The recent plan from Sprint to cut capital expenses has many industry observers wondering if the carrier can remain competitive in the market

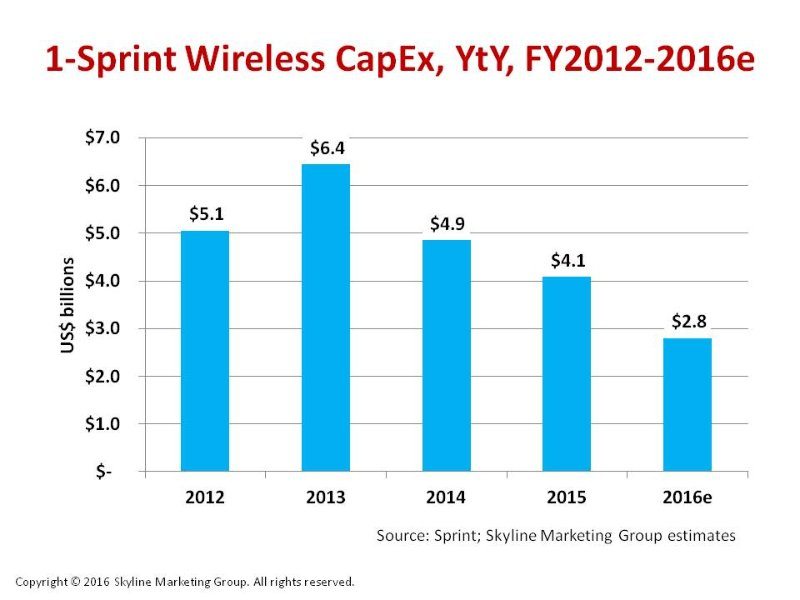

Sprint provided guidance of $3 billion in capital expenditures for financial year 2016, in its recent earnings call. Of that total, we estimate $2.8 billion will be applied to its wireless infrastructure with the balance going to its wireline network.

What this means, though, is that Sprint’s annual wireless capex will nosedive a stunning 32% from the $4.1 billion spent in FY2015. Here’s the big question: Can Sprint achieve its densification goals at these significantly reduced spending levels?

Sprint’s network investment peaked in FY2013 at $6.4 billion as the company was accelerating its LTE rollout and absorbing the Clearwire acquisition. From that peak, annual capex has declined at a compound average growth rate of -24% through FY2016.

Over that same period, Sprint’s capex-to-service revenues ratio steadily has dropped from 22% in FY2013, to 18% in FY2014, and 16% in FY2015. Ratios above 15% indicate network expansion and investment for capacity and coverage expansion while ratios below 15% suggest that the carrier is operating its network essentially in a maintenance mode with minimal expansion.

Through the FY2013 through 2015 period, Sprint has continued to expand its network, albeit at a declining rate. With FY2016 capex guidance and at the current 5% per year run rate for service revenues, that ratio now drops to 12% in FY2016.

This capital spending drop is a function of several factors: near completion of the LTE build out; cash conservation measures as the company is weathering liquidity issues; and a shift to small cell deployments and away from new macrocell builds. On the latter point, the company believes it still can meet its network densification goals by ramping up its small cell roll out for indoor and outdoor applications and leveraging its significant holdings of about 120 megahertz of 2.5 GHz spectrum. It is interesting to note that a lot of 2.5 GHz infrastructure is already in place at many tower locations. So it may be possible just to upgrade the outdoor base stations to LTE without having to build brand new 2.5 GHz macrocells, thus conserving capex.

Sprint’s densification plan calls for extensive small cells deployments in the “tens of thousands” both indoors for small- and medium-sized businesses, and at street level in major markets. The company recently signed a supply deal with Commscope for the S1000 indoor small cell that can operate a combined 2.5 GHz/Wi-Fi operation. Sprint has not identified its outdoor small cell supplier.

By leveraging small cell technology, Sprint believes it can continue its network capacity expansion even at a significantly lower capex levels and without committing to long-term tower leases. Furthermore, as existing tower leases expire, the company will look at options for relocating antennas to lower-cost infrastructure where feasible, thereby lowering operating expenses.

Two caveats to keep in mind in this scenario.

First, the cost of small cell equipment is in the order of one-tenth the cost of a macrocell, but when you factor in the costs for site acquisition (permitted pole attachments and rooftop locations), site engineering, installation and testing, the overall small cell deployment cost can easily double. So a reduced capex budget may not allow Sprint to buy as many small cells that it may need to meet its densification goals.

Secondly, moving a macrocell to lower-cost infrastructure alternatives is not straightforward. On the contrary, the original radio frequency design placed that macrocell at that location for a reason, namely, that location provided the best cellular coverage for that given area. Moving it will require a new and costly RF design, and another round of site acquisition activity.

