End of summer greetings from Charlotte and Dallas. This week we will cover comments from two wireless CEOs as well as update the latest iPhone 6S Apple ship dates.

Apple orders: Thank you, China!

In a couple of events related to last week’s Sunday Brief on Apple, it appears that iPhone 6S and 6S Plus sales are off to a good, but not great, start. With the inclusion of China in this year’s preorder pool, Apple is “on pace” to surpass the initial weekend sales from the iPhone 6. A quick check of the carriers’ websites seems to back-up the claim that sales are good (all data as reported by carrier site as of Saturday, Sept. 19, at 5 p.m. Eastern Standard Time):

• Verizon Wireless’ ship date for the 6S is Sept. 30 and 6S Plus is Oct. 7;

• AT&T Mobility: 6S on Sept. 24; 6S Plus on Oct. 23;

• T-Mobile US: 6S on Sept. 25 except for Rose Gold (add three weeks for this color); 6S Plus is around Oct. 7 except for Rose Gold (also add three weeks); and

• Sprint: 6S on Sept. 25; 6S Plus during the week of Oct. 5 except for Rose Gold which is the week of Oct. 27.

For those who remember previous launches, iPhone 6S volumes will probably be closer to the 6/6 Plus levels of last year and not a disaster like the 5c (as Apple historians will remember, the 5s was not available for preorder). This is driven by both strong carrier switching incentives (e.g., AT&T’s $500/line offer to current DirecTV customers) and by T-Mobile US loyalists, who know that this is the first Apple device to have 700 MHZ band 12 capabilities (hear T-Mobile US’ John Legere explain more about band 12, a.k.a. Extended Range LTE, here).

Keeping up with expectations amid a weak upgrade cycle – the 5c/5s initial purchases were tepid and supply-constrained – is not easy. However, as discussed last week, the iPhone 6S series is a sizeable improvement to last year’s iPhone 6 models.

Last week, we also mentioned that “the real headline is not the iPad Pro, but the increased functionality and attractive pricing of the Apple iPad Mini 4.” This week, several reviews have emerged (such as this one from Ars Technica) which support our thesis. Sometimes the smaller headlines, including Apple’s push into leasing and increased carrier-neutral marketing, at its events have bigger impacts than expected.

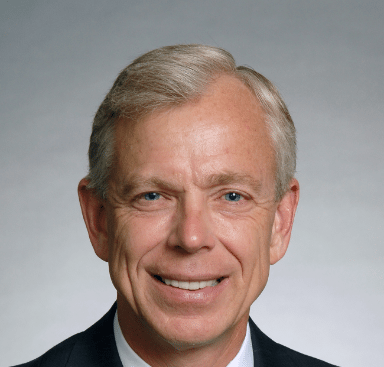

CEO Chatter (Part 1): Lowell McAdam’s Growth Dilemma

This week was the Goldman Sachs annual telecom conference and, with the exception of Randall Stephenson of AT&T, who was well represented by CFO John Stephens, all of the wireless CEOs were speakers.

Lowell McAdam of Verizon Communications was the first wireless carrier CEO to speak (materials here). After his conference appearance, Verizon Communications released a statement with a preliminary outlook on 2016. Because of hard-wireline comparables related to the sale of California, Texas and Florida properties to Frontier, as well as impacts due to “commercial model changes” in wireless (more installment plans resulting in lower service revenue) and earnings before interest, taxes, depreciation and amortization-impacting investments in Go90 (video) and “Internet of Things,” 2016 earnings will plateau before resuming their steady rise in 2017.

This is a big statement to be making in September given the many other multibillion-dollar business units under Verizon Communication’s control. What about enterprise growth, led by Terremark? What about wireless growth from increased movement from “Medium” to “Large” (and “Extra Large”) plans? What about FiOS growth from increased investments in current franchise areas? Basically, Verizon said “everything nets out at the end – the upside of the waterfall chart offsets the downside of the waterfall chart” (or, without being too sarcastic, there’s less low hanging fruit to pick up from Sprint).

Add to the muted expectations this interchange between Brett Feldman, lead telecom analyst for Goldman, and McAdam:

Brett Feldman, Goldman Sachs analyst: When we are sitting here again next year and we are thinking about how Verizon is positioned into 2017, what are we going to be talking about? What will have been the big things you will expect to have accomplished by then and what are you going to be optimistic about as you look into the following year?

Lowell McAdam, Verizon Communications chairman and CEO: Well, I hope we are sitting here talking about how wildly successful our mobile video product has been and how we’ve added additional facets to that product that make it even more interesting. I hope that we will also be doing something similar with over-the-top broadband into the home at that point. I think that we will be – I am fairly confident – we will have significant revenue coming from the “Internet of Things” and I think we will be up here talking about applications in areas of health care and transportation and energy management that people are going, “Wow, that’s really cool.” And then I fully expect there will be a third area that we have no idea what it is today that we will come up and we will say, “Wow, this is the big idea that will propel us into 2017 and 2018.” And I think 5G will be part of that and I think we will be reporting out on some of the early returns on that and I think we are probably going to be pretty optimistic about what it will do for the industry.

