In-building wireless BTS/controller-based small cell solutions finally reach critical size

BTS/controller-based small cell deployments are typically targeted for enterprise vertical applications such as:

- Class A Office

- Hospitality

- Healthcare

- Large Retail

- Multi-Story/Multi-Tenant Housing

- Higher Education

The enterprise market is the key battleground for the in-building wireless (IBW) industry. The enterprise market remains in the nascent stages of deployment for any type of in-building wireless solution. However as more 4G LTE subscribers join mobile networks, the expectations for ubiquitous coverage and user experience will force mobile operators and building owners to deploy an IBW solution.

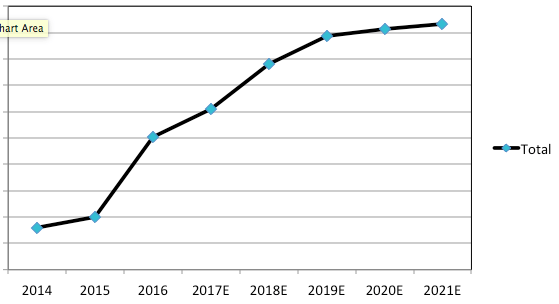

Shipments for BTS/controller-based small cell solutions reached 1 million units in 2016. We forecast that the market will continue to expand through 2021 with China deploying the majority of the units. We estimate a 9% CAGR for the 2017-2021 period regarding unit shipments. The vendors we have included in this analysis are:

- Comba Telecom

- CommScope/Airvana

- Ericsson

- Huawei Technologies

- Nokia Networks

- SpiderCloud Wireless

- ZTE

We note that Huawei Technologies was the top ranked vendor in unit volumes in 2016.

Exhibit 1: Global in-building BTS/controller small cell shipments forecast, 2017-2021

Specifically in North America, we believe that enterprise building owners are beginning to realize and comprehend the following statement:

Wireless in-Building coverage is a utility service

Additionally, we believe that the financial model to incentivize a building owner to deploy an IBW solution is the one presented below. Without loss of money, there is no incentive to change the current behavior and perspective of building owners.

Exhibit 2: Enterprise Client/Building Owner IBW Pain Point Mission Statement

Source: EJL Wireless Research LLC (June 2017)

We believe that LEED-equivalent building practices will drive demand for small cell solutions as well as traditional distributed antenna systems (DAS). However, given the key market for this product segment is China, we expect that local equipment suppliers will continue to capture the majority of the market share going forward. While North America and other regions may limit the use of BTS/controller-based small cells to non Tier 1 venues (airports, metros, & stadia/stadiums), the market in China is dominated by single operator solutions which favor BTS/controller-based small cells over traditional DAS.

In our opinion, the demand for IBW solutions has reached critical mass and we expect that demand may exceed our current conservative outlook and forecast model. We also expect that BTS-based small cells will be the dominant solution over controller-based small cells during the forecasted period.

EJL Wireless Research has recently published its 1st Edition of the Global In-Building BTS/controller-based Small Cells Market Analysis & Forecast.