Note, this article is serialised from a report on the state of the smart energy market. It continues from a previous post.Go here for the last post; go here for the full report.

The case for industrial IoT in the power market, both sides of the meter, is complicated by the increasing variety and sophistication of communications technologies in play.

“One of the game changers is the emergence of NB-IoT. The move toward wireless communications allows utilities to identify issues on the grid in real time. In addition, it enables them to deploy edge intelligence for self-healing and grid automation,” comments Ann Perreault, global director of connected utilities at Honeywell, a stalwart of the metering market.

Vodafone was an early champion of NB-IoT, and NB-IoT finds its way into various of its energy services. Scottish Power is using NB-IoT from Vodafone in subterranean ‘link boxes’ that can overheat and catch fire, according to reports. Sensors send warnings if the link boxes start to overheat, and Scottish Power can dispatch engineers accordingly.

But NB-IoT is, actually, better suited to battery-powered gas and water meters, which do not boast a ready electrical current. In the link box example, the sensor runs on an AA battery. “You don’t have the same power constraint with electricity,” comments Phil Skipper, head of IoT development at Vodafone. “Plus, the amount of data coming off an electricity meter tends to be higher.”

The UK is transitioning to so-called SMETS2 meters (in line with the second-generation of the ‘smart metering equipment technical specifications’), which are cross-compatible between energy suppliers, making switching simpler, and are geared towards new energy technologies like home batteries and electric vehicles.

Skipper suggests these new meters are, in fact, better suited to traditional mobile connectivity, but that a mix of technologies will play into smart home setups. “What you’ll find with NB-IoT and LTE-M is they do some of the slightly lower-bandwidth applications. You will have a hybrid in the home. Simple devices may well be on NB-IoT. More complex, four-part meters, will no doubt be on mobile.”

Indeed, Vodafone has around 15 million (“maybe closer to 20 million now”) cellular meters globally, mostly running on its regular 2G, 3G, and 4G infrastructure. In New Zealand, smart metering company Advanced Management Systems (AMS) has around 500,000 electricity meters on its GPRS (2G) network, each with a SIM card in the modem-part of the meter.

“The GPRS network from Vodafone stood out,” comments Paul Atkins, solutions manager at AMS, making comparison with power line communications (PLC), WiMAX mobile broadband, and RF mesh as alternatives. “The infrastructure was in place with ubiquitous coverage and a high reliability. The limitations of the other options would not have enabled us to roll-out nationwide”.

CONNECTIVITY QUESTION

But, actually, cellular ranks a lowly fourth when it comes to connecting electricity meters. PLC, spurned in the AMS case, has propped the market up until now.

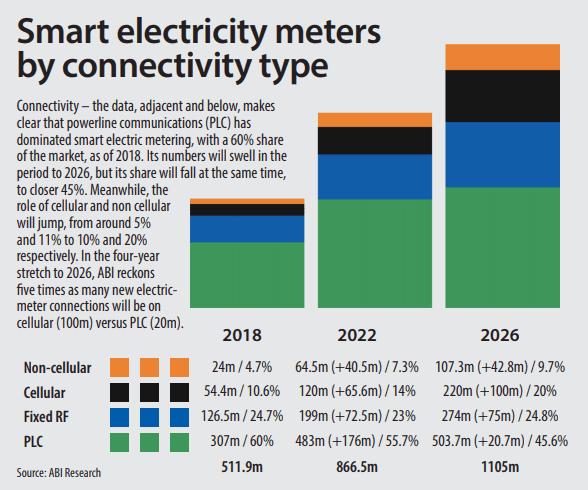

ABI calculates three in five electric meters (59 per cent) are connected with PLC, as of 2018, compared with sliver-like shares for the rest, and just 15 per cent for cellular-based technologies. Smart metering grew up on PLC, starting in Italy, the breakout market for meters.

But Skipper says it has been found wanting, at least in its narrowband form, when tasked with more advanced metering. “Enel in Italy started with powerline, but now has a lot of mobile connections. New Zealand is all mobile,” he says.

Indeed, the growth is with these alternatives. A according to ABI’s projections, PLC connections will jump around two-thirds in the next decade, compared with the well over 100 per cent growth for the market, as a whole, and more than three times growth for cellular and non-cellular direct WAN connections.

“The problem with PLC is it’s a narrowband connection, and it shares with all the noise on the power lines,” says Skipper. He gives the example of British Gas, the UK electric and gas supplier. “Its customer base is all around the UK – every city and village. It needs a point-to-point solution, which is where mobile is useful.”

Non-cellular LPWA technologies like LoRa and Sigfox are also contenders, and ABI’s market projections bear this out. But, like with NB-IoT, they tend to be discounted on the grounds power is unconstrained in electric networks, by definition, and ABI has non-cellular connectivity with a share of just five per cent today, rising to a little under 10 per cent in 2026.

However, markets will choose differently, reflects Skipper. “It is horses for courses,” he says. “There are benefits to each – whether power-line carrier, some of these proprietary technologies, or a national mobile network. But mobile offers better security across many different devices, and is of course accessible everywhere.”

He notes, as well, the viability of private cellular networks in licensed and unlicensed bands, as a twist on the wireless alternative. The German energy market has form with private cellular, typically using a version of 3G in and around 433 MHz.

