Smartphones are an extreme case of a high-volume market that justifies some incredibly complex engineering to pack so much into a small size. Some smartphones include as many as eight processor cores today … making the old comparisons to the Apollo spacecraft laughable.

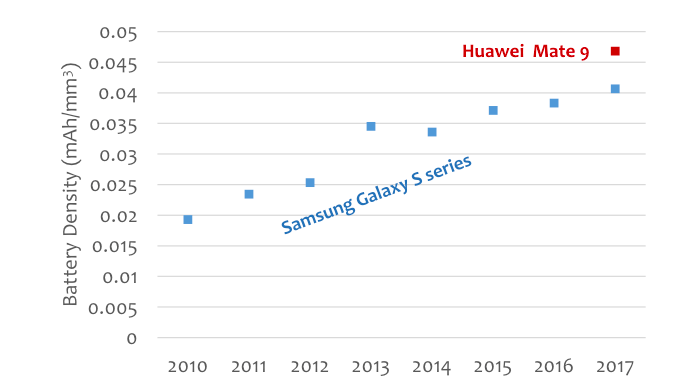

Today’s smartphones do so many things that the battery has clearly become a limiting factor in overall capability. Battery capacity has doubled from 2011 to 2017, and despite larger smartphone sizes the battery has taken over most of the space inside the case.

As big smartphone batteries reach such high energy density, safety issues are coming to the market again. It’s getting dangerous to push energy density even higher because the thin insulators in lithium-ion battery cells can be compromised more easily. Nobody wants to own an exploding phone.

Realizing that higher energy efficiency is critical, smartphone OEMs are willing to adopt some advanced new technologies to improve power consumption. Multicore processors use dynamic voltage scaling and throttle back on clock speeds to save power whenever possible. Advanced display technologies have now reached the market. Advanced RF techniques are a critical step in this process as well since the RF front end consumes between 15% and 40% of the energy in the battery, depending on network conditions and usage patterns.

Many RF technologies have come to market over the past 20 years to address this issue, including:

• Front-end module integration

• Digital predistortion

• Envelope tracking

• Antenna tuning

• Impedance tuning

• Advanced filters, including quadplexers and hexaplexers

• Three-dimensional packaging technology

Single-technology companies don’t remain in the marketplace

In many RF technology areas, innovation has come from small start-up companies. Envelope tracking was pursued by several start-up companies such as Quantance, Nujira and R2. Quantance and Nujira were acquired as a consolidation of IP as ET technology moved from the research and development phase to production.

Similarly, independent power amplifier suppliers have struggled to gain significant volume and most have been acquired. Examples include Amalfi, Axiom, Black Sand, Javelin and Peregrine. Switch vendors (Silanna) and tuning element vendors (Paratek, Peregrine, WiSpry) all follow a similar pattern: the successful companies are acquired and none of these remained as an independent supplier at high volume.

It’s the same story in the filter world. Panasonic and EPCOS are two examples of filter suppliers that have been absorbed by RF module suppliers as filters and amplifiers have become more intimately integrated with each other. Even the merger of RFMD and TriQuint can be seen as an extension of the filter/amplifier integration story.

Multitechnology products are taking over the smartphone RFFE market

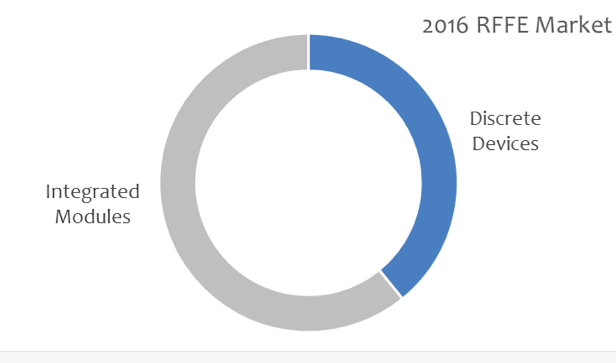

Today, the opportunity for a single technology (such as a MEMS tuner) to shake up the industry has gone away. Integrated PA/filter/switch combinations represented almost two-thirds of the mobile RF front-end market and integrated FEMs represent an even higher fraction of the profit in the RFFE market. Flagship smartphones have tough requirements, but have no physical space available for new discrete devices.

