Further consolidation of fiber assets expected – could Zayo be a target?

The race to acquire metro fiber continues with ExteNet Systems’ announcement that it has purchased Axiom Fiber for an undisclosed amount. Axiom owns and operates fiber in New York City, offering small cell backhaul for wireless carriers as well as fiber services for enterprise customers. ExteNet builds, owns and operates distributed antenna systems and small cell networks for wireless carriers. As carriers rely more heavily on fiber to connect remote radio units to base stations, infrastructure partners like ExteNet are building and buying fiber networks, especially in urban areas.

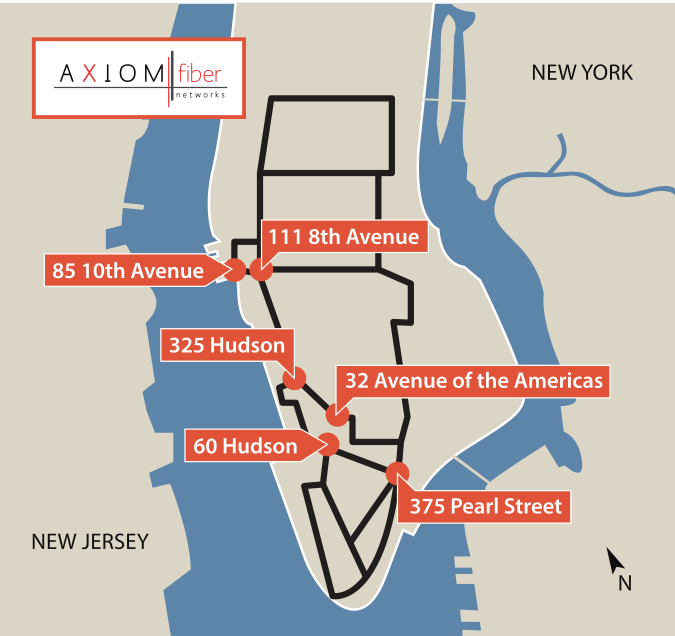

Fiber will also be important to carriers and their partners as they work to maintain service levels inside office buildings. According to Axiom, its core network is able to serve every building in midtown and lower Manhattan.

The Axiom acquisition will make ExteNet a more direct competitor to ZenFi Networks, which also operates a fiber network in New York City. Both Axiom and ZenFi own dark fiber networks, meaning that many strands are not yet activated. Carriers activate dark fiber by installing an optical modular transceiver, and they pay the fiber owner, often through a 10- or 20-year lease called an indefeasible right of use. IRUs can be capitalized, meaning that carriers can depreciate this investment over time.

Verizon Wireless, the first U.S. carrier to launch a large urban small cell rollout, has acquired its own dark fiber assets to complement the fiber it will lease from providers. The company spent $1.8 billion to buy XO Communications, and is will spend at least $1 billion more buying fiber from Corning over the next three and a half years.

Cell tower giant Crown Castle, which has called fiber the “horizontal tower,” has been a voracious acquiror of fiber assets over the last several years. The Houston company’s fiber acquisitions include Sunesys, Lightower, 24/7 Mid-Atlantic, Wilcon and FiberNet.

The flurry of fiber acquisitions has sparked speculation about Zayo, a large independent fiber provider and an active acquirer of permits to access the rights of way in cities across the country. According to analyst Jennifer Fritzsche of Wells Fargo, Zayo has the potential to be an attractive asset for a service provider at some point in the future.

“ZAYO will be a more likely acquirer than candidate in the near term, although we believe there could be strategic interest longer-term,” Fritzsche wrote in a research note. “A tower operator could gain a growing footprint in the small cell space if it acquired ZAYO’s 126,000 fiber route miles. Cable operators could find ZAYO’s large enterprise customer base an effective means to move up the stack in the enterprise market. Finally, wireless carriers could seek to accelerate 5G network builds by acquiring a valuable portfolio of metro fiber assets (given that fiber is a key “ingredient” in 5G architecture).”

Follow me on Twitter.