Verizon VP ‘set[s] the record straight’

Vermont Sen. Bernie Sanders, who’s seeking the Democratic Party nomination for president, has taken a hardline stance on what he sees as corporate tax avoidance. In a recent Twitter post, Sanders, or whoever runs his Twitter account, name-checked Verizon Communications as not paying its “fair share.”

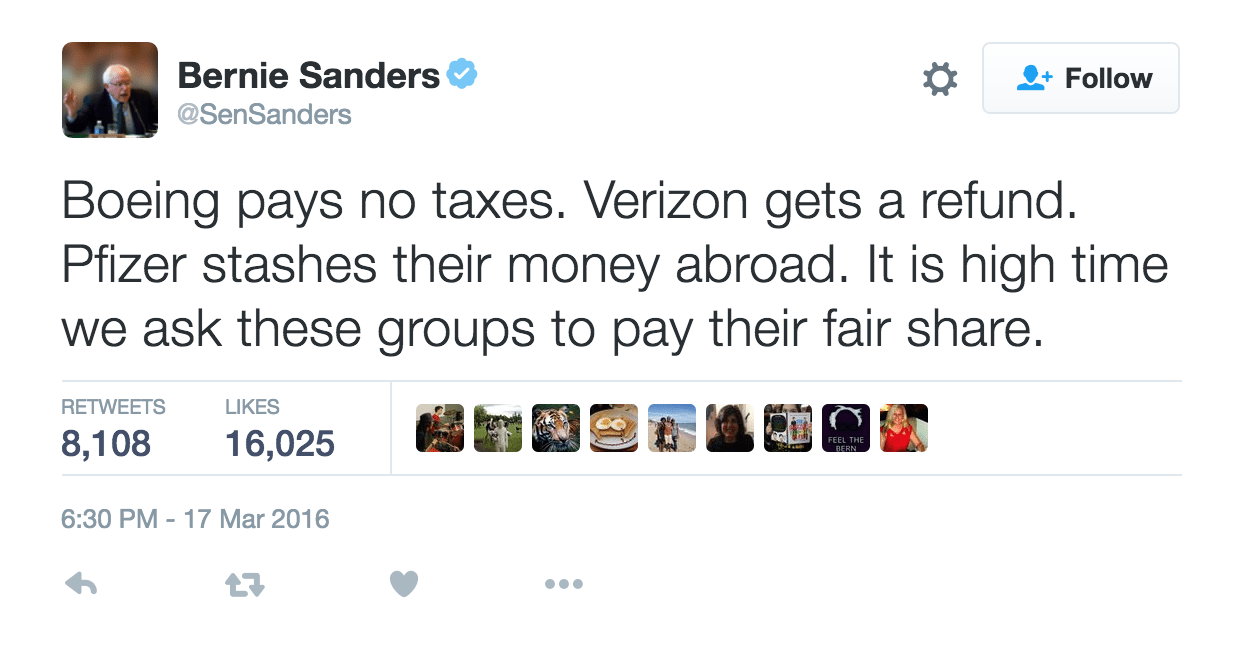

The tweet reads in full: “Boeing pays no taxes. Verizon gets a refund. Pfizer stashes their money broad. It is high time we ask these groups to pay their fair share.”

The Sanders campaign further clarified in a post to its website titled “America’s Top 10 Corporate Tax Avoiders.”

The Sanders campaign alleges from 2008 to 2013, Verizon made $42.4 billion in domestic profits while receiving a total tax refund of $732 million from the Internal Revenue Service.

“Verizon’s effective U.S. corporate income tax rate over this six-year period was -2%,” according to the post, which also says in 2012, Verizon “stashed $1.8 billion in offshore tax havens to avoid paying U.S. income taxes. Verizon would owe an estimated $630 million in federal income taxes if its use of offshore tax avoidance was eliminated.”

