Stagnant growth in IT infrastructure investment to drive data center colocation market

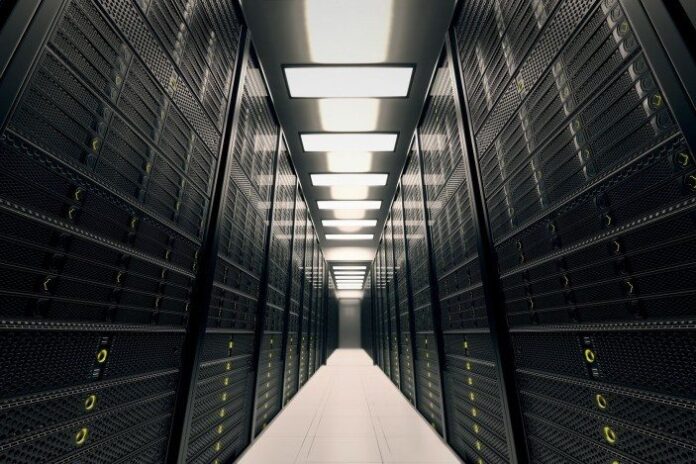

Information technology infrastructure is expensive. No matter how much data continues to transition to the cloud, it still needs a place to live in the analog world. With spending on IT infrastructure expected to remain stagnant over the next few years and data output growing exponentially, finding a cost-effective solution for data storage is becoming increasingly important. That is where data center colocation comes into play.

A 2015 report from market research firm Computer Economics found 10% of companies had plans to increase spending on data center infrastructure. Colocation is said to provide a cost-effective alternative for companies looking to moderate spending on new data centers. This is one key reason the data center colocation market is expected to grow from its current $22.8 billion in spending to a $36 billion business worldwide by the end of 2017, according to a new report from 451 Research. The report predicts “between now and 2017, the global [colocation] footprint will grow close to 75%, while global revenue will grow 63%.”

So far, a dominant company has yet to emerge in the market. The No. 1 data center operator, Equinix, accounts for 8.5% of total global revenue in the market. Kelly Morgan, research director for North American Datacenters, says geography is the biggest factor keeping parity in the market.

“This remains an extremely fragmented industry,” Morgan said. “The majority of colocation facilities are provided by local operators with only one to three facilities each. However, it is becoming harder for them to compete with the more geographically diverse providers that are now entering many local markets. We will see continued consolidation in this sector.”

Scalability, security and maintenance are other factors that make colocation a cost-effective business model. “With colocation you have the option of adjusting your amount of data center space as needed, paying only for what you use,” a blog post from data center operator OnRamp said. “As a result, you won’t have to worry about the costs of building a new facility, or wasting space in your current one.”

As far a security goes, OnRamp says “measures like bulletproof mantraps, a physical perimeter protected by two-factor authentication and 24/7 closed-circuit monitored video surveillance all contribute to a high level of physical security to protect colocated equipment.” Other services and resources data center operators often offer tenants include cooling, power and bandwidth.

According to Optimal Networks, an IT support and consulting firm, when factoring the cost-benefit of colocation, you must take into account four factors: rack space, Internet, support and setup. Prices per “U” of rack space range from $100 to $300 per month.

“Generally, this monthly fee will include a pre-set allotment of bandwidth and IP addresses,” Optimal Networks said in a blog post about data center costs. “If, however, you have incredibly dense equipment or the need for an incredibly large number of IP addresses, your provider will likely tack on an additional charge.”

Server monitoring is another cost that should be taken into account. Optimal Networks set the price range for that service at “anywhere from $75 to $400 per server per month.” Finally, there is often an implementation cost associated with renting rack space, which often adds up to a one time cost of $500 to $3,000 in engineering labor.

So what does the future hold for this growing industry?

“Customers are getting smarter about what they want from their data center providers; enterprises use more and more cloud services, and the role of colocation data centers as hubs for cloud access is growing quickly as a result; technology trends like the ‘Internet of Things’ and DCIM are impacting the industry, each in its own way,” Yevgeniy Sverdlik of Data Center Knowledge predicted in a blog post.

Bob Gill, research director at Gartner, outlines eight factors to watch in the future including the growing role of data structure infrastructure management, edge computing, the “Internet of Things” and the cloud.

Gill says DCIM is set to have an impact both internally and externally on colocation providers. “Internally, providers use it to improve efficiency and resiliency, making more informed decisions about their infrastructure using empirical data,” he said. “Externally, many use DCIM to provide customers with insights into their power usage.

The need for companies to store data in areas that have not traditionally needed data centers is driving the growth of edge data center space. Gill says providing services in edge markets “is a complex business model, since it requires lots of connectivity to and from the data center, internal interconnection as well as WAN capacity.”

The “Internet of Things” is expected to play an increasing role in the data center market, not only as a producer of data to be stored, but also a part of the colocation ecosystem, supplying IP-connected temperature and humidity sensors, power meters and CPUs that transmit operational server data.

Finally, the cloud is seen as the single most important variable driving the need for more server space.

“Cloud and colo are natural-born allies,” Gill said. “The cloud has to live somewhere.”

While companies like Amazon.com and Microsoft build their own data centers to house much of the infrastructure that supports their cloud services, they are also massive colocation customers, using data center providers to expand in places where for one reason or another they don’t build their own facilities.”