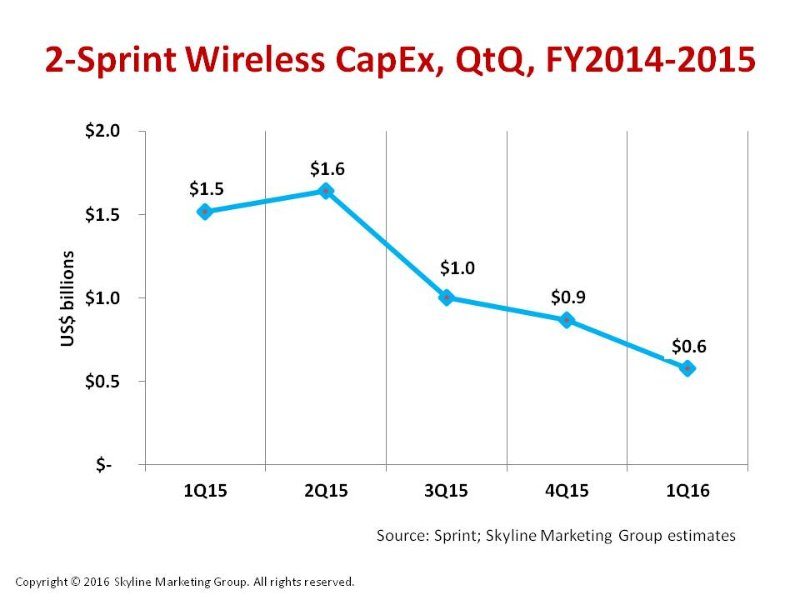

What capital spending levels can Sprint’s suppliers expect for the balance of this year?

This graph shows Sprint’s quarter-to-quarter spend going downhill over the past 15 months. Historically, Sprint’s quarterly capex has averaged $1 billion to $1.5 billion. Now the QtQ capex run rate has dropped to less than half that amount. Given the FY2016 guidance, we expect Sprint to invest $600 million to $700 million per quarter in the next 12 months.

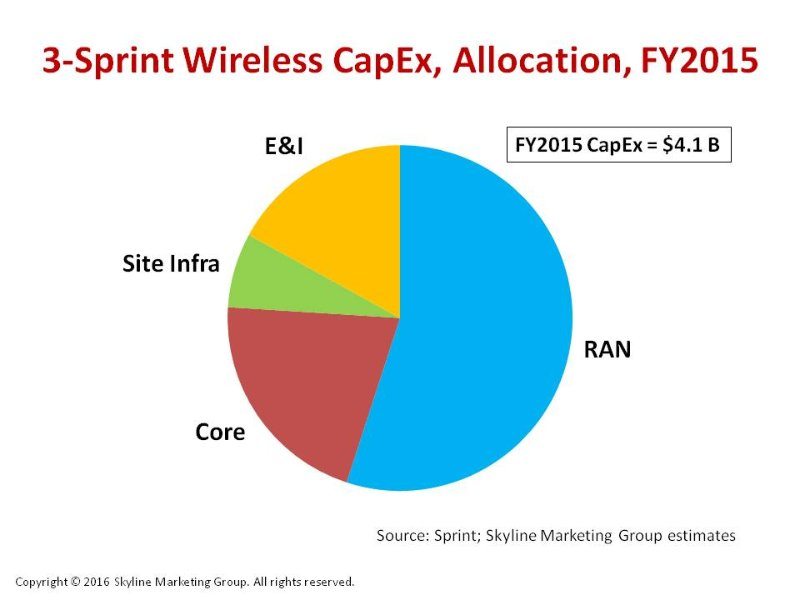

How is Sprint’s capital spending allocated?

This graph shows a rough breakdown of Sprint’s capex in FY2015.

Over half of the total spending is allocated to the radio access network. Most of the RAN investment is in the radio equipment. This includes macro base station equipment [base transceiver stations and baseband unit/remote radio head configurations] and small cells. For the next several years, small cells operating across Sprint’s available spectrum is expected to garner the bulk of the RAN investment.

Supporting the radio equipment, a smaller portion of the RAN segment includes what we call the “RF subsystem” that consists of antennas; fiber optic and coaxial cable; combiners; filters and splitters; and tower-mounted amplifiers.

We also include backhaul in the RAN segment, specifically where Sprint purchases its own point-to-point microwave systems. Leased backhaul fiber optic or copper cable facilities typically are accounted for in opex, not capex.

Core network capex accounts for nearly one-quarter of the total. Core equipment includes legacy voice switching systems; data switches and routers; servers and storage devices; software-defined network and network function virtualization platforms; operation support systems and billing support systems.

Site infrastructure, roughly 7% to 10% of the total, includes towers and shelters; antenna mounts for all types of installations (towers, rooftops, water towers, etc.); back-up power; lightning protection and grounding. Engineering and installation ranges between 15% and 20% of the total, and encompasses all the professional services needed for site planning; site acquisition and permitting; site and RF engineering; and installation and testing.

Sprint is making valiant effort to shore up its financial position as it leverages new small cell technologies to reduce infrastructure expansion costs, even as service revenues erode. We should know in short order how well this strategy is working.

John Celentano, a telecom industry veteran, offers expert analysis and strategic marketing advice on wireless and wireline infrastructure markets to equipment manufacturers and service providers. Questions?: jcelentano1@gmail.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.