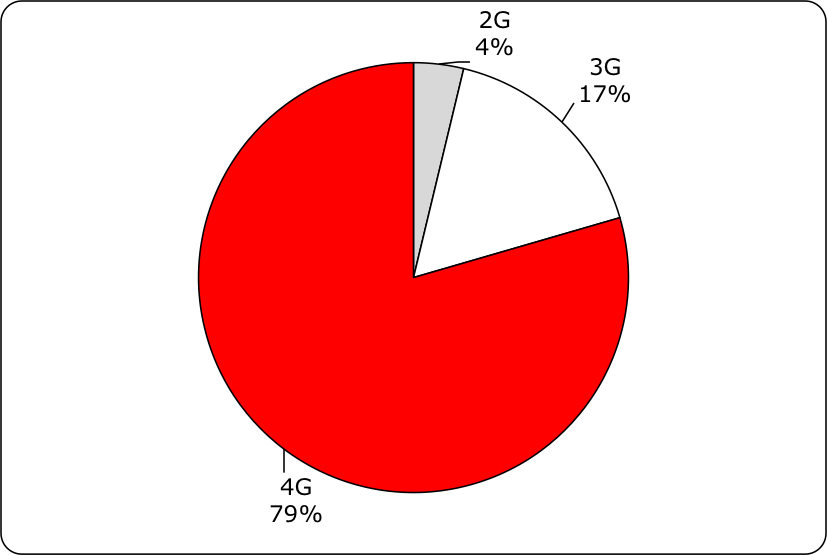

EJL Wireless Research just published its new macrocell base station market analysis and forecast research report. The findings indicate the overall market grew by 16% in 2015, and reached record shipment levels with Huawei Technologies still the number one supplier. LTE technology also represented 79% of overall macrocell base station shipments in 2015.

Global macrocell BTS shipments by technology generation, 2015

Source: EJL Wireless Research

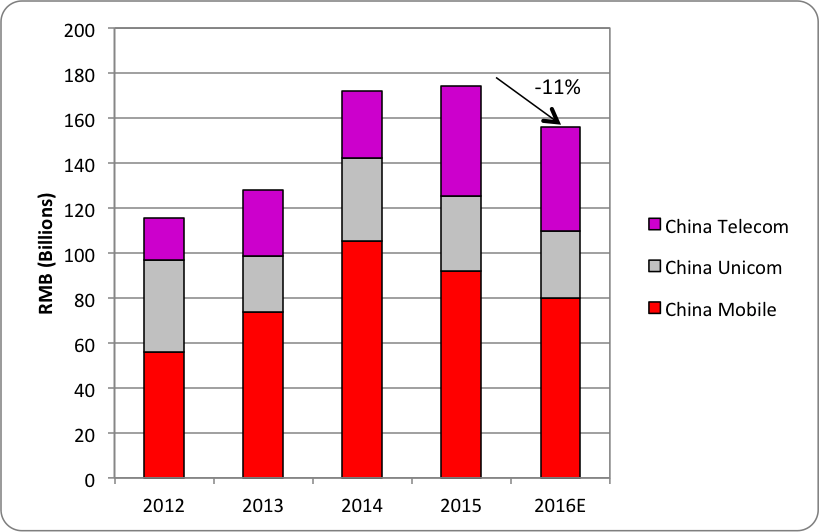

While the last two years have been record breaking years despite severe chaos within the supply chain, the outlook for 2016 is difficult given reduced capital expense spending in China for mobile operators. EJL Wireless Research is forecasting a 12% decline in macrocell base station shipments in 2016, with continued downward pressure in 2017 and 2018. The market has been riding the Chinese “4G” wave since 2013, and it has been a wild ride. However, the 4G deployments in China have peaked and are now slowing down. The network sharing agreement between China Unicom and China Telecom is also impacting demand for FDD-LTE macrocell base stations.

Chinese mobile operator capex spending, 2012-2016 (estimate)

Source: China Mobile, China Unicom, China Telecom

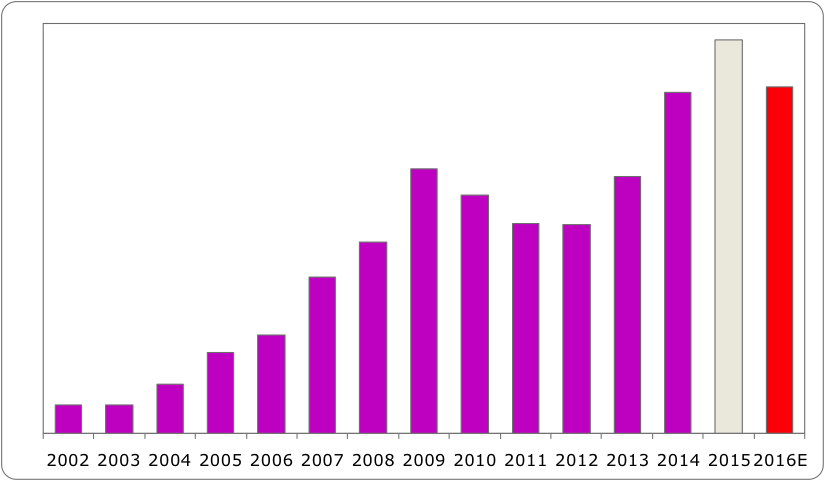

EJL Wireless Research has been tracking macrocell base station shipments since 2002. The time period between 2002 through 2010 was driven by GSM upgrades and widespread adoption of UMTS technology. Initial LTE shipments began in 2009, and China Mobile’s rollout in late 2012 for TDD-LTE marked the starting point for the most recent upward cycle in demand from 2013 through 2015. While India as a market has returned, it is unable to fill the void left by the demand slowdown in China.

Global macrocell BTS shipments, 2002-2016 (estimate)

With “5G” deployments beyond the 2020 horizon, this puts the industry in a delicate situation during the period of 2016 to 2020 that EJL Wireless Research is calling the “5G chasm.” While “4.5G” upgrades, additional spectrum availability and 3GPP Release 13 and 14 upgrades will create demand over the next five to 10 years, it is unclear if the next bottom of the demand cycle turns the clock back to 2011/2012 shipment levels.

Analyst Angle: 2016 outlook for macrocell base station market murky

ABOUT AUTHOR