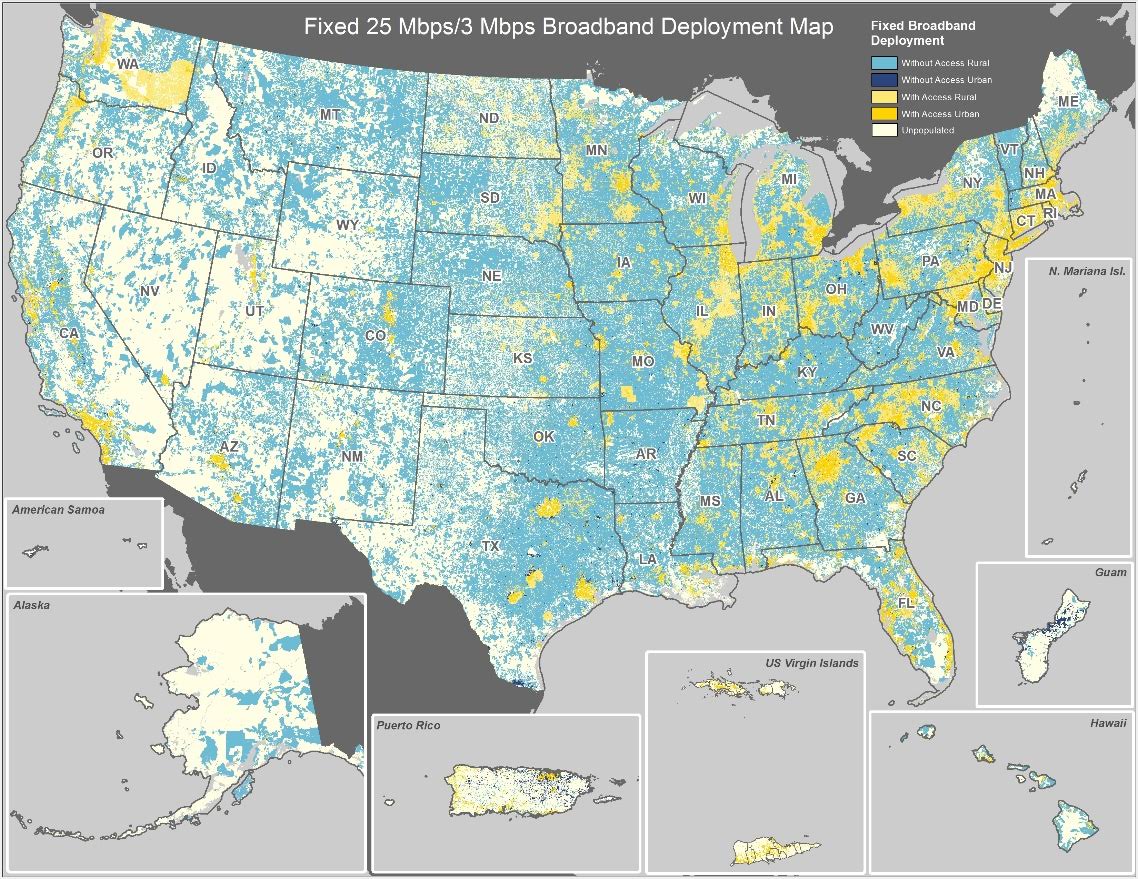

One of the important goals of the presidential administrations past and present is to provide all Americans with a baseline level of communications. Originally oriented for landline voice services, recent focus has shifted to include broadband (10 megabits per second downlink/1 Mbps uplink) speeds. The Federal Communications Commission recently announced a new phase to their Connect America Fund, called Phase II or CAF II, which provides incumbent carriers annual subsidies in exchange for construction commitments.

AT&T (2.2 million homes) CenturyLink (1.2 million homes), Hawaiian Telecom (11,000 homes), Windstream (105,000 homes) and Frontier Communications (650,000 homes) have all committed to plans to accept CAF II for a cumulative annual payment of $1.168 billion for the next six years ($300 per connected home per year). Even when including those built out under Phase 1 CAF, only 30% of the 14 million homes originally identified in the National Broadband Plan as lacking broadband speeds will have been connected.

What’s missing? Verizon’s plans. While they have accepted $48 million for states where they are in the process of selling their local operations (California and Texas, which likely become Frontier’s responsibility in early 2016), they have decided not to accept any additional funds in their predominantly Northeastern and Mid-Atlantic service territories.

This opens up a competitive bidding process for approximately $175 million in annual payments for 10 years (a $2 billion commitment). Could this be the trigger for fixed wireless solutions to emerge, provided they can meet/exceed the 10 Mbps requirement? Will rural cable companies (Mediacom, Suddenlink, Northland, Cable One, Charter and others) step up to challenge incumbent providers? Will the Federal Communications Commission relax speed restrictions if satellite is the only remaining technology alternative?

There are a number of questions remaining around the process, but $2 billion is not a small number and is likely to draw both scrutiny and innovation. For more details on the competitive bidding process and CAF history, this Davis Wright Tremaine brief on the subject is excellent.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.