The Sanders campaign post also calls out Verizon CEO Lowell McAdam for making $15.8 million in 2013, while pushing “to raise the eligibility age for Medicare and Social Security to 70, and make significant cuts to Social Security.”

Verizon came in at No. 3 on the Sanders’ campaign list, which included around Verizon in order, General Electric, Boeing, Bank of America, Citigroup, Pfizer, Federal Express, Honeywell, Merck and Corning.

Mark Mullet, VP of federal government relations for Verizon, wrote in a blog post: “In any election year, there’s always an extra amount of rhetoric about corporate taxes. But sometimes basic facts get lost in the claims and counter-claims. For example, there is a lot of misinformation about how much Verizon pays in taxes.

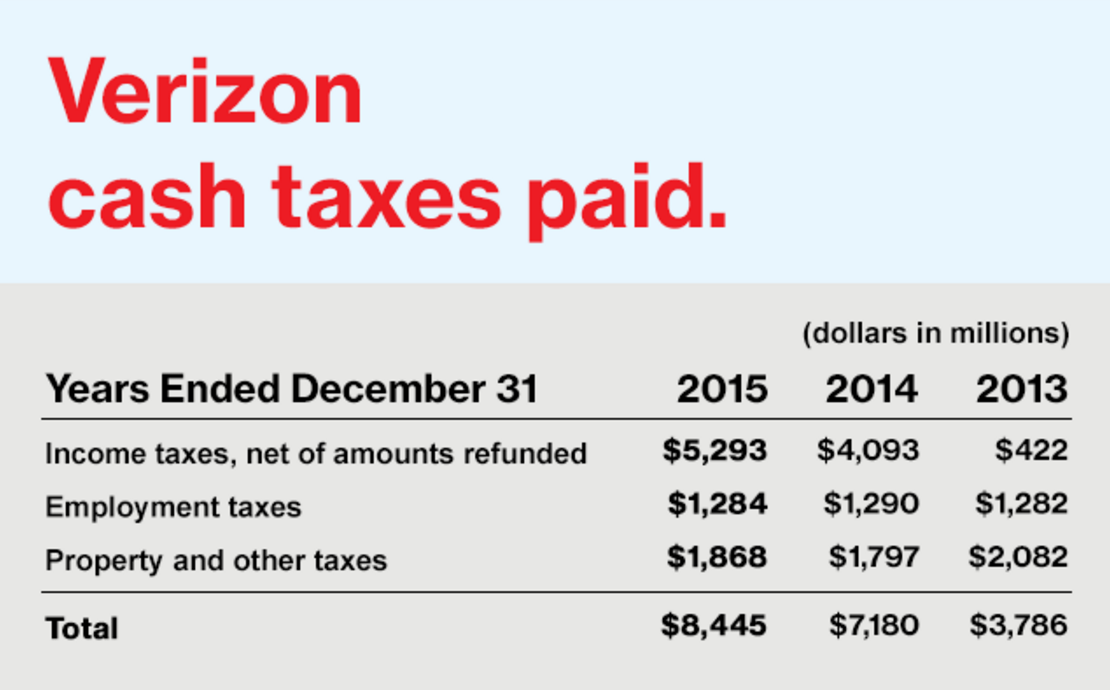

“Let’s set the record straight: Verizon complies with all tax laws and pays the taxes it owes under the law. In 2015, that amounted to $8.445 billion. That’s $5.293 billion in income taxes (net amount of any refunds the company received); $1.284 billion in employment taxes related to its 177,700 employees; and $1.868 billion in property and other taxes. These are the tax dollars that Verizon actually paid, as attested to by the company’s CEO and CFO, and verified by an independent auditor. The company reported these totals in its recent 10-K, which was filed with the [Securities and Exchange Commission]. This is even more than the $7.180 billion that Verizon paid in taxes in 2014.”

Mullet went on to put the system on trial: “The U.S. corporate tax rate is the highest in the world, but there are too many loopholes. This is counterproductive and results in U.S. companies being uncompetitive on the world stage.”