The SD-WAN space has received considerable attention from telecommunication operators, but what industry segment is set to lead the market going forward?

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.

Over the last year, there has been steadily growing enthusiasm among vendors, carriers and their customers for software-defined wide-area network solutions. Is this excitement warranted? Can it be sustained? With many of the large carriers having now established partnerships with SD-WAN providers and with new solutions continuing to come to come to market, now seems a good time to pause and evaluate some of these recent developments, while assessing the current and likely future state of the market for SD-WAN solutions.

The SD-WAN market does indeed appear to be poised for dramatic growth in the coming years. Currently estimated to be approximately $111 million, it is forecasted to expand to between $1.2 and $1.6 billion by 2021, according to analyst firms. This growth is being driven by an increasing demand among enterprises for solutions that can both improve their network performance, and reduce capital expense and operating expense. At the same time, it has been enabled by the prevalence of cloud computing, shared networks and stable public internet.

In response, communications services providers have moved quickly into the space over the last year, principally through partnerships with leading SD-WAN providers. Although this could be interpreted, in part, as a defensive effort to protect their legacy multiprotocol label switching businesses, it is nevertheless expected that the carriers will become the largest distribution channel for SD-WAN services over the next five years, as they are fundamentally well positioned to respond to customer demands for flexible network access.

Verizon Communication’s partnership with Viptela in February 2016, was among the first of these joint arrangements and it was followed in June by CenturyLink’s partnership with Versa Networks. In October 2016, both AT&T and Sprint announced partnerships with SD-WAN provider VeloCloud, each with the goal of providing customers greater network access flexibility. Looking ahead, we expect to see carriers introducing additional bundled services around their SD-WAN offerings. In January, for example, Verizon announced a partnership with SevOne, a network monitoring solutions provider, to allow customer to better assess the real-time performance of their hybrid networks.

At present, there does not appear to be a great deal of meaningful differentiation in terms of performance or functionality among the leading SD-WAN providers in the market. Customers’ principal priorities, meanwhile, appear to be straightforward: reducing latency and increasing throughput; automation of routing and optimization; and a simple and intuitive user interface.

Vendors’ differentiation will come largely in how they go to market – either as a pure-play SD-WAN provider or a WAN optimization provider, for example. We expect, however, that customers’ purchase decisions in the coming years will be driven largely by recommendations from carriers, driven by the perceived ease of integration of new solutions with customers’ legacy WAN networks.

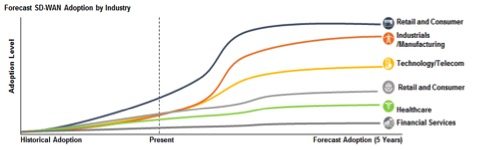

Adoption rates of SD-WAN solutions are likely to vary considerably by industry over the next five years. Retail and consumer enterprises are positioned to be among the earliest adopters, given the relatively high geographic concentration of their work sites as well as their relatively low IT budgets and limited data security compliance requirements. Industrials and manufacturing firms – especially those with facilities principally in the United States – will not be far behind retailers in their rate of adoption, given their limited compliance constraints. Those with far-flung production facilities may be slower in their uptake, however.

Not surprisingly, we anticipate that technology and telecommunication companies will be early adopters of SD-WAN solutions, given their advanced levels of network sophistication and their preference for next generation solutions. By contrast, organizations in more highly regulated industries are expected to be slower SD-WAN adopters. In health care and financial services, for example, rigorous compliance standards around data security may slow the rate at which firms are comfortable transitioning to SD-WAN or other hybrid network solutions.

Organizational size will also have an impact on adoption rates. Large enterprises are likely to have more work sites and a more complex and distributed network architecture as well as greater bandwidth requirements, which expands the potential benefits that could be achieved with SD-WAN. These big businesses, on the other hand, are more likely to have extensive legacy network architectures, which could create integration challenges; they are also likely to have established relationships with conventional networking vendors.

Medium-sized enterprises typically have less of the network architecture complexity of large businesses, but could still benefit from the advantages offered by SD-WAN. The mid-market is likely to be segment in which pure-play SD-WAN vendors that remain unpartnered with carriers will have the greatest potential to gain share. Finally, small businesses are expected to remain relatively limited consumers of SD-WAN solutions (despite their need for IT budget efficiency), given their typically straightforward networking requirements.

Although it is too early to tell what switching behavior will be like across these customer segments, our sense is that once SD-WAN solutions are implemented, they will be rather sticky – becoming deeply engrained within enterprises’ technology architectures. The average length of vendor contracts (two to three years), as well as the time and effort involved in new solutions’ phased implementation, are further deterrents to switching.

Looking ahead, it seems that the drivers of market growth for SD-WAN solutions will remain strong. With their increasing reliance on cloud solutions, and their growing demand for bandwidth and app delivery, large- and medium-sized enterprises will continue to seek new solutions for improving their network performance and reducing costs. These firms, in turn, will likely select vendors that have the strongest channel partnerships and offer the most advanced technical capabilities – real-time performance monitoring and transmission efficiencies, for instance. And the connectivity requirements of the emerging internet of things will only bolster demand for flexible network access solutions. For all these reasons, the SD-WAN space will remain one to watch.

Rajive Keshup, co-leads the TMT sector within the PwC Strategy& Deal Strategy practice, a group focused on delivering commercial diligence and growth strategy to financial sponsors and corporations on their investment, growth and M&A agenda. Keshuhp has performed a number of market assessments and commercial diligences within the SD-WAN space and with a background in telecom and technology from The Parthenon Group, BCG and AT&T, is generally considered a thought leader within the software-defined-X space.

Tim Sullivan advises corporate and private equity clients on organic and inorganic growth strategies at PwC Strategy&, with a focus on technology-enabled industries.