Co-designing multiple RF functions in a single module has become the key to shrinking size in the RF front end. Complete front end modules now contain all of the amplifiers, switches and filters for an entire range of frequency bands, allowing the battery to take over more space inside the phone.

For battery life and thermal efficiency, co-design is even more important. Envelope tracking is a good example to prove this point. In envelope tracking, very time-sensitive communication must be coordinated between the modem and the amplifier’s power supply. The power supply must be located close to the amplifier itself and a filter must be used to clean up the noise created by the power supply. In 2012, the ecosystem structure involved four different companies: a modem supplier, a power supply vendor, an amplifier company and a filter supplier. Over the past five years, production experience shows that all of these functions must be owned by a single company for best optimization. The result is an improvement of roughly 30% in current consumption, compared with the conventional technique (APT).

Filter complexity is growing quickly with carrier aggregation

Now that we use filters to clean up the noise inherent in envelope tracking, we have to consider the overall filtering approach in the RF front end. Carrier aggregation in “hi-hi,” “mid-hi” and “mid-mid” combinations today require quadplexers and/or hexaplexers to achieve simultaneous downlink reception in multiple bands. For most of these cases, basic SAW filters don’t meet the requirements so a company that hopes to provide an RFFE module must include BAW or FBAR technology in order to address the entire market.

It’s easier said than done. Only a few companies provide BAW or FBAR-level filter performance today, so any supplier without access to one of these high-volume fabs has a major strategic challenge.

Antenna tuning needs to be closed loop, requiring co-design of tuning and modem/transceiver

As the RF front end complexity grows, naturally the loss increases for switches and filters in the front end, reducing the amount of power that can be effectively transmitted at the antenna. This problem gets even worse as handsets are moving to 4×4 multiple-input/multiple-output antenna technology in high bands, which limits antenna performance even more than before. As a result, many smartphone OEMs are now revisiting the concept of antenna impedance tuning to ensure maximum delivery of power despite mismatch conditions in the real world. Antenna tuning can increase total radiated power by four decibels or more, which means that the amplifier can run at 60% lower power.

Carrier aggregation has been a question for tuning advocates in the past since in concept a narrowband tuning algorithm is incompatible with some CA scenarios. Closed-loop antenna tuning solves this conflict by optimizing the tuning conditions for dual-band or wideband performance by coordinating closely with the modem and a sample receiver.

More than 100 smartphones now use a form of closed-loop tuning so the modem and related tuning components have reached a mature stage of production.

The whole enchilada

Many people in the smartphone ecosystem talk as if PA/filter/switch is the end of the integration roadmap. That’s not quite right. The ET and tuning functions are becoming even more highly integrated into the mix with widespread adoption by many OEMs. The endgame here is that the RFFE players now have to compete with modem suppliers that can do it all. Modem suppliers have advantages that the RF suppliers don’t have: they can run closed loops to optimize performance and reduce characterization/calibration requirements. The point is that a modem supplier can deliver a product with lower cost of production than any RF supplier can provide.

Physical integration of these components is not necessary. In fact, single-module integration of everything is probably not the right answer because separate components provide more flexibility for different product options. The modem and transceiver will continue on CMOS. Specialty RF devices will be jammed into very dense multichip modules. There’s no magical technology on the horizon that will enable single-chip integration for the PA, filter, switch and tuner functions.

So, unlike other semiconductor markets, instead of on-chip integration the RF engineers will focus on co-design of different functions. The RF system must be considered all together and engineers need to eliminate the constraints of using standard interfaces (like 50 ohm impedance matching) between each chip. We expect more than 70% of the RFFE market to use integrated devices by 2020.

What are the essential ingredients of a smartphone RF front end? In the past, the list was obvious: amplifiers, filters and switches. Today, system co-design has become an essential ingredient because the flexibility of closed-loop adjustment has become indispensable.

Over the next five years, a new level of consolidation is likely to play out. Qualcomm is ahead of the game with internal capability in multiple areas due to acquisition of ET (Nujira), switch (Silanna) and filter/module capability (EPCOS). Other modem suppliers are likely to follow.