PRIVATE AND SHARED

But a surfeit of new options are available, with the availability of private and shared networking in CBRS spectrum in the US, development of the MulteFire standard using the 5 GHz band (among others), various European territories carving up prime 5G spectrum for industry, and even 3GPP developing a work item for 5G networks on the 5 MHz and 6 MHz unlicensed bands.

“There is a long discussion around whether utilities want their own networks, or they want to use a national network like 5G,” says Skipper.

Will 5G have a bearing on the grid itself? Deployments are cheaper, but much of the infrastructure is wired and static. “It’s a little bit like railway signalling. Once you’ve run the wires, you’re going to keep them in and use those,” says Skipper.

“What you will see is 5G extend around some of the areas where higher visibility is required, in the way you do it with 4G today. It is really about extending reach and visibility, rather than ripping everything out and replacing it with 5G.”

Is Fingrid talking to the likes of Nokia and Telia about private networks or private network extensions? “Not at the moment; it’s not on our to-do list, right now. But of course, we are watching with interest. The thing is our substations are in the middle of nowhere, so it can be hard to get even 4G connected,” says Marcus Stenstrand, the company’s digitalisation manager.

What about KCP&L and Westar? “Utilities need to look at what this new private spectrum looks like,” says Matt Bult, senior manager for technology operations at KCP&L and Westar.

“We’d find ourselves behind the eight ball if we weren’t already evaluating it. So, yes, we are talking with industry folks about private LTE, but it is still an education process right now.”

In the end, the case for 5G is aligned with the case for private networks, centred around large industrial energy consumers. “Frequency control is the challenge, which requires real-time data,” says Skipper at Vodafone.

“If you want to optimise consumption on a manufacturing site, say, then energy management will become part of a private 5G network. You will see 5G much more on the demand side.”

For its part, PPC, which has played in various of the German state energy experiments, is in the business of marrying the electric network with broadband-type data communications. “5G, while powerful, lacks the range. It [will be more] useful in urban applications,” says Eugen Mayer, the company’s chief operations officer.

POWERLINE COMMS

PPC makes the case for PLC in its new broadband incarnation, rather than its old narrowband guise, which got countries like Italy and Spain started on smart energy metering. Until recently, broadband-type data rates weren’t required for utility and grid applications. Narrowband, though prone to interference, was good enough.

“Narrowband was great for occasional remote meter reading and switching. You could always repeat short bursts of signal until they made it through. But smart metering and other data-hungry applications are driving the need to transfer in real time, or near real-time, and narrowband will never deliver that,” explains Mayer.

The industry pursued the “unicorn of faster narrowband” for years, but has since ditched the search in favour of broadband PPC. “The beauty of broadband PLC is that all parts of the low and medium voltage power grid are connected by powerlines. If you use the lines themselves, you only need to connect modems and sensors – and you have your comms with no additional infrastructure.”

In Germany, the largest broadband PLC deployment to date was as part of the seminal Modellstadt Mannheim (Model City of Mannheim) project, contained within the German government’s 2008-2013 E-Energy programme. In Mannheim, the grid was organised to take green energy from over 500 producers and redistribute it to local residents.

Doubling as a broadband powerline, it also connected smart appliances in homes, and availed residents with a number of software tools to monitor usage and spending. The team, led by PPC, even instituted an ‘energy butler’ to switch on appliances during periods when energy is plentiful and cheap.

Private households saved around 10 per cent in energy consumption, and 15 per cent on energy bills, and the grid was better equipped to manage loads on the network. The Mannheim findings have been used to legislate for flexible energy tariffs and a single communications platform, running both the smart grid and smart meters.

There are other large-scale broadband PLC deployments, besides: E.On is using broadband PLC for 200,000 homes in Germany; Qatari supplier Kahramaaa has connected 12,000 electricity and water meters wideband powerlines. PPC is working on the same in Switzerland, Czech Republic, Poland, Turkey, Middle East and North Africa.

It is stable, secure, and robust against interference, says Mayer, quoting IPv6 and 1,000 OFDM (orthogonal frequency-division multiplexing) carrier frequencies. “It is very hard to disrupt, and it has a much lower total cost of ownership,” he says.

It also works to form a self-healing meshed network using the powerlines. “If one line is weak, broken, or suffering from a lot of noise, the modems can re-route the flow of communication by using another line.”

It is being enhanced, too; the distances it covers – limited to a few hundred metres per ‘hop’ – are compatible with wide-area networks. For longer hops, PPC has developed a router that transfers local powerline data to an LTE backbone, says Mayer.

But the truth is successful implementations of smart metering system will rely on a choice of communication technologies, however, likely including some broadband and narrowband cellular, non-cellular, and short-range connectivity pieces, as well.

“Undoubtedly, it requires a hybrid of all of the above,” says Mayer. Different aspects such as the final application, the features of the location, and the topology electricity grid, among others, highly influence the choice of the most suitable technology.

There is a wide range of available technologies for the communication network of a smart metering system; however, there is currently no communications technology that fits all needs and sometimes more than one technology is used in the same deployment.

This article is a serialised from a new editorial report from Enterprise IoT Insights, called Keeping The Lights On – With Green Power, which looks at development of IoT technologies in the energy market. The full report, free to download, can be found here.