Lowell’s statement encapsulates Verizon Communication’s growth dilemma. McAdam had just finished telling the audience how puny IoT was ($320 million out of $64.2 billion for the first half of 2015), but it’s now a 2016 headline? I get Go90, but it’s an advertising play with some marginal pull through revenue for Verizon customers – could that generate even $300 million in advertising growth in 2016?

The third headline needs to be big – a $1 billion to $2 billion organic growth initiative that has a close relationship to the core networking business. More fiber, more data, more throughput, more data centers, more global, more service excellence, more customer trust. Playing the “our future is moving so fast our next revenue source could be anything” might play well for a company presenting at next week’s TechCrunch Disrupt, but not at Goldman Sachs.

CEO Chatter (Part 2): John Legere’s Donald Trump moment

To close out the Goldman Sachs conference, John Legere (CEO), Neville Ray (CNO) and Braxton Carter (CFO) presided over a lengthy Q&A session (webcast link here). They used the occasion to give an update on their net add performance for the quarter:

• Postpaid branded net additions of 1 million or more (960K as of the conference day);

• Postpaid branded phone net additions of at least 760K (equaling 2Q);

• Prepaid branded net additions of at least 500,000 (triple second quarter); and

• Total branded net additions in excess of 2.1 million.

This is in keeping with our view that as T-Mobile US expands its LTE network (at the 1900 MHz, AWS and at the 700 MHz spectrum bands), they are going to reach its current 17% market share much faster than the historical 1% per quarter penetration. Ray disclosed that it has deployed 165 million of the 190 million POPs where T-Mobile US has 700 megahertz of spectrum. Of equal importance, T-Mobile US has deployed or will deploy more than 1 million square miles of coverage in 2015 – fewer metro areas equals more traditional macro cell deployments.

Another interesting note from T-Mobile US’ disclosure is that some portion of the postpaid phone net additions had to come from current prepaid customers; the Smartphone Equality program was introduced in late January. T-Mobile US appears to be replenishing these prepaid customers at a faster rate in the third quarter than in either the first or second quarters.

All of this prior to their first super-fast iPhone (band 12) activation which will have a slight impact on the remainder of Q3 but a big impact on fourth-quarter results.

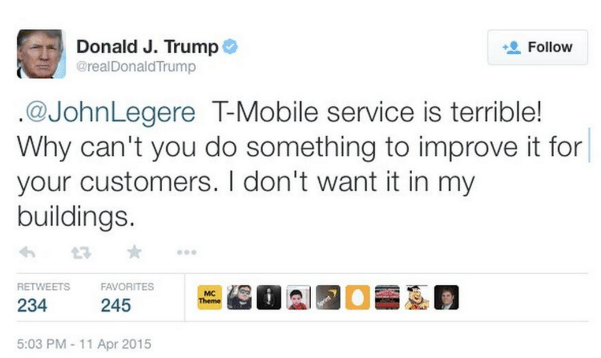

At the end of the session, Feldman asked John Legere the same question he asked McAdam. John’s response: “I may not be here because I may end up being the communications secretary for President Trump … when pigs fly (41:29 in the webcast link).” Several of the news reports missed the last three words of this quote and have little memory or appreciation of the Twitter fight Legere and Trump had in April, which resulted in Legere checking out of Trump’s hotel (full details of the what caused the fight here – it’s worth the read). Makes you wonder how folks like Trump and Legere communicated prior to Twitter.

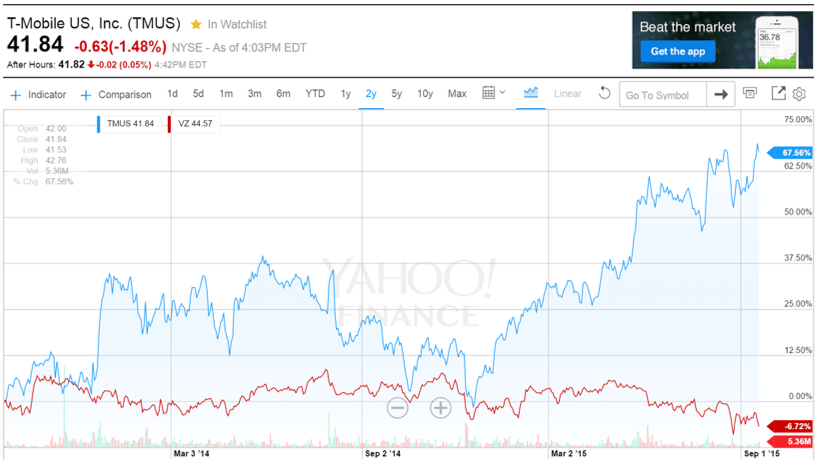

Bottom line: T-Mobile US is truly in the catbird’s seat. It has completed the conversion from subsidy-based to equipment installment plans. It is growing postpaid branded (including phone) subscribers at industry leading rates, and it is growing its retail prepaid base at an equally amazing rate. The carrier is (re)introducing itself to many communities with faster speeds on the latest iPhone. And it is stockpiling cash to grow even stronger in the upcoming 600 MHz auctions. It’s a good day in Seattle.

Next week, we cover half of the top events that are shaping Q3 results. Until then, please invite your colleagues to become regular Sunday Brief readers by having them drop a quick note to sundaybrief@gmail.com. We’ll subscribe them as soon as we can (and they can go to www.mysundaybrief.com for the full archive). Thanks again for your readership, and Go Royals!

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.