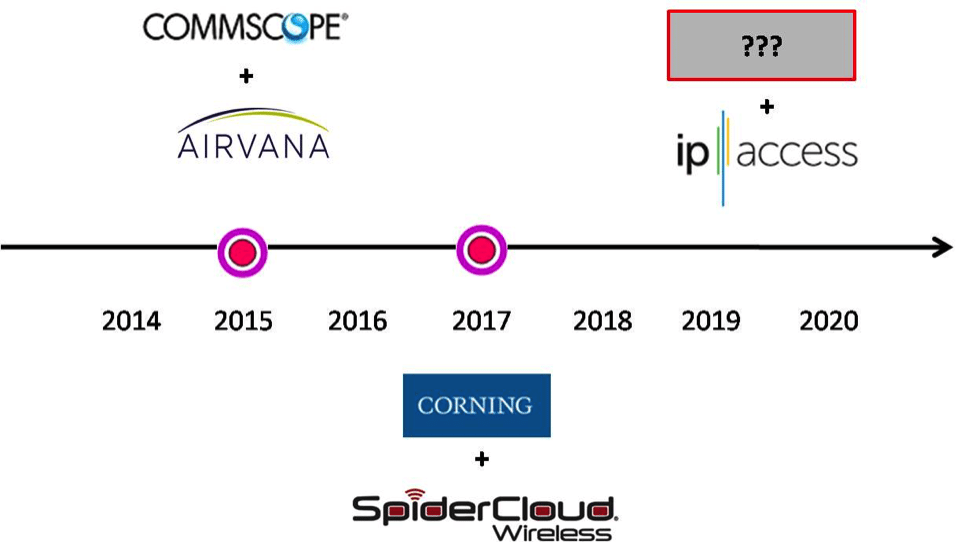

Stand alone small cell vendors continue to look for exits. CommScope acquired Airvana in 2015. We recently learned that Corning Optical Communications plans to buy SpiderCloud Wireless. Sources external to the companies put the purchase price at approximately $200-250 million plus an additional amount for earn-out compensation over the next few years. Based upon our estimates of revenues for SpiderCloud Wireless in 2017, the forward 12-month valuation multiple is 2.0-2.5x revenue, which would be on the lower side of investor expectations. However, the potential revenue earn-out over the next few years may increase the final revenue multiple to 4.0-4.5x. We do not believe it will reach a 10x multiple. We have been aware that investment bankers have been trying to find a buyer for SpiderCloud Wireless for many months. Was the investment in SpiderCloud Wireless a grand slam home run for investors? No, but at least it wasn’t a strikeout.

Exhibit 1: Small Cells Vendor Consolidation Timeline

Source: EJL Wireless Research LLC (July 2017)

The past several years have been a buyer’s market for the small cell industry. The industry has pinned its hopes on the evolution towards a HetNet architecture for mobile operators given the continuous increasing mobile data usage globally. However, demand has remained sluggish due to a variety of technical and business case issues for the past several years. For outdoor small cells, the issues have been site acquisition costs, suitable backhaul technologies and an acceptable return on investment for the mobile operators.

With regards to indoor small cells, which is where both Airvana and SpiderCloud Wireless have focused, the enterprise segment for the in-building wireless market that would deploy these solutions has also be slow to adopt and accept the responsibility that in-building wireless signal availability and coverage is a utility that must be provided by the building owner/landlord and is not the responsibility of the mobile operator. Certainly with large venues such as sports stadiums (think Super Bowl), there are marketing and quality of service incentives for mobile operators to deploy or participate in a neutral host distributed antenna system (DAS).

However, the enterprise segment has too many buildings and a very complicated business model, which results in a poor ROI for mobile operators. Additionally, mobile operators are first and foremost focused on outdoor macrocell coverage and performance metrics. 5G is a major distraction for mobile operators currently, leaving few resources available to focus on in-building coverage issues.

We believe that small cell controller-based solutions such as the Enterprise Radio Access Network (E-RAN) from SpiderCloud Wireless fit well into supporting one or possibly two mobile operators within a building that is less than 500,000 square feet (~55,000 m2). The advantages over a traditional DAS solution begin to decline as requirements increase to larger buildings and support for 3-4 mobile operators and 3-4 frequency bands.

SpiderCloud’s small cells are certified for both the Verizon Wireless LTE network and for AT&T’s network, but so far Verizon is the only U.S. operator to deploy the solution. In addition, Verizon has asked its five DAS vendors to integrate their systems with SpiderCloud, so that the SpiderCloud small cells can be used as signal sources for distributed antenna systems. It is unclear whether or not these integration efforts could continue if Corning buys SpiderCloud.

Given the fact that the Corning Optical Communications business has been focused on supplying fiber-based DAS indoor wireless solutions, the addition of the SpiderCloud Wireless product fills a gap in the current portfolio offered by Corning. It allows Corning to target enterprise customers that its Corning One digital DAS solution was unable to effectively serve. We believe that this acquisition will enhance Corning’s ability to effectively compete head to head against CommScope, JMA Wireless, and other traditional DAS vendors.

EJL Wireless Research has recently completed an extensive analysis on small cell solutions for the enterprise market globally. Information regarding this report can be found on the EJL Wireless Research website at www.ejlwireless.com.