Comcast to focus on offering cellular services to cable TV and internet customers, while also leveraging access to 15 million Wi-Fi hot spots

Comcast: Your wide-area, wireless services provider. On one hand, thinking of Comcast as your wireless network services provider seems outrageous. What do they know about running a wireless business (other than owning more than 15 million Wi-Fi hot spots)? On the other hand, because they have an arrangement to use the Verizon Wireless network, it makes great sense for them to provide current customers with cost effective packages for cable, Internet, telephone and wireless.

Comcast CEO Brian Roberts recently said the company plans to exercise their option to utilize the Verizon Wireless network at defined (wholesale, reseller) prices and begin cellular wireless services by mid-2017. You can be assured Comcast negotiated favorable pricing. Roberts said they are going to focus on marketing wireless in areas in which they have already significant customers.

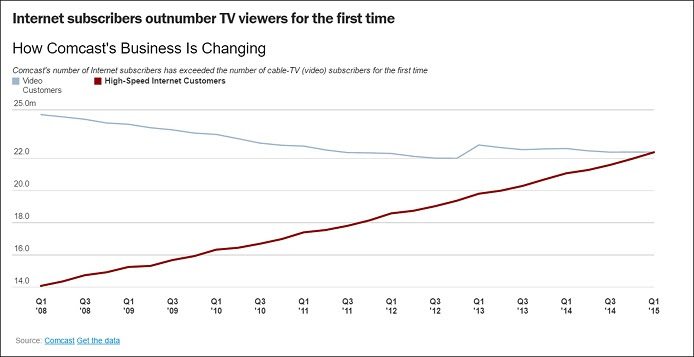

Comcast now has a total of 22.3 million video customers, 23.3 million internet customers and 11.5 million phone customers with 27.7 million total unique customers. Internet access customers recently surpassed video customers for the first time. The company reported 89,000 net additions during the fourth quarter of 2015, which was Comcast’s best result on the video subscriber front in the past eight years. The broadband business continued to do well with adding 460,000 connections in the quarter and 1.4 million connections for the year. Comcast’s total customer base increased by 281,000 connections in the quarter and 666,000 connections for 2015. Here’s the chart that shows historical TV subscribers vs. internet subscribers. The crossover was bound to happen.

Now, with these sizable customers in both cable TV, internet and telephone access, it gives Comcast a large base of families (and businesses) the opportunity to offer wide-area wireless broadband. Think of walking in to a Comcast store, ordering your cable TV and, oh by the way, they have the new iPhone 7 as well. They can offer cable TV, internet access, home phone and wireless phone service in one convenient plan. It will become a new “quadruple play” plan from Comcast.

One note of caution: Comcast is limited, at least initially, to selling cellular wireless and devices as part of an overall Comcast (Xfinity) package, not standalone. But customers can certainly “tack on” a wireless device and plan to an existing account. This is especially true for the Comcast for Business customer that might want to save on the cost of providing internet to the employees plus mobile phone and wireless services. While most organizations keep their telecom providers in place year after year, perhaps Comcast may have the ability to get some consideration for organizations to change telecom and mobile service providers. Interesting.

All of this is going to increase the stickiness of Comcast with the customers who sign up for such plans. Another example: they just struck a deal with Netflix to offer the streaming video service directly through the Comcast X1 system. Turn on your TV and dial into Netflix. Examples like this will be very attractive to customers.

One of the Comcast hidden gems is their footprint of Wi-Fi hot spots. Comcast (and especially the Comcast for Business division) can leverage these hot spots and provide shared access that serves as an additional benefit for signing up for their wireless cellular plan. For example, cellular subscribers can download video at no additional charge if they are using either the Wi-Fi broadband in their home or using anyone of those 15 million Wi-Fi hot spots. In addition, they can extend Wi-Fi calling as well to their hot spots that will offload the burden from the Verizon Wireless cellular network.

Comcast isn’t trying to become the largest wireless operator in the U.S. However, they certainly could have more than 10 million wireless broadband customers within a few years and we could see the cable giant becoming the fifth largest wireless operator behind Verizon Wireless, AT&T Mobility, Sprint and T-Mobile US.

Another hidden gem for Comcast is their access to NBC Universal content. It would seem reasonable that Comcast could provide preferred access to movies, TV shows and music to customers. While Comcast hasn’t announced anything yet, it seems obvious that they will leverage all of that content at some point.

Roberts has stated publically one of the reasons they are moving forward in wireless is because cable subscriptions have stalled. More to the point, their cable subscriptions declined for many quarters through most 2015, but turned positive in the fourth quarter of last year thus bucking the recent trend.

Comcast can offer wireless bundles that might be very competitive when looking at just wireless subscriptions alone. Thus, the company has a resource in their partnership with Verizon Wireless whereby they can begin to offer cellular wireless services next to their existing (consumer and enterprise) cable services. Let’s say a wireless plan might cost $100 per month for four lines. Comcast could offer that same plan plus provide basic internet access or basic cable TV for the same fee. Or, they could provide cable subscribers who are paying $150 per month for cable TV, internet access and home phone service with a wireless plan for just $50 per month extra, which would save a lot of money for customers.

AOTMP perspective

Is Comcast becoming a true mobile virtual network operator through this relationship with Verizon Wireless? Because it’s required to only offer mobile devices and services as part of a bundle, it’s not becoming a true MVNO. Consumer or business customers cannot buy wireless devices and services standalone.

However, there are some very real potential benefits once Comcast begins offering wireless broadband services. For one, it will enable the company to gain additional, new incremental business customers that they didn’t have before. For the enterprise, it offers the possibility of getting a better rate for wired broadband combined with wireless cellular services. For the market, it offers more choice and expands competitive offerings.

On a personal, individual level it offers the convenience of an employee being able to easily stay connected at both work, while traveling locally via the Wi-Fi hot spots and at home. I would expect them to combine security with such an offering to protect the user when connecting through Comcast.

I find it interesting that Verizon Wireless may end up competing for large enterprise with Comcast but, more than likely, they may likely join forces and provide an integrated set of access services to such accounts. As for AT&T, they are going to not have to worry in places where the cable provider does not have a large cable footprint. There may be “spot competition” in large metropolitan areas.

One of the more interesting things about this entire offering is whether Comcast can become a major disrupter in the telecom space. It’s hard for anyone to make inroads, but the company has the muscle and the ability to make it very worthwhile for businesses to switch. Companies tend to keep their telecom provider year after year without much thought about changing to a new provider. And then, Comcast comes along and makes new integrated “four-pack” offerings that many others can’t and at really attractive prices. This is going to get the attention of telecom manages in the enterprise. It could be that in five years, Comcast is sitting at the table next to AT&T, Verizon Communications and others for the enterprise business. Some will ask, “How in the world did this happen?”

Overall, I welcome Comcast to the cellular (consumer and business) wireless world. While Comcast doesn’t (yet anyway) own any wireless network infrastructure, it brings a formable competitor to market that will likely become, over the coming years, a major force in mobile and wireless.

Dr. Gerry Purdy is Principal Analyst with Mobilocity LLC. He writes a weekly column called the Mobilocity newsletter. He is widely quoted in the press, and has appeared on a number of TV news shows such as MSNBC, Fox Business and CNN regarding mobile and wireless products. Purdy has a Ph.D. from Stanford University, an M.S. From UCLA and a B.S. from the University of Tennessee. Contact: Gerry.Purdy@aotmp.com, mobile 404-855-9494.

Editor’s Note: In the Analyst Angle section, we’ve collected a group of the industry’s leading analysts to give their outlook on the hot topics in the wireless industry.